Sierra Madre Gold and Silver Ltd. (SM:TSX.V; SMDRF:OTCQX) announced financial results for the quarter ended March 31, 2025, marking its first full quarter of commercial production at the La Guitarra silver-gold mine complex in Mexico. The company reported revenues of US$4.8 million and a gross profit of US$1.2 million, with US$535,000 in cash generated from operating activities.

The company sold 165,093 silver equivalent ounces during the quarter, comprising 75,137 ounces of silver and 1,022 ounces of gold. Silver revenues totaled US$2.34 million at an average realized price of US$31.13 per ounce, while gold revenues reached US$2.89 million at an average price of US$2,828 per ounce. Cost of sales amounted to US$3.6 million, translating to US$21.84 per silver equivalent ounce sold. All-in sustaining costs per silver equivalent ounce sold were US$28.98, down from US$32.18 in the fourth quarter of 2024.

The company processed 39,167 tonnes of ore with silver and gold recoveries averaging 79.21% and 78.77%, respectively. In addition, 871 dry metric tonnes of silver-gold concentrates were delivered during the quarter.

Alex Langer, Chief Executive Officer, highlighted the progress, stating in the news release, “We are very pleased with the Q1 results, with US$4.8 million in revenues and a gross profit of US$1.2 million, including US$535,000 in cash generated from operations, reflecting an exciting first quarter of commercial operations at our Guitarra silver-gold mine complex.” Langer added that the company expects accelerating revenue growth for the next two quarters as higher-grade feed from the Coloso mine, which began supplementing production in April 2025, continues to ramp up.

Sierra Madre made strategic investments in equipment during the quarter, spending US$378,000 to acquire and refurbish key mining and mobile equipment, including a large front-end loader, excavator, and personnel transport vehicles. The company also focused on accelerating underground development, particularly at Coloso, which is expected to improve head grades and reduce per-ounce mining costs. Recent hires included a metallurgist to oversee blending and processing optimization and a civil engineer to manage tailings and construction work.

The company successfully transitioned to commercial production on January 1, 2025, after a six-month commissioning phase that began in mid-2024. At quarter-end, current assets, including cash, totaled US$4.3 million, up from US$3.5 million at the end of 2024. The next financial update will be presented during a webinar hosted by Adelaide Capital on May 13, 2025, at 11:00 AM ET.

Commodities and Precious Metals Gain Ground Amid Global Shifts

The commodities and precious metals sector has been gaining renewed attention as macroeconomic uncertainty and shifting global trade dynamics continue to drive interest. In a May 8 essay published by GoldFix, the author examined gold’s evolving role as a strategic monetary tool. The paper argued that gold had reemerged not merely as a store of value but as a method for sovereign debt management, sanctions circumvention, and currency stabilization. It highlighted that, under frameworks like the Mar-a-Lago Accord and post-Basel III reforms, gold was increasingly being used to monetize assets without outright liquidation. The report concluded that gold’s function in global monetary strategy had grown essential as nations sought to rebalance economic power while avoiding traditional U.S.-centric financial systems.

In a May 9 interview between Rick Mills of Ahead of the Herd and Bob Moriarty of 321Gold, Moriarty stated that the shift toward commodities was less about commodities themselves and more about global economic instability. He commented, “Commodities, PMs, are the only safe haven left,” adding that financial markets had become disconnected from tangible goods production, with 32% of the U.S. economy revolving around paper transactions rather than real output. Mills emphasized that historical patterns suggested commodities had typically experienced major upswings following global monetary resets, noting that recent capital flows out of equities and cryptocurrencies had started redirecting into resources.

A May 9 video interview featuring Matt Piepenburg of VON GREYERZ further reinforced gold’s role as a key hedge against fiat currency devaluation. Piepenburg explained that gold’s long-term stability made it the asset of choice for wealth preservation, especially during periods of economic distress. He stated, “Gold holds its purchasing power better than paper money,” and pointed out that rising geopolitical and financial risks had driven central banks and high-net-worth individuals alike to increase their allocations to physical gold, viewing it as essential protection against systemic shocks.

VSA Capital Reaffirms Buy Rating and Upside

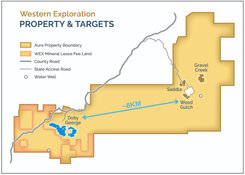

According to a May 6 research report from VSA Capital, Sierra Madre Gold and Silver made significant progress in optimizing production across its two operating mines in Mexico. Analyst Oliver O'Donnell highlighted that the company restarted mining at the Coloso mine, located approximately 4 kilometers northwest of the La Guitarra mill, as part of a revised operational strategy. The report noted that Sierra Madre enhanced its management team and updated its mine plan to include Coloso, with a metallurgist working to balance ore output from both sites. O'Donnell wrote, “This development highlights the nimble, low cost and focused approach that management has taken to restarting La Guitarra, with the benefit of their past experience combined with new insight.”

The VSA Capital report reiterated a Buy rating and maintained a CA$1.30 per share target price for Sierra Madre, which represented a 124% potential return based on the company’s CA$0.58 share price at the time of the report. O'Donnell stated that Coloso alone could support the mill for at least seven years at a throughput of 500 tons per day, while additional exploration potential at the Jessica and Joya veins could extend that timeline further. The analyst also highlighted Sierra Madre’s early revenue achievements, noting, “We continue to believe that Sierra Madre is on track to deliver strong profitability in 2025, while the strong silver grade means that the stock is well-positioned to benefit from the catch-up in the silver price following gold's strong rally.”

Upcoming Milestones for La Guitarra and Tepic

Looking ahead, Sierra Madre continues to develop its strategic position with a focus on expansion and optimization at La Guitarra, where the company has restarted mining at both the Guitarra and Coloso mines and is running its 500 tonnes-per-day processing facility at full capacity. According to the company’s investor presentation, Coloso’s resource grades are on average 1.7 times higher in silver and 1.2 times higher in gold compared to Guitarra mine veins, which is expected to accelerate revenue growth in the coming quarters.

The company is also looking at district-wide exploration, with over 59 kilometers of mineralized structures identified in the Temascaltepec district and ongoing work to access higher-grade zones. Equipment upgrades, financed through operating cash flow, have helped streamline operations, while recent concentrate shipments are expected to continue on a weekly basis.

Sierra Madre maintains a strong shareholder base, with First Majestic Silver holding a 44.5% interest and institutional investors accounting for 12.9%. As the company works to expand production and optimize efficiencies, upcoming milestones include continued ramp-up at Coloso and ongoing optimization of mining and milling processes to enhance recovery rates.

Ownership and Share Structure

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Sierra Madre Gold and Silver Ltd. (SM:TSX.V; SMDRF:OTCQX)

Sierra Madre provided a breakdown of the company's ownership and share structure, where management and founders own approximately 24.8% of the company.

According to Refinitiv, President and CEO Alexander Langer owns 2.68% of the company, Executive Chairman and COO Gregory K. Liller owns 1.77%, Director Jorge Ramiro Monroy owns 1.32%, Director Alejandro Caraveo owns 1.26%, Director Kerry Melbourne Spong owns 0.57%, and Director Gregory F. Smith owns 0.14%.

Institutional investors own 12.9% of the company. Commodity Capital A.G. owns 4.4%, Refinitiv reported.

| Want to be the first to know about interesting Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Sierra Madre Gold and Silver Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.