American Salars Lithium Inc. (USLI:CSE; USLIF:OTC; Z3P:FWB; A3E2NY:WKN) announced it has added lithium brine expert Mark King as technical adviser and qualified person.

A hydrogeologist with more than 30 years of international experience in groundwater modeling and geochemistry, King has specialized in the exploration and evaluation of lithium brine projects for the last 15 years, the company said in a release.

"American Salars is yet again adding depth to its technical team," Chief Executive Officer and Director R. Nick Horsley said. "We are fortunate to welcome Dr. King and his team at GWI to American Salars and look forward to working together in our search for significant lithium salar projects. Mark is a globally recognized authority whose work has taken him to lithium brine projects throughout North and South America and beyond."

American Salars said King has a strong chemistry and numerical modeling background that has "proven to be an excellent foundation for brine exploration and quantitative evaluation."

"Consequently, his resource and reserve estimation experience on major brine projects is now arguably the most extensive of any geologist, hydrogeologist or engineer in the world," American Salars said.

According to the company, King has served as a resource and/or reserve estimation qualified person for Albemarle at Salar Atacama (Chile), Silver Peak (Nevada) and Antofalla salar (Argentina); Neo Lithium at the 3Q salar (Argentina); Lithium Americas at the Cauchari salar (Argentina); Vulcan Energy in the Rhine Valley (Germany); and Alpha Lithium at Tolillar and Hombre Muerto salars (Argentina).

King and his team also have conducted due diligence reviews of more than 20 advanced brine projects and reconnaissance reviews of more than 100 greenfield to early stage products in both North and South America, American Salars noted.

"His technical team at GWI has advanced expertise in geological modelling, GIS (geographic information system), data management and 3-D visualization," the release said. "Dr. King and his team will provide exploration and resource consulting services to American Salars from time to time."

Exploration Across Multiple Jurisdictions

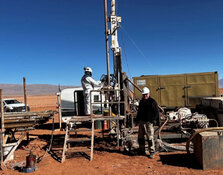

American Salars' corporate presentation from March 2025 highlights the Jaguaribe Project as a cornerstone of its growing portfolio of lithium assets across the Americas. The company owns four lithium projects, including salar brine assets in Argentina and Nevada, and additional hardrock holdings in Quebec, Canada.

The Jaguaribe Project is particularly notable for its combination of scale, historical artisanal mining, and proximity to global battery markets. The company's strategy emphasizes securing large, underexplored pegmatite regions with high potential for LCT mineralization. The initial discoveries at Jaguaribe have already prompted the acquisition of ten claim blocks surrounding the area.

Elsewhere in the company's portfolio, American Salars continues to advance its Pocitos lithium brine project in Argentina, where a previous NI 43-101 report estimated 760,000 tonnes of lithium carbonate equivalent (LCE) across Pocitos 1 and Pocitos 2. Although American Salars does not own Pocitos 2, all drilling to date occurred on Pocitos 1, with the company planning to update the resource estimate.

Additionally, in Nevada, the company has completed a NI 43-101 report for its Black Rock South project, where 33 of 38 soil samples returned lithium concentrations exceeding 100 ppm, averaging 131 ppm. The company is exploring the potential for direct lithium extraction (DLE) technologies that could reduce environmental impact and increase efficiency.

With infrastructure in place and a diversified asset base spanning both hardrock and brine lithium projects, American Salars is positioned to continue advancing exploration efforts across multiple jurisdictions. Second-phase work underway at Jaguaribe represents a key step in expanding the company's Brazilian footprint and potentially identifying drilling targets for further resource delineation.

Co. Strengthens Position for Market Recovery

John Newell of John Newell & Associates identified American Salars Lithium Inc. as a company with potential upside. In a February 19 report, Newell noted that lithium sector valuations had fallen significantly due to increased global supply, which weighed on prices and affected investor sentiment. He observed that certain lithium exploration companies, including American Salars, had taken steps to strengthen their positioning for a possible market recovery.

Newell pointed to American Salars' focus on lithium brine exploration within Argentina's Lithium Triangle, describing it as one of the world's key lithium-producing regions. He highlighted the company's land expansion at the Pocitos project and its continued progress in advancing resource development as key developments.

"Among the hardest hit in the correction were Atlas Lithium Corp. and American Salars Lithium Inc.," Newell wrote. "Both of which saw significant share price declines as lithium prices softened and investor sentiment turned bearish. However, technical indicators suggest these stocks may be in the process of forming a bottom, setting up for a potential recovery."

Newell's report also referenced broader sector dynamics that could provide support for companies in the space. He cited the anticipated tightening of lithium supply and steady growth in demand from the electric vehicle industry as factors likely to draw renewed investor focus on exploration and development firms. With long-term lithium demand forecast to increase substantially by 2030, Newell suggested that companies with well-situated projects could be positioned to benefit as market conditions evolve.

In a separate technical analysis on May 5, Clive Maund provided a Strong Buy rating for American Salars.

"American Salars is believed to be at an outstanding point to buy here for the following reasons: from late February it has reacted back across the large trading range that has formed since last August to the strong support near to its lower boundary, having been driven lower by a steeply falling 50-day moving average (which is set to flatten out soon) and this trading range is viewed as a base pattern that has formed following a severe bear market from the Spring 2024 highs at CA$0.45," he wrote.

Maund added that significant upside volume since February had pushed the Accumulation line to new highs, noting, "This has created a major positive divergence by this indicator that is clearly bullish. Lastly, the price and its moving averages are now bunching closely together, which is a frequent precondition for a reversal. This is a powerful confluence of bullish factors — and American Salars is still at an excellent entry point. It is therefore rated an Immediate Strong Buy."

The Catalyst: Mining Giant Doubles Down on Metal

Mining giant Rio Tinto this week announced that it was doubling down on lithium, declaring South America's Lithium Triangle (which contains the Pocitos project) as the ideal region to secure the critical metal, Mining.com reported.

"The Lithium Triangle is the optimal location to develop lithium projects that can meet global demand and for miners to get to the bottom of the cost curve," Stausholm said. "From both a resource and production cost perspective, the brines in the area are unmatched."

Rio Tinto is investing US$2.5 billion to scale up its Rincon lithium project in Argentina, aiming to increase production capacity to 60,000 tonnes per year by 2028. The move is part of the company's broader strategy to establish itself as a dominant force in critical minerals, particularly those tied to electric vehicles and stationary battery storage.

A Stockhead article published on April 22 highlighted ongoing optimism about Argentina's growing role in the global lithium supply chain. According to the report, electric vehicle (EV) sales in the first quarter of the year rose 29 % worldwide, with China leading at 2.4 million units sold, followed by 900,000 units in the European Union, and 500,000 units in North America. Citing Citi's projections, the article noted that a lithium carbonate equivalent deficit of 12,000 tonnes was expected by 2026, growing to 34,000 tonnes by 2027.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

American Salars Lithium Inc. (USLI:CSE; USLIF:OTC; Z3P:FWB; A3E2NY:WKN)

In a Stockhead video posted on May 8, American Salars Lithium CEO Nick Horsley noted that major players had demonstrated sustained interest in lithium despite recent market fluctuations. Horsley pointed to significant investments made by Rio Tinto, stating that the company had committed over US$9 billion within the past four years, including US$7 billion in mergers and acquisitions, along with US$2.5 billion toward the Rincon development. He remarked, "The smart money, I think, is looking at this as a real opportunity to buy while the supply chains are in a bit of a surplus.

Ownership and Share Structure

American Salars said it has 31,430,605 shares outstanding and 5.5 million warrants, according to the company.

As for insiders, the CEO Horsley owns about 1.83 million, or about 7.37%, with 4666,666 warrants. Strategic investor Hillcrest Merchant Partners owns 1 million shares or 4.03%. There are no institutional investors, and the rest is retail.

Its market cap is CA$1.39 million. It trades in a 52-week range of CA$0.39 and CA$0.05.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese and Battery Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of American Salars Lithium Inc.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.