Gold has been the place to be for the last few years as we banged on that drum, and it finally worked. We were, of course, continually frustrated with the performance of gold stocks versus gold in North America and here.

Gold was going to go higher, and gold stocks would catch up a lot and really zoom. Or so we thought.

This will still happen, but it seems it might be a little further out yet.

This certainly has not been your father's or grandfather's bull market in gold, as has been said many times. No inflationary pressure or big wars (if we ignore Ukraine and Gaza).

The US$ still hasn't crashed, nor have the U.S. T Bond or the equity markets.

So why is gold rising?

Central banks buying? Keep in mind Western central banks haven't really been buying.

It's all China, et al.

As I said in that recent Ausbiz interview one could cynically say that bureaucrats sold Australia's, Canada's and the UK's gold at the bottom so Asian bureaucrats might be buying at a top.

Just sayin'.

The performance of the Chinese stock market has been a history of seventeen years of lower highs, a Yuan that is continuing its 40-year bear market, and >30% youth unemployment in a grossly lopsided economy certainly doesn't suggest the CCP and the PBOC have been brilliant economic managers.

China seems to have stopped releasing data that was showing falling jobs market and the drift back to the countryside of over 40m city based workers.

Ain't centrally planned economies wonderful!

So why has gold risen?

The bubble the Gold Bugs (I am a Gold Bull, not a Gold Bug) have lived in for the past year or two became mainstream there for a while. The bulls are still whipping it up out in the markets.

Roland Stoeferle put out his magnificent annual In Gold We Trust magnum opus, but the world yawned.

The momentum has now gone.

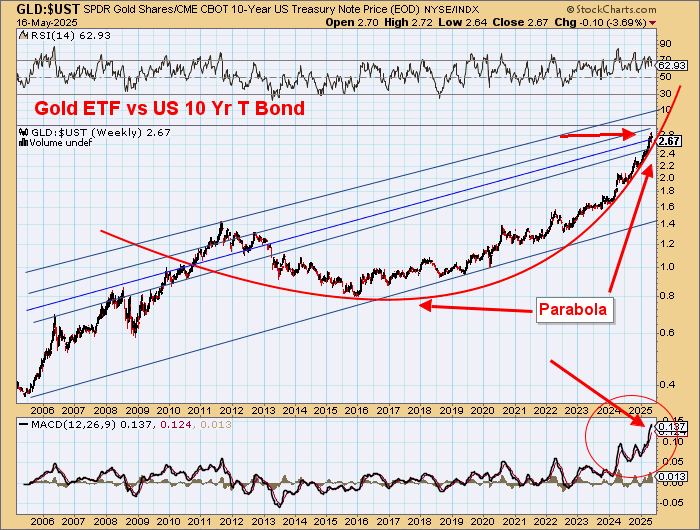

That is why noting parabolas is so important. Parabolas show an accelerating rate of change, and so they take a lot of the emotional energy that pushes markets to extremes when they run.

We never quite know quite far the Rhino horn of a parabola will rise, but when you see them, you should become very wary.

Is this the Mother of all Parabolas?

So being a bond market bull doesn't seem so crazy. But being a Peter Schiff Gold Bug gold bull, and bond market bear does.

Parabolas work in reverse as well. Parabolic downlegs generally create important market bottoms.

So, in the gold markets, the short-term parabola in the GLD ETF was breached again.

Now, the 30-month parabola is being tested. Lower prices this week (and I am expecting them) will breach this one, too.

Breaching of parabolas isn't necessarily a bad thing. They just reflect momentum, and parabolas show the rate of change. Very high rates of change do not generally last long!

See just below.

Thursday was a goodbye kiss — now falling another 10% to ~US$3,000.

If so, this parabola might be breached here.

Some other parabola breaches we have seen recently in markets. A parabola here, and 30 months later, the US$ DXY isn't down too much.

After almost two years later, U.S. 10-Year yields aren't really much different either, even after a couple of parabolic moves.

Parabolic blow off led to lower prices then sideways

Same but multiple parabolas here — up . . . and down

Of course, if sideways movement is going to be the case with gold, then gold stocks should keep rising. Earnings yields are so high.

For gold stocks, that breaking of the 2011 Downtrend line has been really critical.

The breakout followed by that backtest was technically very significant and set gold stocks off in yet another parabola.

A pullback to 165 on XAU will keep the parabola intact, but this index wouldn't want to come back much more; otherwise, 130 would be tested in late 2025 or early 2026.

However, these two provide some troubling evidence.

The two heavyweight leaders.

Not a recent upside parabola in sight!

NO NEW HIGHS!!

Still below their October 2024 highs.

Newmont Corp. (NEM:NYSE): 20% fall back to US$40.

Barrick Mining Corp. (ABX:TSX; B:NYSE): Back below US$16.

And the growth companies should pull back to their uptrends which are quite close but breaches could turn out nasty in each case.

Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE): US$100 will be important here.

Kinross Gold Corp. (K:TSX; KGC:NYSE): US$12 will be important here.

This ratio has been very disappointing, and it seems it will need another six months at least before testing this downtrend again.

Supporting on the downtrend line for almost five years:

Nothing visible yet for when this might change. Perhaps another six months?

Don't forget that the two main goldstock ETFs, GDX and GDXJ, have seen shares redeemed by about 40% since the beginning of 2025.

Not a good sign at all.

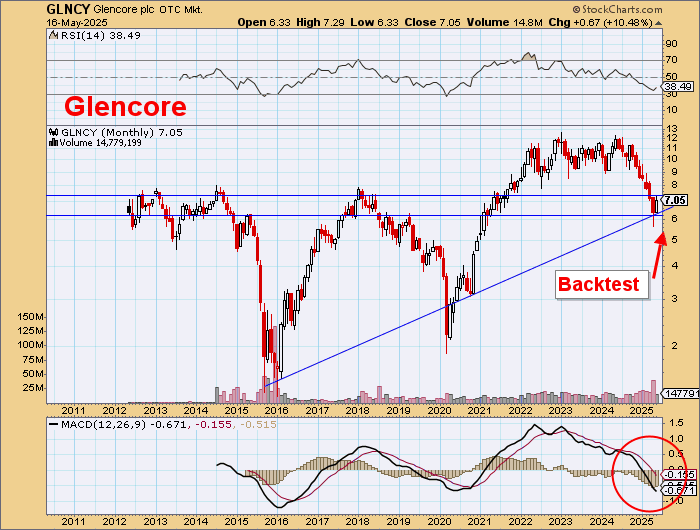

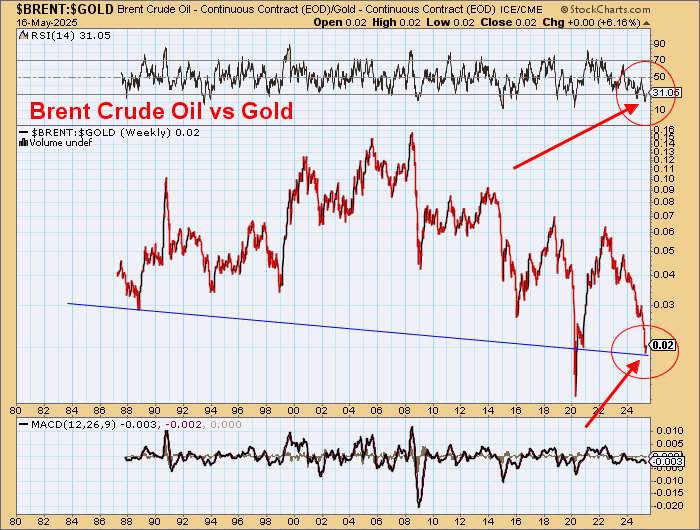

So, while gold is in its lofty levels, other assets are in the basement and giving consequent bargain basement entries.

These heavyweight miners are ready to rise after over four years of sideways movement.

BHP Billiton Ltd. (BHP:NYSE; BHPLF:OTCPK):

Rio Tinto Plc (RIO:NYSE; RIO:ASX; RIO:LSE; RTNTF:OTCMKTS):

Freeport-McMoRan Inc. (FCX:NYSE):

Glencore International Plc (GLNCY:OTCMKTS; GLEN:LSE):

And look at this one: Sibanye-Stillwater Ltd. (SBSW:NYSE).

Sibanye is a producer of PGMs. PGMs are bottoming out and super cheap versus gold.

A major opportunity here!

And other assets look at rock bottom levels with only one way to move from here.

The break out against general equites was very encouraging but a full backtest is needed now.

So gold might not be heading to the Moon right away but it has created so many opportunities elsewhere.

Heed the Markets!

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Barrick Mining Corp. and Agnico Eagle Mines Ltd.

- Barry Dawes: I, or members of my immediate household or family, own securities of: BHP and RIO. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.