War, debt, and empire transition (from West to East) dominate the gold, silver, and oil market landscape . . . and more so now than in quite some time.

Here's a stunning visual picture of what's creating the surge in the price of oil:

Western investors are mainly fiat-oriented. They seem oblivious to outrageous U.S. stock market overvaluation and the financial danger presented by a potential skyrocket move for oil.

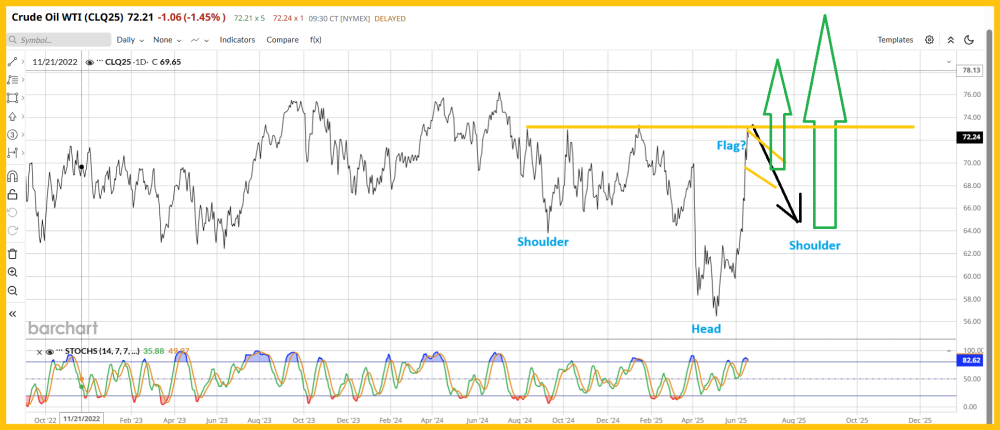

Here's a look at the oil chart:

The situation is serious. The oil chart is becoming more bullish by the day. Flag patterns and H&S bottoms are strong indicators that higher prices lie ahead.

How can investors protect themselves against what is likely to come?

Buying oil stocks (both production and transport) is one way to do it and here's a view of a lowed-price shipper that trades on the NYSE:

The chart is phenomenal. Any time junior resource stock enthusiasts can buy a senior company on a senior exchange and do it at a junior price . . . my suggestion is to consider doing so with gusto!

NAT-NYSE certainly fits that bill. Stoplosses could be used at either $2.65 or $2.50 to contain risk on the trade.

What about uranium?

Well, the U.S. government is backing it, and that alone makes the sector a Buy.

Here's the Sprott physical uranium fund chart:

It looks like an unstoppable freight train, and with the government's backing, this action can continue not just for months . . . but for years.

Here's a look at a very interesting junior yellowcake stock, Deep Yellow Ltd. (DYL:ASX):

The chart action is bullish.

Investors can buy grub stakes now, and more on a pullback to the neckline of the nice H&S pattern.

The hottest sector in town right now is the "Three White Metal Amigos" . . . platinum, palladium, and silver.

Here's a look at a key chart for silver:

Silver is pushing through the important 35.50-38 resistance zone. That opens the door for a surge straight to 44.

Incredibly, while these metals are "white hot," the companies looking to mine them are ever hotter!

Here's a look Coeur Mining Inc. (CDE:NYSE), one of the most exciting breakouts in the history of the silver stocks market:

Coeur is now the number two holding in the massive XME metal miners ETF. The breakout is stunning, as is the volume accompanying it on this monthly chart.

Clearly, the time is now for junior resource investors to not only take the bull by the horns, but to ride it while exclaiming, "Hi Ho Silver!"

Special Offer for Streetwise Readers: Please send me an Email to [email protected] and I'll send you my free "Silver Stocks Blastoff!" report. I highlight key silver stocks trading under $1 with breakout gaps, big volume, and rock-solid investor tactics to play the action. I write my junior resource stocks newsletter 2-3 times a week, and at just $199/12mths it's an investor favourite. I'm doing a special pricing this week of $169 for 14mths. Click this link or send me an email if you want the offer and I'll get you onboard. Thank-you.

| Want to be the first to know about interesting Silver, Oil & Gas - Exploration & Production and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Stewart Thomson: I, or members of my immediate household or family, own securities of: SIL:N YSE. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Stewart Thomson Disclosures

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?