At the beginning of this month, Americans celebrated Independence Day. Spectacular light displays, barbecues, and the display of the American flag are ultimately a tribute to liberty.

Yet while Americans commemorate their political freedom, few ponder whether they've achieved economic liberation.

Let's face it: most citizens remain bound to a framework that dictates how they spend, save, and grow their wealth. It's referred to as the fiat monetary system, and it's well past time for a revolution.

The reality is, the dollar (and every other major government-issued currency) is hemorrhaging purchasing capability at an alarming rate. . .

Monetary authorities create currency as if there's no tomorrow, federal administrations accumulate deficits with zero plans to eliminate them, and rising prices silently devour your diligently earned reserves.

So this celebration, instead of merely honoring America's sovereignty, why not extend it further?

Why not proclaim your personal independence — from government-issued money, from climbing prices, and from the entire dysfunctional arrangement?

Fiat Currency: The Source of the Problem

To grasp why the fiat framework is so hazardous, you must comprehend what fiat money actually represents.

It's a currency that is lacking inherent worth. It's unsupported by tangible assets. It holds value because governmental authorities declare it does — and because society collectively pretends it possesses worth.

Historically, however, currency was anchored by gold, and each dollar could be traded for a specific quantity of this precious metal.

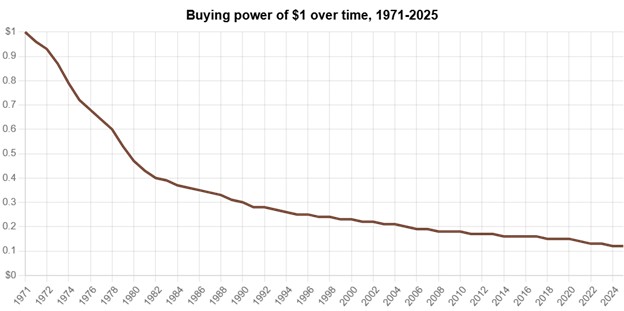

That arrangement concluded in 1971 when President Nixon eliminated the final connection between dollars and gold.

Ever since, monetary authorities have possessed unlimited authority to generate currency, which is precisely their course of action.

The consequence? A dollar in 2025 purchases approximately 10% of what it acquired in 1971.

This isn't merely inflation. It's systematic theft.

Consider this: You labor intensely, you accumulate savings, and your money's worth gradually vanishes because several individuals in professional attire at the Federal Reserve decide to "stimulate" the economy.

It resembles competing in a footrace with weights attached — except your competitor continuously repositions the endpoint.

Gold: The Time-Honored Solution

Gold represents the remedy for this insanity. It's functioned as money for over five millennia. It doesn't corrode, it doesn't deteriorate, and most crucially . . .

It cannot be fabricated from nothing.

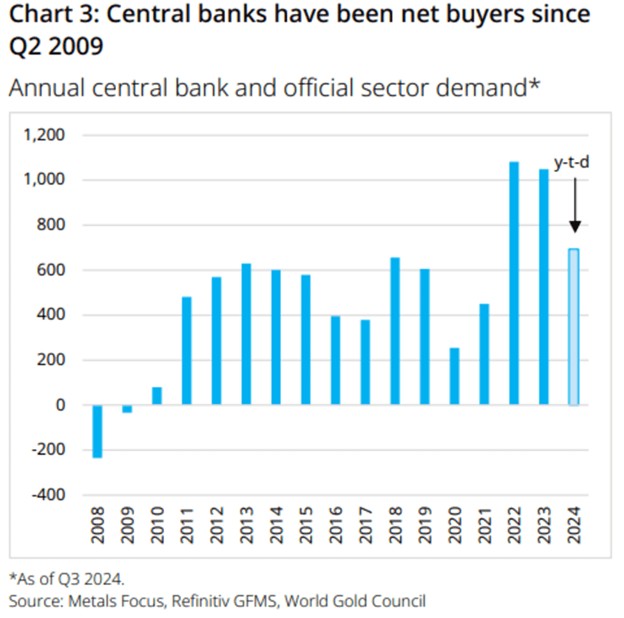

That's why monetary authorities — yes, the very institutions printing all this fiat currency — have been stockpiling gold like there's no alternative.

Indeed, they've been acquiring gold at unprecedented levels for nearly ten years. Ask yourself: Why would they pursue this strategy if the system they manage functions effectively?

Gold is authentic. It's physical. It's limited. And most significantly, it retains value across time.

When global confidence in paper currency falters — and make no mistake, that's already occurring — gold becomes the escape vessel.

Investing in gold isn't solely about safeguarding wealth. It's about exiting a broken framework.

It's about seizing control. It's about declaring your personal financial autonomy.

But what if a superior approach to gold ownership existed? A more contemporary, adaptable, and transparent method to access this ancient value repository?

The Future of Gold is Digital

The monetary ecosystem is presently experiencing massive transformation.

Conventional assets are becoming digitized and incorporated into blockchain technology. Property, stocks, debt instruments, and even gold are being tokenized.

Tokenization involves creating digital versions of physical assets. Imagine it like possessing a stock certificate, but rather than residing in a brokerage account, it exists securely on blockchain technology.

It's quicker, more economical, and without borders. No intermediaries. No bureaucracy.

Tokenized gold takes this concept further. It merges gold's enduring value with modern financial innovation. And this brings us to one of the most promising developments in the gold sector: NatGold.

NatGold: Where Digital Finance Meets Real Gold

NatGold represents a novel digital asset category.

It isn't backed by gold stored in vaults. It's supported 1:1 by underground gold resources that have been confirmed using industry-standard NI 43-101 and JORC assessments.

This means every NatGold token symbolizes an actual, measurable amount of gold still embedded in the earth.

Why is this significant?

Unlike vault-secured gold tokens requiring costly storage, verification, and transportation, NatGold allows investors to access gold without extracting it at all, resulting in a substantially lower expense. This creates enormous upside potential.

It resembles owning a portion of an undeveloped gold deposit — without requiring mining operations or equipment to realize profits. Better still, NatGold is already generating excitement.

Tens of millions in investment have arrived from participants across nearly 100 nations already.

And these aren't merely speculators...

These are individuals — just like yourself — who recognize the impending crisis and seek escape from the fiat predicament.

They're reclaiming authority over their economic destiny.

They're selecting authentic assets.

They're choosing gold.

And they're doing so using the most intelligent, contemporary approach possible.

So the question remains — what's holding you back?

The Powerhouse Behind Digital Gold

Now that you understand NatGold and why it represents such a revolutionary concept, you're likely wondering, "Where exactly is all this underground gold originating?"

That's where NatBridge Resources Ltd. (NATB:CSE; NATBF:OTC) enters the picture.

NatBridge isn't just another gold exploration enterprise. It's the first — and currently sole — provider of verified underground gold meeting stringent NatGold requirements.

NatBridge truly stands alone.

It maintains exclusive priority access to NatGold's tokenization platform, meaning it will pioneer the tokenization of up to 2.5 million ounces of verified underground gold under the NatGold framework.

This isn't a distant objective — it's happening now.

These ounces have already received confirmation through NI 43-101 or JORC standards, so the gold is authentic, quantifiable, and already awaiting extraction.

NatBridge isn't merely ahead of competitors — it's constructing the pathway others will eventually attempt to traverse.

But what makes the NatBridge model particularly exciting is its extended strategy.

The company targets gold assets already possessing geological verification and perpetual mineral ownership rights. That's significant because it eliminates much uncertainty plaguing traditional mining enterprises.

NatBridge isn't interested in speculative ventures in unstable regions. Its focus remains precise — secure quality assets in safe, stable jurisdictions like the United States, where ownership remains secure and regulations are predictable.

So while the mining industry continues pursuing familiar strategies, NatBridge is quietly assembling a gold-backed venture poised to propel the NatGold revolution.

If NatGold represents digital gold ownership's future, then NatBridge certainly constitutes the foundation.

And with priority tokenization access until at least 2030, it might also be one of the most consequential gold companies you've never encountered — until today.

Join the Revolution

The established system is collapsing before our eyes. Fiat currencies are buckling under debt burdens, mismanagement, and unrestrained currency creation. Inflation is depleting your purchasing power and won't disappear. Monetary authorities, accumulating gold while instructing the public to "trust the system," won't suddenly become responsible. And politicians won't suddenly curtail spending (regardless of campaign promises).

But you needn't sink with the vessel.

You can liberate yourself. You can invest in authentic value. You can embrace gold's digital evolution.

So, this July, take a lesson from your country's forefathers and declare your own independence.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of NatGold Digital Ltd. and Natbridge Resources.

- Jason Williams: I, or members of my immediate household or family, own securities of: NatGold Digital Ltd. and Natbridge Resources. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.