Lithium Ionic Corp. (LTH:TSX.V; LTHCF:OTCQX; H3N:FSE) again increased the overall resource estimate of its Bandeira project in Brazil's Lithium Valley, this time by 9%, reported Clarus Securities Analyst Varun Arora in a May 7 research note.

"Overall, we see potential for multiple production fronts as the company continues to discover new resources, adding to the production profile while also expanding mine life and potentially providing exposure to multiple commodity cycles," wrote Arora.

1,011% Upside Implied

Clarus has an CA$8 per share target price on the Canadian lithium explorer whose current price is about CA$0.72 per share. The difference between these prices suggests a potential return for investors of 1,011%.

Lithium Ionic remains rated Speculative Buy.

The company has 159 million (159M) basic shares outstanding and 185M diluted shares outstanding. Its market cap is CA$114 million. Its 52-week range is CA$0.41–1.17 per share.

Resource Keeps Growing

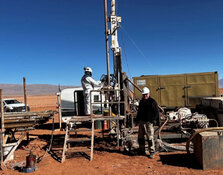

Arora discussed Bandeira's new resource estimate and how it compares to previous ones. The updated global resource now is 45,800,000 tons (45.8 Mt) of 1.34% lithium oxide (Li2O). It is based on 297 drill holes over 60,301 meters, drilled between April 2022 and September 2024.

The previous resource update in April 2024 reflected a 42% increase from the October 2023 one.

"As a reminder, the maiden global resource at Bandeira was only about 16 Mt at about 1.4% Li2O in June 2023, which represents more than 185% resource growth in less than two years," wrote Arora.

Between the April 2024 and latest updates, the Measured & Indicated (M&I) resource increased 15% to 27.27 Mt of 1.34% Li2O. The Inferred resource, mostly the same, is about 18.6 Mt of 1.34% Li2O.

Companywide Resource

Lithium Ionic's total resource, encompassing all of its projects, is 68.6 Mt of 1.25% Li2O. This represents only about 5% of the 14,182 hectare land package. The companywide resource breaks down into 45.8 Mt at Bandeira, 19.4 Mt at Baixa Grande and 3.4 Mt at Galvani.

Clarus Securities expects that with more drilling, the resources at Bandeira at Baixa Grande will keep increasing, the latter toward 25–30 Mt, noted Arora.

Implications of Growth

With an expanding resource comes the potential for multiple production fronts, mine life extensions and optionality to the commodity price, wrote Arora.

For example, using the 85% conversion rate used in the 2024 study of Bandeira, the project's current M&I resource equates to roughly 5 Mt of additional reserves. This translates into another three to four years of mine life, or specifically for Bandeira, an increase to a 17- to 18-year life of mine.

"This is in line with our current modeled mine life as we had assumed additional reserves in our mine model for Bandeira through conversions and resource expansion," Arora explained.

The mine life outlined in the 2024 feasibility study was 14 years. That study was based on only 17 Mt in the mine plan or 21 Mt (85% of the M&I resource).

On the Horizon

Lithium Ionic plans to incorporate the new Bandeira mineral resource estimate into an updated feasibility study, due to be completed in H2/25.

Other near-term catalysts for the company are approval/receipt of a construction permit and finalization of financing through the Export-Import Bank of the United States.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |