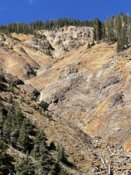

Stillwater Critical Minerals Corp. (PGE:TSX.V; PGEZF:OTCQB; J0G:FSE) has mobilized drill rigs to its flagship Stillwater West nickel-platinum group elements (Ni-PGE), copper, cobalt, and gold project in Montana, USA. The 2025 drill program will focus on expanding drill-defined deposits of polymetallic sulphide mineralization by testing newly identified targets that emerged from the company's recent geophysical survey and updated geological model.

Energold Drilling has been contracted for the campaign, which is supported by Glencore plc through a technical committee formed under its strategic investment agreement. The company also continues to collaborate with ALS GoldSpot, which is applying artificial intelligence and machine learning to refine exploration targeting. Stillwater's updated 3D geologic model, expanded from 9.5 kilometers to over 20 kilometers, incorporates findings from the 2024 MobileMT magneto-telluric geophysical survey, which identified multiple large-scale conductive anomalies coincident with known mineralized zones.

"The 2024 geophysical survey has transformed our understanding of the Stillwater West project," said Dr. Danie Grobler, Vice-President Exploration, in the announcement. "The identification of multiple large-scale conductive targets in and around known mineralization provides us with a robust pipeline of high-quality drill targets for expansion of our current resources."

CEO Michael Rowley added that Stillwater's exploration strategy aims to replicate the economics of South Africa's large polymetallic sulphide mines in the Platreef district within the geologically parallel Stillwater Igneous Complex. The company's most recent NI 43-101 mineral resource estimate, released in January 2023, outlines 1.6 billion pounds of contained nickel, copper, and cobalt and 3.8 million ounces of platinum group elements and gold at the Stillwater West project. The company noted its position as host of the largest nickel-platinum group element resource in an active U.S. mining district, referring to its location beside Sibanye-Stillwater's active PGE mines.

Stillwater also holds a 49% interest in the Drayton-Black Lake gold project in Ontario, and additional assets in Alaska, Yukon, and British Columbia. Stillwater West is located adjacent to Sibanye-Stillwater's J-M Reef, which contains more than 100 million ounces of platinum and palladium and is the highest-grade PGE deposit globally.

Critical Minerals Sector: Strategic Supply Chains and Rising Demand

The global critical minerals sector is playing an increasingly central role in ensuring national security, enabling clean energy transitions, and reinforcing industrial supply chains. In response to growing geopolitical and economic concerns, countries such as the United States and Canada are accelerating efforts to establish domestic production and reduce reliance on imports, particularly from China. On June 13, Indian Defence Review cited analysis from the Climate Institute of Canada, which warned that Canadian critical mineral output could drop from CA$9.2 billion in 2023 to CA$4 billion by 2040 without swift intervention. "The demand will increase over the next 15 years, while the local production will decrease," said Marisa Beck, the institute's director of research in growth. Beck estimated that meeting domestic demand would require CA$30 billion in investment, while supplying global markets would require CA$65 billion, including the construction of at least 30 new mines.

A June 14 report from the Washington Examiner highlighted U.S. efforts to streamline critical mineral development through the FAST-41 permitting program. Initially established during the Obama administration, the program was expanded under President Trump in 2025 to include six additional mining projects. Its objective is to cut permitting delays and support the rapid development of key infrastructure. Emily Domenech, who leads the Permitting Council, said, "My goal would be to move as many projects to construction in the first two years of the Trump administration as is humanly possible." She also noted that 25 more critical mineral projects are currently being tracked through the program's transparency tools.

On June 16, Reuters reported that G7 leaders had reached a draft agreement focused on securing critical mineral supply chains in light of growing concerns over China's market influence and export restrictions. The document stated, "Non-market policies and practices in the critical minerals sector threaten our ability to acquire many critical minerals." The G7's strategy calls for greater diversification in mining, processing, manufacturing, and recycling across member nations to reduce exposure to geopolitical disruptions.

According to Daily Fortex analyst Christopher Lewis on June 18, copper has a reputation as a barometer of global economic health, remains under pressure amid persistent growth concerns and overall market volatility. While the price is hovering near the 50-day exponential moving average (EMA)—which is beginning to trend upward—Lewis noted that this level could offer some short-term support. Still, the broader market remains in a holding pattern, consolidating between US$4.50 and US$5.00 per pound. With copper's role in sectors such as construction, artificial intelligence, and electrification, its performance may serve as a signal for broader market trends. However, given current uncertainties, Lewis suggests traders view copper less as a directional trade and more as a reflection of global risk appetite.

Driving the Next Phase of American Supply: Stillwater's Strategic Momentum

Stillwater Critical Minerals is pursuing a strategy to become a primary domestic source of critical minerals in the United States, aligning with federal efforts to strengthen national supply chains. The company reports that its 61 square kilometer claim block spans 33 kilometers of the Stillwater Igneous Complex and hosts five "Platreef-style" deposits - large, bulk-tonnage polymetallic sulphide systems enriched in nickel, copper, cobalt, platinum group elements, and gold. These deposits are geologically analogous to the high-profile Mogalakwena and Platreef mines in South Africa.

According to the company's May 2025 investor presentation, Stillwater West is being positioned as a scalable and low-carbon source of nine minerals identified as critical by the U.S. government. With over 40,000 meters of drilling completed, the company has advanced to the stage of expanded resource definition, metallurgical studies, and planning for a preliminary economic assessment.

Stillwater's strategic partner Glencore has invested US$7.04 million to date, with an option to increase its stake by a further US$6.76 million. Glencore also holds a seat on Stillwater's board of directors and provides technical support through the joint technical committee. Stillwater is further leveraging relationships with Cornell University and the Lawrence Berkeley National Lab for carbon capture and hydrogen production research, adding environmental innovation to its resource development plans.

Streetwise Ownership Overview*

Stillwater Critical Minerals Corp. (PGE:TSX.V; PGEZF:OTCQB; J0G:FSE)

As Stillwater's 2025 drill campaign gets underway, the company is aiming to unlock further expansion potential by testing targets identified across a 12-kilometer-long anomaly. Recent drill results from 2023 include intervals such as 5.8 meters at 0.99% nickel equivalent and 63.7 meters at 0.84% nickel equivalent. The company expects to provide additional updates on exploration progress, government initiatives and its non-core assets in the coming months.

Ownership and Share Structure

Management and insiders own approximately 20% of Stillwater, according to the company.

Executive Chairman and Director Gregory Shawn Johnson owns 2.86%, President and CEO Michael Victor Rowley owns 2.56%, Independent Director Gregor John Hamilton owns 1.65%, Independent Director Gordon L. Toll owns 0.44%, and Vice President of Exploration Daniel F. Grobler owns 0.23%, according to Reuters.

Institutions own approximately 25% of the company, high net-worth investors own about 37%, and Glencore Canada Corp. owns 15.4%. About 18% of the company's shares are in retail, Stillwater said.

There are about 233 million shares outstanding with 180.5 million free float traded shares, while the company has a market cap of CA$49.93 million and trades in a 52-week range of CA0.0900 - CA0.2250.

| Want to be the first to know about interesting Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Stillwater Critical Minerals is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.