Just days ago, the head of America's biggest banking institution delivered a stark message that should make every investor pause.

"We shouldn't be stockpiling Bitcoin — we should be stockpiling guns, bullets . . . and rare earths."

Jamie Dimon's message cuts straight to the heart of geopolitical reality: future conflicts will be determined not by digital currencies or social media trends, but by tangible resources and the essential elements that fuel weapons systems, power infrastructure, and computing centers.

He's far from alone in sounding this alarm.

Recently, we highlighted how industry titans including BHP, BlackRock, and Saudi interests are positioning themselves strategically—from antimony through uranium, cobalt through scandium, a silent competition is intensifying to secure access to the planet's most crucial metals.

What's driving this urgency?

The struggle for global economic supremacy is approaching a critical juncture.

While America commands unmatched financial resources and military might, its primary economic competitor wields a different trump card—one potent enough to potentially dethrone U.S. leadership.

Particularly if Washington fails to act decisively.

The issue centers on critical mineral availability.

And the statistics are eye-opening.

Complete Market Control

Beijing currently controls worldwide production, providing approximately 70% of global rare earth and graphite output, 98% of gallium, 88% of magnesium, and over 80% of tungsten supplies.

This control extends throughout the refining process, granting China authority over 86% of essential energy-transition mineral markets in 2024, rising from 82% in 2020.

These materials' strategic importance cannot be understated.

They form the foundation of semiconductor manufacturing, nuclear power, battery technology, integrated circuits, and defense systems. Without access to them, none of these industries can function.

Advanced artificial intelligence? These materials are essential.

Cutting-edge military equipment? These materials are required.

Next-generation mobile devices? These materials are mandatory.

The pattern is clear.

Beijing is leveraging this advantage to project influence.

According to the International Energy Agency:

"In December 2024, China restricted the export of gallium, germanium, and antimony — key minerals for semiconductor production — to the United States. This was followed by further announcements in early 2025, including restrictions on tungsten, tellurium, bismuth, indium, molybdenum, and on seven heavy rare-earth elements."

"Currently, more than half of a broader group of energy-related minerals are subject to some form of export controls. These restrictions are not only increasing in number but also expanding in scope to cover not just raw and refined materials but also processing technologies, such as those for lithium and rare-earth refining."

Naturally, Washington is mobilizing a counteroffensive.

In March, President Donald Trump issued an executive directive mandating rapid expansion of American mineral extraction.

Subsequently in May, representing a watershed moment for domestic critical mineral development, the U.S. Department of the Interior authorized a uranium-and-vanadium operation in Utah—representing America's inaugural project approved through a revolutionary 14-day environmental assessment procedure, launched following President Trump's national energy emergency declaration.

This marks only the opening salvo.

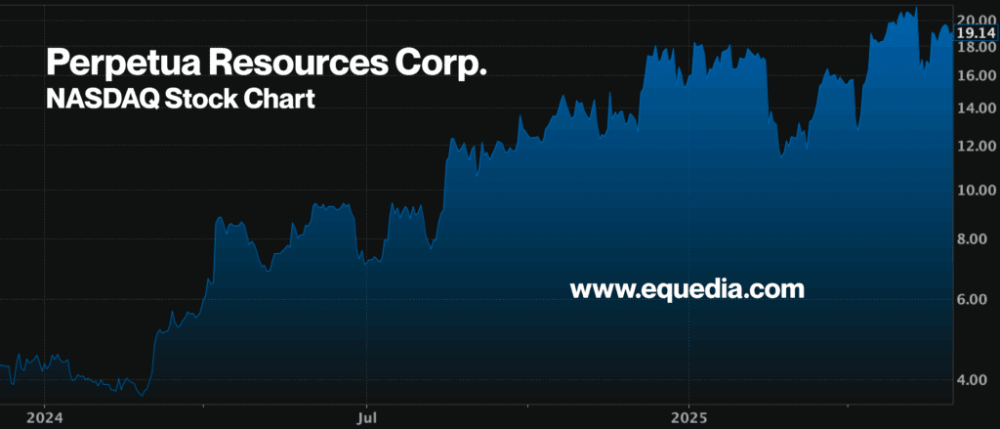

Consider Perpetua Resources Corp. (PPTA:TSX; PPTA:NASDAQ), which secured final federal authorization for its Stibnite gold-antimony venture in Idaho during May after almost ten years of regulatory processes.

Perpetua's Stibnite development holds 4.8 million gold ounces and 148 million antimony pounds—recognized as America's sole practical antimony production source.

Now let's look at their performance over the past year.

Over just one year, Perpetua shares surged from under C$4 to above $20—delivering a clean five-fold return.

Naturally, we're not highlighting a company whose stock has already quintupled over twelve months. We're not journalists—we're investment advisors.

We're emphasizing that financial institutions and major players are aggressively pursuing critical mineral assets across America—particularly those combining antimony-gold potential like Perpetua Resources—seeking to capture similar extraordinary gains.

Here's the challenge: precious few gold-antimony developments exist within U.S. borders.

For investors seeking even greater returns potential, like those available in junior exploration companies, options become scarcer still.

However, we've identified one exceptional opportunity.

It represents an unusually advanced gold-antimony exploration venture delivering outstanding drilling outcomes.

Focus carefully, as this enterprise could emerge as the next major gold-antimony success story.

NevGold Corp.

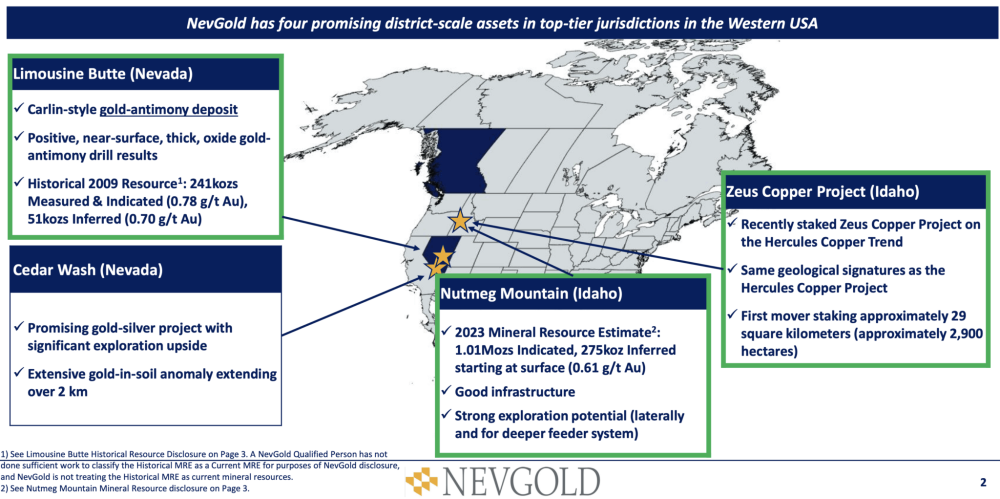

NevGold Corp. (NAU:TSX.V; NAUFF:OTC; 5E50:FSE) represents an advanced-phase exploration gold junior offering rare upside opportunity.

Remember, we previously introduced this company (for a deeper analysis, click here). Full transparency: We maintain equity positions, and NevGold maintains an advertising relationship with us.

Today's analysis will be direct and focused — we want to ensure you understand this opportunity before additional catalysts emerge.

NevGold controls four compelling district-scale properties in premier western U.S. jurisdictions.

These can be seen below.

Limousine Butte Project (LBP), Nevada

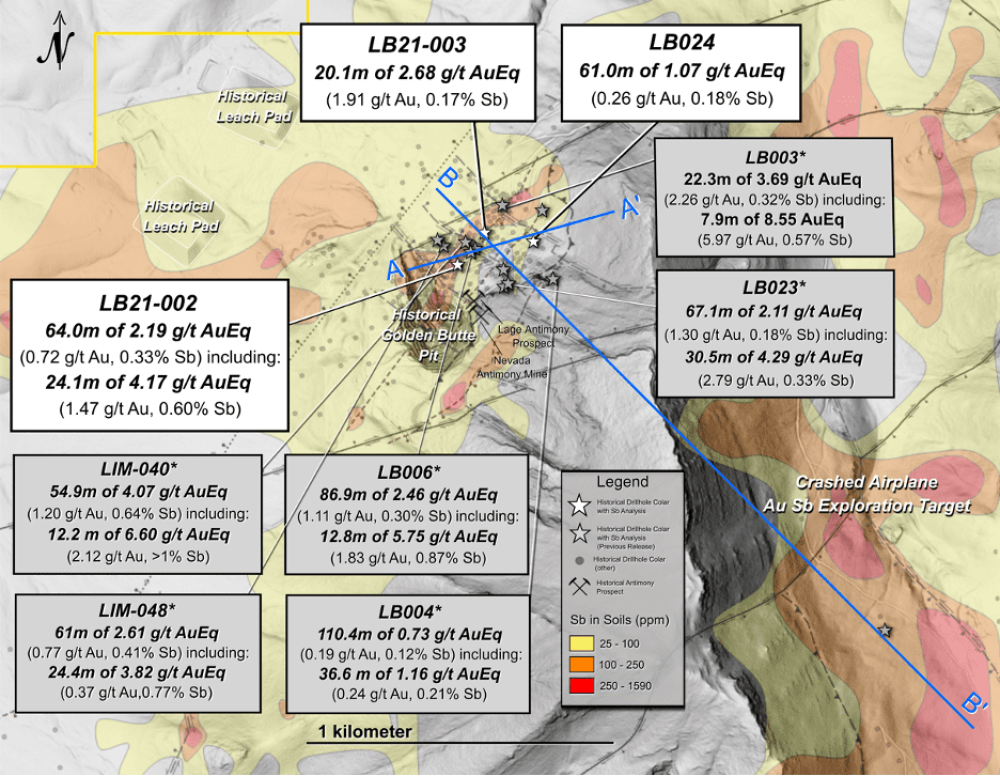

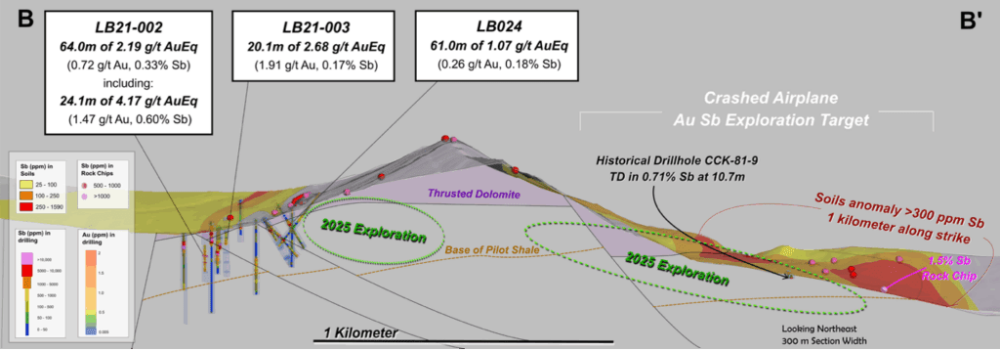

NevGold's wholly-owned Limousine Butte Project represents a Carlin-type gold-antimony deposit consistently producing favorable, shallow, substantial, oxide gold-antimony drilling outcomes.

Oxide gold formations are highly preferred in mining due to their economic and operational benefits compared to sulfide ores. Their free-milling characteristics enable cost-effective recovery through simplified techniques like heap leaching, achieving excellent recovery rates of 90–95% while requiring less sophisticated infrastructure, reducing capital investment. Additionally, oxide gold's reduced environmental impact can expedite permitting.

Shallow deposits also allow less expensive open-pit extraction, while faster processing accelerates cash generation—improving profitability even during volatile gold markets. With gold approaching $3,300/oz, oxide deposits can generate substantial cash flow once operational.

Recent drilling continues producing remarkable, high-grade intersections of gold and antimony, establishing groundwork for a major resource update by year's end.

Consider these results:

Consistent Positive Headlines

Since March, NevGold has maintained a steady stream of favorable drilling outcomes—announcement after announcement:

- March 26 2025 – NevGold Discovers Further Significant Gold-Antimony Results: 2.46 g/t AuEq over 86.9 Meters (1.11 g/t Au and 0.30% Antimony), Including 5.75 g/t AuEq over 12.8 meters (1.83 g/t Au and 0.87% Antimony), and Also Including 6.77 g/t AuEq over 6.7 meters (2.29 g/t Au and +1% Antimony) at the Limousine Butte Project, Nevada

- April 10 2025 – NevGold Discovers More Significant Oxide Gold-Antimony Results: 1.70 g/t AuEq Over 169.2 Meters (0.89 g/t Au and 0.18% Antimony), Including 2.85 g/t AuEq Over 54.4 Meters (2.26 g/t Au and 0.13% Antimony), and Also Including 13.15 g/t AuEq Over 3.1 Meters (0.76 g/t Au and 2.76% Antimony) at the Limousine Butte Project, Nevada

- April 24 2025 – NevGold Discovers More Significant Oxide Gold-Antimony Results: 2.11 g/t AuEq Over 67.1 Meters (1.30 g/t Au And 0.18% Antimony), Including 4.29 g/t AuEq Over 30.5 Meters (2.79 g/t Au And 0.33% Antimony), and Also Including 7.12 g/t AuEq Over 16.8 Meters (5.05 g/t Au And 0.46% Antimony) at the Limousine Butte Project, Nevada

- May 13 2025 – NevGold Adds More Significant Oxide Gold-Antimony Results: 2.19 g/t AuEq Over 64.0 Meters (0.72 g/t Au And 0.33% Antimony), Including 4.17 g/t AuEq Over 24.1 Meters (1.47 g/t Au And 0.60% Antimony), and Also Including 10.86 g/t AuEq Over 4.50 Meters (1.43 g/t Au And 2.10% Antimony) at the Limousine Butte Project, Nevada

Mining enthusiasts recognize these exceptional drilling outcomes.

Multiple intersections spanning Resurrection Ridge and Cadillac Valley confirm this extends beyond a single-zone project—it's a growing oxide system already covering over 5 kilometers of strike length.

Historical information also shows strong antimony values previously limited by analytical detection thresholds. NevGold is currently re-analyzing those sections, potentially further enhancing the project's already outstanding metrics.

This suggests the market hasn't yet fully recognized the magnitude of NevGold's discoveries at LBP.

These oxide-type intersections indicate both scale and strong economic potential, thanks to near-surface mineralization.

Limousine Butte's ore occurs within the Devonian Pilot Shale — the identical host rock that created Nevada's famous Carlin gold belt. Combined with jasperoid breccias containing stibnite and stibiconite, you have the classic characteristics that major companies seek.

The property has already demonstrated its value: historical operations at the Nevada Antimony Mine and Lage Antimony Prospect, both within the current claim area, produced stibnite exceeding 9% antimony content. This production history indicates exactly the upside potential modern investors desire.

Put simply, LBP possesses a substantial geological advantage: a Carlin-type system with critical mineral potential.

Could NevGold Mirror Perpetua Resources' Success?

Perpetua Resources currently maintains a market capitalization exceeding CA$1.3 billion (approximately US$1 billion).

Throughout a decade of permitting and project development, Perpetua's Stibnite Project has expanded to encompass 4.8 million gold ounces and 148 million antimony pounds — considered America's only practical antimony production source.

However, with ongoing positive drilling outcomes and an anticipated initial resource calculation expected by late 2025, NevGold and its Limousine Butte Project may be positioning to challenge this status.

Institutional investors have noticed.

Capital Influx

NevGold recently completed a CA$6 million expanded financing led by Clarus Securities, among Canada's top-performing boutique investment banks. Clarus maintains established credibility with billion-dollar funds and a history of identifying market winners early.

Remember that Clarus Securities was a primary financier of K92 Mining Inc. (KNT:TSX.V) — a company we featured when shares traded below CA$2. Currently, K92 Mining trades above US$14 with a market cap exceeding US$3.4 billion.

NevGold's oversubscribed financing represents institutional confidence from well-capitalized investors — precisely why we also acquired additional shares, substantially expanding our position.

NevGold's market cap following this financing remains just under CA$50 million; Perpetua stands at US$1.3 billion.

We believe if NevGold continues delivering positive Limousine Butte results, it possesses genuine potential to become the next gold-antimony success story.

Despite all this, NevGold offers additional upside potential.

While Limousine Butte commands attention given America's urgent need for critical mineral assets, NevGold's opportunity extends beyond one property.

NevGold's Idaho Zeus Copper Project already displays the characteristic indicators of another company-making discovery. The property sits on the same mineralized trend as Hercules Metals, just kilometers from one of Idaho's most discussed copper discoveries. That find propelled Hercules from CA$0.12 to CA$1.50 and attracted Barrick Gold as a strategic investor, paying CA$30 million for a 15% stake.

NevGold has now prioritized Zeus, and with its prime location and district-scale footprint, a second breakthrough discovery could materialize sooner than markets anticipate.

Multiple Upcoming Catalysts

Here's why 2025 could transform NevGold's trajectory:

- Initial Resource by Year-End – Limousine Butte's first NI 43-101 is scheduled for Q4, establishing concrete value for underground ounces and enabling major funds to invest.

- Grade Enhancement Catalyst – Re-analysis of previously "limited" antimony intervals is proceeding; releasing those figures could boost Au-equivalent grades and force analysts to reassess valuations.

- Metallurgical Milestone – A 100 kg bulk sample is currently under laboratory analysis to determine optimal processing methods for co-recovering gold and antimony—positive outcomes reduce technical risk and development costs simultaneously.

- Ongoing Drilling – Fully permitted programs at Resurrection Ridge and Cadillac Valley aim to extend mineralized zones further and deeper, adding fresh ounces to the resource.

- Growing Institutional Support – Clarus Securities' due diligence and investment creates momentum for broader institutional investment to follow.

Summary

The global community is finally understanding how precarious the critical mineral supply chain truly is. Early Perpetua believers rode that realization to substantial profits.

NevGold could follow, equipped with:

- A demonstrated gold-plus-antimony oxide system in Nevada—already highlighted by double-digit AuEq intersections.

- Additional upside potential at Zeus Copper in Idaho, mirroring the Hercules trend that sent a junior company skyward.

- Sophisticated investor endorsement from Clarus Securities, potentially leading to broader institutional backing.

- A fully permitted flagship property, ready to expand immediately upon maiden resource completion.

The pieces are aligning: geology, permitting, capital, and timing.

Gold recently surged through US$3,500 per ounce in April, recording 28 record-breaking closes through 2025.

Antimony has performed even better — rocketing from obscurity to stunning highs exceeding US$50,000 per tonne, demolishing every historical price record.

Jamie Dimon advises accumulating rare earths, not cryptocurrency. BlackRock and BHP are competing for critical mineral opportunities. Yet this capital surge has limited destinations — especially for investors seeking antimony-gold exposure. Perpetua has already gained 400%.

For us, this means NevGold remains at bargain-basement levels with active drilling and a maiden resource due this year.

If Wall Street giants and trillion-dollar funds are competing for critical mineral exposure, where does that position individual investors?

That's why we've invested in NevGold — and why you should conduct your own research as well.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Perpetua Resources Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of NevGold Corp.

- Ivan Lo. I, or members of my immediate household or family, own securities of: [COMPANY]. My company has a financial relationship with [COMPANY]. My company has purchased stocks mentioned in this article for my management clients: [COMPANY] I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Equedia Investment Research Disclosures

Equedia.com and Equedia Network Corporation are not registered as investment advisers, broker-dealers or other securities professionals with any financial or securities regulatory authority. Remember, past performance is not indicative of future performance. This article also contains forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from the forward-looking statements made in this article. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. We are biased towards Nevgold (NAU) because the Company is an advertiser on www.equedia.com. We currently own shares of NAU. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Special Report Editions. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence and consult your own professional advisers before investing in NAU or trading in NAU securities. NAU and its management have no control over our editorial content and any opinions expressed in this article are our own. We’re not obligated to write a report on any of our advertisers and we’re not obligated to talk about them just because they advertise with us. For a complete disclosure of the compensation received by us from NAU, please review our Terms of Service and full disclaimer at www.equedia.com/terms-of-use/.

This newsletter (this “Newsletter”) is provided by Equedia Network Corporation (“Equedia”, “we” or “us”). Your access to and use of this Newsletter is subject to and governed by this disclaimer and Equedia’s Terms of Use, which is available at http://www.equedia.com/terms-of-use (the “Terms”). Please read this disclaimer and the Terms carefully. This Newsletter is not an offer to sell or a solicitation of an offer to buy any securities or commodities. To the extent that anything contained in this Newsletter may be deemed to be investment advice or a recommendation in connection with a particular company or security, such information is impersonal and is not tailored to the needs of any specific person. In addition to historical information, this Newsletter may contain forward-looking statements, including statements with respect to third parties regarding product plans, future growth, market opportunities, strategic initiatives, industry positioning, customer acquisition, the amount of recurring revenue and revenue growth. In addition, when used in this Newsletter, the words “will,” “expects,” “could,” “would,” “may,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “targets,” “estimates,” “looks for,” “looks to,” “continues” and similar expressions, as well as statements regarding a third party’s focus for the future, are generally intended to identify forward-looking statements. Each of the forward-looking statements we make in this Newsletter involves risks and uncertainties that may cause actual results to differ materially from these forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those disclosed by the parties referred to in this Newsletter in their public securities filings. You should carefully review the risks described therein. You should not place undue reliance on the forward looking statements in this Newsletter, which speak only as of the date such statement was published. Equedia undertakes no obligation to publicly release any revisions to the forward-looking statements or reflect events or circumstances after the date of their publication, except as required by law. As of the date of publication of this Newsletter, Equedia (on behalf of itself and any partner, director, officer or insider of Equedia) may have a financial or other interest in the party or parties featured in this Newsletter, within the meaning of National Instrument 31-103 – Registration Requirements, Exemptions, and Ongoing Registrant Obligations, published by the Canadian Securities Administrators. For full details of our compensation, please visit https://www.equedia.com/terms-of-use/.

As of the date of publication of this Newsletter, Equedia (on behalf of itself and any partner, director, officer or insider of Equedia) may have a financial or other interest in the party or parties featured in this Newsletter, within the meaning of National Instrument 31-103 – Registration Requirements, Exemptions, and Ongoing Registrant Obligations, published by the Canadian Securities Administrators. Equedia and its directors own shares of Nevgold (NAU) at the time of this writing. In May 2025, Equedia was paid C$350,000 for a six month advertising contract for NAU, which includes expenses for advertisements on third party sites or other third party coverage that we arranged for NAU. These services were paid for by NAU. We have also previously been compensated by NAU for advertising contracts which have expired. For full details of our compensation, please visit https://www.equedia.com/terms-of-use/.