Our expedition across America's abundant natural resource territories now veers toward Nevada, a region gifted with remarkable mineral and power reserves. We've previously showcased the underground bounty at Alaska's Pebble Creek and Donlin Gold ventures, along with Michigan's Back Forty. Now we visit Nevada, a state so lavishly supplied with mineral abundance that it earned the moniker "Silver State."

Nevada harbors an incredible cache of natural assets . . . spanning from precious metals (the Carlin Formation and the Comstock Deposit) to subterranean geothermal riches valued in the billions.

In fact, since the 1850s, Nevada has yielded over 205 million troy ounces of gold. This represents approximately 78% of America's total gold output and roughly 5% of worldwide production.

Join me on this journey. . .

Let me transport you to a location most investors haven't encountered — but will soon wish they had. It's a high-desert settlement tucked against the snow-covered Egan Mountains in White Pine County, Nevada.

You might drive past without noticing. Yet beneath the arid surface of this overlooked mining community lies something extraordinary.

A reservoir of mineral assets so immense, so abundant with gold, copper, molybdenum, and additional elements, that it could transform America's economic landscape overnight.

The destination? Ruth, Nevada.

Yes — that Ruth. A hamlet with barely 400 residents. Nearly a ghost town in every sense.

But beneath the surface? It contains one of the Western Hemisphere's most significant concentrations of metallic wealth. And after languishing in obscurity for decades, Ruth may soon reclaim the spotlight.

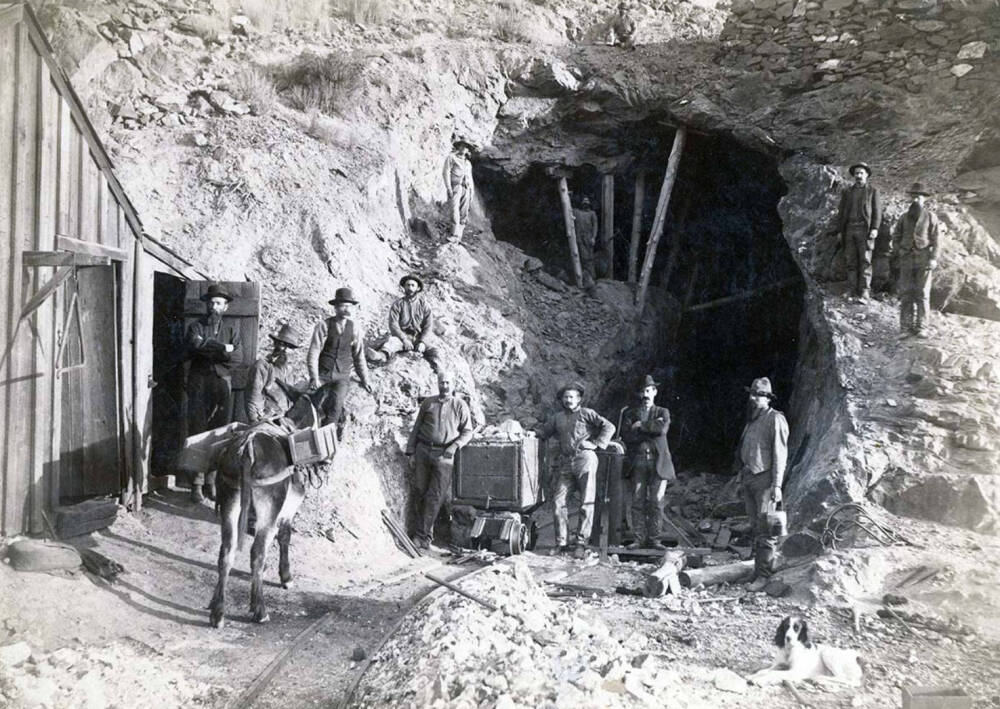

A Heritage of Copper and Gold . . . Concealed by History

Ruth's narrative begins, like many Nevada boom settlements, during the copper-hungry early 1900s.

The famed Robinson Mining Region — which encompasses Ruth — burst into activity when substantial copper porphyry formations were identified around 1906. The Nevada Consolidated Copper Company initiated extraction shortly afterward, supplying America's expanding demand for electricity and communications.

For years, the Robinson Mine, situated just beyond Ruth, ranked among the nation's premier copper producers. By 1929, it had generated over 200 million pounds of copper, merely the beginning of its story.

Here's what few realize. . .

Alongside copper, Ruth's deposits also contain substantial quantities of gold, silver, and molybdenum — metals now essential for contemporary technology, defense systems, and electrification initiatives.

Today, as the American government finally acknowledges its hazardous dependence on foreign minerals, Ruth increasingly resembles less a historical footnote and more a strategic asset.

Introducing the Contemporary Stakeholder: KGHM Polska Miedź

Fast-forward to present day. The operation now forms part of the Robinson Mine complex, possessed and managed by Polish mining corporation KGHM Polska Miedź SA (KGHPF:OTCMKTS; KGH:GR; KGH:WA; KGHM:PLM) — ranking among the world's top 10 producers of copper and silver.

In 2004, KGHM purchased the Robinson Mine from BHP. Since then, they've upgraded operations, increased copper production, and shipped significant amounts of gold and molybdenum as secondary products.

But here's the unexpected twist. . .

Despite ongoing extraction, Ruth's authentic potential remains largely untapped. According to recent NI 43-101 resource evaluations, Robinson Mine still holds:

- 3.3 million ounces of gold

- 2.7 billion pounds of copper

- 95 million pounds of molybdenum

And that's solely the measured and indicated resource. Applying conservative 2025 market prices. . .

- Gold at $2,350/oz = $7.76 billion

- Copper at $4.50/lb = $12.15 billion

- Molybdenum at $20/lb = $1.9 billion

That's over $21.8 billion in gross resource value — excluding inferred resources or unexplored zones surrounding the Ruth pit (one of the mine's three open excavations) and beyond.

Robinson isn't merely a mine. It's a national security treasure in disguise.

Why Ruth Could Become Central to Trump's Mineral Renaissance

President Trump's 2025 executive directive to accelerate domestic mineral extraction has rekindled exploration throughout the American West. And Ruth — situated in the world's premier mining jurisdiction (Nevada) — satisfies every requirement for expedited development:

- Authorized operations already underway

- Existing processing facilities

- Railway access and nearby electrical infrastructure

- Confirmed mineralization with century-old credentials

The only element Ruth now requires is recognition.

And investors who understand how to anticipate the rediscovery.

What Mainstream Media Isn't Reporting (Yet)

Let's be direct: Wall Street remains indifferent to Ruth — for now. But that will change. Because identical macro trends propelling gold toward $4,000 (and higher) and copper toward record valuations are creating ideal conditions for established mineral giants like Ruth.

- The worldwide copper deficit could reach 10 million metric tons by 2035.

- Gold is re-entering a currency competition phase, spearheaded by BRICS nations and central banking institutions.

- Molybdenum, vital for high-durability alloys, now appears in defense acquisition strategies.

- And digitized minerals — like NatGold Digital Ltd. — are beginning to transform our approach to mineral reserve investments.

Simply stated: Ruth represents a dormant colossus, positioned atop a $20+ billion treasure, in a country desperate for secure, domestic metals.

Could a Contemporary Gold Token Emerge from Ruth?

Consider if the certified reserves beneath Ruth became tokenized — similar to what the pioneering NatGold project accomplishes with other unmined gold deposits. Investors wouldn't need to await decades for mining returns. Instead, they could access digitized resource ownership, guaranteed by the earth itself — zero extraction, zero environmental backlash, zero geopolitical uncertainty.

This isn't far-fetched. KGHM already possesses experience with metal streaming and financial innovation. And with mounting pressure on international corporations to harmonize with U.S. mineral independence initiatives, circumstances might align for a NatGold-style offering directly from Ruth.

Imagine it as cryptocurrency backed by buried precious metals. And this time, it's not located in some volatile jurisdiction — it's right here, in a tranquil Nevada community you've never heard mentioned . . . until today.

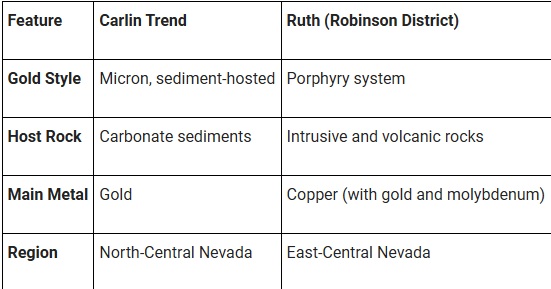

Does Ruth Belong to the Carlin Gold Formation?

I receive this question whenever I discuss Ruth. No, Ruth isn't part of the Carlin Formation. It belongs to the Robinson Mining District, characterized by porphyry copper-gold-molybdenum systems — quite distinct from the sediment-hosted, "invisible" micron gold found in the Carlin Formation.

Nevertheless, both represent world-class mining regions. Ruth's advantage lies in its multi-metal profile and proximity to existing infrastructure — making it a uniquely investable revival opportunity.

Final Reflection: Don't Allow Ruth to Escape Your Notice

We've stated it previously, and we'll reiterate. . .

History doesn't repeat; it whispers. And currently, Ruth is murmuring to those willing to listen.

It murmured in 1906, when copper launched America's electrical revolution. It murmured during the 1980s, when molybdenum achieved strategic metal classification. And now, in 2025, Ruth murmurs again — signaling to investors who perceive what's approaching before the wider world awakens.

- A global realignment of currency.

- A domestic pursuit of resource independence.

- A tokenized revolution in investment methodology.

And, concealed deep beneath Ruth, Nevada, a vault of metallic wealth that could become the next significant chapter in American economic resurgence.

You simply need to arrive early.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of NatGold Digital Ltd.

- Brian Hicks: I, or members of my immediate household or family, own securities of: NatGold Digital Ltd. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.