Dolly Varden Silver Corp. (DV:TSX.V; DVS:NYSEA; DVQ:FSE) announced its 2025 exploration drill program concentrated on its 100%-owned Kitsault Valley project is underway.

Two diamond drills began in early May at the Moose vein and Red Point exploration targets. The four drills are now concentrated on the Wolf vein stepouts on the southwest side of the deposit, where the vein is widening, with indications of higher-temperature mineralization and alteration.

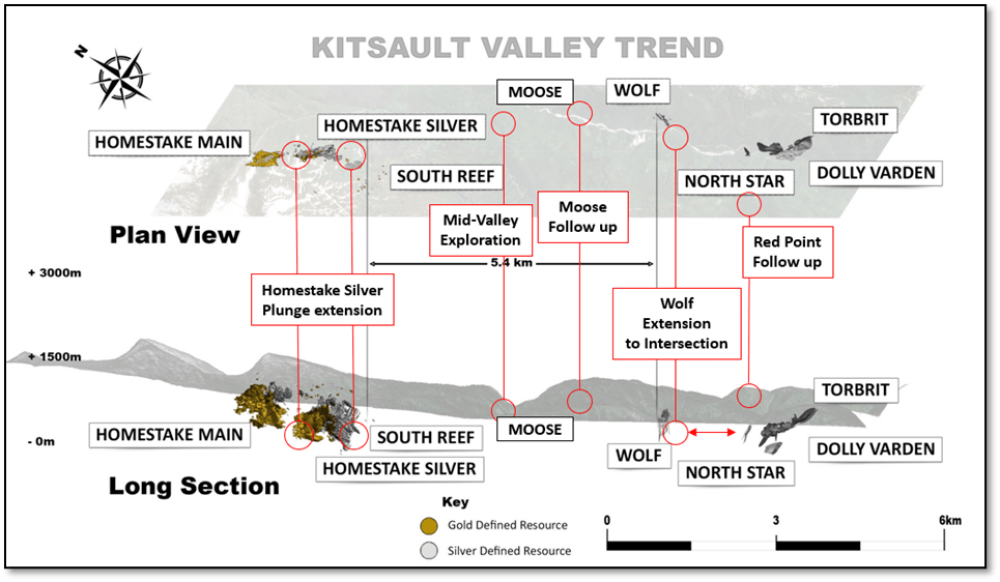

About 35,000 meters of drilling is planned for 2025, the company said. The program will be divided approximately 60/40 between the Dolly Varden properties to the south, including the Big Bulk copper-gold porphyry, and the Homestake Ridge property to the north, along the Kitsault Valley trend.

"Our 35,000-metre drilling program, which is well under way, is balanced between the discovery of new mineralization, expansion of known zones and derisking through infill drilling," said Chief Executive Officer Shawn Khunkhun. "In particular, priority drilling at our high-grade Wolf vein is targeting a key structural intercept with a controlling structure, where there is significant expansion potential located along strike to the south. Concurrent derisking work will continue to add value to one of the premier silver and gold advanced exploration projects in the Golden Triangle,"

Drill Targets

At the Wolf vein, drilling is concentrated on the extension of the southwesterly plunging, high-grade silver corridor along strike and at depth, with the aim to further expand the zone and target the intersection of the two main structures interpreted to be the locus of silver mineralization, the company said in a release.

Directional drilling technology is being employed to accurately intersect the steeply dipping vein with prioritizing aggressive westerly step-outs from the last 120-meter step-out hole, DV24-421, which intersected 379 grams per tonne silver (g/t Ag), 0.64% lead (Pb) and 0.66% zinc (Zn) over 21.69 meters, including 1,804 g/t Ag, 4.36% Pb, and 3.10% zinc over 1.67 meters, Dolly Varden said.

The Moose vein is positioned 1.5 kilometers north of the Wolf vein on a comparable crosscutting structure that extends under the mid-valley sedimentary cap, the company said. Drilling in 2023 encountered mineralized vein and vein breccias similar to the Wolf vein, with previously reported results from drill hole DV23-371 of 712 g/t Ag over 1 meter within a wider vein interval grading 269 g/t Ag over 7.55 meters.

The company said the 2024 drilling at Moose will target the downplunge mineralization projection, trending toward and below the mid-valley sedimentary cover rock. This target is a newly interpreted plunge orientation of the wide and high silver grade seen at similar crosscutting veins located farther south of the Moose vein, such as Wolf and Kitsol.

The Red Point target is on the west side of the Kitsault River trending northwest toward the Homestake Ridge deposits, approximately six kilometers to the northwest, the release noted. Its mineralization consists of a broad area of quartz, sericite, pyrite alteration with high-grade gold values within stockwork zones. Reinterpreted downhole structural data suggest high-grade structural corridors crosscutting the main northwestern trend should be prioritized for drill testing early in the 2025 season.

Follow-up drilling will step out from drill hole DV24-400, which intersected 21.10 g/t gold (Au) over 0.50 meter within a broader zone averaging 0.79 g/t Au over 20.15 meters associated with intense quartz sericite stockwork.

Co. Has Plenty of Cash

Dolly Varden also recently completed purchases of the Kinskuch and Porter projects in British Columbia's Golden Triangle. The expansions increase the company's Kitsault Valley Project to about 77,000 hectares (ha), "covering some of the most underexplored and prospective rocks for silver, gold, and copper mineralization in the Golden Triangle," the company said.

The Kinskuch Property was acquired from mining heavyweight Hecla Mining Co. (HL:NYSE) for consideration of CA$5 million, which was satisfied through the issuance of 1,351,963 shares, Dolly Varden said. Hecla also retains a 2% net smelter return royalty on the property. Hecla Mining now owns 15% of Dolly Varden Silver shares, according to the company's investor presentation.

DV also announced it had closer another sale, its purchase of the 3,192-ha Porter Property from StrikePoint Gold Inc. (SKP:TSX.V; STKXF:OTCQB) for CA$1.1 million or 295,6999 common shares of the company.

Also recently, the explorer entered into an agreement to acquire interests in four other properties totaling 20,000 ha in the same district as its Kitsault Valley silver-gold project. Unlike the Kiskuch and Porter property deals, this deal has yet to close.

Raymond James Analyst Craig Stanley noted on May 5, after the Kinsuch purchase that it would triple DV's strike length of the Red Line, which is the contact between the Triassic Stuhini and Jurassic Hazelton formations, "a key marker for precious metals and copper mineralization" in the historical mining district.

Stanley has an Outperform rating with a CA$3.52 per share target price on the stock.

"Dolly Varden has plenty of cash," he wrote. "Next year, the company will update the Kitsault Valley mineral resource estimate, incorporating into it drill results from the past four programs."

The Catalyst: 'Silver Is Going to Surge'

Silver was volatile during Wednesday's trading session in the early hours. If we do experience a retreat, I expect that it will simply become a purchasing opportunity as traders view the US$33 level beneath as a major potential support, Christopher Lewis wrote for FX Empire.

"If we decline below there, then we could witness a pretty significant selloff to the downside," Lewis wrote. "But really, at this point in time, I think we have a situation where traders must believe that eventually we surpass the highs and advance much higher. This would be assisted by a weakening US dollar if we receive one. Although it is worth noting that the US dollar is doing everything it can to resist. But there are other factors that could propel silver markets higher anyway."

Lewis continued, "I think you have a situation where you must view this through the lens of a market that is doing everything it can to penetrate this barrier. And if and when it does, it's probable that silver is going to surge."

Ernest Hoffman, writing for Kitco on May 27, noted that Francisco Blanch, head of global commodity and derivatives research at Bank of America Securities, said his firm expected silver to reach US$40 an ounce.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Dolly Varden Silver Corp. (DV:TSX.V; DVS:NYSEA;DVQ:FSE)

“We think silver is one of the better investments because remember, silver is half precious, half industrial," Blanch said. "The precious aspect of silver has been driving it higher, the industrial side has been taking a back seat, but this will eventually change."

Analysts still expect enormous investment in solar panels, which contain silver, and in the electrification of everything since it's nature's best electricity conductor.

Ownership and Share Structure

According to the company's latest corporate presentation in January 2025, 50% of its stock is held by institutional investors, including Fidelity Management & Research Company LLC, Sprott Asset Management LP, U.S. Global Investors Inc., and Delbrook.

About 40% is with strategic investors, including 15% with Fury Gold Mines, 15% with Hecla, and Eric Sprott owns about 10% himself. The rest, 10%, is with retail.

The company has 81.27 million outstanding shares. Its market cap is CA$357.73 million, and its 52-week trading range is CA$3.21–5.84 per share.

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- StrikePoint Gold Inc. and Dolly Varden are a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of StrikePoint Gold Inc and Dolly Varden.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.