Harmony Gold Mining Co. (HMY:NYSE; HAR:JSE) named it Mponeng. In South Africa's Sotho tongue, this translates to "look at me."

And when you comprehend what's transpiring over two miles beneath our planet's crust near Johannesburg, you'll grasp why.

This isn't merely an excavation site. It's an underground metropolis. A testament to human avarice, ambition, and folly.

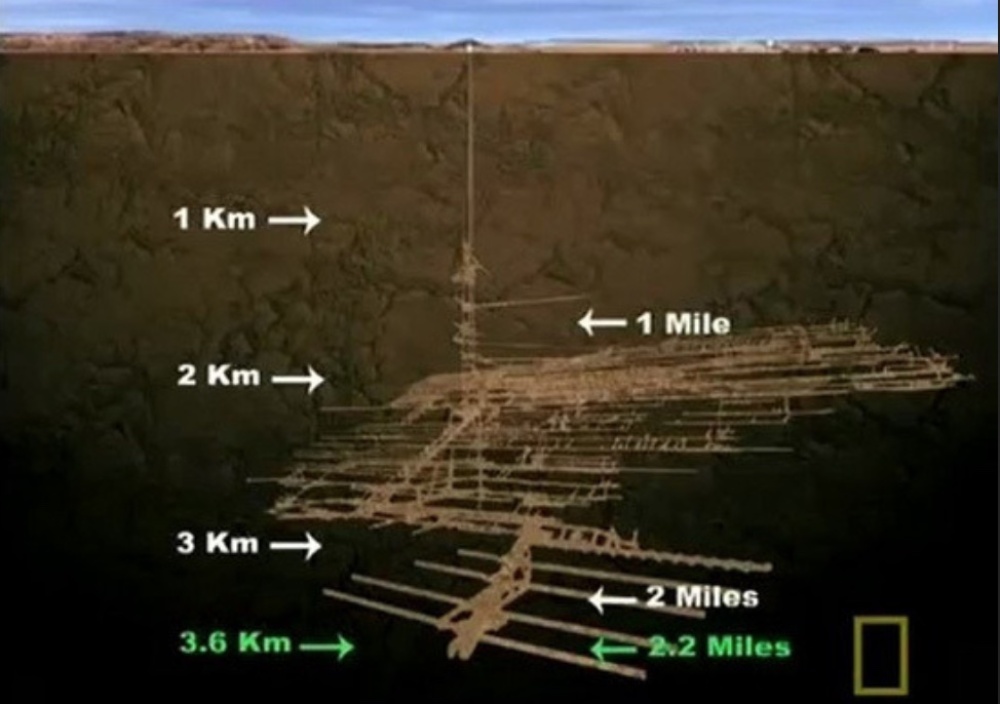

Mponeng stands as Earth's deepest mine, penetrating an astonishing 2.5 miles into our planet's shell.

That's 40 times deeper than the Empire State Building's height.

Its tunnels, if extended, would span over 240 miles. Equivalent to driving underground from DC to NYC. In absolute darkness. Facing potential collapses, inundations, and stone temperatures reaching a scorching 150°F.

Here, humanity confronts Earth's molten edge in the perpetual quest for precious metal.

The Subterranean Metropolis of Insanity

To extract precious metal from Mponeng, 4,000 laborers descend daily.

They plummet at speeds approaching 40 mph in dual-level elevators — some journeying an entire hour before reaching their workstations.

Below, temperatures soar so high that massive air conditioners must pump 6,000 tons of chilled air daily just to preserve human life.

The heat isn't the sole danger — death lurks everywhere.

Earth tremors occur constantly. Sudden rock explosions — essentially subterranean quakes — happen frequently. Workers carry tracking devices in case of entrapment. Over 100 fatalities occurred at Mponeng during just one decade.

Operating this behemoth consumes nearly 10% of South Africa's entire energy production.

Consider this reality:

A single excavation site, comparable to Manhattan's footprint, devouring sufficient electricity to supply 400,000 residences.

And its yield?

Approximately 10 tons of gold annually.

That's it.

Ten tons. From an operation that devours humans, mountains, and megawatts like an insatiable monster.

Our Continued Motivation

So why endure this ordeal? Why risk everything for just 10 tons of this element?

Because it transcends mere metal.

Gold embodies memory.

It represents trust.

It functions as a universal currency.

For over six millennia, this precious substance has remained the one asset universally valued, from ancient Egyptian rulers to modern central bankers.

Gold formed the coins along ancient trade routes. These ingots backed national currencies. This substance adorned sacred structures. This element fueled empires, toppled kingdoms, and shaped contemporary financial frameworks.

Even today, when paper currency can multiply infinitely, financial institutions stockpile gold as if nothing else matters.

Because perhaps nothing else does.

The Actual Price of Authentic Metal

But our extraction methods? They're fundamentally flawed.

We've exhausted the richest deposits, scoured mountain peaks, and explored bottomless pits. Now, we're left with operations like Mponeng, where expenses are so enormous that only minimal yields justify recovery.

We excavate deeper. Endanger more lives. Invest billions. And devastate entire ecosystems for mere bars of bullion.

The human toll is astronomical.

The environmental damage is unconscionable.

The financial burden proves unsustainable.

Yet . . . we still require this precious substance.

So what's the solution?

Introducing NatGold: Revolutionary Metal Ownership

Picture Mponeng never requiring excavation.

Imagine if $8 billion worth of precious metal already discovered and verified underground could be digitized — authenticated, registered, and traded electronically without extracting a single gram.

No detonations.

No casualties.

No ecological devastation.

Just digitally-secured tokens, recorded on unalterable registers, representing certified, untouched deposits already verified by scientists, reserves Mponeng possesses abundantly.

That's the concept behind NatGold Digital Ltd.

This represents the future of precious metal ownership.

Mponeng Exemplifies the Past, NatGold Defines the Future

What Mponeng accomplished with heavy machinery, NatGold Digital Ltd. achieves with digital technology.

Rather than investing $1.4 billion to excavate a hole rivaling an inverted skyscraper, NatGold provides worldwide access to previously identified reserves — deposits independently assessed, geographically confirmed, and digitally certified.

No pollutants.

No blasting.

No government bribery.

No environmental guilt.

It's a transformation in precious metal ownership. Enabling authentic metal possession — without planetary destruction.

And here's the surprising revelation. . .

We've Already Secured Over 3,400 Digital Reservations Before Official Launch

Indeed. Merely through mentions in select editorial communications — like this one — investors have already claimed more than 3,400 NatGold Tokens.

Once publicly available, we anticipate overwhelming demand, particularly as awareness grows that operations like Mponeng represent outdated methodology.

Precious metal will forever retain value.

But our access methods are transforming — right now.

With NatGold, you're participating before widespread adoption begins.

This resembles acquiring Bitcoin during 2009 . . . but with something considerably more stable. Far more ancient. Far more tangible. Far more real.

| Want to be the first to know about interesting Gold and Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of [NatGold Digital Ltd.].

- [Brian Hicks]: I, or members of my immediate household or family, own securities of: [NatGold Digital Ltd.]. My company has a financial relationship with [None]. My company has purchased stocks mentioned in this article for my management clients: [None.] I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.