Spot gold did not make a new high in this last rally. Gold futures did not make a new high in this rally. U.S. T Bonds are still in Groundhog Day. The U.S. dollar is still bottoming out. Gold stocks are uncertain. Everything is in limbo.

So much is happening, and no one knows anything!

I hope it has been planned to be so.

Getting through and out the other side is likely to bring us much lower bond yields, a strong US$, rising commodities, and a booming U.S. economy.

Heed the markets, but they don't know what is happening either.

Spot gold has broken this downtrend in pennant but no new high.

Supporting on parabola:

Gold Futures pricing:

Gold Futures up close:

My US$3,300 target has been exceeded.

Overbought on RSI, suggesting a peak.

Gold Stocks

Pathetic for a bull market.

Not much volatility at a market high.

Is up 50% and overbought:

What does this mean?

And this?

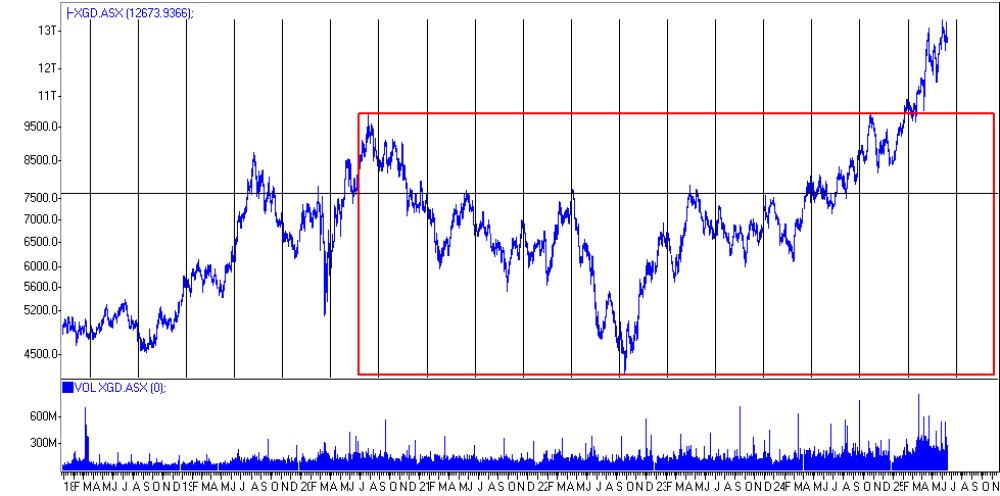

ASX Gold Index

This should be showing frenzied market action, but it isn't.

CRB Index

The CRB Index is getting interesting.

36-month trading range:

A big break out is coming soon.

Gold Versus Other Asset Classes

Gold is peaking against T Bonds.

That bond rally will be really big.

This is even more compelling:

Silver was just 1% of gold.

CRB bottom against gold:

US T Bonds

10-year yields are heading lower.

30-year yields are heading lower.

20-year Bond ETF looks like it is bottoming.

The next move could be up strongly.

Other Bond Yields

All other bond yields are heading higher, likely with weaker currencies.

The 10-year German bond yields are heading up again.

The UK 10-year treasury yield has a parabolic rise coming.

The 10-year Japanese government bond is heading higher again.

Yen is breaking down soon.

The mighty U.S. dollar.

Head the markets, even if they don't know either!

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.