From the wisdom of artificial intelligence comes a gripping description: "A black swan event is a rare, unexpected event that has a significant impact, often beyond what is normally expected. It's characterized by its extreme rarity, severe consequences, and the tendency for people to rationalize it as predictable after it has happened."

The most important part of that paragraph is the part where they add "and the tendency for people to rationalize it as predictable after it has happened."

In my years employed in the investment industry, which began in May of 1977, I developed the bad habit of reading volume upon volume of research reports, thinking erroneously that the authors of such reports were actually "reporting" as opposed to "crafting" their conclusions. I would blindly memorize the "salient points" of the dissertation and pass along the information to my clients whose eyes would glaze over or voices trail off in thinly-disguised yawns as I delivered the corporate manifesto in grandiose fashion.

However, after a number of years, I began to lose my faith in corporate research as I slowly discovered how the "game" actually worked. The documents that were delivered to me as "research" were actually one feather short of "sales brochures" and commonly omitted massive conflicts of interest and misrepresentations of the highest order.

The best example of that was in the 1990's when an esteemed Canadian financial institution called "Royal Trustco" was sailing along with the support and blessings of many members of the Canadian Establishment at $14 per share when the management team decided to engage my firm as their "financial advisor". Our head of research (name withheld) organized a conference call to all branches coast-to-coast to laud and applaud the virtues of this blue-blood firm that was founded in Montreal in 1892.

The firm for whom I tolled had barely survived the '87 Crash and the brokers were being encouraged to build their businesses around "gathering assets" as opposed to "finding great ideas" that actually made clients wealthier so this campaign promoting Royal Trustco to the brokers and their clients was management's not-so-subtle message that the firm was "upgrading to quality" thus improving their brand from "gunslinging traders" to "conservative wealth managers". It all sounded great and the vast majority of my colleagues bought in to the concept and began acquiring huge swaths of Royal Trustco stock which was conveniently sold to clients as cornerstone assets for the portfolios tailored for "conservative growth."

Being a cynic, I had been tracking their acquisitions starting with real estate broker Lepage in 1984, then Dow Financial Services in 1986 followed by expansions with offices established in Tokyo, of all places, in a move designed to promote trade between Canada and Japan. So, as this RT lovefest was spreading like Alberta wildfires across the country into every nook and cranny of every office across the country, I was quietly avoiding sales and research managers while wearing fake noses and moustaches whenever compliance officers came into the office because in the course of the year, I had purchased not one share of Royal Trustco and instead has been buying shares in a little diamond explorer called Dia Met Minerals that had my superiors up in arms because it was considered "too speculative" for our clients to own.

Then disaster struck the world of "conservative investing."

The venerable old blue-blood company suddenly in 1992-1993 found itself out "over its skis," forgetting that the tried-and-true method of managing a trust company was "Borrowing long and lending short". Royal Trustco suddenly found its loan book reversed and with interest rates on the rise and with recession in the home-building and sales sector weighing in on free cash flow, Royal Trustco's share price collapsed from $14 to $1. The brokers, devastated that they had been led down a virtual garden path designed to have them emerge as "protectors of wealth," called for heads to roll and within a couple of months, parent Royal Bank of Canada bought the remaining assets but alas, the damage was done. The head of research who spearheaded the RT campaign was summarily fired and a series of management shakeups ensued and then in a wondrous stroke of mercurial luck and masterful salesmanship, the firm was sold to an ambitious U.S. investment bank.

I recall the day that my superior called me on the carpet to discuss why I was buying this "penny stock" called Dia Met and I replied that the founder, an eccentric genius called Chuck Fipke, had found a chrome diopside indicator mineral in one of the glacial trains located near Lac de Gras in Canada's NWT. After my superior's glazed eyeballs returned to normal and after his jaw had rejoined his face, I asked him how his Royal Trust was doing, then watched as his blood pressure went "red line," ending the meeting and my employment a few days later.

Well, it all ended well for the brokers that became asset gatherers and for the management that cashed in their shares and options when the U.S. giant pulled out its cheque book but I often wondered what became of the thousands of clients that were victimized by the demise of Royal Trustco.

These were not one but two "black swan events" that occurred in the early 1990's. The first "rare, unexpected event that has a significant impact, often beyond what is normally expected" was the unimaginable fate of a legendary institution that had survived two world wars and an economic depression only to be vapourized by unbridled greed and financial folly. The second one, "characterized by its extreme rarity," was the discovery of economically-viable gem-quality diamonds in the Canadian arctic by none other than that eccentric geologist that ran that "highly speculative penny stock" called Dia Met Minerals. In 2001, Dia Met Minerals was acquired by BHP Billiton in a deal worth $687 million. BHP Billiton acquired over 75% of Dia Met's shares, giving them an 80% ownership of the Ekati Diamond Mine, where Dia Met previously held a 29% stake. The remaining 20% of Ekati was held privately by Dia Met's founder, Charles Fipke, and his partner, Stuart Blusson.

Two completely different outcomes that had nothing to do with research or "conservative money management;" the swans quite simply arrived.

Stocks

The Israeli air raid on Iranian nuclear and military facilities late last week might resemble a "black swan event" but it really was miles apart from being an event for "people to rationalize it as predictable after it has happened" because the two countries have been lobbing ten-pounders at each other for what seems like an eternity. However, with stocks on a tear with professional investors scrambling to increase weightings after being net sellers all the way up from the April 7 low, markets were (and still are) vulnerable to a sizeable drawdown given the overbought status of the S&P and NASDAQ.

I re-established exposure to volatility on CPI Day (Wednesday) with a 25% allocation then added more on both Thursday and Friday going into the weekend 75% exposed to the same volatility positions that treated me so well going into "Liberation Day."

To give you all some perspective on valuations, when I entered the securities industry in 1977, the average price-to-earnings ratio for the S&P 500 was 8.43 with yields averaging 5.39%. At the April lows, the average P/E was 18 with the average yield at 1.27%. That was at the lows. As of Friday's close, the P/E was 24.21 and the average yield was approaching 1%. If anyone would have told me that Wall Street analysts would classify stocks as "undervalued" while sporting a P/E of 18 back in 1977, I would have laughed them out of the room. In fact, buying anything above 10 times earnings was cause for dismissal back then.

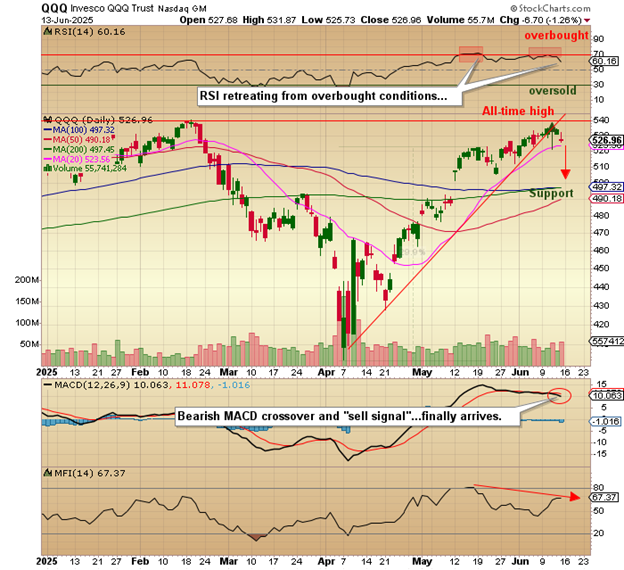

The QQQ:US has finally gotten the MACD "sell signal" on Friday after being completely neutral since May 22. It flatlined for literally three weeks trying in vain to make its mind up until the Israeli's gave is a strong boot to the backside on Thursday evening. Money flow indicator was unable to match the move it made back in mid-May despite prices getting to within an earshot of the record high last seen on February 19. It came within 4.03 points of that number last Thursday.

This market has been tossed around like a five-dollar football by headlines, be they about tariffs or billionaire megalomaniac Twitter feuds or Middle East turmoil and now appears poised to respond to the spectre of Iranian retaliation that just might find support through Russian or Chinese technology. I found it interesting that reports from the recent India-Pakistan skirmish in the Kashmir region had fighter planes designed and built in China for use by the Pakistani Air force running rings around the Indian or Russian-built jets. It will be interesting to see if the Chinese jets are as effective against the American-built jets of the Israeli Air Force.

One way or another, geopolitical "black swans" are starting to glide into the crosshairs of the professional money managers so with stocks ahead over 30% since the April 7 lows, it would not be surprising to see a sharp increase in volatility over the next few weeks. With corporate buybacks ending now going into the blackout period, a major driver for stocks is now sidelined so if ever there was a window for the bears to retake control, it would be next week.

As I have stated for the past three weeks, I changed my tune about this rally being a "B-Wave" rally also known unkindly as a "sucker's rally" so I will set as a target for the QQQ:US as the convergence zone between the 200-dma and the 100-dma that exists at around the $497 level. The 50-dma is now rising quickly at the $490 level so a few more days of sideways action and there will be a triple moving average convergence zone that should (there's that operative word again) represent support. However, if the dust-up between Israel and Iran gets uglier or if it drags Mssrs. Putin or Xi into the mix, that support will vapourize with nothing much left until the April 7 lows. For now, I rate that as "unlikely" but then again, Royal Trustco looked like a surefire winner, too.

Gold (and Silver)

A few weeks back, I abandoned my GLD:US hedge by taking a small profit on the June $310 puts and I did so for a number of reasons, the primary one being that in all bull markets, one should be flat, long, or really long but never should one be short. Now, as measured against the huge position in the junior gold developer space, I was merely "hedged" but I almost felt as though I was committing a sacrilege against the cause by cheerleading a drop to $275 for the GLD:US so I covered.

Not only did I flatten my puts, I actually opened a new call position in the August $315 series on expectations that the Iranians are planning to retaliate with more than a few drones and bunker busters. If it gets ugly, gold is going to knife up and through the old high at $3,509 and that is a mere chip shot because on Friday, the GLD:US traded up to $317.00 within a paltry $.63 of the April 22 top. If it takes out that high next week, we will see a runaway gap that might take to $330 (or higher) which would be a huge plus for the gold miners and a much-needed shot of adrenaline for moribund silver that continues to consolidate the much-heralded breakout above the $35-36 resistance zone.

Speaking of silver, I continue to read the Twitter-fueled ravings of the usual crowd of silver bugs whining and wailing about the big, bad bullion banks and how they are manipulating the market to avoid crushing margin calls and the God-given ascent to $200 an ounce. The bullion banks have been active in the silver market since I was in university in the U.S. Midwest in the mid-70's and they were also active in 2011 when silver demand exceeded the power of the banksters and rocketed to nearly $50 per ounce.

Rather than whine about the evil bullion bank behemoths, why not ask why the retail public is unable to overcome the heavy-handed influence of the bullion banks. Either someone or some "thing" is mobilizing supply or perhaps the absence of central bank bids such as the kind that keeps the bullion banks away from gold is having a debilitating effect on silver. For certain, the gold market is far deeper and far more liquid than the silver market but surely a GSR at 95 would generate some interest in the "long silver, short gold" paired trade that has for some been a widow maker given gold's outperformance in 2025. From where I sit, silver needs to get moving. Period.

Staying with the gold trade has kept me from stubbing my toe on that elusive hunt for the silver moonshot that is always "just around the corner." Copper and gold have been my "GO TO" metals since 2020 with the most compelling metal from a fundamental perspective being copper.

It does not have central bank buying but it does have a serious supply issue against the rising tide of the electrification movement and the global infrastructure build-out of the electricity grids.

Copper

Copper had a poor week based largely on its correlation with equities after popping to over $5.05/lb. exactly one week ago. It had a bad day on Friday with stocks under pressure but did rally sharply off the $4.709 low it touched in early morning trade closing at $4.8145 versus the intraday high at $4.857.

That was a critical rebound for the red metals.

I am starting to take a serious look at Ivanhoe Mines Ltd. (IVN:TSX; IVPAF:OTCQX) the copper producer/explorer founded by billionaire Robert Friedland that is operating as a part owner of the Kamoa-Kakula Copper Mines in the Democratic Republic of the Congo deep in the heart of Africa.

Troubled by underground seismic activity at the mine recently, the stock is down 46.7% since the seismic issue popped up but by all reports, the mine is a state-of-the-art, technologically-advanced operation that commands grade, scale, and capital.

While the company has withdrawn production guidance for 2025, I am confident that operator Zinjin Mining will restore the mine to full capacity within the next few months which makes this a "black swan event" that represents opportunity.

It should be remembered that IVN/IVPAF also has the Platreef PGM-Nickel Mine, the Kipushi Zinc Mine, and Western Foreland Copper Exploration fortifying its asset base.

Getchell Gold

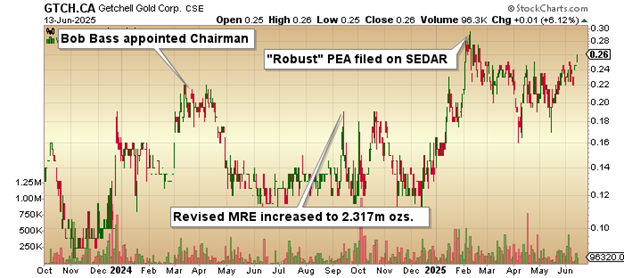

From all reports, Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) has completed the CA$4m (oversubscribed) financing while offering to exchange all debt for units in the same offering. The debt was created in late 2023 and early 2024 in the form of a debenture where proceeds of sale allowed for the final US$1.6m payment to Canagold Resource Corp. and thus rescuing the Fondaway Canyon Project from a disastrous fate, that being a forfeiture of the asset and return to Canagold.

As it stands, GTCH/GGLDF owns 100% of the Fondaway asset and is now moving quickly to fortify their balance sheet in advance of a return to exploration of their Nevada-based project which is wide open along strike and to depth. It is also the focus of a 2025 PEA that shows investors a 10.3-year life-of-mine, a 46.7% after-tax IRR and a discounted NPV of US$474 million all with an assumed gold price of US$2,250. With gold now north of US$3,400, Fondaway has an enormous sensitivity to gold price advances so if I am correct in assuming that there could be additional fireworks this week from Iranian retaliation, then the closing of the funding and the retirement of debt should lead to some very long awaited upside revaluation for Getchell shareholders.

I know I have sounded like a broken record, droning on and on about value-per-ounce and market cap per in-ground resource but with this funding round and the debt-to-equity conversion, the new capital structure will include over 260 million shares outstanding (fully-diluted) giving it a market cap of tad under US$50 million. Assuming 2,317,100 ounces at Fondaway Canyon, that represents a value of US$21.50 for each ounce, an incredibly low valuation for a project boasting such a robust PEA in a most-favourable jurisdiction. The point I am making here for what must be the billionth time since launching the service in January 2020 is that the stock is absurdly cheap with upside leverage to both the gold price and to an upsized resource once exploration gets fully underway in July. In the interim, they do not need one more ounce of gold to justify a market cap of US$100 per ounce especially if gold embarks on a runaway gap next week into Middle East shenanigans.

That completes the one billion and "one-th" comment on GTCH/GGLDF.

| Want to be the first to know about interesting Critical Metals, Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involve