Odd Burger Corp. (ODD:TSX.V; ODDAF:OTC; IA9:FRA) is a technology company that is working to transform the fast food industry by producing a range of plant-based fast foods that have universal appeal, even to the most conservative consumers of fast food. An outstanding feature of the company's food products is that, although they are technically classified as Vegan, you don't have to be Vegan to really like them.

Odd Burger is very attractive to investors here because, after many years of research and investment and the assembling of an exceptionally experienced management team, the company is now taking off and entering the mainstream. This is made abundantly clear by the big news out of the company released on the 21st of this month that Odd Burger received shelf space at 500 7-Eleven locations. So, Odd Burger Corp. has received approval to list its retail product line at 7-Eleven Canada in over 500 locations across Canada.

"This is, without a doubt, one of those game-changing moments for our company," said James McInnes, chief executive officer and co-founder of Odd Burger. "We see incredible potential with this partnership, not only to grow our brand, but also to create truly accessible plant-based food options available to the masses. We believe that we can create huge change with this partnership, and we are ready to embark on this next chapter of innovation and growth."

In addition, on May 14, the company announced that Odd Burger's manufacturing division, Preposterous Foods, signed a distribution deal with Dot Foods Canada. The distribution deal with Dot was put in place to support the distribution needs of 7-Eleven, but also provides the company with a mechanism to greatly expand its retail presence with other retailers.

While it is worth reading this news release, the implications of this development for the future of Odd Burger are summed up by CEO and co-founder James McInnes thus: "We believe that this is a very significant step forward for Odd Burger." He continued, "This distribution deal will allow us to secure listings with national retailers and will greatly increase our ability to grow revenue. Dot will also simplify our logistics and production process, which will drive efficiency across our manufacturing division."

The company provides a full menu at its locations, including all of the classics so popular with fast food customers, at comparable prices to the established fast food chains, and as they are plant-based, they will increasingly appeal to more health-conscious consumers going forward.

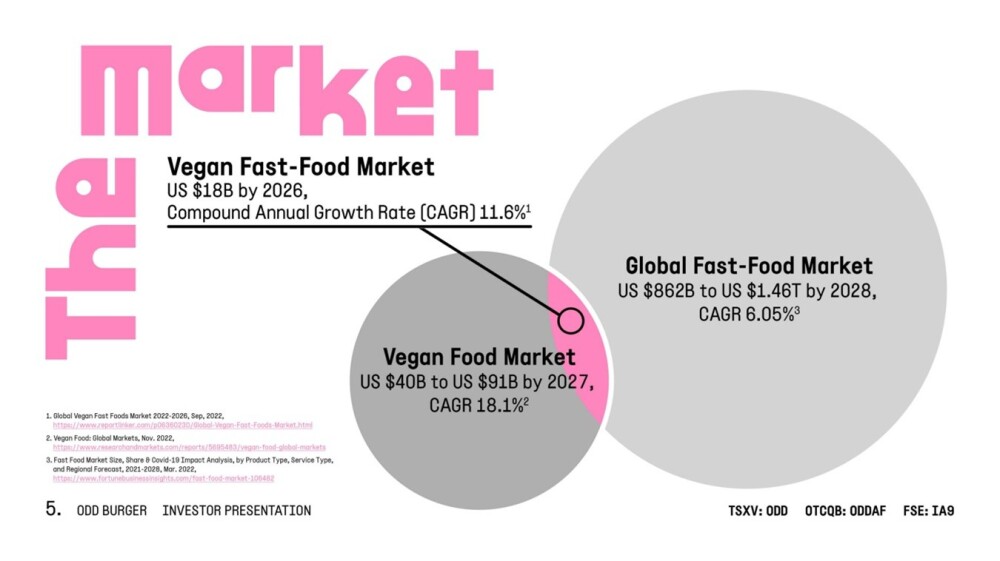

The following page, taken from the company's investor deck, shows the projected growth of the Global Fast Food Market which from now through 2028 has an impressive projected compound annual growth rate (CAGR) of 6.05%, the projected growth of the Vegan Food Market which has a more impressive CAGR of 18.1%.

Where the circles overlap is the Vegan Fast Food Market, which has a CAGR in between these two figures, which is still an impressive 11.6% CAGR.

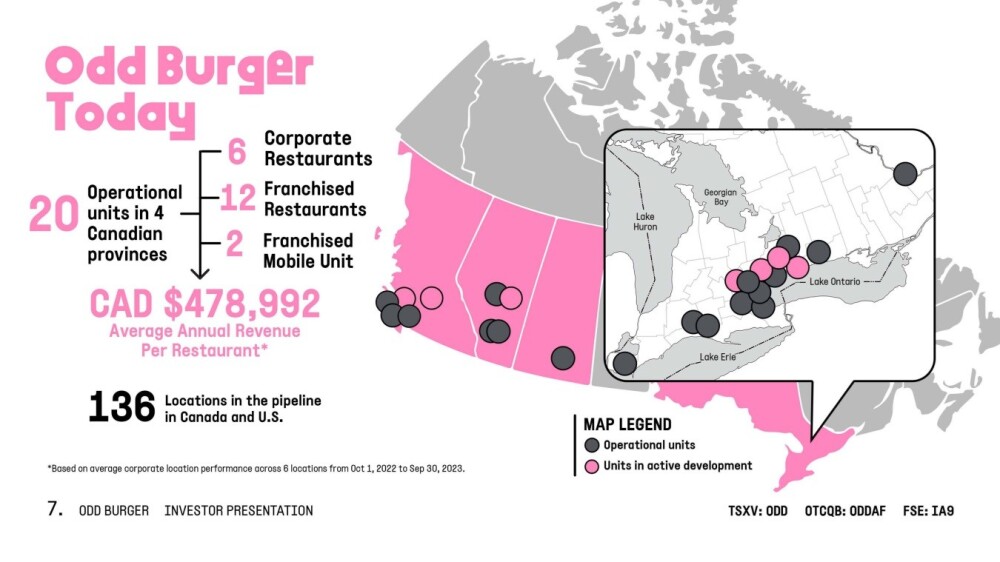

Currently, the company is operating in Canada, where it all started, and it is rapidly expanding within Canada and also soon into the U.S. and international markets.

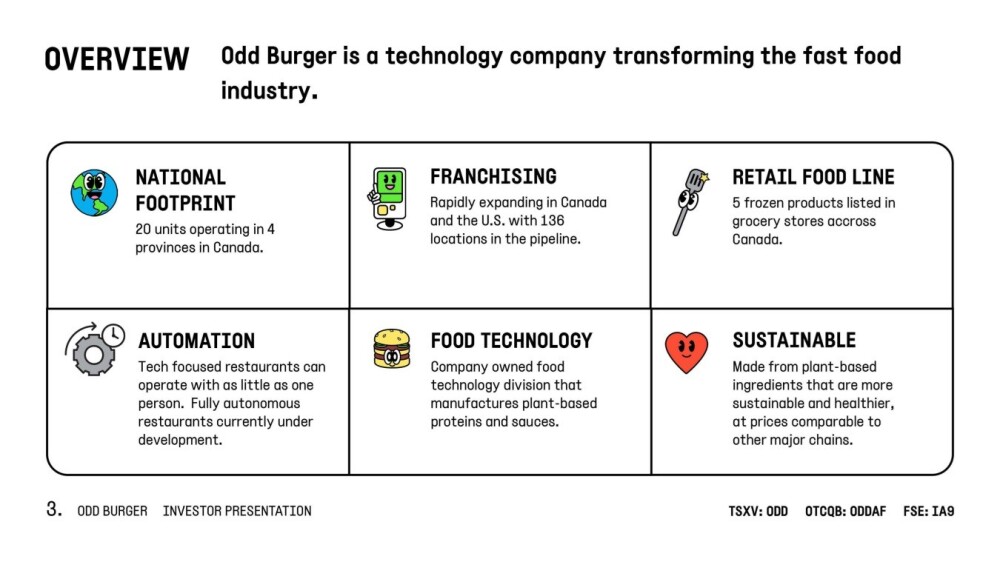

This picture provides an overview of the company, and a very important point to note is that Odd Burger produces its own food under its food technology division, Preposterous Foods, which was launched in 2018 under the guidance of Co-Founder and Food Scientist James McInnes.

Part of the output of the Preposterous Foods division is sold as CPG (consumer packaged goods), with over 40 retailers, and is seeing very rapid sales growth, as demonstrated by the deal with 7-Eleven.

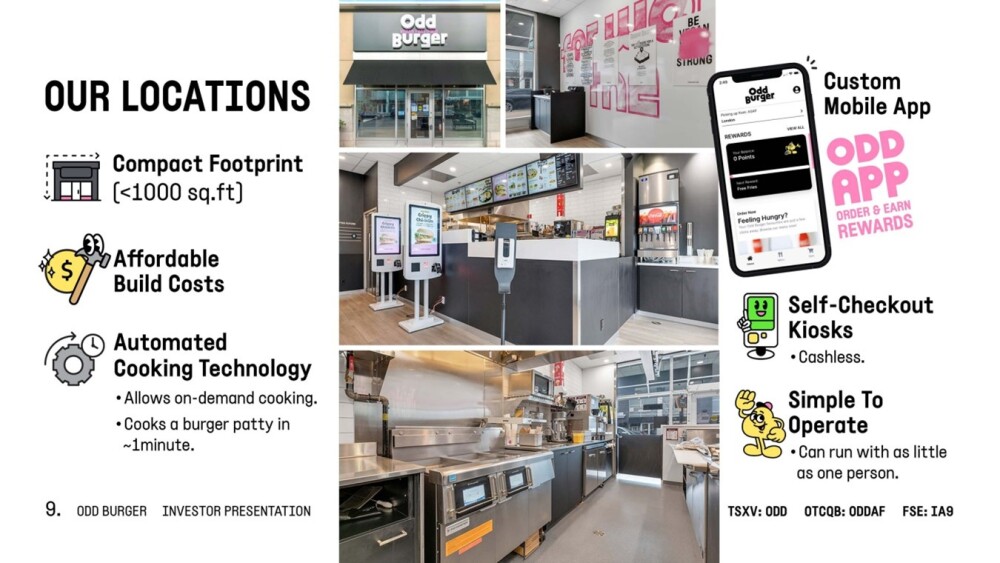

Odd Burger's retail locations are optimized to run at maximum efficiency and have an affordable build cost, compact footprint (floor area), automated cooking technology — the grill / stove is not on all the time, operating according to demand, thus saving energy, has a self-checkout and can be run with as little as one staff member.

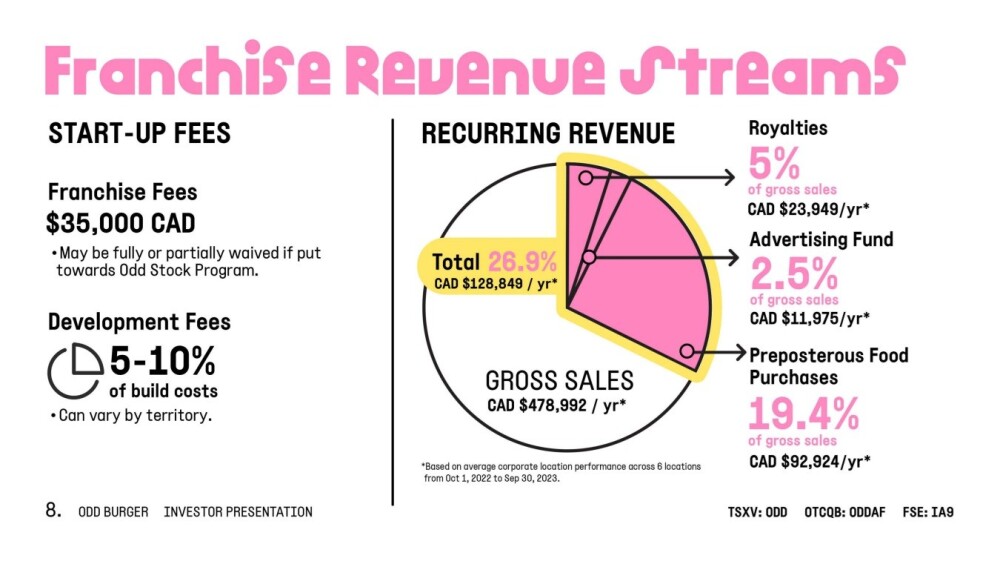

This picture shows how the franchises operate:

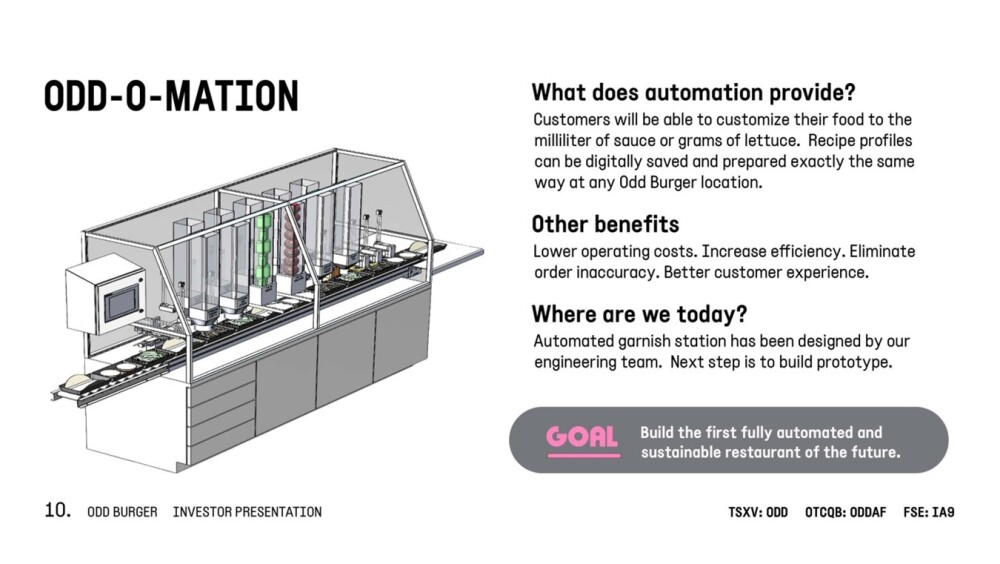

ODD-O-MATION — customers will soon be able to customize their orders according to personal preference, and a valuable feature is that recipe profiles can be digitally saved and thus prepared exactly the same way at any Odd Burger location.

This will be accomplished by automation technology that the company is currently developing, with a prototype expected to be launched sometime in late 2025 or early 2026.

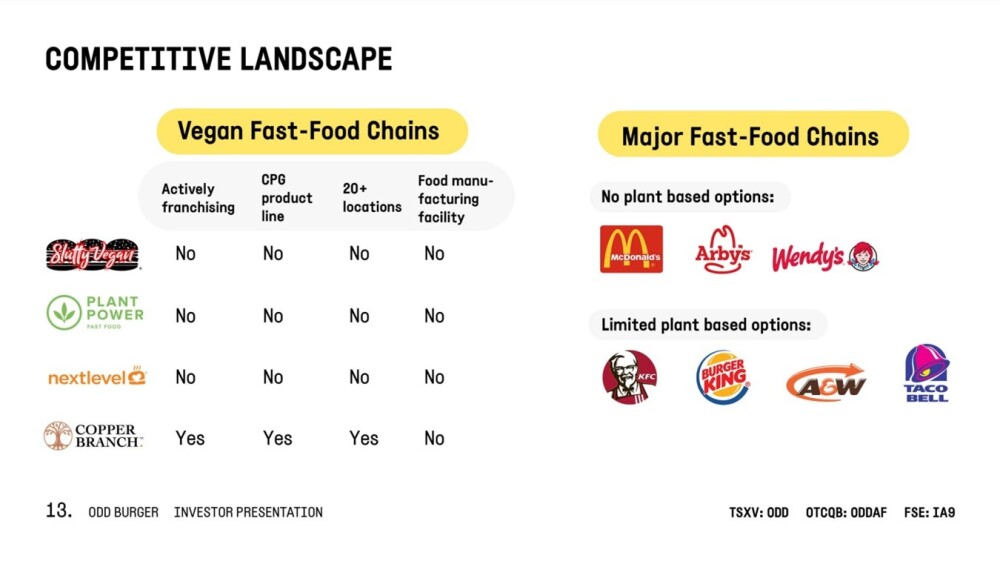

As the following illustration makes clear, Odd Burger is ahead of its competitors.

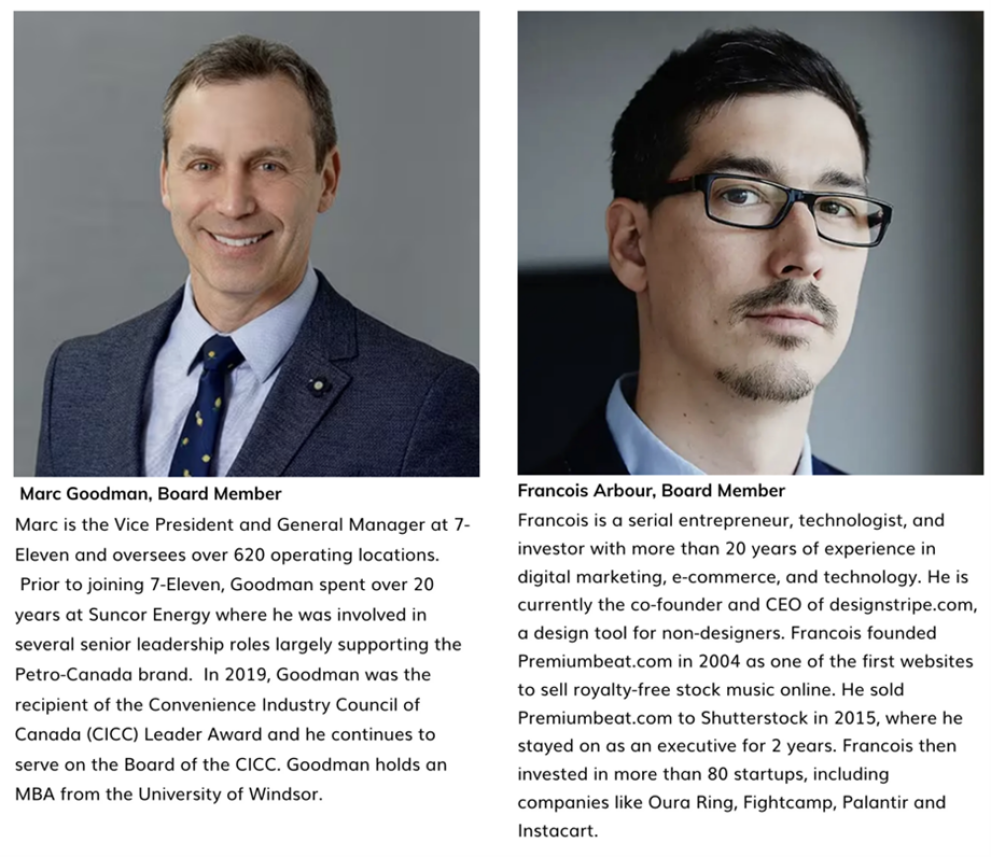

A key factor laying the foundation for the future success of the company is the strength of the management team, and it is an indication of the potential of the company that it has attracted such people.

In addition to the co-founder and CEO James McInnes, who is the food scientist behind Preposterous Foods, and the other co-founder Vasiliki McInnes, who is an experienced leader and public health specialist, the board members include,

Marc Goodman, Vice President and General Manager at 7-Eleven, who oversees over 620 operating locations, and Francois Arbour, who is an entrepreneur, technologist, and investor with more than 20 years of experience in digital marketing, e-commerce, and technology. Francois has invested in upwards of 80 startups, including companies like Oura Ring, Fightcamp, Palantir, and Instacart. Graham Taylor, who is a university professor in the field of Artificial Intelligence at the University of Guelph, and has extensive experience in automation and technology development at large corporations such as Google. The credentials of these board members clearly speak for themselves.

Of the 98.4 million shares in issue, about three-quarters are owned by insiders and those close to management, which only leaves about a quarter of the shares in the float.

Now, we will review the stock charts for Odd Burger.

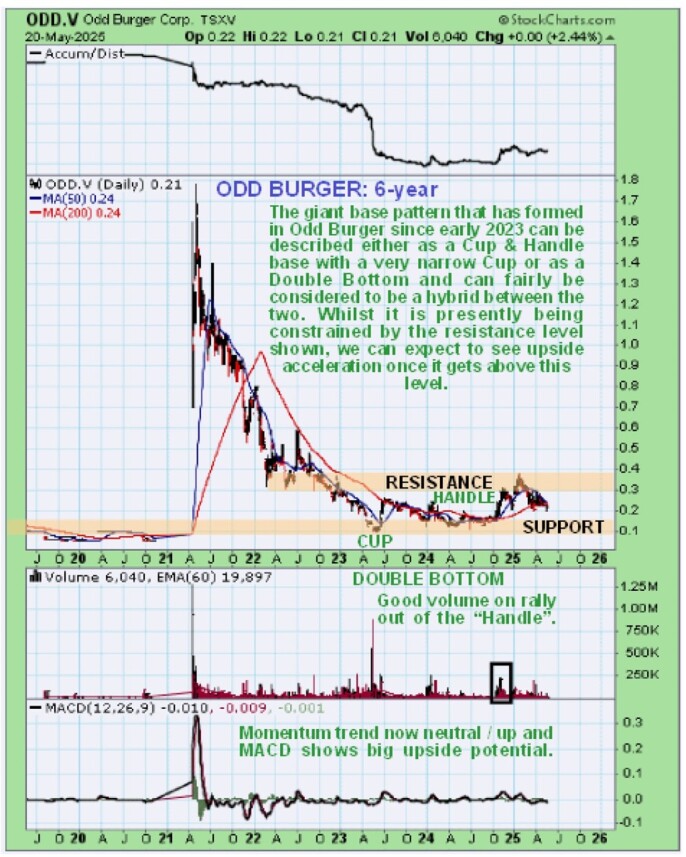

On the long-term chart, we can see that after a severe bear market from its 2021 peak approaching CA$1.80 that brought it all the way down to hit bottom at 10 cents in the Spring of 2023, a very large base pattern has built out in the stock that is viewed as a hybrid between a Cup & Handle base with a very narrow Cup or as a Double Bottom.

In the Fall of last year, the price started to break out of this base pattern on good volume, which drove up the Accumulation line. Following an attempt to break clear out of it early this year, the price has reacted back, but the Accumulation line has remained relatively buoyant, which is viewed as a positive sign that points to renewed advance.

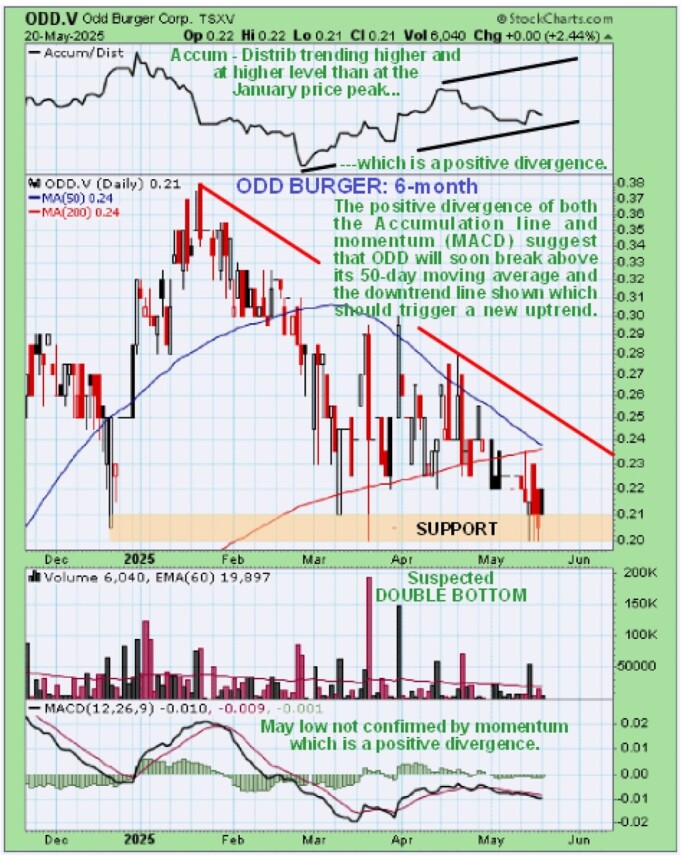

On the 6-month chart, we can see recent action in much more detail and how, following the attempt to break out of the base pattern in January, the price has reacted back to the zone of support shown which led to its stabilizing above the CA$0.20 level but over the past month or so it has dipped back to the support level again.

However, the Accumulation line has been trending higher since late February, a positive divergence which suggests that the price may have just made a Double Bottom with its March lows, and we can see that the latest low was not confirmed by momentum (MACD), which is another positive divergence. It is therefore considered likely that the price will now advance to break out above the falling 50-day moving average and the falling trendline shown, especially given the latest very positive news out of the company detailed above, a major technical development that once it occurs will trigger acceleration to the upside as these have been restraining factors up to now.

This, therefore, looks like a very favorable point to buy Odd Burger or add to positions in the stock. The first target for an advance is the January high at CA$0.38. The second target is the resistance at and just below CA$0.60, with much higher targets possible once it clears this level.

Odd Burger Corp.'s website.

Odd Burger Corp. (ODD:TSX.V; ODDAF:OTC; IA9:FRA) closed for trading at CA$0.235, US$0.1683 on May 21, 2025.

| Want to be the first to know about interesting Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Odd Burger Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.