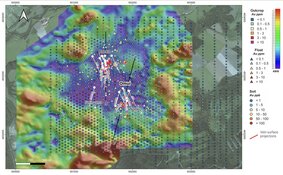

Omineca Mining and Metals Ltd. (OMM:TSX.V; OMMSF:OTCQB) has reported results from its eight-hole, 3,740-meter diamond drill program completed in the winter of 2024 at its Wingdam gold project in British Columbia's Cariboo Mining District. According to the company's May 8 news release, gold mineralization was encountered in six of the eight holes, including broad zones of anomalous gold and nickel values, supporting Omineca's exploration thesis that the hard rock source of the rich placer gold found beneath Lightning Creek may lie west of the Eureka Thrust Fault.

Among the highlights, drill hole WD24-37 intersected 15.10 meters averaging 227.25 parts per billion (ppb) gold (0.23 grams per tonne, or g/t) and 1731.25 parts per million (ppm) nickel, including a two-meter interval grading 870.00 ppb (0.87 g/t) gold. This hole also intersected the Eureka Thrust Fault and was described in the release as yielding the most notable results of the 2024 season. Another hole, WD24-35, returned 2.93 meters grading 0.224 g/t gold and 1607 ppm nickel, with a 0.7-meter section containing 0.536 g/t gold and 1790 ppm nickel.

TerraLogic Exploration Inc., based in Cranbrook, British Columbia, conducted the geological analysis and targeting for the program. A total of 2,835 core samples and 253 quality assurance/quality control (QAQC) samples were collected and sent to AGAT Laboratories in Calgary for assay. All drill holes were sampled from top to bottom.

The results in the announcement confirm polymetallic mineralization — primarily gold, silver, copper, molybdenum, and base metals — associated with sulphide-bearing quartz veins and fault structures in proximity to the Eureka Thrust Fault. WD24-35 showed mineralization distributed throughout the hole, which Omineca attributed to multiple generations of veining and healed faulting containing sulphides. These findings further suggest that the Eureka Thrust Fault acts as a mineralizing conduit.

The company stated that a follow-up drill program is currently being planned. According to the release, the focus will be on further defining mineralization in the ultramafic unit intersected in WD24-37 and on extending drilling southeast along the Eureka Thrust Fault toward a mapped magnetic anomaly. Additional deeper drilling may also be conducted to test the continuity of quartz vein systems intersected in holes WD24-38 through WD24-40.

Core processing was completed between November 2024 and January 2025. In addition to standard fire assays, select samples underwent metallic screening to assess coarse gold content. The best composite intercept reported from the 2024 program was the 15.10-meter interval grading 227.00 ppb gold in an amygdaloidal basalt affected by brittle faulting and brecciation.

Gold in a Shifting Economic and Geopolitical Landscape

The gold sector continued to show resilience amid a mix of economic slowdowns, monetary policy uncertainty, and heightened geopolitical risk. According to a May 4 article from Ahead of the Herd, recent signs of stagflation, where inflation remains high despite stagnating growth, have renewed interest in gold as a defensive asset. The author wrote that "gold does well in stagflationary periods and outperforms equities during recessions," citing historical data showing a 32.2% return for gold during stagflationary environments compared to negative equity returns.

A May 8 report by Stockhead noted that the gold price had surpassed AU$5,200 per ounce on the Australian market, contributing to renewed project development activity across the sector. The article stated that "gold developers are flourishing once again" following a multi-year slowdown during the pandemic, with conditions improving due to easing inflation and rising commodity prices. It added that companies with previously deferred expansions were now moving ahead, and new developers were accelerating plans.

On May 9, Morris Hubbartt of Super Gold Signals commented that junior miners had entered a "blastoff" zone as broader gold sentiment improved. His outlook suggested that smaller exploration companies were beginning to benefit from increasing market attention due to the sustained rally in gold prices and a supportive macro environment.

Further highlighting the broader momentum, a May 12 article from Junior Stocks reported that gold had surged over 25% year-to-date in 2025. The article cited Rob McEwen, founder of Goldcorp, who argued that gold equities had not yet caught up with the price of bullion. McEwen described the situation as potentially "explosive" and projected that gold could reach US$5,000 per ounce within a few years. He emphasized that rising central bank demand and geopolitical instability had pushed gold back into the spotlight as a hedge against uncertainty.

Looking Deeper: Strategic Drivers at Wingdam and Beyond

Omineca's exploration program at Wingdam forms part of a dual-track strategy aimed at both placer and hard rock gold opportunities in the Cariboo Mining District, as cited in the company's investor presentation. The company's operations are centered on a 61,329-hectare land package that straddles the prolific Eureka Thrust Fault trend. According to the company's January 2025 investor presentation, Wingdam is positioned on a parallel geological trend to Osisko Development's Cariboo Gold Project, approximately 40 kilometers to the east, where multi-million-ounce gold resources have been identified.

One of the primary strategic drivers is Omineca's effort to locate the lode gold source of the placer deposits recovered from beneath Lightning Creek. According to the company, gold characteristics from the 2012 test crosscut — where 173.4 ounces were recovered from a 2.4-meter by 23.5-meter section — suggest minimal transport from source, supporting the hypothesis that a nearby hard rock origin exists.

Management and insider ownership stood at approximately 23.7% as of January 13, 2025. Several members of Omineca's leadership team, including President and CEO Tom MacNeill and geologist Stephen Kocsis, have prior experience with successful regional projects such as Barkerville Gold Mines, now part of Osisko Development.

Omineca also holds a 50% interest in an underground placer gold recovery joint venture with D&L Mining, which is actively mining gold-bearing gravels buried beneath Lightning Creek. According to the presentation, early-stage haulage and drifting toward the central portion of the paleochannel are ongoing, with placer gold-bearing gravels visible at the channel contact.

With its strategic location, proven gold recovery at the placer level, and advancing hard rock exploration, Omineca continues to refine its approach to both near-term and long-term gold discovery at Wingdam. Further updates on both the underground mining and upcoming drill program are expected in future announcements.

Positive Outlook on Omineca's Near-Term Production and Long-Term Potential

On February 25, technical analyst Clive Maund rated Omineca as an "Immediate Strong Buy for all time horizons." He wrote that Omineca presented "an outstanding opportunity for investors," citing the restart of underground operations at the Wingdam Project as a significant milestone. Maund highlighted that with bureaucratic delays resolved, mining had resumed into a known high-grade placer deposit and noted that costs would be borne by Omineca's joint venture partner, D&L Mining. He also pointed to recent financing, stating the company had completed a CA$2.4 million private placement for hard rock exploration. According to Maund, Omineca's share price had returned to a strong support zone, and accumulation indicators had moved higher, suggesting a potential technical bottom. He provided near-term and long-term price targets ranging from CA$0.08 to as high as CA$0.75.

In a research note published on February 26, Bill Newman of Research Capital Corporation reiterated a "Speculative Buy" rating on Omineca and adjusted the firm's target price to CA$0.42 per share, down from CA$0.55, to reflect dilution from recent financings. At the time of the report, Omineca was trading around CA$0.04, implying a potential return of 833%. Newman wrote that "the company expects gold-bearing gravel recovery to commence in the near term," supported by full mobilization of equipment, supplies, and personnel. He also outlined the mining sequence at Wingdam and discussed operational planning designed to access the highest-grade portion of the channel.

Newman analyzed the project's potential economics, noting that if Omineca could replicate its 2012 bulk sample results across 2.4 kilometers of the paleochannel, it could define a resource of 175,000 ounces of gold and produce approximately 35,000 ounces annually. Using a base case gold price of US$2,000 per ounce and a fixed CA$1,000 per ounce operating cost, Newman estimated the project could generate CA$32 million in annual cash flow. He calculated a net present value of CA$121 million discounted at 10%, or CA$0.46 per share. Newman added that the economics would be even more attractive using the then-current gold price of approximately US$2,925 per ounce.

According to Newman, the company benefited from a "low-risk structure" at Wingdam, as D&L Mining was responsible for all operational costs in exchange for a 50% interest, while Omineca retained its share of production at a fixed price. He concluded that continued updates on recovery rates and production efficiency would serve as key catalysts going forward.

On March 7, Chris Temple of The National Investor commented on Omineca Mining and Metals Ltd.’s progress at Wingdam, stating, "It does seem that, at last, gold is going to be pulled from underground at Omineca Mining and Metals Ltd.'s Wingdam project and [will] start to be reported on in the coming few weeks. . .CEO Tom MacNeill [is] optimistic that the next news from underground will finally be of the first recovered gold."

Ownership and Share Structure

Streetwise Ownership Overview*

Omineca Mining and Metals Ltd. (OMM:TSX.V; OMMSF:OTCMKTS)

The company is about 24% owned by insiders and management, according to the company. The rest is retail.

Top shareholders include 49 North Resources Inc. with 17.41%, Sprott Asset Management LP with 3.49%, President and CEO Thomas MacNeill with 2.99% and Chief Financial Officer/Director Andrew Davidson with 1.37%, according to Reuters.

Omineca has 261.8 million shares outstanding, the company said.

The company's market cap is CA$11.82 million, and its 52-week price range is CA$0.04−0.14 per share.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Omineca Mining and Metals Ltd.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.