Northern Shield Resources Inc. (NRN:TSX.V) stock has taken off higher in the recent past as the investment world starts to wake up to the prospect of the company sitting on a potentially massive gold resource in Newfoundland which has the rather odd name “Root and Cellar,” where a diamond drill program is just commencing.

Before we review the latest stock charts we will consider the fundamentals of the company using pages from its latest investment deck.

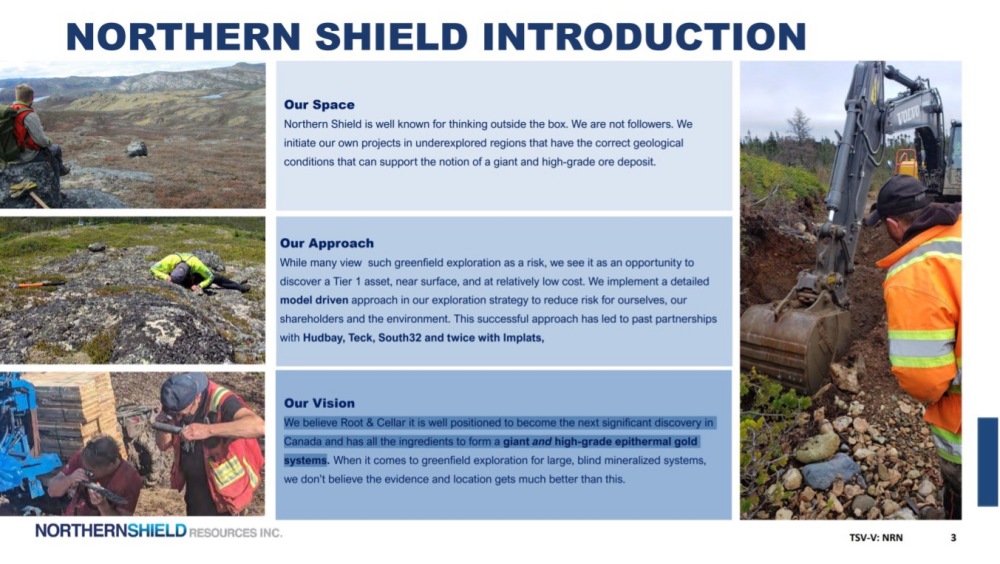

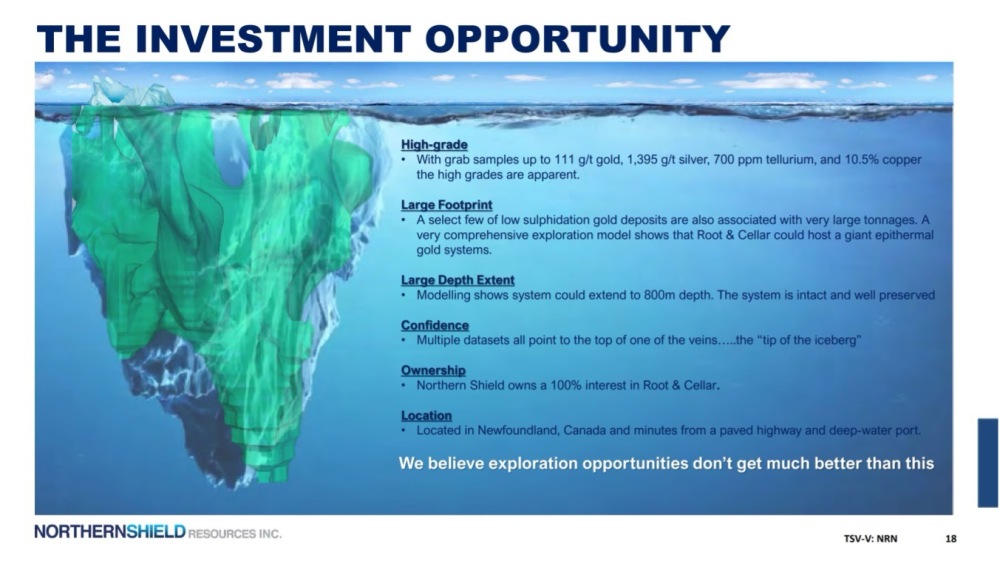

As it says on the following introductory page, “We believe Root & Cellar is well positioned to become the next significant discovery in Canada, and has all the ingredients to form a giant and high-grade epithermal gold system.”

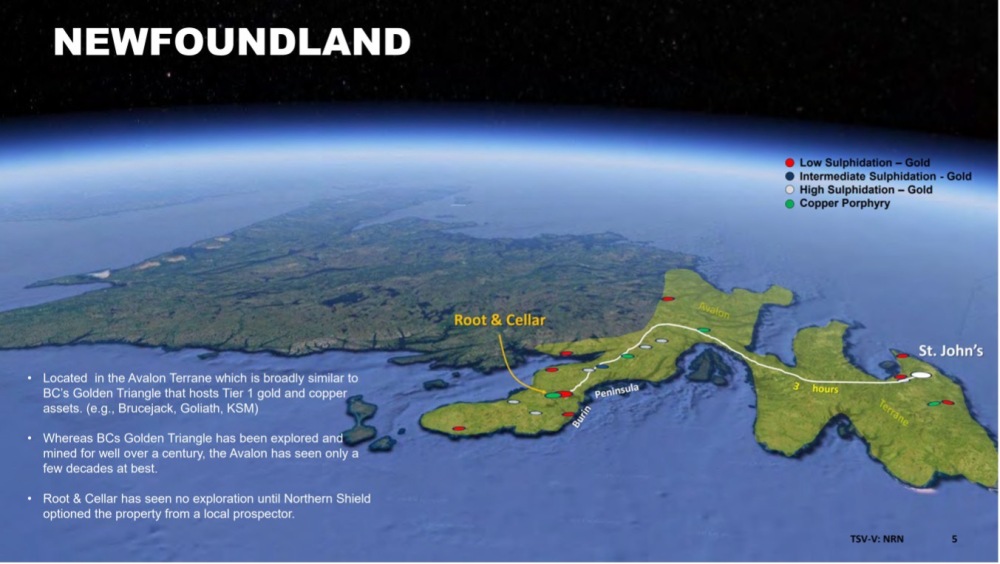

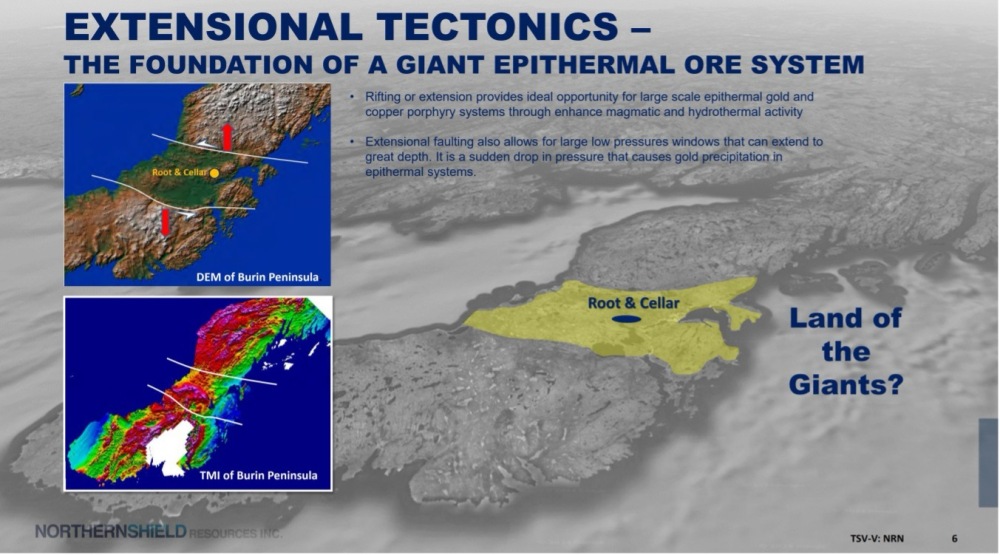

The Root and Cellar Project is located in the Avalon Terrane on a large peninsula in southeast Newfoundland. Although broadly similar to BC’s Golden Triangle, the area is underexplored, and despite its seemingly remote location, it has good infrastructure…

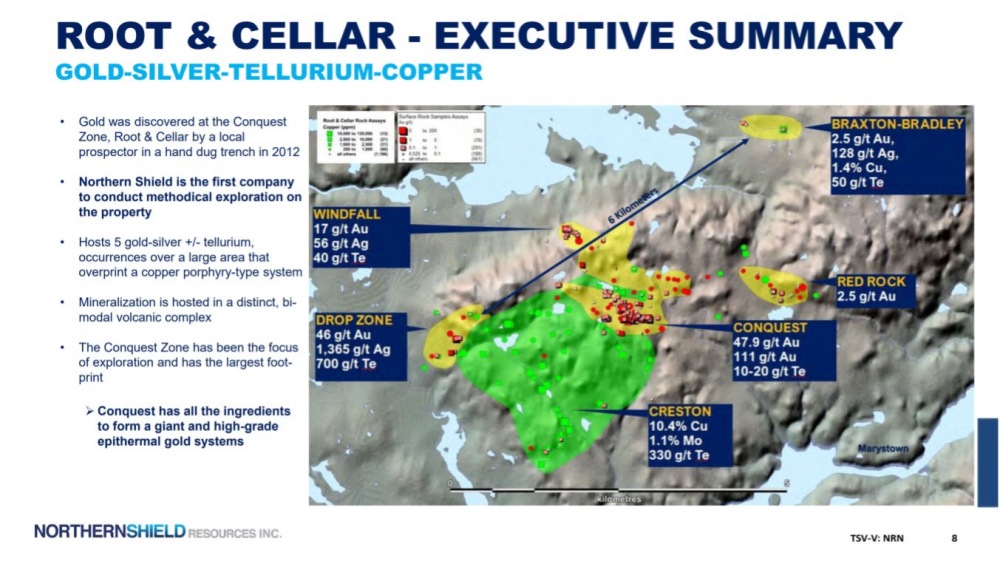

The zone of interest within the peninsula in which Root and Cellar sits is shown on the following page…

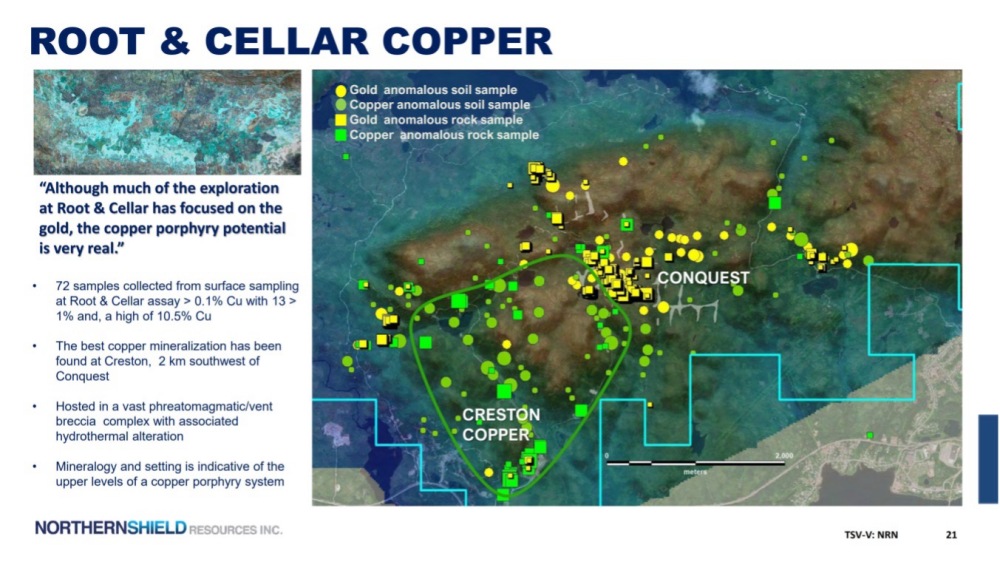

Whilst the main focus is the gold in the Conquest Zone, a very substantial copper deposit may exist a little to the southwest in the large Creston Zone and silver is present in significant quantities too…

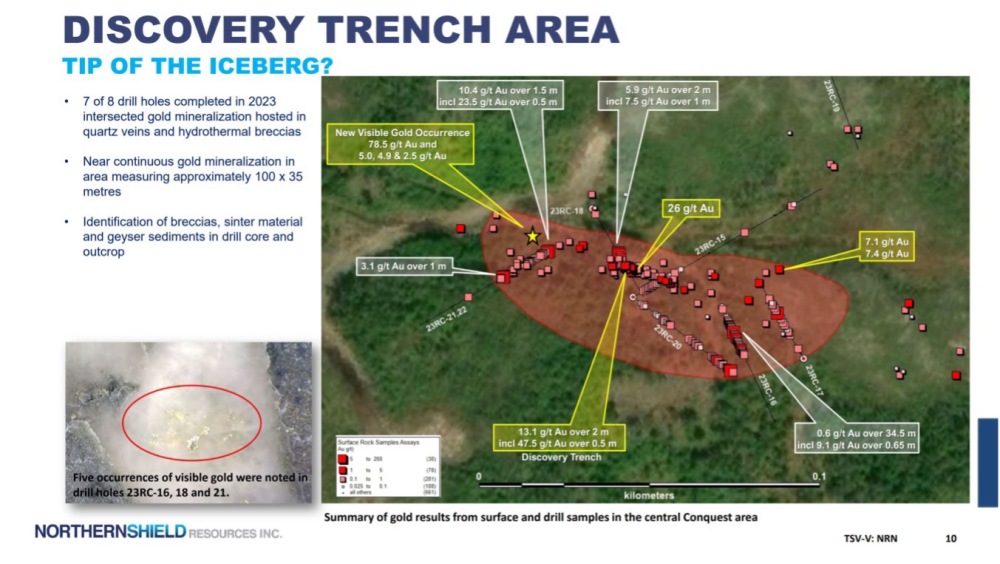

A closer look at the Conquest Zone…

Impressive gold grades found in the Trench area…

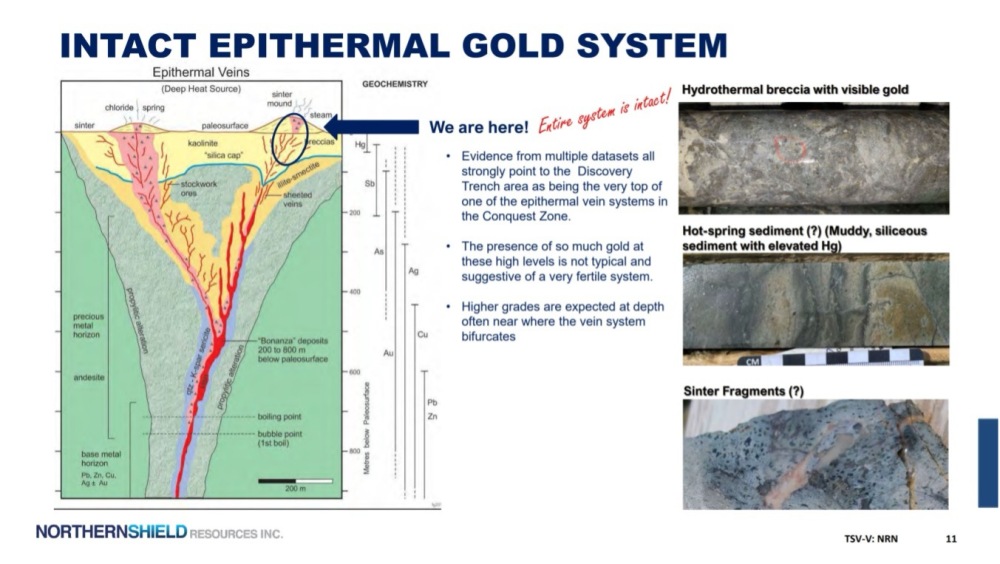

The gold system at Conquest looks like it is BIG, DEEP and RICH, and judging from the recent action in the stock price, the word seems to be spreading…

More details of geology of the gold system at Conquest, which are not included for reasons of space, may be viewed in the investment deck.

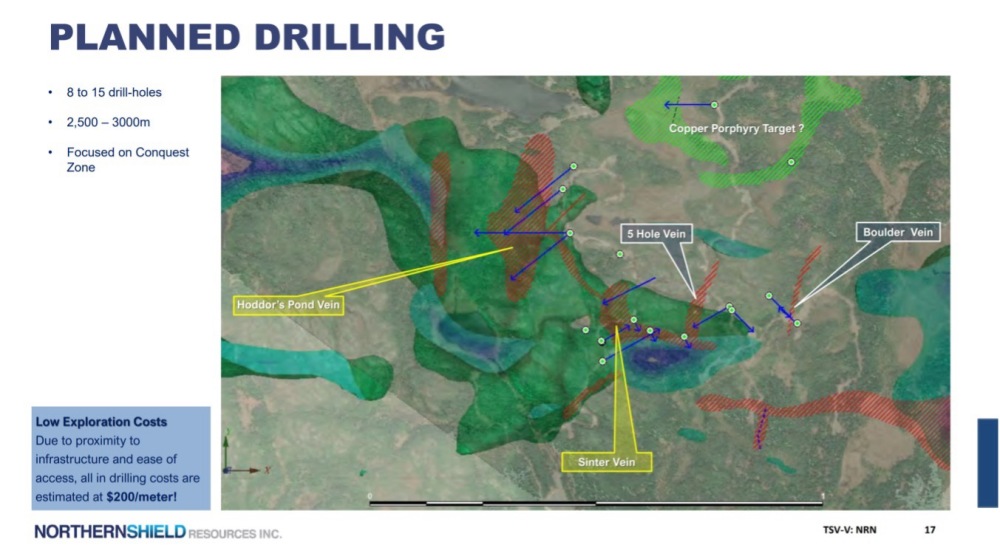

The planned diamond drilling has just begun and the results could be impressive!...

What has been found at and near-surface is just the tip of the iceberg — this could turn out to be a really big rich gold bearing system…

While the emphasis so far has been on the gold at Conquest, for obvious reasons, we should keep in mind that Conquest also hosts copper and also the potential for a big copper porphyry system at Creston within the Root and Cellar Project area, not far away to the southwest…

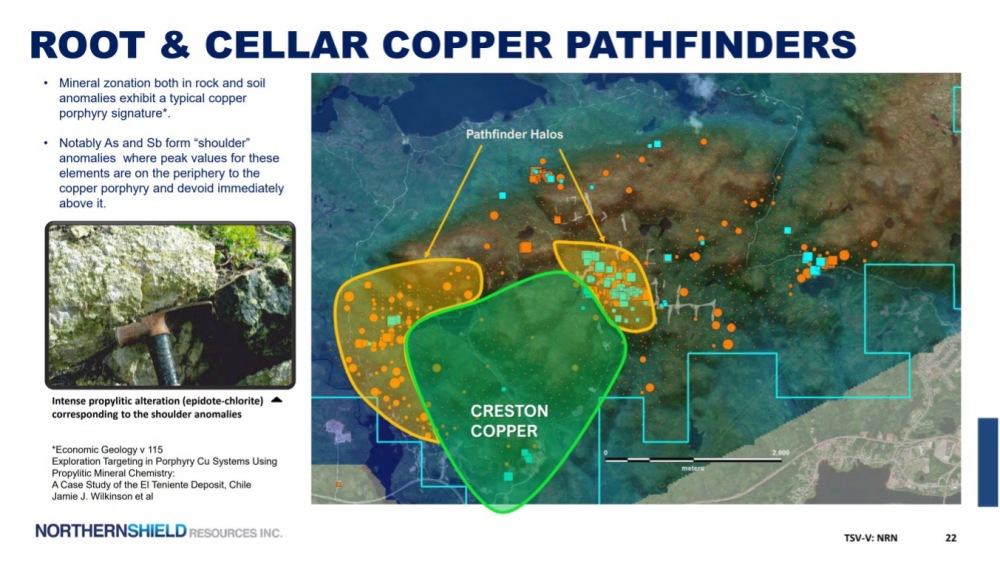

There are strong indications of a big copper porphyry system at Creston…

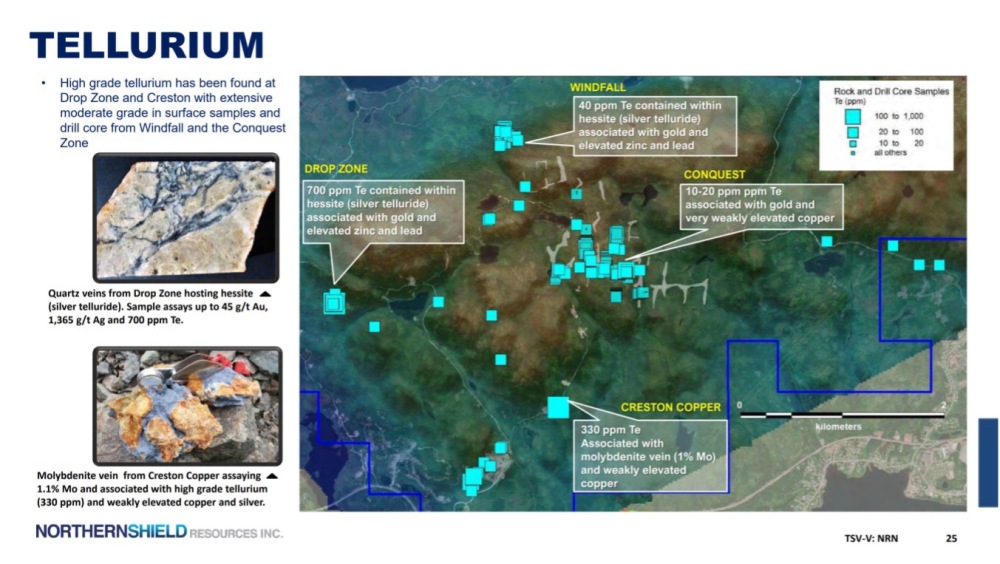

There are good Tellurium grades across the project which is a positive indicator for a big gold system as mentioned above. This page gives details…

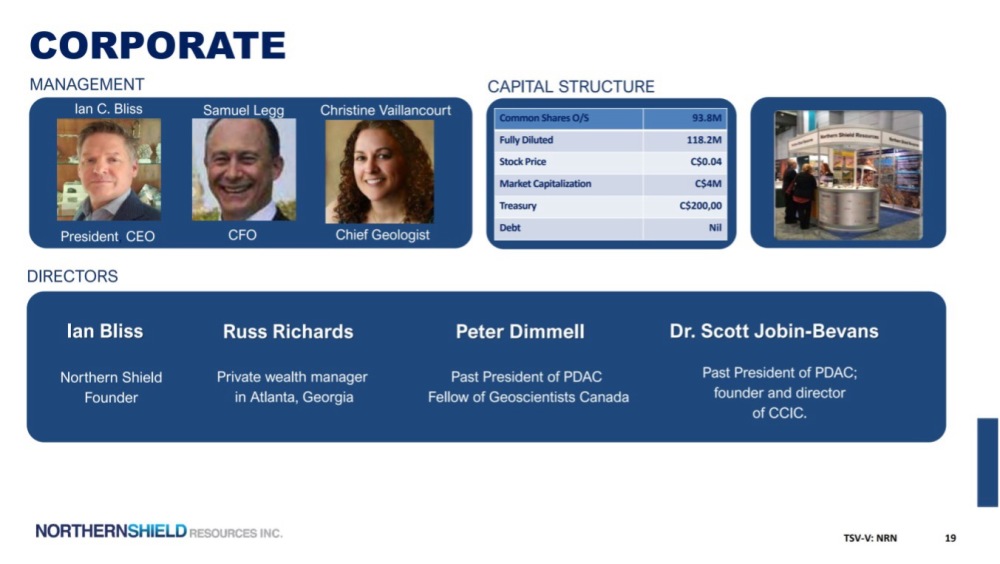

Lastly, the Capital Structure of the company is shown on this page. There are a reasonable 93.8 million shares in issue and no debt…

Now to consider the latest charts for Northern Shield.

We will start with the very long-term chart going back to 2002 because this shows the entire history of the stock. and thus gives us an overall perspective. The stock was stuck in a long and erosive bear market that finally ended at the early 2024 low at just 2.5 cents (although it did form a bottom in 2014 and 2015 at 5 cents). So we see that it became virtually worthless compared to the highs in the 2000s by the time this bear market ended.

Now we will zoom in to look at the sub-bear market from the 2020 highs at about 87 cents on a seven-year chart. On this chart we can see that this sub-bear market had essentially run its course by the end of 2022, although the price did drop a little more by the time it hit its final low early in 2024. However, it is clear that a basing process began from the late 2022 lows. After an attempt to break out of a smaller Pan base in mid-2023 failed, the price dropped back to do more basing work and marked out another low Pan base through 2024 and into the first part of this year which it is right now breaking out of. This chart is very useful as it shows us that the resistance associated with the base pattern extends up to 13 cents and it can be traced back to the early basing action in the Spring and Summer of 2022. So a clear breakout above this level should lead to acceleration to the upside as the price targets the next zone of stronger resistance shown in the CA$0.24 – CA$0.28 price zone. The strong upside volume on the current advance, that is causing the Accumulation line to skyrocket is a clear indication that this stock “means business” and is going to get on with it, break above the resistance and continue on towards the next target.

Now we move on to consider recent action in more detail on the 30-month chart. Here we can see the impressive rally from early April. However, after such a strong rally the stock is clearly overbought and is thus entitled to consolidate its gains and perhaps react back some, especially as it has arrived at the resistance zone shown and has opened up a very big gap with its 200-day moving average, but there are signs that it could press on regardless which fundamentally would be due to a growing appreciation of the potential magnitude of the company’s gold resource at — that could be huge.

Zooming in still further via the three-month chart enables us to break down the action during the strong uptrend from early May. This enables us to see that, although the ascent looks almost vertical on longer-term charts, it has actually taken the form of the orderly uptrend shown. We have just seen a strong 2nd upleg out of the fine bull Pennant delineated (earlier predicted by this writer) that has taken the price up to a short-term target at the upper boundary of the channel shown. Whilst there is some chance that the price could even further ahead and the uptrend get even steeper, it is considered more likely that it will consolidate within the channel, perhaps reacting back some short-term, before a third upleg gains traction. Everything about this chart is bullish, although we are cognizant of the current overbought status of the stock.

Conclusion: Northern Shield Resources is on the verge of breaking out of a large base pattern that started to form in early to mid-2002, and although it may pause for a little while here at resistance before it does so, it is set up to overcome this resistance and then advance swiftly to a first target at the next significant resistance at the CA$0.24 – CA$0.28 zone. The next target is resistance in the CA$0.50 zone and once above that it should advance to the CA$0.80 – CA$0.90 area with long-term charts showing much higher targets possible.

Northern Shield Resources' website.

Northern Shield Resources Inc., NRN.V, C$0.12, NSHRF on OTC, $0.077 FRA: N9SA. Prices for close of trading on June 12, 2025

| Want to be the first to know about interesting Silver, Gold and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Northern Shield Resources Inc.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.