Disconnects between price and value in the resource sector occur regularly but are usually accompanied by issues. Issues such as a low metal price, local social pressures, political interference, or an environmental problem.

In situations like these, the disconnect between price and value makes sense. There is something that has to be overcome to get price recognition from the market. Investors looking to take positions in these sorts of situations must be cautious of their approach and understand how these risks will be overcome. In essence, this is what a contrarian investor is all about: taking a calculated risk on a solution to issues such as these.

That said, there are times when there is a disconnect and no major reason for it. These aren't as common, but I have learned that when I personally come across them, I need to pursue them as strongly as I can. These are the true asymmetrical bets that can really propel a portfolio's return forward.

Over the last two years, I have personally benefited by identifying a few of these situations, taking a big position, and waiting.

In my experience, the biggest factor to overcome in situations is time.

As they say, patience is a virtue. In situations like this, it becomes glaringly obvious.

Today, I have for you an opportunity that I think has no obvious reason for the major disconnect between price and value. The company is focused on developing two copper-gold porphyry projects in Chile. One is at the feasibility study stage, while the other is a brand new discovery story.

The company is Hot Chili Ltd. (HCH:ASX; HCH:TSXV; HHLKF:OTCQX).

Let me explain to you why I think this is arguably the most undervalued junior mining company in the sector right now.

Costa Fuego

Costa Fuego is Hot Chili's flagship project, which just recently had a PFS completed.

Costa Fuego will be both an open pit and an underground mining operation in the future.

On average, it will produce 116kt CuEq (copper equivalent) for 14 of the 20 years of its mine life, making it one of the largest undeveloped copper operations owned by a junior.

In terms of economics, Costa Fuego has great leverage to the copper price, with an NPV above US$2B and an IRR of 27% at US$5.30/lb copper.

- Post-tax NPV8% of US$1.2 B and IRR of 19% (at US$4.30/lb copper)

- Post-tax NPV8% of US$2.2 B and IRR of 27% (at US$5.30/lb copper)

As I mentioned, Costa Fuego will start as an open pit mining operation and then transition to an underground block caving operation later in the mine life.

Upfront CAPEX is, therefore, estimated to be US$1.27B with an expansionary capital around US$1.35B — big mines cost big money.

If I were to pick a reason for Hot Chili's low valuation, this might be it. That said, if you look at all of the large, advanced (at least PFS level) projects out there and owned by a junior, billions in CAPEX is the commonality.

Not only this, but I view Hot Chili's recent discovery of copper-gold mineralization at their La Verde project as reason to believe that the impact of the CAPEX will be lessened.

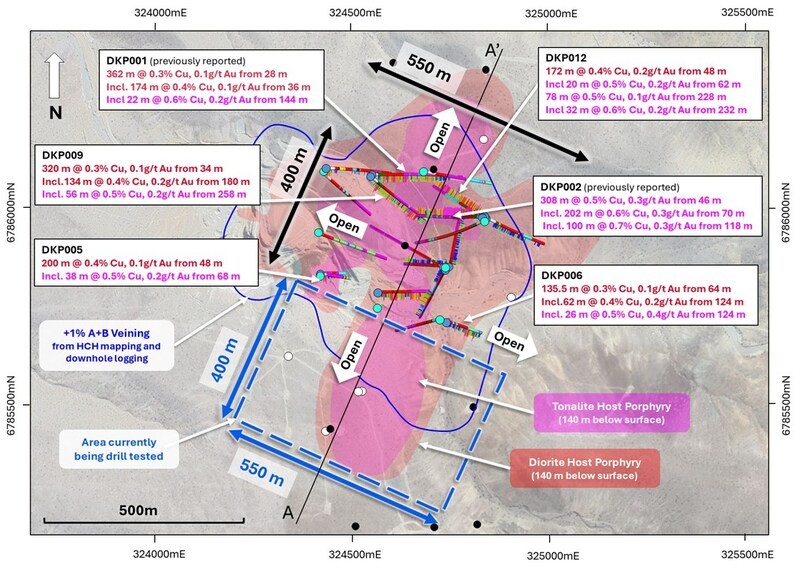

Discovery hole: DKP002 308m of 0.5% copper + 0.3g/t gold, including 202m of 0.6% copper + 0.3g/t gold, and including 100m of 0.7% copper + 0.3g/t gold.

As I see it, La Verde has the potential to add significant amounts of ore early on into a future combined mining operation. This additional open pit tonnage from La Verde could be trucked to nearby Costa Fuego and push out the expansionary capital needed to build the underground — this is very meaningful.

In a discounted cash flow model, cash flows in the future are discounted.

Meaning, the earlier in a mine life you can produce higher cash flow, the better the net present value (NPV).

Hot Chili still has much to prove at La Verde, but I think they are well on their way to doing it.

In closing, additional tonnage from La Verde doesn't negate the size of the CAPEX; what it does is push it further out in the mine life, which will increase the overall NPV of the project.

Huasco Water

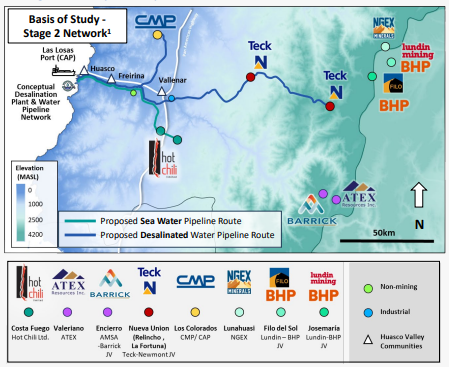

One of the biggest factors affecting copper project development in both Chile and Argentina right now is access to water. On the Chilean side, it's both an altitude and a permit issue.

Firstly, the Chilean government is no longer allowing water extraction via underground sources. They are exclusively forcing development projects to apply for a maritime concession or do a deal with a company that already has one. A maritime concession allows for the extraction and treatment of seawater.

The reality of the situation is that there have only been two maritime concessions granted in the last 13 years. One of those was granted to Hot Chili, which has since placed that permit into Huasco Water — of which they own 80%.

Hot Chili is now very much in the driver's seat for water supply of a region which is on the cusp of a major development cycle.

Now, I don't believe that this situation allows Hot Chili to unreasonably leverage their position; that isn't what the Chilean government would promote or accept.

What it means, though, is that HCH has a major source of value that the market isn't giving them credit for.

So the question begs: What are the water rights worth?

It's a great question, one that I can't fully answer.

What I will draw your attention to is Antofastga's deal with Transelec and Almar Water Solutions for $600M. That situation is a little different because it includes some existing infrastructure, but essentially gives us a rough idea of what these types of assets are worth.

Further, Hot Chili completed an economic study on the Huasco Water business, which proves its potential — 2 Stage / 1300L/s Desalinated Water Supply: Post-tax NPV(8%) of US$977M and IRR of 19%.

Not only do I think that this supply is meaningful for Chilean development projects, but it is an obvious source of water for the Argentinian side, too.

I think one of the biggest misnomers right now is the water situation for a few of the largest copper development projects in the world — BHP & Lundin's Jose Maria and Filo projects.

Personally, I don't think they have an alternative to doing an off-take agreement with Hot Chili's Huasco Water. . .

Concluding Remarks

Nothing is for sure in life, especially in the junior mining sector. However, once in a while there are asymmetric bets that you can make that are mostly a function of time, rather than the solving of some other specific issue.

In my view, the opportunity in Hot Chili is one of those high-potential asymmetric bets whose value recognition is just a matter of time.

Currently, Hot Chili's MCAP is around $70M, which I think is extremely cheap.

Its flagship project, Costa Fuego, has a PFS completed on it with an after-tax value well over US$1B at today's copper price. Not only is the project undervalued to the current state of development, but I think it has a clear path towards optimization with the combination of the discovery at La Verde.

The real X-Factor lies with Huasco Water, which holds the water rights to a region of Chile and Argentina which is on the cusp of major development.

Mine construction and operation don't happen without water, and, therefore, this is a catalyst that is very much a when question, not if.

With over AU$10M in cash, continued drilling at La Verde and the potential for water offtake agreements to be signed with Huasco, I believe it is only a matter of time before Hot Chili's value is recognized by the market.

| Want to be the first to know about interesting Critical Metals and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Brian Leni: I, or members of my immediate household or family, own securities of: Hot Chili. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.