Giant Mining Corp. (CSE: BFG; OTC:BFGFF; FWB:YW5) announced the submission of core samples from drill hole MHB-35 for assay and the completion of drilling for hole MHB-36 at its Majuba Hill Copper-Silver-Gold Project in Pershing County, Nevada. The activity is part of the company’s Phase 1 Spring 2025 Drill Program, which includes five diamond drill holes totaling 5,484.5 feet (1,671.7 meters). Hole MHB-35, drilled to a depth of 595 feet, is now in the hands of ALS Global Services for analysis. Meanwhile, MHB-36, drilled to 1,100 feet, is being prepared for shipment to the same lab.

The 2025 drill program follows multiple exploration campaigns conducted since 2020. Its aim is to expand known mineralization zones and support the development of a new Mineral Resource Estimate (MRE). Notably, results from MHB-32, announced in May, included a broad 379.5-foot interval averaging 0.33% copper and 16.97 ppm silver, with higher-grade sections up to 4.36% copper over 10 feet.

Hole MHB-36 was guided by an AI-assisted geophysical modeling system developed by Exploration Technologies Inc. The proprietary system identified a resistivity anomaly in the southern sector of the project area, leading to the discovery of visual disseminated and vein-hosted chalcopyrite mineralization starting at 650 feet and extending beyond 905 feet.

Giant Mining also announced a non-brokered private placement of up to 15,000,000 Special Warrants at US$0.20 per warrant, targeting gross proceeds of up to US$3,000,000. Each Special Warrant will convert into one common share and one share purchase warrant exercisable at US$0.32 for four years. An acceleration clause applies if the company's shares trade at or above US$0.80 for five consecutive trading days. The offering is intended to fund ongoing exploration activities and general working capital. The securities will be subject to a four-month hold period and will not be registered under the U.S. Securities Act of 1933.

Copper Crunch Warnings Grow as Supply Risks Mount

Copper's critical role in the global energy transition has come under increasing scrutiny as warnings of a looming supply shortfall intensify. A May 21 report by The Guardian cited the International Energy Agency’s (IEA) projection that copper supply could fall 30% short of global demand by 2035 without corrective action. Fatih Birol, the IEA’s executive director, called the situation “a major challenge,” urging developed nations to increase refining capacity and build cooperative ties with resource-rich regions like Africa and Latin America. Birol emphasized copper’s role as “a key component of every form of electrical energy system at present,” warning that delays in addressing the shortfall could significantly increase the cost of the green transition.

The IEA noted that new copper deposits take an average of 17 years to reach commercial production. However, Birol argued that the gap is not inevitable, pointing to recycling, strategic metal substitution, and fast-tracking new projects as potential solutions.

Market signals have echoed these concerns. On May 22, Bloomberg’s Michael Ball reported that copper was expected to resume its longer-term upward trajectory, citing global electrification trends and strengthening macroeconomic signals from China. Ball observed that “the COMEX-LME copper spread has significantly declined following the trade war de-escalation,” with China’s copper demand rising 6% year-to-date on the back of energy infrastructure, electric vehicles, and industrial activity. He also highlighted chronic underinvestment in new mines as a factor contributing to tight market conditions.

Investor sensitivity to supply disruptions was further underlined in a May 27 article by Stockhead News, which reported that Ivanhoe Mines temporarily shut down a major copper operation in the Democratic Republic of Congo following seismic activity. The incident sparked gains across the sector, with Capstone Copper Corp. up 6.5% and Sandfire Resources rising 2.5%, underscoring how tightly copper markets are linked to real-time supply dynamics.

Building Momentum at Majuba Hill

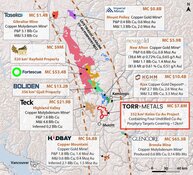

Giant Mining’s 2025 campaign at Majuba Hill is positioned within a broader strategy to define and expand copper, silver, and gold resources in a mining-friendly jurisdiction. According to the company’s investor presentation, the Majuba Hill project is situated near key infrastructure and has access to a primary electric power line just 22 miles away. With over 88,000 feet of cumulative exploration drilling completed to date, the project benefits from a robust geologic model supported by historical production and recent AI-integrated exploration techniques.

The company’s focus on copper is underscored by macroeconomic drivers. With electric vehicles requiring significantly more copper than traditional vehicles and renewable energy infrastructure depending on the metal, Giant Mining sees long-term demand as a tailwind. Industry projections referenced in the company’s deck anticipate a rise in global copper consumption to 50 million metric tons by 2035.

In the near term, Giant aims to integrate assay data from all five 2025 drill holes into a National Instrument 43-101 compliant deposit model. With copper mineralization confirmed at deeper levels and an evolving understanding of the porphyry system, management expects these developments to further refine resource estimates. The company’s use of AI-driven targeting tools and a flexible drill contract allows it to adapt exploration based on real-time geological findings. With the Special Warrant financing now in motion, Giant Mining has taken steps to sustain its exploration momentum through the rest of the year.

Chart Signals Point to Potential Rebound for Giant Mining

In a May 2 technical review, analyst Clive Maund offered a bullish outlook on Giant Mining Corp., citing a combination of chart patterns and sector fundamentals. Maund observed that the company’s share price was approaching a key historical support level, mirroring lows reached in November and December. “It is thus at a very good point to buy as it is expected to form a Double Bottom with its November and December lows and reverse to the upside,” he wrote.

Maund’s commentary highlighted Giant Mining’s Majuba Hill Project in Nevada, underscoring its exposure to copper, silver, and gold. He pointed to the project’s favorable location, which includes established infrastructure such as roads, power supply, and water access—elements he suggested could reduce future development costs. Maund also referenced the site’s historical output, which included 2.8 million pounds of copper, 184,000 ounces of silver, and 5,800 ounces of gold.

Analyzing the stock’s longer-term performance, Maund identified what he described as a “massive volume buildup” in recent months, interpreting the activity as rotation from short-term to longer-term investors. “The massive volume of recent months indicates a lot of rotation of stock from weaker to stronger hands, which is bullish,” he noted. He also cited technical indicators including a possible Saucer bottom and an oversold Relative Strength Index (RSI), both of which he viewed as consistent with a potential price reversal.

While acknowledging past volatility, Maund concluded that the combination of favorable technical signals and advancing exploration at Majuba Hill could support upward momentum. “If favorable [drill results] they could, of course, get the stock moving higher,” he added.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Giant Mining Corp. (CSE: BFG;OTC:BFGFF;FWB:YW5)

Ownership and Share Structure

According to Giant Mining Corp., approximately 15.1% of its shares are held by insiders. The remaining shares are held by retail investors.

As of May 28, 2025, Giant Mining Corp. has a market capitalization of approximately CA$17.17 million, based on a closing share price of CA$0.23.

The company's current share structure includes 74,664,097 shares issued and outstanding, 38,231,865 warrants, 850,000 options, and 2,400,000 restricted share units.

The company's shares are traded on the Canadian Securities Exchange (CSE) under the ticker BFG, on the Deutsche Boerse AG (DB) under the ticker YW5, and on the OTC Pink Sheets in the U.S. under the ticker BFGFF, with these listings active since December 2017.

The company's Warrants are traded on the Canadian Securities Exchange (CSE) under the ticker BFG.WT.A and BFG.WT.B.

| Want to be the first to know about interesting Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

.

Want to be the first to know about interesting Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- Giant Mining is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Giant Mining Corp.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.