The main reason for looking at PreveCeutical Medical Inc. (PREV:CSE; PRVCF:OTCMKTS) here is that its stock looks like it is at last ready to break out of a very long low base pattern into a major new bull market.

Preveceutical Medical is a preventative health sciences company — hence the name — and has a diverse portfolio of R&D programs in varying stages of development that may be spun off as separate companies, which probably explains the existence of a range of decks covering the different programs. It has an extensive portfolio of intellectual properties (patents), etc., with which to enter into joint ventures.

The company's approach is to leverage innovative science and technology to enhance natural products as novel targeted therapeutics to address significant life-affecting diseases.

Amongst a number of positive developments that will together act as catalysts for the stock we have the news that PreveCeutical announced the closing of BioGene Therapeutics Transaction back on November 15, which among other things, will involve the distribution of "consideration shares" to shareholders at a future date, the announcement also last December that wholly-owned subsidiary BioGene Therapeutics welcomed ex Pfizer and Moderna senior leadership Dr. Barry Ticho, and the closing on May 22 of an upsized private placement.

We will now review the company using pages from the latest investor deck.

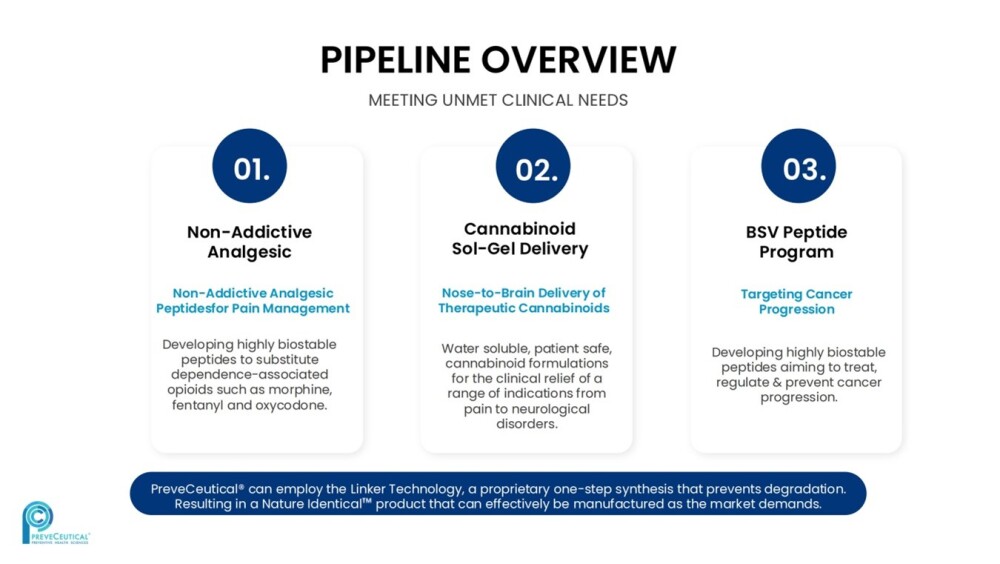

The three core programs of the company are shown on the image below.

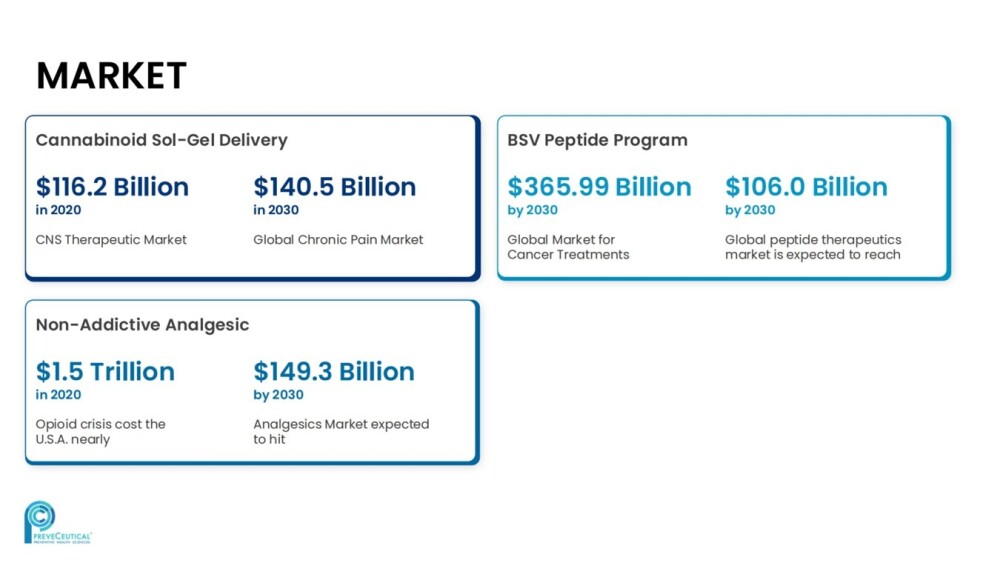

The markets for the successful adoption of these programs are huge.

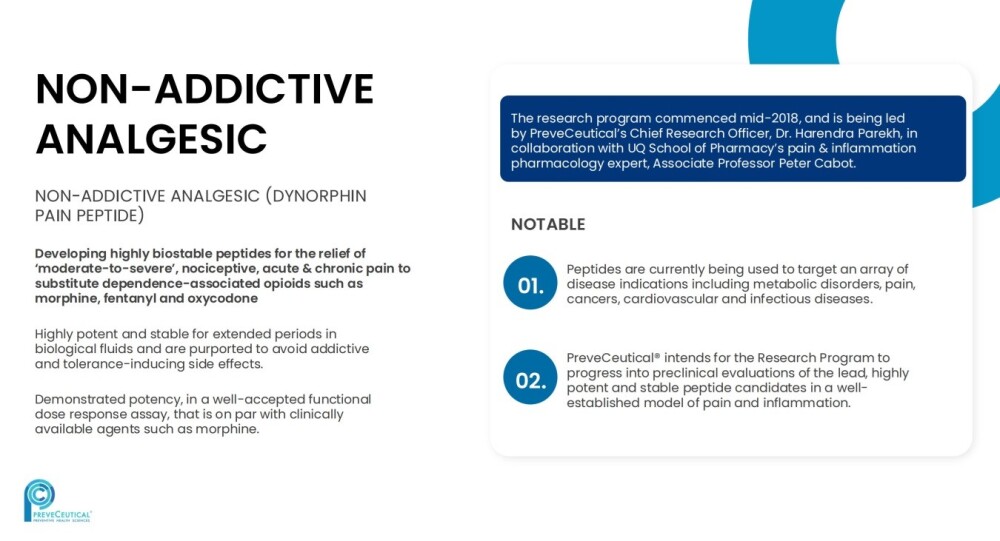

The following image provides an introduction to the Non-Addictive Analgesic program.

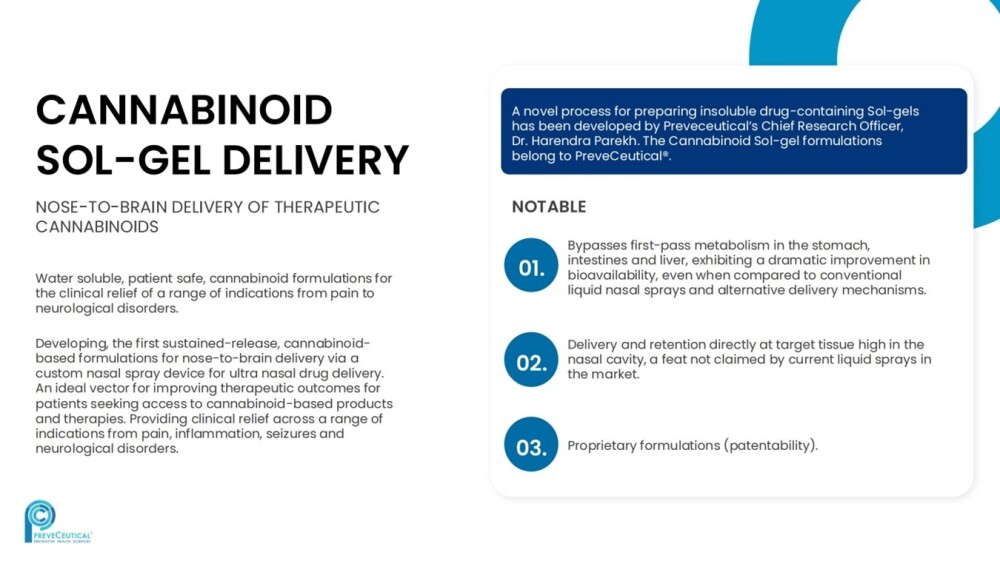

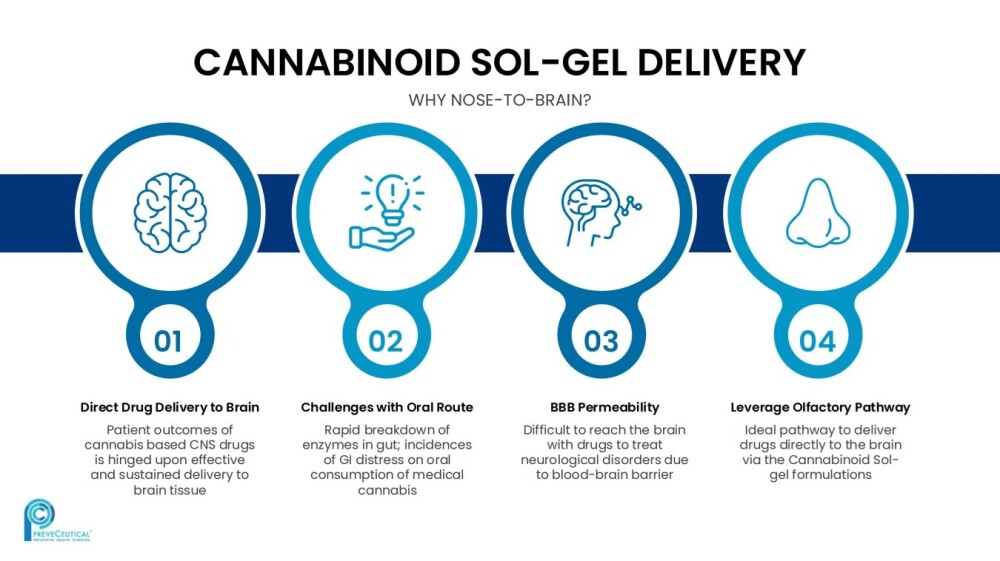

And this image provides an introduction to the Cannabinoid Sol-Gel Delivery program:

With respect to the above program, it is noteworthy that the nasal delivery system is much more efficient than oral ingestion, as set out in the following image, which means that the same effect can be achieved with much less, making it more cost-effective for the company to produce.

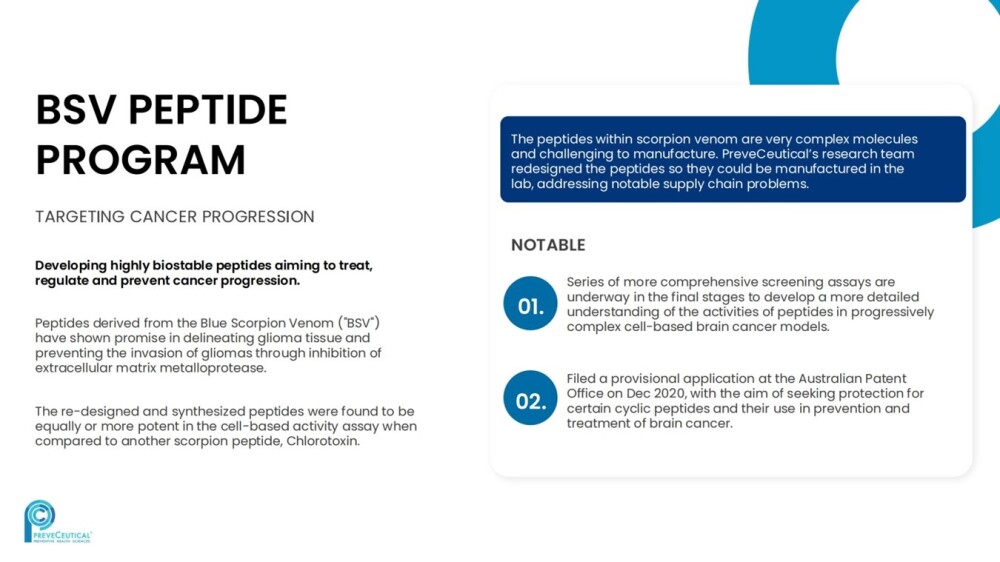

This image provides an introduction to the BDV Peptide program:

More information on the above programs is available in the deck.

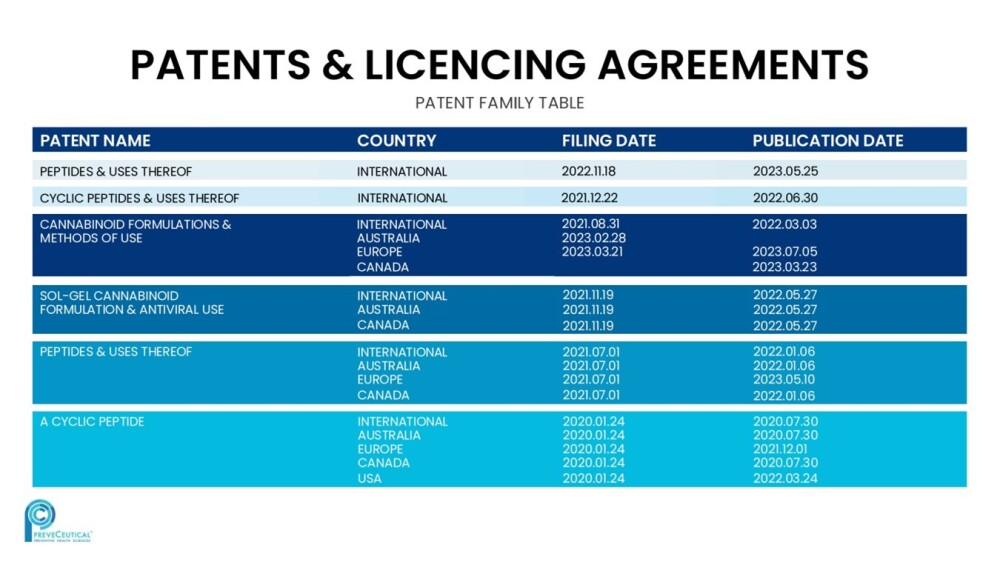

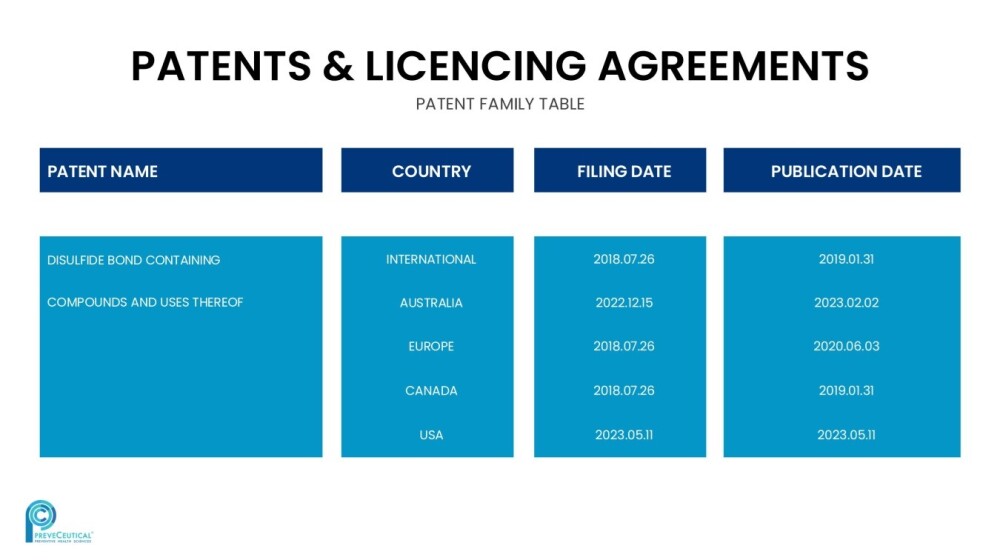

The company has an impressive list of patents and licensing agreements that clearly add to its value, which are set out on the following two images.

Now, we will review the latest stock charts for the company to see why it is looking ready to commence a major new bull market soon.

After a brief spike when it came to market in 2017, Preveceutical Medical went into a severe bear market, as frequently happens with new issues, that took it down to a price of just 1 cent by the time it hit bottom in November and December of 2019. After forming a Double Bottom with these lows in March and April of 2020, it rallied sharply into early June of that year to briefly peak at about 9 cents.

After this recovery rally, it came rattling back down again to bottom at the 2 cent level this time late in the Spring of 2021, and it has been tracking sideways above this level ever since in a narrow range bounded for most of the time by 4 cents on the upside, apart from much of last year when the lower boundary of the range dropped to 1.5 cents.

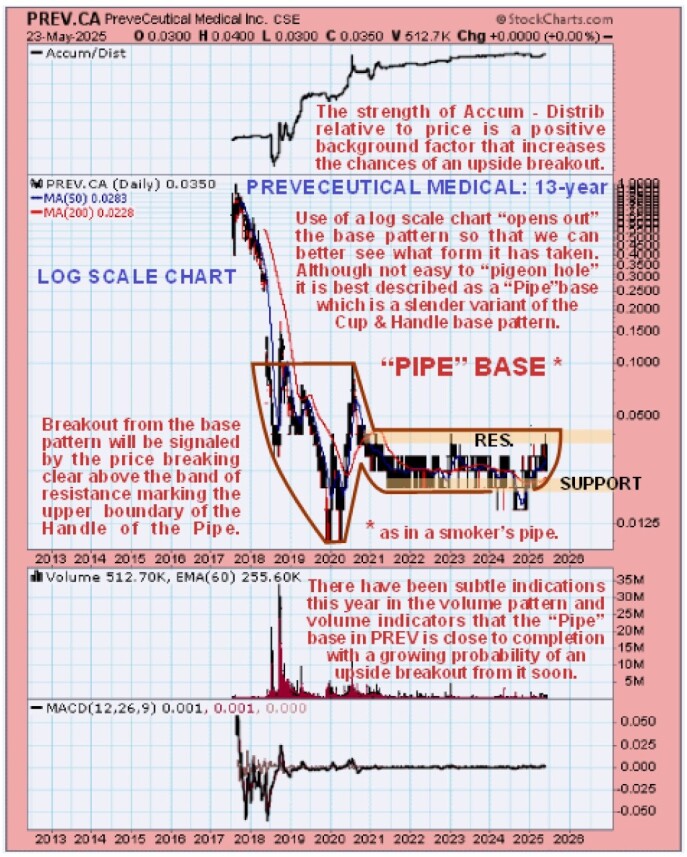

We can see all of this on the 13-year log chart below, the log scale being chosen to "open out" the base pattern, which on an arithmetic scaled chart is "squashed flat" by the much higher prices prevailing years ago. Although this chart goes back 13 years, there are only seven years of trading for this stock, because it started trading in 2017. The reason for the longer duration of the chart is to get the early high prices out from under the writing at the top left of the chart.

It is only on a long-term chart like this that we can grasp the big picture of what is going on in this stock. It makes clear that a giant "Pipe" base, which is a slender variant of the better known Cup & Handle base, has formed in Preveceutical Medical and not just that, this base pattern is clearly approaching completion and a breakout from it will be signaled by the price breaking above the resistance towards and at the upper boundary of the "handle" of the pipe which will be achieved once it breaks clear above the 4 cent level that marked the high early in 2023 and the intraday high just last week.

Such a breakout is made more likely by the positive volume pattern and volume indicators — even on this chart, we can see that the Accumulation line, shown at the top of it, has been trending steadily higher for years, which is a positive background factor.

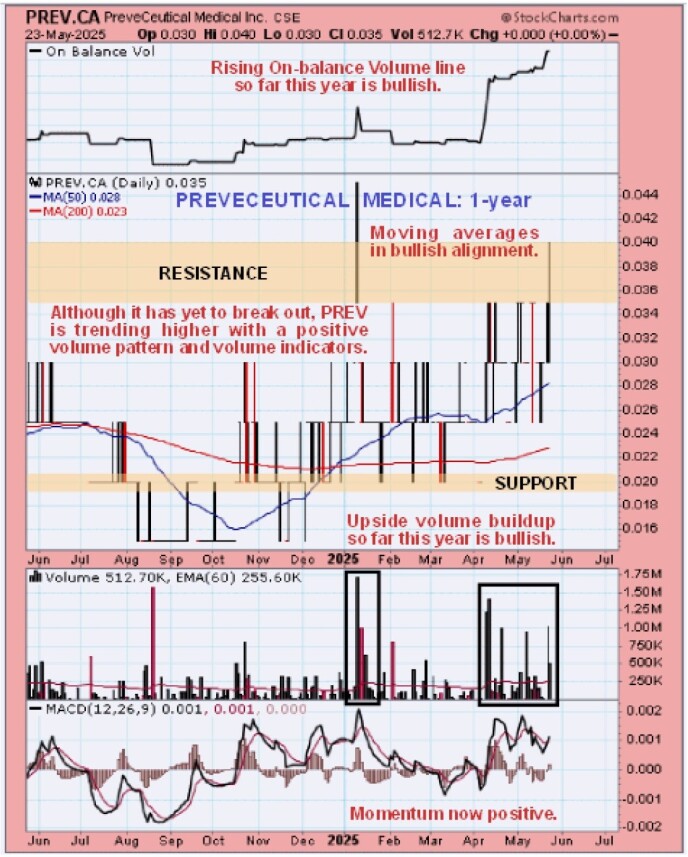

On the 1-year chart, we can see that the price has been trending higher since last December with a series of higher lows and moving averages in bullish alignment, and it is now challenging the resistance at the upper boundary of the base pattern.

With good upside volume this year that has driven the On-balance Volume line quite steeply higher in recent weeks, it is looking well placed to break out of the base pattern and commence a major new bull market and given that it has been stuck in this base pattern since early 2021, such a breakout will clearly be a significant development.

Preveceutical Medical is therefore rated a Strong Buy here for all time horizons. The first target for an advance is the CA$0.09 – CA$0.10 area. The second target is CA$0.40, with higher targets possible.

Preveceutical Medical's website.

PreveCeutical Medical Inc. (PREV:CSE; PRVCF:OTCMKTS) closed for trading at CA$0.04, US$0.0259 on May 26, 2025.

| Want to be the first to know about interesting Biotechnology / Pharmaceuticals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.