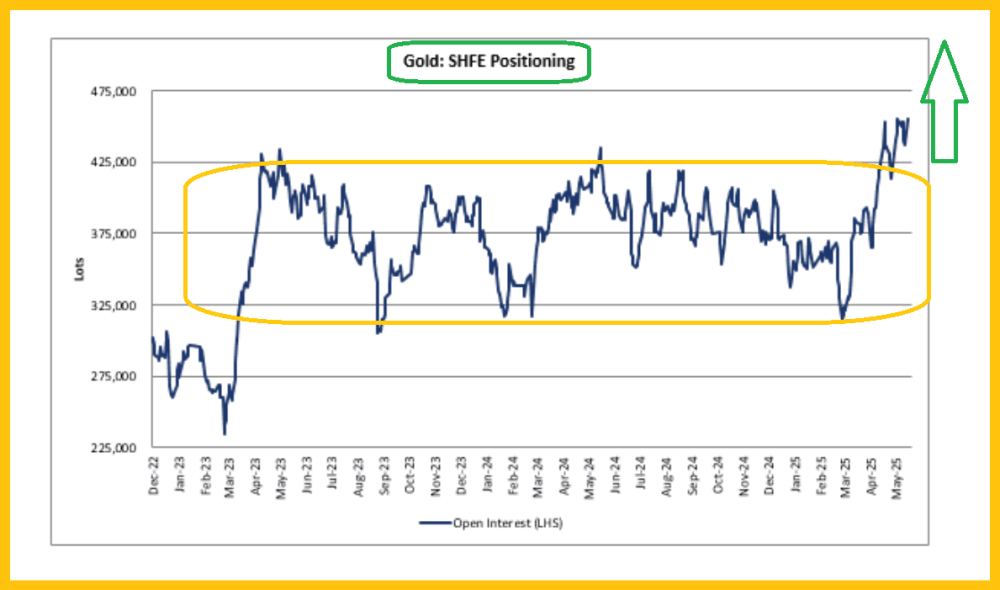

Gold looks fantastic, and here's a look at the stunning rise in Shanghai futures market action:

The rectangle pattern targets the 525,000 contracts zone. That could equate with a gold price of $3500. Most gold bugs in the West like the mining stocks, and almost everyone is aware of the long-term disconnect between gold bullion and the stocks.

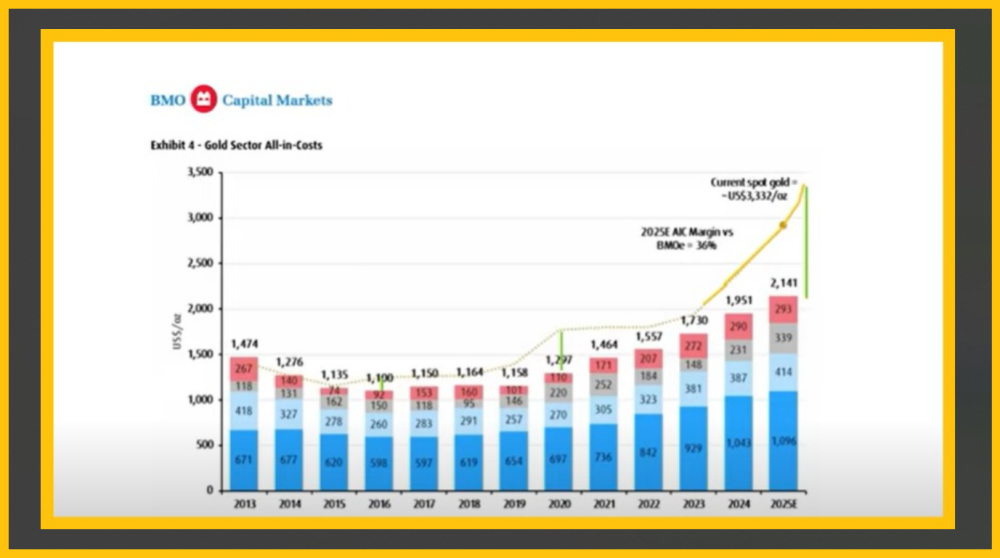

Here's a look at mining costs versus the gold price, courtesy of Bank of Montreal:

How will the conundrum be resolved?

Well, the problem the miners have faced (but is quickly ending now) relates to the U.S. 40-year interest rate/inflation cycle.

Here's a look at it on the U.S. rates chart:

While conspiracy buffs will point to naked shorting as the culprit for gold stock underperformance, that's murky and hard to prove.

What's much more obvious is the lack of stagflation now in comparison to that of the 1970s. Then, rates soared as inflation soared. The Fed hiked rates, pounding the stock market and sending money managers into the miners.

The rally in 2008-2012 was QE-related, so it was deflation-related, and the negative rates and QE benefited the stock market. So, there was no need for money managers to get overly excited about the miners.

That's changed now, with the tariffs and the bigger and much more ominous "Sell America" theme. Here's Jamie Dimon's take on what lies ahead:

What Jamie is forecasting is basically what happened in the 1970s; earnings collapsed and did so while inflation soared.

Instead of rescuing the flailing stock market investors, the Fed pounded them with rate hikes . . . hikes that weren't enough to overcome the inflation, so the money managers turned to gold.

Fast forward to today, with this view of the CDNX weekly chart:

Here's a long-term view of it:

It's clear that the huge base patterns on these charts are suggesting something much bigger (for both price and time) lies ahead for the junior miners… than just a 2008-2012 flash in a deflation-oriented pan.

The launchpad?

I'll suggest it is three surprising CPI and PCE reports in a row . . . reports that accompany very disappointing earnings reports from major SP500 corporations.

What about a timeline?

Well, it could start as early as August, but odds favor the October period, which is also often a seasonal low for gold, ahead of the Indian wedding season and the Chinese New Year.

A U.S. stock market crash, ironically, could accompany the mining stocks' "blastoff."

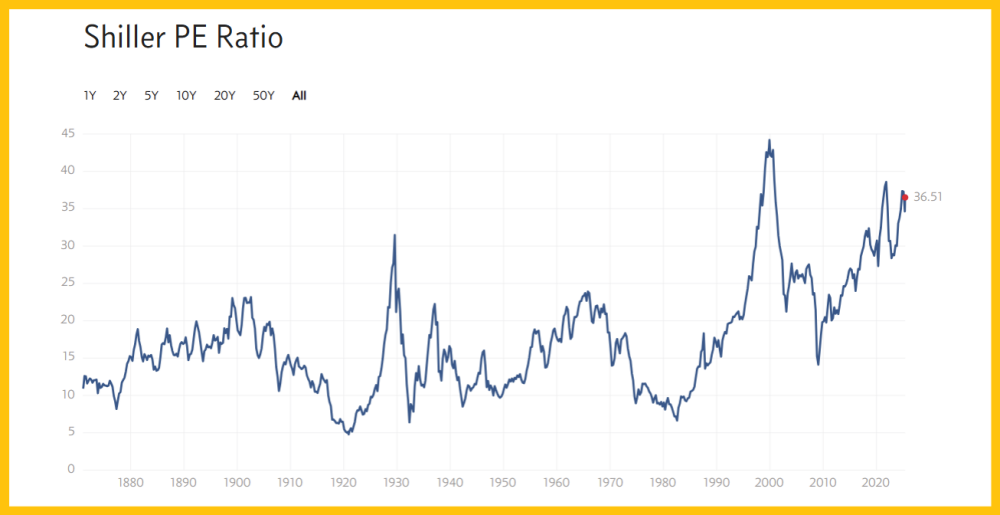

Here's a look at the CAPE/Shiller ratio for the SP500, which is frankly quite disturbing:

It's essentially the opposite of what quality miners look like, and speaking of the miners, here's a look at an interesting one:

The thesis looks set to double or even triple, with steady action from here. Junior mine stock enthusiasts may like the stable British Columbia jurisdiction where the company operates.

I've mentioned Benz before, and here's a look at it on the weekly chart:

Benz has broken upside from a massive bull wedge formation and is now in what looks to be the final stages of an inverse H&S launchpad pattern.

In a nutshell, some sort of macabre replay of 1929 and 1966 looks likely for the stock market (and for Main Street Americans with no gold, silver, or miners). At the same time, the junior mining stocks look ready for two or even three decades of gains, in what is best described as the opening act of a multi-century gold bull era!

Special Offer for Streetwise Readers: Please send me an Email to [email protected] and I'll send you my free "SGDJ: It's Time For Fearless Play!" report. With the stagflation dynamite fuse lit, it's time to add key SGDJ component stocks to winning portfolios. I highlight top component stocks, with action points for all!

I write my junior resource stocks newsletter about twice a week, and at just $199/12mths it's an investor favourite. I'm doing a special pricing this week of $169 for 14mths. Click this link or send me an email if you want the offer and I'll get you onboard. Thank-you.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Stewart Thomson Disclosures

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?