Dolly Varden Silver Corp. (DV:TSX.V; DOLLF:OTCQX) provided the details of its 2025 exploration program, to start in the middle of this month, at its Kitsault Valley project in northwest British Columbia's (B.C.'s) Golden Triangle, a news release noted. The objectives are to grow the resource base and continue demonstrating the project's scale.

"We are following up on some of the strongest silver and gold intercepts we've seen to date as we grow the known deposits while also targeting new areas with district-scale potential," President and Chief Executive Officer Shawn Khunkhun said in the release.

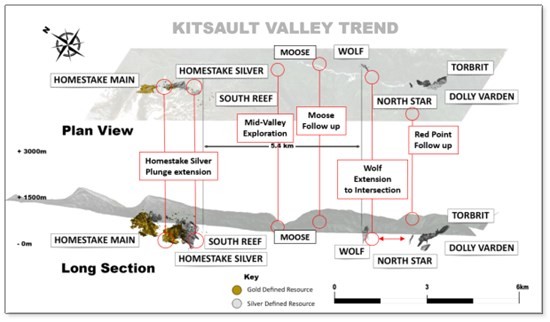

The upcoming campaign, fully funded, will comprise at least 35,000 meters (35,000m) of diamond drilling at various targets on both the Dolly Varden and Homestake Ridge properties, the release explained. One target is the 5.4-kilometer-long area between the southern end of Homestake Silver and the Wolf vein, beneath the midvalley sedimentary cap rocks. Other targets are west of Homestake Main.

Specifically, building on the success of last year's program and with four rigs active, drilling will focus on expanding high-grade mineralization at the Wolf and Homestake Silver deposits and will follow up on encouraging results from numerous exploration targets, such as Red Point and Moose.

Deep drilling will be done of the Big Bulk target, prospective for porphyry- and skarn-style copper and gold mineralization similar to that of other projects in the region, including Seabridge Gold Inc.'s (SEA:TSX; SA:NYSE.MKT) KSM, Silver47 Exploration Corp.'s (AGA:TSX.V; AAGAF:OTCQB) Red Mountain and Newmont Corp. (NEM:NYSE)/Imperial Metals Corp.'s (III:TSX; IPMLF:OTCMKTS) Red Chris.

This year's plans also call for initial exploration work on the adjacent Kinskuch project that Dolly Varden is acquiring from Hecla Mining Co. (HL:NYSE), once the deal closes later this month. This is to include geological mapping and reconnaissance of the prospective Jurassic Age Hazelton Group rocks in the underexplored Illiance trend in Kinskuch's eastern portion and where the property approaches Goliath Resources Ltd.'s (GOT:TSX.V; GOTRF:OTCQB; B4IF:FSE) Surebet zone in the southwest.

With these efforts, in concert with results of ongoing data compilation, Dolly Varden Silver will generate priority targets, and may drill test them too this year if timing and budget allow. Further, the company will field map underexplored areas of Kinskuch and do road access, advanced metallurgical, wildlife and baseline environmental studies.

Building a Leading Silver Co.

Vancouver-based Dolly Varden wants to be the leading pure silver company in safe, prolific jurisdictions and to deliver sustainable value to stakeholders and shareholders, its Corporate Presentation notes. One component of this junior mining company's strategy is to pursue resource growth via aggressive exploration, and the upcoming campaign at its 100%-owned Kitsault Valley is an example of this.

The project, in the Golden Triangle's newly emerging southern Eskay Rift sub-basin, hosts the high-grade silver and gold resources of Dolly Varden and Homestake Ridge and the past-producing Dolly Varden and Torbrit silver mines.

Kitsault Valley is considered prospective for additional precious metal deposits because it is in the same structural and stratigraphic belts of numerous other, on-trend, high-grade deposits, including Skeena Resources Ltd.'s (SKE:TSX.V) Eskay Creek and Newmont's Brucejack.

Another of Dolly Varden strategies is to pursue accretive acquisitions. To this end, it has spent CA$5 billion on mergers and acquisitions activity since 2018. Most recently it agreed to acquire Hecla's adjacent prospective and underexplored Kinskuch project that, Streetwise Reports reported, quadrupled Kitsault Valley's size and added several mineralized trends.

"The company now controls a consolidated 77,000-hectare district, ideal for streamlined exploration," wrote Jeff Valks, senior analyst with The Gold Advisor, on May 5. "It's a classic mining move: less risk, more leverage, shared reward."

Get a Jump on Silver Equities

According to Technical Analyst Clive Maund, a huge buildup in short positions in silver over the previous six months has created a pressure cooker-like situation for the metal, out of which it eventually will burst. When this happens, the silver price likely will spike, past its 2022 highs of US$50 an ounce (US$50/oz), and silver stocks will "go ballistic," with little to no warning. (At last close, the silver price was US$33.02/oz.)

"Regardless of their individual charts/patterns, pretty much all mid and large-cap silver stocks will ascend vertically, and you won't be able to chase them fast enough," added Maund. "You want to be positioned in silver stocks before they break higher like this, not after."

Bob Haberkorn, a senior commodities broker at RJO Futures, told Kitco News recently that silver prices are set to gain 40% or more in the medium term.

"A realistic target for silver is probably closer to US$50 at some point this year," he said. "And I think the move's going to happen sooner than later. I think you're going to see a move in the short term to US$40, and [to] US$50 by September."

The gold:silver ratio also indicates more upside for silver, Ahead of the Herd's Richard Mills wrote on May 2. The ratio currently is 100:5, which compares to 60:1, the average since the early 1970s. (A 100:5 ratio means it takes 100 ounces of silver to buy one ounce of gold.)

FXEmpire Senior Analyst Christopher Lewis purported on April 30 that if silver can break the US$34/oz level, it most likely will race towards US$35.

"Ultimately, this is a market that, given enough time, I think reaches those highs and eventually breaks out," he added. "And that's especially true if the U.S. dollar continues to suffer in the currency world."

The 29 analysts and traders who participated in Reuters' latest quarterly poll were more conservative in their forecasts. Collectively, they predicted an average silver price of US$33.10/oz in 2025 and US$34.58/oz in 2026, the news agency wrote in an April 30 article.

From a fundamentals point of view, ongoing robust demand for silver and its ongoing supply deficit will drive the metal's price to new highs this year and for many more after, wrote Peter Krauth of Silver Stock Investor on May 2.

BMO Capital Markets Analyst Neils Christensen told Kitco News last week that use of silver by the solar power sector, needed for photovoltaic panels, will keep silver supply in a deficit for the foreseeable future. This year, BMO predicts the solar power industry will use 246,000,000 ounces (246 Moz) of silver, versus demand for jewelry of 203 Moz and investment demand of 234 Moz. Next year, solar demand for silver is forecasted to peak at 261 Moz.

The Catalyst: Project Milestones

Possible stock-boosting events for Dolly Varden, according to its website, include launching its 2025 exploration program at Kitsault Valley, mid-month. Once underway, the results will be released on an ongoing basis. An update of the Kitsault Valley resource is expected in early 2026, noted Marcus Giannini, Haywood Securities analyst, in an April 17 research report.

Later this month, the junior is expected to close its Kinskuch property acquisition.

Stock Is a Buy

The Gold Advisor's Valks and colleague Jeff Clark are bullish on Dolly Varden and both hold long positions in it, the former wrote in a May 5 note.

"This is a core silver position," Valks added. "If you want shares, we'll point out the stock is near the bottom of its trading range."

Krauth of Silver Stock Investor wrote on May 7 that he, along with the market, liked Dolly Varden's deal with Hecla. He described it as "a great strategic move in one of the hottest exploration areas of the planet." He recommended investors add to their DV positions on weakness.

Haywood's Giannini rates Dolly Varden Buy and has a target price on it reflecting a potential 153% return. In his most recent report, he pointed out that this year's drill program will exceed the scope of last year's, which was 32,000m. He highlighted that that the Canadian explorer offers investors something unique with Kitsault Valley, and that is exposure to both high-grade gold and high-grade silver throughout. He sees the asset as an ideal takeout target.

Giannini wrote, "Ultimately, we continue to view Dolly's Kitsault Valley project as increasingly suitable for larger miners, such as Hecla, given its uncapped growth potential, as seen in the company's most recent exploration program, as precious metal grades at site are highly competitive amongst peers."

Ownership and Share Structure

According to the company's latest corporate presentation in January 2025, 52% of its stock is held by institutional investors, including Fidelity Management & Research Company LLC, Sprott Asset Management LP, U.S. Global Investors Inc., and Delbrook.

About 37% is with strategic investors, including 15% with Fury Gold Mines, 12% with Hecla, and Eric Sprott owns 10% himself.

The rest, 11%, is with retail and high-net-worth investors.

The company has 79.52 million outstanding shares. Its market cap is CA$279.91 million, and its 52-week trading range is CA$3.21–5.84 per share.

| Want to be the first to know about interesting Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Dolly Varden Silver Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Dolly Varden Silver Corp.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contrator.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.