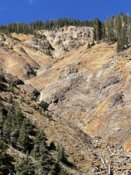

Gladiator Metals Corp. (GLAD:TSX; GDTRF:OTC) reported results from its Phase 1 and early Phase 2 drill programs at Cowley Park within the Whitehorse Copper Project in Yukon, Canada. According to the June 17 announcement, assay results confirmed the continuity of near-surface high-grade copper-gold-molybdenum-silver skarn mineralization across multiple zones, further validating exploration targets and the overall geological model.

Highlights from the Phase 2 program included drill hole CPG-078, which returned 58.7 meters at 1.94% copper from 102.3 meters, including 11.1 meters at 6.00% copper and 8.0 meters at 3.80% copper. Additionally, CPG-077 intersected 24.8 meters at 0.77% copper from 30 meters, including a 6.0-meter interval grading 2.18% copper. These results were described by CEO Jason Bontempo in the news release as demonstrating "consistent high copper grades from near surface," confirming the "exciting potential of the Cowley Park prospect."

The company has completed 23 holes totaling 4,377 meters in Phase 1 and received results for the first 1,443 meters of its 29,000-meter 2025 drill campaign. Two rigs remain in operation at Cowley Park, and a third is testing regional prospects, with further results expected shortly. Drilling is targeting strike extensions and new zones of mineralization in both known and underexplored areas, including the endoskarn system, which has not been systematically tested in past campaigns.

These results are being incorporated into a maiden mineral resource estimate for Cowley Park, scheduled for the second quarter of 2026. In parallel, drilling continues at other key targets across the Whitehorse Copper Belt, including the Arctic Chief and Best Chance prospects.

Copper's Rising Demand Meets Trade Disruption

The global copper sector has experienced heightened volatility in 2025 due to shifting trade policies, pricing pressure, and growing demand from electrification and renewable energy projects. According to J.P. Morgan Research on May 1, the global outlook for copper has been weighed down by a higher probability of recession, coupled with trade policy uncertainties. The firm projected average copper prices of US$8,300 per metric ton for Q2 2025, reflecting reduced demand growth forecasts.

Gregory Shearer, head of Base and Precious Metals Strategy, stated, "Tariff-driven cuts to economic growth forecasts and an increased probability of recession this year translate to steep cuts to our metals demand forecasts." He added that a minimum 10% tariff on copper imports was expected to be applied following the U.S. Department of Commerce's ongoing Section 232 investigation.

Jeff Clark of The Gold Advisor wrote, "If you don't yet own shares, today offers a good entry point for a first tranche."

Reuters reported on June 15 that a surge in physical copper shipments to the U.S. ahead of potential tariffs had created imbalances in global supply. "U.S. imports of refined copper jumped to more than 200,000 tons in April, the highest monthly arrival rate this decade," wrote columnist Andy Home. The article noted that Chilean brands accounted for up to 75% of inbound shipments, draining London Metal Exchange warehouse stocks to nearly two-year lows. Time spreads on the LME moved into backwardation as physical inventories were cancelled for shipment, underscoring the tightness in global supply chains.

While supply has faced disruption, the demand side remains strong, particularly in sustainability-focused markets. A June 17 report by Barchart highlighted that the global recycled copper market was expected to grow from US$50.49 billion in 2025 to US$102.28 billion by 2032. The report cited regulatory mandates and technological advances as key drivers. In North America, the Inflation Reduction Act and rising EV charging infrastructure adoption supported increased use of recycled copper. Market research noted that "recycled copper now accounts for over 35% of overall copper output in some regions," reflecting a broader trend toward sustainable sourcing.

Expert Highlights Ongoing Growth Potential at Gladiator Metals

According to Jeff Clark's June 17 analysis, Gladiator Metals' recent drill results at Cowley Park provided further confirmation of high-grade mineral continuity and expansion potential. Clark's Gold Advisor commentary stated that the latest intercept of 58.7 meters at 1.94 percent copper, including 11.1 meters at 6.00 percent copper and 8.0 meters at 3.80 percent copper, amounted to "yet another strong intercept from Cowley Park." He calculated the result as "a very healthy 114%-meters copper," noting that it reinforced the strength of the ongoing drill campaign.

Clark pointed to multiple additional intercepts as part of the final batch of Phase 1 and early Phase 2 results, highlighting consistent grades across several drill holes. He reported that "mineralization remains open along strike and at depth," with two rigs currently focused on Cowley Park and a third drilling regional targets across the Whitehorse Copper Belt. He described the property as "clearly both strengthening and growing," and added that the planned 29,000-meter drill program could yield "lots of results and potential catalysts between now and then."

He also shared commentary from CEO Jason Bontempo, who emphasized that "ongoing resource definition drilling on the defined high-grade mineralized skarn at Cowley Park continues to deliver consistent high copper grades from near surface and confirms the exciting potential of the Cowley Park prospect."

Clark concluded that the stock remained within his buy range, writing, "If you don't yet own shares, today offers a good entry point for a first tranche." He disclosed that he held a personal position in the company and was watching for a pullback to add more.

Near-Term Drivers from Cowley and Beyond

Gladiator's 2025 exploration and development plan is centered on advancing Cowley Park toward an initial inferred resource while continuing to test high-grade copper skarn targets across the broader Whitehorse Copper Project. The company has identified Cowley Park as its cornerstone asset, with more than 300 holes drilled to date and mineralization now confirmed over 700 meters of strike. The zone remains open in all directions.

According to the company's May 2025 investor presentation, Gladiator is operating under a Class 1 permit with plans to secure Class 3 permit approval by mid-year, which would allow for increased drill density. The current campaign includes a total of 29,000 meters of drilling, split between Cowley Park and additional targets including the Arctic Chief, Cub, and Chiefs Trends.

A key milestone is the completion of an inferred resource for Cowley Park by the first half of 2026. The presentation emphasizes strong continuity of high-grade copper-molybdenum mineralization from near surface and the identification of previously unrecognized zones. These include extensions westward toward the Cub Trend, where new magnetic anomalies and surface mapping suggest significant exploration upside.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Gladiator Metals Corp. (GLAD:TSX;GDTRF:OTC)

The Whitehorse Copper Project is located on the western margin of the city of Whitehorse, offering road access, local labor, hydro power, and proximity to established infrastructure. Historical production on the belt between 1967 and 1982 totaled more than 267 million pounds of copper and over 225,000 ounces of gold, with Gladiator aiming to reestablish the region as a viable source of high-grade copper supply.

Ownership and Share Structure

According to Refinitiv, 10.54% of Gladiator Metal's stock is held by management and insiders. Howard Coyne owns the most with 6.37%. Jason Bontempo has 1.53%. Shawn Khunkhun has 1.34%.

Institutions hold 6.08%.

The rest is held by retail investors.

According to MarketWatch, as of June 18, Gladiator Metals had a market cap of CA$61.99 million, with 77.49 million common shares outstanding. It trades in the 52-week range between CA$0.3350 and CA$0.8500.

| Want to be the first to know about interesting Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Gladiator Metals.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.