Clean technology company BioLargo Inc. (BLGO:OTCQX) announced case study data on the cost savings of its Aqueous Electrostatic Concentrator (AEC) solution for removing "forever chemicals" from water.

Per- and polyfluoroalkyl substances (PFAS) break down very slowly, which is why they are called "forever chemicals." High concentrations may lead to health risks, although research is still being conducted. Tens of millions of people have been exposed. The AEC can capture and destroy the contamination down to non-detect levels in water and landfill leachate.

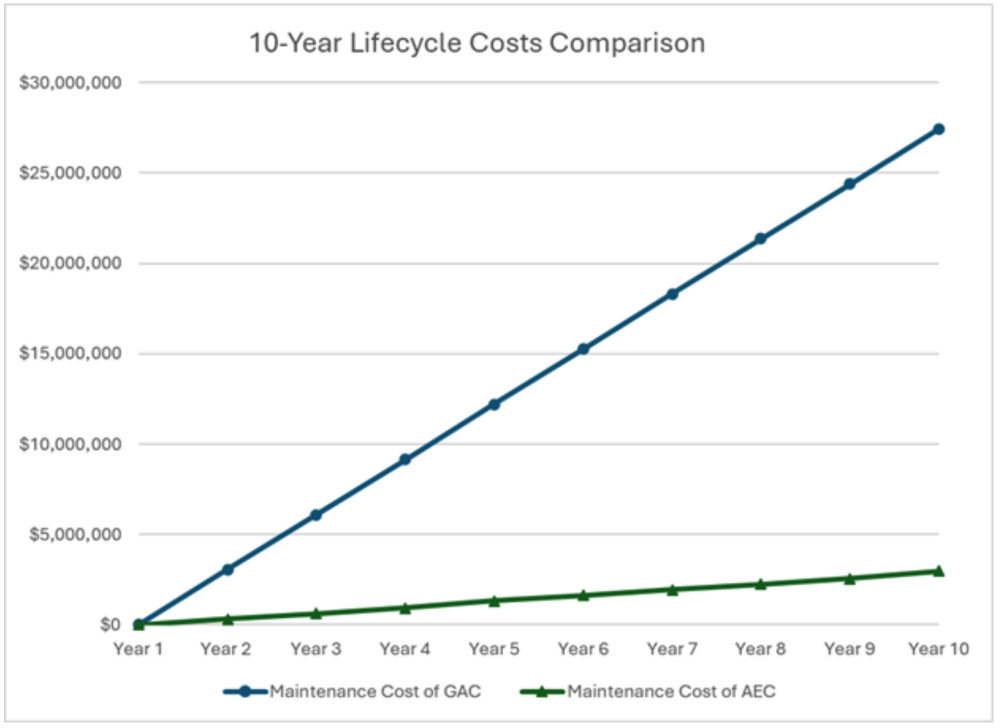

The case study data show a more than 80% long-term savings in lifecycle costs, such as replacing filters or substrates or removing waste, coming from steep reduction of PFAS-laden waste generated by BioLargo's AEC compared to carbon-based treatment systems.

BioLargo's treatment materials also have lower replacement costs, the company said.

Many current technologies for filtering the chemicals, such as activated carbon and ion exchange resins, have "substantial lifecycle costs," the case study said.

"BioLargo's AEC turns this paradigm on its head, with less ongoing media replacement, less waste, and ultimately total mineralization of that PFAS-laden waste using a separate electrochemical oxidation process," the company said in a release.

Lifecycle Cost Comparison

The graph at left shows a 10-year lifecycle cost comparison, according to BioLargo. The AEC data were collected from trials with client-provided water and include ongoing costs for replacement membranes and the costs to destroy the PFAS-laden waste via electro-oxidation.

The activated carbon (GAC) costs include replacing carbon filters based on current pricing but do not include costs associated with transporting or disposing of PFAS-laden waste, or other costs like taxes, fees, and capital costs, the company said.

Unlike GAC and ion exchange, BioLargo said its AEC does not suffer from breakthrough or channeling phenomena that can occur with filtration media based PFAS capture technologies, especially with short chain PFAS. In addition to better capturing PFAS chemicals, the company's engineers expect this will further reduce maintenance costs.

"Waste equals cost," said BioLargo Equipment Solutions & Technologies (BEST) President Tonya Chandler.

"We built the AEC specifically to capture PFAS efficiently onto small volumes of substrate. That means lower disposal costs, more affordable and less frequent maintenance, lower regulatory liability, and better, budget-friendly economics for utilities and municipalities trying to protect public health."

Government is stepping up enforcement of PFAS water standards and "BioLargo's American-made technology offers a realistic path to addressing" those standards "with less capital and operational costs."

A 'Large Emerging Market'

Analyst Richard Ryan of Oak Ridge Financial noted in an April research note that the pipeline of opportunities is large and growing for BioLargo's AEC.

"The large emerging market for PFAS removal and BLGO's growing validation in this opportunity should not be overlooked," the analyst wrote, rating the stock a Buy with a base case target price of US$0.38 per share.

First made in the 1930s, PFAS are now found "widely in the food and water supply and in most people's blood," NPR reported.

High concentrations of some PFAS may lead to adverse health risks such as cancer, hormonal disruption, and reduced immune system effectiveness, although research is still being conducted. BioLargo's AEC technology has been shown in pilot studies to meet the EPA's specifications for PFAS in drinking water, the company said. The process separates the compounds in an electrostatic field, forcing them across a proprietary membrane system. The AEC's energy costs are very low, and its waste stream is a fraction of that of GAC or ion exchange systems.

Testing has shown the technology removes the chemicals to a level of "non-detection," or a level at which science can no longer detect them, the company said.

A 'Family of Companies'

BioLargo is made up of subsidiaries that work in different sectors, a "family of companies," including ONM Environmental, BioLargo Engineering, BioLargo Water, BioLargo Energy Technologies, Clyra Medical Technologies, and the new BioLargo Equipment Solutions & Technologies Inc. (BEST) subsidiary.

ONM Environmental includes Pooph, the company's wildly successful consumer pet odor line; Clyra Medical Technologies includes its copper-iodine wound irrigation solution, Bioclynse; and BioLargo Energy has developed a new long-lasting battery that the company said is safer than lithium-ion batteries.

"BioLargo is yet another of our story 'story stocks' you should be doubling down on at current prices," Chris Temple of The National Investor wrote.

Ownership and Share Structure

About 14.6% of BioLargo is owned by insiders and management, according to Yahoo! Finance. They include Chief Science Officer Kenneth Code with 8.33%, CEO Calvert with 3.27%, and Director Jack Strommen with 1.62%, Refinitiv reported.

About 0.04% is held by the institution First American Trust, Refinitiv said.

The rest, about 85%, is retail.

Its market cap is US$83.28 million, with about 301.78 million shares outstanding and about 259.49 million free-floating. It trades in a 52-week range of US$0.37 and US$0.16.

| Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- BioLargo Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of BioLargo Inc.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.