Metallic Minerals Corp.'s (MMG:TSX.V; MMNGF:OTCQB) follow-up district-scale exploration program at its La Plata copper-silver-gold-platinum group elements (PGEs) project in southwest Colorado returned positive surface rock sample results, noted a news release.

"The program resulted in the advancement to a priority drill-ready status at three untested targets with over 25 additional target areas identified for additional work within the 25 square kilometer porphyry system footprint," President Scott Petsel said in the release.

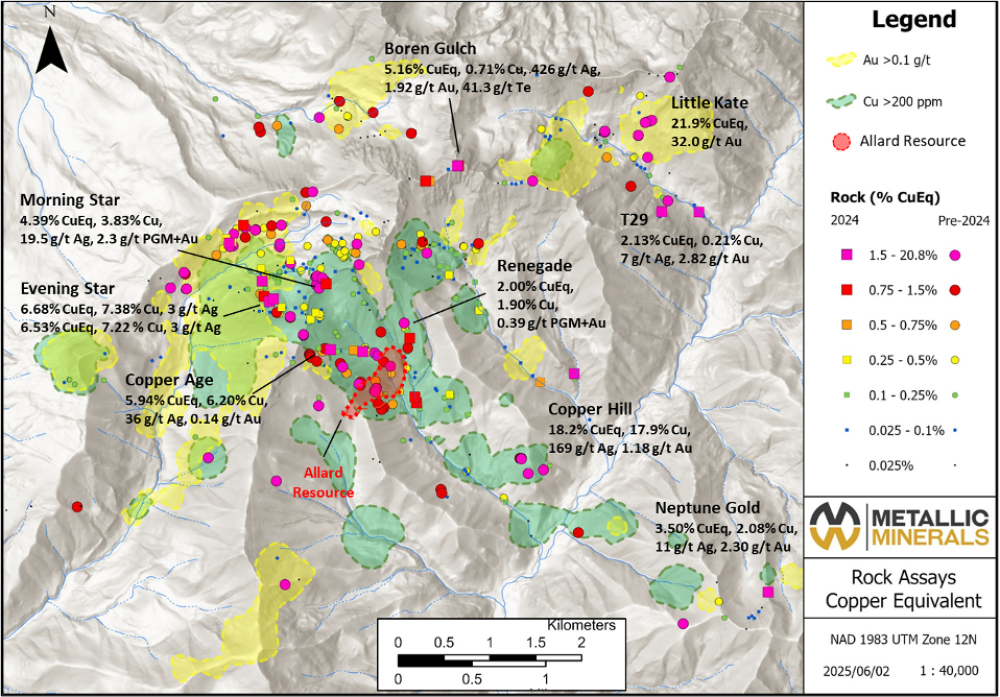

The rock samples returned significant high-grade results and confirmed highly prospective ground. The Top 30 samples returned:

- Copper (Cu): an average of 1.68% copper equivalent (Cu eq), with 12 samples exceeding 1% Cu eq

- Gold (Au): an average of 0.51 grams per ton (0.51 g/t) with seven samples higher than 1 g/t Au

- Silver (Ag): an average of 25.7 g/t, with grades as high as 426 g/t Ag

- Platinum (Pt)+palladium (Pd): an average of 0.037 g/t combined, the highest value being 0.3 g/t Pt+Pd

The Evening Star target, now drill ready, returned some of the highest-grade surface rock sample results. They include 6.68% Cu eq (7.38% Cu and 3 g/t Ag) and 6.53% Cu eq (7.22% Cu and 3 g/t Ag).

The adjacent Morning Star target also returned high-grade samples in porphyry host rocks at 4.39% CuEq, (3.83% Cu, 19.5 g/t Ag, 2.3 g/t PGM+Au) (See figure).

The Copper Age North target, near the current Allard resource, returned 5.94% Cu eq (6.2% Cu, 36 g/t Ag, and 0.24 g/t combined Au+Pt+Pd (0.14 g/t Au, 0.03 g/t Pt and 0.06 g/t Pd).

Through this rock sampling and mapping, Metallic Minerals, with help from strategic investor Newmont Corp. (NEM:NYSE) geologists, prioritized existing targets and identified four new target areas (Lower Boren, Middle Bedrock, New Star and T29 Extension) with significant copper, silver, gold and PGE grades, including many Cu eq grades higher than 1.5%.

Additional exploration work done during the program at La Plata included mineralogical testing by researchers at Cardiff University, results from the U.S. Geological Survey's high-resolution airborne magnetic and radiometric survey over the La Plata Mining District, and Metallic Minerals' first community open house events.

In other news, Metallic Minerals' management team will be available at these two upcoming and other events: the Precious Metals Summit in Beaver Creek, Colorado, Sept. 9–12, 2025, and the Precious Metals Summit in Zurich, Switzerland, Nov. 10–11, 2025.

Creating Value Via Project Advancement

Based in Vancouver, British Columbia, Metallic Minerals is a mineral explorer with three keys assets.

One is La Plata, where the company is working toward an updated mineral resource estimate. The existing NI 43-101-compliant La Plata Inferred resource, as of July 2023, is 1,210,000,000 pounds of Cu and 17,600,000 ounces (16.6 Moz) of Ag, with 147,300,000 tons at an average grade of 0.37% Cu and 3.72 g/t Ag (or 0.41% Cu eq) using a 0.25% Cu eq cutoff grade, according to the news release.

In May, the company announced the presence of light and heavy rare earth elements (REEs) at the project, discovered via exploration and confirmed with geochemical analyses, Streetwise Reports reported. As such, Metallic noted that "significant potential" exists for co-producing critical minerals in addition to copper, silver, gold and PGEs at La Plata.

This finding is significant for many reasons, Peter Krauth of Silver Stock Investor wrote in a May 7 report. REEs are essential for advanced technologies, military applications, and clean energy. The U.S. Geological Survey has designated the La Plata Mining District a Critical Minerals Resource Area, thus making it vital to U.S. national security and economic resilience. In fact, previous work conducted by the U.S. Bureau of Mines showed enriched REEs and other critical minerals in the system. Further, the current U.S. Administration is prioritizing and supporting secure, domestic supply chains of critical materials.

Geochemical results "so far are positive and suggest that a second processing phase for the critical mineral content, after recouping the copper and silver, could boost the project's value and minimize potential environmental impact by maximizing the resources extracted," reported Krauth.

Metallic Minerals also owns the Keno silver project in Yukon Territory, adjacent to Hecla Mining's Keno Hill silver operations in the historical Keno Hill Silver District, according to Metallic's Fact Sheet. Keno has an estimated Inferred resource, as of last year, of 18.2 Moz silver equivalent (Ag eq) at grades of 120 g/t Ag, 0.1 g/t Au, 0.8% lead and 1.77% zinc. Currently, with 11 advanced stage and 40-plus high-grade, bulk-tonnage predrill targets at Keno, potential exists to rapidly develop the project's mineral resource.

Metallic Minerals' third asset is an expanding portfolio of production royalties on alluvial gold claims in the historic Klondike Gold District and beyond.

Copper and Silver: Two Growing Markets

The near-term outlook for copper is uncertain as it is being influenced by "dueling forces," wrote MetalMiner in a May 29 article. Robust long-term demand drivers, such as electrification and the green energy transition, support the price. In contrast, the threat of an escalating U.S.–China trade war and a potential copper surplus have the opposite effect.

The International Copper Study Group forecasts a 2025 copper surplus of 289,000 tons, more than double last year's amount, reported The Rio Times on June 17. This is due to increasing mine output, particularly from new projects in the Democratic Republic of Congo, Mongolia and Russia. The group anticipates 2.3% growth in global mine production this year and further gains in 2026 as new and expanded capacity comes online.

The International Copper Study Group forecasts a 2025 copper surplus of 289,000 tons, more than double last year's amount, reported The Rio Times on June 17. This is due to increasing mine output, particularly from new projects in the Democratic Republic of Congo, Mongolia and Russia. The group anticipates 2.3% growth in global mine production this year and further gains in 2026 as new and expanded capacity comes online.

"Despite these surplus projections, short-term market sentiment remains cautious," The Rio Times noted. "The technical picture matches the fundamentals: copper is consolidating, with neither bulls nor bears in clear control."

Chile's state copper commission Cochilco expects an average copper price above US$4/lb this year, reported MetalMiner. However, unless trade tensions between the U.S. and China ease, copper may not advance anymore in 2025. (The copper price was US$4.79/lb when the markets closed on June 17.)

Long Forecast, more optimistic in its prediction, forecasts the copper price hitting $5.23/lb by year-end 2025 (YE25), increasing further to $5.71/lb by YE27 and jumping to $7.06/lb by YE29.

From a longer term perspective, the copper to gold price indicates that copper is at one of its most undervalued levels in the past 50 years relative to gold, which is similar to the extreme undervaluation currently seen in the silver to gold price.

The current uptrend in the silver price is likely to continue, purported a June 9 CBS News article. At the close of trading on June 17, silver was US$37.22/oz.

The current uptrend in the silver price is likely to continue, purported a June 9 CBS News article. At the close of trading on June 17, silver was US$37.22/oz.

"Silver is up 25% from a year ago and has room to run higher, with many analysts predicting US$40/oz by end of year," Brett Elliott, director of content at precious metals marketplace APMEX, told the television broadcaster. "This is roughly a 20% gain from current levels, which would be an excellent return if price action follows the expected path."

Industrial demand for the metal, for solar panels, electric vehicles and electronics, is expected to reach new highs and surpass new supply this year after record demand last year, wrote Christian Norman in a June 10 MarketPulse article. Other factors pushing up the silver price are global monetary policy, ongoing safe haven demand and a weaker U.S. dollar.

Brien Lundin of Gold Newsletter posited in a June 9 alert that the next target for silver is US$40/oz. Analysts and other experts expect US$50/oz silver sometime in 2026. Lundin, however, thinks we could see US$50 silver sooner, by the end of this year, he wrote.

Given the rising price, he suggests buying physical silver or investing in silver stocks as the latter "can provide extraordinary leverage to physical silver," he noted. "Silver equities finally are moving and outperforming the metal itself."

Further out, the silver price will rise incrementally through at least 2036, according to Coin Price Forecast on June 18. Predications call for silver to reach $43.14 by the end of this year, $51.75 by YE26, $72.03 by YE28, $92.06 by YE30 and $152.23 by YE36.

The Catalyst: La Plata MRE Update

Soon, Metallic Minerals expects to announce planned H2/25 exploration programs for La Plata and Keno, Petsel said in the release.

This year, the company expects to complete an update to the existing La Plata resource estimate, to include recent drilling funded by Newmont. In addition to copper and silver, the resource will incorporate gold, platinum and palladium results as well as expanded precious metals analyses.

Other catalysts, according to the company's June 2025 Investor Presentation, are field results from Keno and, potentially, new alluvial production and royalty agreements.

100%-Plus Return Potential

Peter Krauth of Silver Stock Investor recommended, in a May 7 report, that investors add to their position in Metallic Resources on weakness.

He wrote this about La Plata: "This could be an outstanding copper/precious metals project and a strategically important source of U.S. critical minerals. That could help La Plata gain government support and even potential fast-tracking towards eventual production."

Couloir Capital's research team highlighted, in an October 2024 research report, the impending resource estimate update for La Plata and the potential to expand the significant silver resource at Keno further. They view Newmont's investment in the company as "a vote of confidence, by a tier 1 miner, in its resource potential."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Metallic Minerals Corp. (MMG:TSX.V; MMNGF:OTCQB)

The analysts noted that Metallic Minerals is one of the largest holders of alluvial gold mining claims in Yukon Territory and is generating revenue from production royalties on these claims.

"MMG will have two operators by the 2025 season with five-year deals that pay a 15% royalty on revenue," they wrote.

Couloir Capital has a Buy rating on Metallic Minerals and a fair value target that implies a 119% return from the current share price.

Ownership and Share Structure

According to Metallic Minerals' Investor Presentation, ownership of the company breaks down this way: management and associates own 15%, Newmont Corp. holds 9.5%, Eric Sprott has 12.5% and high net worth individuals own 15%.

Institutional ownership totals 20%. The remainder, 28%, is in retail.

As of June 3, the Canadian explorer has 179 million (179M) issued and outstanding shares, 15.6M in options, 18.9M in warrants and 214M fully diluted shares. Its market cap is CA$52 million. Refinitiv reports Metallic Mineral's 52-week range is CA$0.125–0.325 per share.

| Want to be the first to know about interesting Silver, Base Metals, Gold and PGM - Platinum Group Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Metallic Minerals Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.