Ring Energy Inc. (REI:NYSE) is an independent oil and gas exploration and production company focused on the Permian Basin in West Texas.

They engage in the acquisition, exploration, development, and production of oil and natural gas properties. The company's operations are primarily located in the Northwest Shelf and Central Basin Platform in West Texas.

Here's a more detailed breakdown:

Core Business:

Ring Energy's main activities include acquiring, exploring, developing, and producing oil and natural gas.

Geographic Focus:

The company's operations are concentrated in the Permian Basin, specifically the Northwest Shelf and Central Basin Platform in West Texas.

Production Method:

Ring Energy primarily utilizes vertical drilling to produce oil and natural gas, according to TMX Money and Simply Wall Street.

Company Size:

With 108 employees, Ring Energy is considered a mid-sized company within the energy sector.

Headquarters:

The company's headquarters are located in The Woodlands, Texas.

Recent Performance:

In 2023, Ring Energy saw record fourth quarter and full year oil and gas sales volumes, according to their press release.

Recent Price:

The shares are trading at the US$0.8223 level with a 52-week range of US$.72 to US$1.99.

Valuation:

The shares trade at a 30 P/E and have a book value of US$4.24.

Conclusion

The shares of this little junior oil and gas producer are an excellent place to hide in the event of a painful correction overtaking the U.S. equity markets.

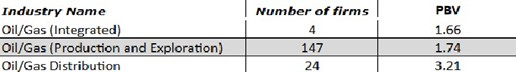

The stock is cheap trading at a fraction of book value versus the industry average shown below:

If we call REI an "explorer-producer," then it should trade at 1.74 times book value which was established at $4.24 so $4.24 times 1.74 = $7.37 per share. From what I am hearing through my dear friend Freddie (of Freddie's Corner fame), there has been talk of a buyer surfacing.

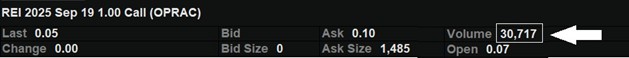

Well, we hear those narratives all the time but being the super sleuth that he is Freddie drew my attention to the REI September $1.00 calls where the volume today exceeds 30,722 contracts with a daily range of $0.01-$0.08 per contract.

Since the stock hasn't been over $1.00 since April 7, someone is making a big bet that it will before September 19. What option volume like this tells us is that someone might be getting ready to make a bid for Ring so with a P/E of only 2.30 while trading at 19.58% of book versus industry average at 1.74, valuation is cheap enough to represent minimal downside risk versus substantial capital appreciation potential.

This is a great proxy for one's allocation to the energy sector.

In the GGMA 2025 Portfolio Account:

- BUY 50,000 REI at $0.83

- Target $2.00

| Want to be the first to know about interesting Oil & Gas - Exploration & Production investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Ring Energy. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.