Golden Sky Minerals Corp. (AUEN:TSX.V; LCKYF:OTC) has announced the completion of a 735 line-kilometer helicopter-borne Z-Axis Tipper Electromagnetic (ZTEM) and aeromagnetic survey over the Gnome and Semlin targets at its Rayfield copper-gold property in south-central British Columbia. This Phase 1 exploration program aimed to enhance geological understanding and inform future exploration phases.

The survey identified a prominent high-resistivity anomaly interpreted as a large intrusive batholith stretching between the Semlin and Gnome targets. This geophysical signature suggests geological continuity across the broader area and aligns with models of district-scale porphyry systems. According to the company, this intrusive body is believed to play a central role in the region's metal fertility and hydrothermal alteration.

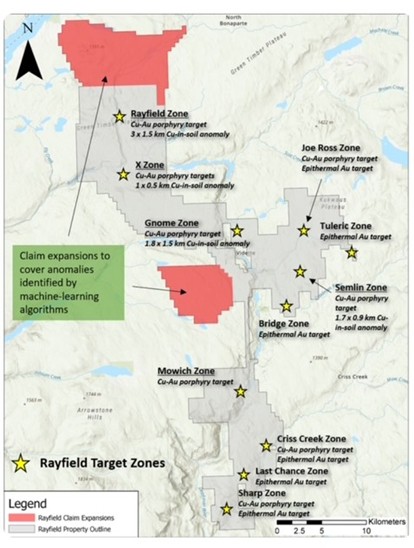

At the Gnome target, a soil anomaly covering approximately 1.8 by 1.5 kilometers revealed elevated concentrations of copper, gold, zinc, arsenic, and molybdenum. The company noted that this anomaly, which remains open to the southeast, aligns with features commonly associated with buried porphyry deposits. Historic sampling from the area returned values including 0.35% copper, 8.9 grams per tonne silver, and 4.8 grams per tonne gold from a single chalcedonic quartz-carbonate vein.

At the Gnome target, a soil anomaly covering approximately 1.8 by 1.5 kilometers revealed elevated concentrations of copper, gold, zinc, arsenic, and molybdenum. The company noted that this anomaly, which remains open to the southeast, aligns with features commonly associated with buried porphyry deposits. Historic sampling from the area returned values including 0.35% copper, 8.9 grams per tonne silver, and 4.8 grams per tonne gold from a single chalcedonic quartz-carbonate vein.

Geophysical modeling further identified a deep-seated resistive zone beneath the Gnome area. The anomaly's geometry is consistent with preserved porphyry systems, particularly those featuring intense silicification and quartz veining. Golden Sky reported that mineralization and alteration were observed along the flanks of this resistivity feature.

Drill hole 72455 intersected 0.1% copper over the final 68 meters, which the company interprets as potentially intersecting the outer margin of a porphyry center. Additional magnetic, gravity, and radiometric anomalies consistent with copper-gold porphyry systems were also reported across the zone.

At the Semlin target, a 1.4 by 0.9 kilometer soil anomaly was identified along the edge of the same interpreted batholith. Historical rock sampling revealed mineralization in basalt of the Nicola Group, including 10% pyrite and trace chalcopyrite.

One sample returned 0.2% copper and 135 ppm molybdenum. The presence of monzonitic to dioritic intrusions near the anomaly and the identification of disseminated pyrite and quartz veins supported further porphyry potential.

Golden Sky stated that it plans to follow up with expanded soil sampling, induced polarization (IP) and magnetic ground surveys, and a diamond drill program, pending permits.

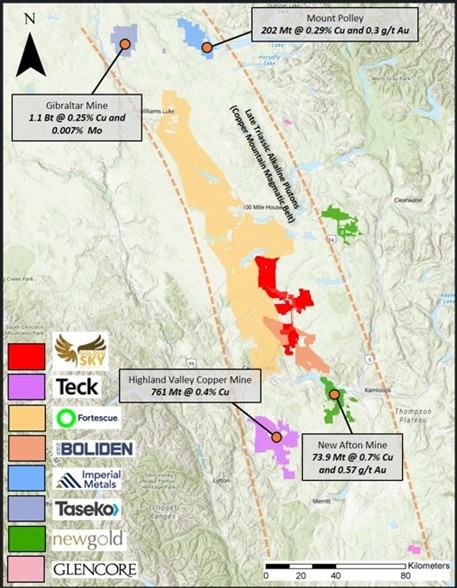

The 52,000-hectare Rayfield property lies within British Columbia's Quesnel terrane, a prolific copper belt that hosts several operating mines, including the Highland Valley, Mount Polley, and Mount Milligan mines. The Rayfield property is road-accessible and situated approximately 20 kilometers east of 70 Mile House.

"Our recent ZTEM survey results significantly strengthen the case for a large, district-scale copper-gold porphyry system at the Gnome and Semlin targets," said John Newell, President and CEO of Golden Sky Minerals, in a company news release.

"We now have robust, multi-layered evidence pointing to a buried porphyry center at the Gnome target.

Additionally, Semlin is emerging as a second, highly prospective and underexplored porphyry target."

Copper's Bull Market Gains Momentum Amid Tariff Pressures and Industrial Demand

Copper remained a key driver of strength in the commodity sector during mid-2025, supported by trade policy shifts, global supply constraints, and long-standing industrial demand.

According to a July 22 report from Mining.com, copper futures reached a record US$5.732 per pound on the CME, representing more than a 40% increase year to date. The publication noted, "This takes copper's year-to-date gains to over 40%, making it one of the best-performing commodities of 2025, even surpassing that of gold."

The price surge coincided with the announcement of a 50% tariff by the U.S. government, prompting traders to front-run purchases and stockpile domestic inventories. Analysts from ANZ Bank told Reuters that the new tariff regime could shift reliance to existing stockpiles, with the potential to impact short-term pricing volatility in both U.S. and international markets.

Excelsior Prosperity's July 27 analysis emphasized that the current rally is part of a longer-term trend, tracing copper's rise from US$1.98 in March 2020 to multiple highs over the past five years. The report noted that copper broke US$5.00 per pound on several occasions, including in 2021, 2022, and 2024, attributing previous surges to factors such as supply chain constraints, war-driven market uncertainty, and rising demand linked to artificial intelligence infrastructure. Most recently, the metal reached US$5.94 in July, a move that Excelsior Prosperity said reflected "the projected future AI datacenters and electricity buildout demands."

Copper's performance also continued to draw attention from investment firms. In a July 28 interview with Morningstar, Nitesh Shah, head of macroeconomic and commodity research at WisdomTree, named copper as one of the top three commodities alongside gold and aluminum. Shah stated, "There is so much need for those base metals in energy transition and data center buildout, where those two metals are heavily used."

Technical Momentum Builds for Golden Sky Amid Strategic Investment

On July 5, Robert Sinn of The Charts Of The Week featured Golden Sky Minerals Corp. in his review of junior mining stocks. He noted that the company's shares had risen nearly 20% over the prior week, marking the fifth straight weekly gain. Sinn pointed out that the stock had doubled from its March low, "The volume expansion since mid-April helps to confirm the nascent uptrend." He stated that technical indicators such as the Commodity Channel Index (CCI) and Relative Strength Index (RSI) "confirm that a strong trend is taking shape in AUEN shares."

He added, "A major-sized land position in one of Canada's emerging porphyry copper belts. Trump copper tariffs and the prospect of $6/lb copper has just begun to generate a modest uptick in investor attention towards Golden Sky. You would be hard-pressed to find a handful of legitimate copper explorers with such a tight share structure, the tight trading float, and strong insider ownership give AUEN shares unparalleled torque to discovery success. "

Sinn also addressed the company's valuation, noting that Golden Sky maintained a modest CA$3 million market capitalization despite the recent rally. He referenced the April 24 announcement of a CA$220,000 strategic investment from Rob McEwen, describing it as a significant step in the company's development.

Exploration Milestones and Project Focus

Golden Sky's 2025 exploration efforts at the Rayfield property are centered on confirming porphyry copper-gold systems across multiple targets within the Quesnel terrane. The Gnome and Semlin zones have been prioritized due to the convergence of strong geochemical, geological, and geophysical indicators.

According to the company's investor presentation, both targets were historically underexplored, with minimal to no drilling at Semlin and only three historical holes at Gnome. One of those, hole 72455, returned 0.19% copper over the final 68 meters. The company highlighted that these results are consistent with intercepting the margins of a porphyry system.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Golden Sky Minerals Corp. (AUEN:TSX.V; LCKYF:OTC)

The company noted that the Gnome and Semlin anomalies are defined by large multi-element geochemical footprints and supported by high-resolution geophysical data. Field observations included phyllic and propylitic alteration and quartz-carbonate vein-hosted mineralization, which aligns with typical porphyry copper deposit models.

Golden Sky Minerals holds 100% ownership of the Rayfield project with no underlying royalties. The company has a low share count of fewer than 20 million shares outstanding and reported over US$300,000 in cash with no debt as of its last presentation. With a pending drill permit and ongoing ground-based surveys planned, the company continues to advance its exploration strategy across the Rayfield property.

Ownership and Share Structure

According to Refinitiv, the institution, Crescat Capital, owns 13.34%. Individual investor John Newell holds 5.29%. The rest is retail.

The company has a market cap of CA$2.74 million with 16.68 free float shares.

The 52 week range is is CA$0.075 to CA$0.13.

| Want to be the first to know about interesting Copper and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Golden Sky Minerals.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.