Another day, another colossal earnings print from Tether, the world's largest stablecoin issuer. The company recently released its latest "attestation," validated by BDO under ISAE 3000 standards. Here's the LINK for those who love reading attestation reports!

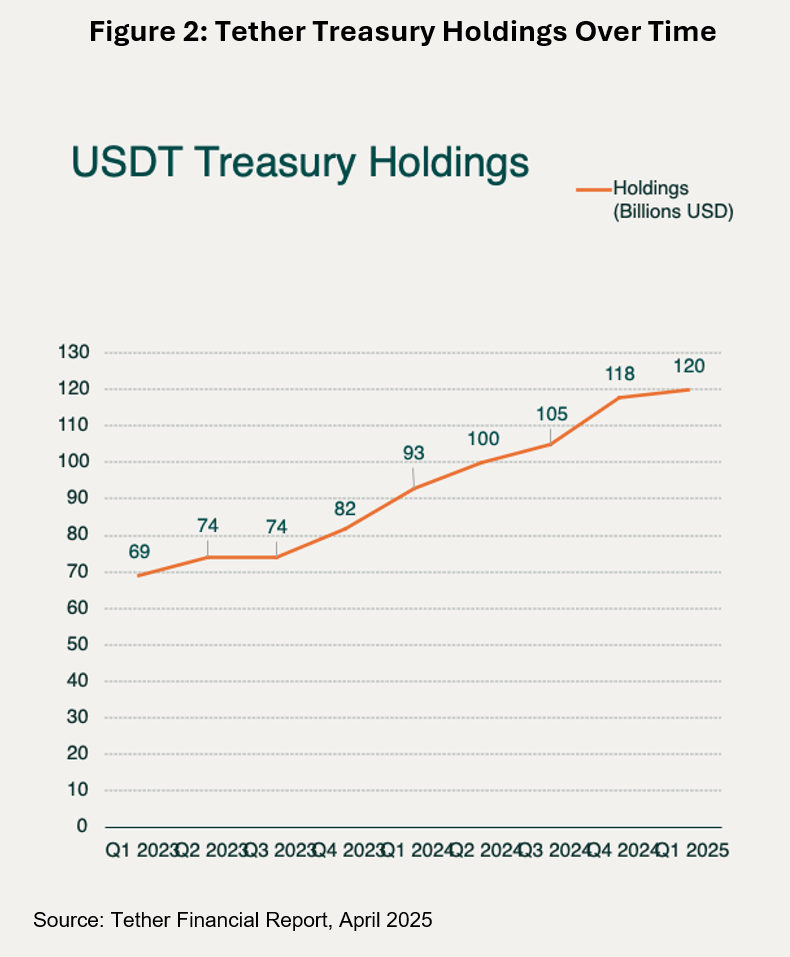

In summary, the report shows Tether has quietly grown into a juggernaut. Tether holds $149.3 billion in assets, including $121 billion in treasury bills, cash equivalents, and short-term deposits. What's more, Tether generated $852 million in net profit last quarter (after paying out dividends). It also holds a surplus of excess reserves totaling nearly $6 billion and is investing in Bitcoin and launching new initiatives, including Tether AI (more on that later in the newsletter).

Now, the company is turning its focus to the U.S. after years of operating primarily overseas. According to the company, the new token will operate under U.S. oversight. Underscoring this point, CEO Paolo Ardoino has reportedly engaged with U.S. lawmakers, including Senator Bill Hagerty, to conform to proposed stablecoin legislation.

As a reminder, stablecoins are digital tokens backed 1:1 by fiat reserves, primarily denominated in U.S. dollars. They circulate over open blockchain networks, enabling instant, low-cost settlement and global access to dollar liquidity.

But beyond enabling digital payments, they have become significant net purchasers of U.S. Treasuries.

Tether's foray into the U.S. is not only a signal of crypto's rehabilitation in the eyes of the U.S. government, but it is also a sign stablecoins could become strategic financial infrastructure for the U.S. — if Congress can pass legislation that would accelerate their adoption by consumers and businesses alike.

As a reminder, stablecoins are digital tokens backed 1:1 by fiat reserves, primarily denominated in U.S. dollars. They circulate over open blockchain networks, enabling instant, low-cost settlement and global access to dollar liquidity.

Those efforts suffered a setback when a group of Democratic lawmakers who had previously backed Republican-sponsored stablecoin legislation, known as the GENIUS Act, pulled their support (for now), casting some doubt over the law getting passed quickly. For now, this appears to be a speed bump on the road to greater regulatory clarity.

People close to the issue tell me that Trump's brazen attempts to enrich himself using crypto have given Democrats, and some Republicans, pause. We have long maintained that these attempts by the President to profit from crypto actually undermine legitimate efforts to pass pro-crypto laws.

The timing is important here. We've previously discussed how traditional foreign buyers of U.S. government debt — Japanese pension funds, European mutuals, and even central banks — may be starting to pull back. If these long-standing buyers step away, the question becomes: Who will finance America's growing fiscal needs?

Stablecoins will be part of the answer— just ask Paul Ryan or Scott Bessent, who have been vocal proponents.

In fact, blockchain-based stablecoins are now among the top holders of U.S. government debt — exceeding countries like Germany and Australia — and growing quickly. According to Tether's Q1 2025 report, nearly 82% of its reserves are held in U.S. Treasury securities, repos, and money market funds with indirect exposure to Treasuries.

Could stablecoins also emerge as a tool of monetary diplomacy — a way to project the U.S. dollar globally without requiring physical banks or correspondent networks?

Today, billions of people lack reliable access to the dollar, not because they don't want it, but because legacy infrastructure can't reach them. Stablecoins could fix that. With only a smartphone, anyone can store, send, and settle in digital dollars in real-time.

After years in borderline exile, Tether's move into North America may come just as regulatory clarity and increase interoperability with U.S.-based financial institutions grows demand for stablecoins and expertise in this area. And if stablecoin issuers like Tether are embraced as legitimate financial actors, they could play a much larger role in the financial system.

This week, Tether also announced that it was venturing into the world of AI. Tether AI, according to CEO Paolo Ardoino, is a "fully open-source AI runtime, capable of adapting and evolving on any hardware and device, no API keys, no central point of failure, fully modular and composable, WDK-infused to enable USDT and Bitcoin payments."

That's quite a mouthful. And so far, the details are limited. But in spirit, we believe that AI and crypto are intuitively related.

For example, in January, we wrote about how AI 'agents' like chatbots, virtual assistants, and trading bots, use cryptoassets like a digital bank account.

This makes intuitive sense and could be the most bullish driver of all for crypto. AI agents may outnumber humans soon, but unlike people they can't walk into a bank and open a checking account, start a company or enter into a legal agreement. The only way for them to do transactions, move and store value and form binding business relationships is using cryptoassets and the on-chain toolkit of smart contracts and DAOs.

So, an AI system where people and agents alike can transact instantly and peer-to-peer with USDT and Bitcoin feels directionally correct, even if the details are murky for now. We'll be keeping an eye on that one.

Alex Tapscott is the managing director of the Digital Asset Group, a division of Ninepoint Partners LP. He is also the author of "Web3: Charting the Internet's Next Economic and Cultural Frontier." Sign up for his newsletter, Digital Asset Digest.

| Want to be the first to know about interesting Cryptocurrency / Blockchain investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

NinePoint Disclosures

The Ninepoint Web3 Innovators Fund is generally exposed to the following risks. See the simplified prospectus of the Fund for a description of these risks: No Assurance in Achieving Investment Objectives; Loss of Investment; Active Management Risk; Concentration Risk; Asset Class Risk; Blockchain Risk; Cryptocurrency Risk; Disruptive Innovation Risk; Emerging Technologies Risk; Communication Services Companies Risk; Information Technology Companies Risk; Liquidity Risk; Equity Securities Risk; General Risks of Foreign Investments; Trading Price of ETF Units; Cease Trading of Securities Held by Ninepoint Web3 Innovators Fund; Small Company Risk; Specific Issuer Risk; Trading Price of Underlying Funds Risk; Derivative Instrument Risk; Securities Lending Risk; Reliance on the Manager; Manager and Custodian Standard of Care; Potential Conflicts of Interest; Valuation of Ninepoint Web3 Innovators Fund; Currency Risk; U.S. Currency Exposure; Substantial Securityholder Risk; No Ownership Interest in the Portfolio; Changes in Legislation; Inflation Risk; Not a Trust Company; Cyber Security Risk; COVID-19 Outbreak; Tax Risks.

Disclaimer: The information and/or materials contained in this email and any attachments are derived from sources believed to be reliable when transmitted, but the accuracy or completeness of the information is not guaranteed. The opinions, estimates, projections and/or recommendations contained in this email and any attachments are those of the author as of the date hereof, and are not given or endorsed by any of Ninepoint Partners LP unless otherwise independently affirmed by Ninepoint Partners LP.

The opinions, estimates and projections (“information”) contained within this report are solely those of the author and are subject to change without notice. The author makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, the author assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Ninepoint is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances.

Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners LP. These views are not to be considered as investment advice nor should they be considered a recommendation to buy or sell.

The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Funds may be lawfully sold in their jurisdiction.