West Red Lake Gold Mines Ltd. (WRLG:TSX.V; WRLGF:OTCQB; FRA:UJO) announced positive reconciliation results from its bulk sample program at the 100% owned Madsen Mine, located in Ontario's Red Lake Gold District. The company reported that 14,490 tonnes of material produced 2,498 ounces of gold, with an average grade of 5.72 grams per tonne (g/t) gold — slightly above the predicted 5.68 g/t — and a mill recovery rate averaging 95%.

Shane Williams, President and CEO, stated in the news release, "We acquired the Madsen Mine because we believed appropriate geologic work, responsive engineering, and quality mining would unlock the tremendous value in this asset. I am extremely pleased today to deliver bulk sample results that show mined tonnes and grade matching well with expectations, which validates our approach to this mine and underlines that Madsen is on track to become a new high-grade gold mine in 2025." Williams added that the close reconciliation between predicted and actual grades highlights the effectiveness of over 90,000 meters of definition drilling completed since October 2023, which now forms the basis for approximately 90% of the detailed 18-month mine plan.

The bulk sample included material from six stopes across the Austin, South Austin, and McVeigh zones, mined using the long hole retreat method. This involved drilling development sills at 20-meter vertical intervals, blasting, and mucking with remotely operated Load Haul Dumpers. Sampling was carried out at regular intervals to ensure accurate reconciliation between underground extraction and surface stockpiles. Processing at the Madsen Mill used a combination of gravity concentration, cyanide leaching, and carbon-in-pulp adsorption, producing gold ore on site.

West Red Lake noted that independent consultant Soutex Inc. observed the entire bulk sample process, from milling to sampling, and reconciled results using BILMAT software. Williams emphasized that designing stopes for today's higher gold price environment opens the potential to mine additional tonnes and ounces, which could improve operational costs and enhance overall economics relative to the company's pre-feasibility plan.

The Madsen Mine sits within one of Canada's most prolific gold-producing regions, having yielded more than 30 million ounces historically. According to West Red Lake, gold-bearing zones are best identified by sub-millimeter free gold grains and sulphide minerals such as arsenopyrite and pyrrhotite, accompanied by strong alteration and veining. The technical content of the release was reviewed and approved by Maurice Mostert, P.Eng., Vice President of Technical Services and the company's Qualified Person under Canadian National Instrument 43-101 standards.

Sector Snapshot: Gold Industry Perspectives

According to a May 2 report from FX Street, the gold price touched fresh daily highs near US$3,260 to US$3,265, supported by a modest decline in the U.S. Dollar (USD) ahead of the U.S. Nonfarm Payrolls (NFP) report. FX Street noted that "the optimism over possible U.S.-China trade negotiations might cap the precious metal," even as traders ramped up bets on aggressive policy easing by the U.S. Federal Reserve.

The report explained that traders were anticipating four quarter-point rate cuts by year-end after data showed the U.S. economy unexpectedly contracted for the first time since 2022. FX Street also highlighted that "the U.S. ADP report on private-sector employment suggested that the U.S. labor market is cooling," adding to the cautious sentiment around the USD and giving gold prices a tailwind.

Red Cloud analyst Taylor Combaluzier gave West Red Lake a Buy rating and a target price of CA$2.50, showcasing a potential 268% return to target.

FitzGerald emphasized that this price environment allowed companies to generate cash flow that could fund further exploration, enhancing the long-term development potential of their projects. He pointed to the surge in gold prices, noting that juniors focused on near-term production had opportunities to capitalize on meaningful indicated resources, which at these price levels could significantly elevate company valuations.

Ahead of the Herd reported on May 4 that the U.S. economy was showing signs of strain, with GDP growth slipping and key agricultural exports facing cancellations from China. The report cited renowned economist Stephen Roach, who believed the global economy was heading for "a prolonged period of stagflation." The publication stressed that "gold does well in stagflationary periods and outperforms equities during recessions," drawing historical parallels to the 1970s when gold surged from US$100 per ounce in 1976 to around US$650 in 1980 as inflation topped 14%. A Forbes analysis referenced by Ahead of the Herd showed that in six of the last eight recessions, gold outperformed the S&P 500 by an average of 37%, underlining gold's role as a hedge against economic uncertainty and inflationary pressures.

Analysts Highlight Progress and Revaluation Potential at West Red Lake Gold

Analyst coverage of West Red Lake Gold Mines Ltd. has intensified as the company advanced toward its first gold pour at the Madsen project in Ontario.

Jeff Clark of The Gold Advisor reiterated a Strong Buy recommendation on April 3, writing that West Red Lake Gold was on the "preproduction golden runway." Clark noted the stock had the chance to benefit from both the broader advance in gold prices and the impending production start at Madsen.

On April 14, Paul O'Brien of Velocity Trade Capital issued an Outperform rating on West Red Lake Gold and set a target price of CA$1.25, further underscoring the growing attention and positive sentiment surrounding the company's progress and revaluation potential.

According to a March 19 research note from Cantor Fitzgerald, analyst Matthew O'Keefe issued a Buy rating on West Red Lake Gold with a one-year target price implying a 114% return. O'Keefe highlighted construction progress, including the 94% completion of the 1.4-kilometer connection drift, an acceleration in underground development, and operational readiness supported by the company's newly established 114-person camp facility.

On May 7, O'Keefe reiterated his Buy rating and updated his target price to CA$2.20, implying a 219% return from the price at the time of the report.

On the same day, Chen Lin of What is Chen Buying? What is Chen Selling? wrote about West Red Lake's recent bulk sample reconciliation results, saying, "Gold grades are pretty consistent, right on the prediction. This is similar to PVG bulk sampling if you remember, and should be very positive and give a boost to confidence when the mining starts in a month or so."

On May 8, Red Cloud analyst Taylor Combaluzier gave West Red Lake a Buy rating and a target price of CA$2.50, showcasing a potential 268% return to target.

Positioning for 2025: Near-Term Catalysts and Strategic Outlook

According to West Red Lake Gold's latest investor presentation, the company is on track for gold production in the second half of 2025, supported by a combination of prior capital investments, recent financings, and anticipated gold sales. As of late February 2025, West Red Lake reported holding CA$31 million in cash, with an additional US$20 million available from an established debt facility, alongside expected proceeds from the bulk sample. The company has laid out a clear operational timeline, noting that bulk sample mining and processing are nearing completion, while ramp-up efforts will continue throughout the year, gradually increasing mining and processing rates to the targeted 800 tonnes per day.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

West Red Lake Gold Mines Ltd. (WRLG:TSX.V; WRLGF:OTCQB; FRA:UJO)

West Red Lake's pre-feasibility study estimates a post-tax net present value (NPV) of US$496 million for the Madsen Mine, assuming a long-term gold price of US$2,640 per ounce. Average annual free cash flow is projected at US$94 million over six full production years, with diluted head grades averaging 8.2 grams per tonne gold and an all-in sustaining cost (AISC) of US$1,681 per ounce. Importantly, management believes there is upside potential from additional resource conversion, as engineering plans now target mining larger stopes and increasing throughput beyond pre-feasibility assumptions.

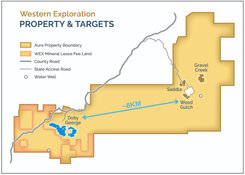

Additional catalysts include the advancement of the company's Rowan and Fork deposits, where indicated resources and recent exploration results suggest potential integration into an expanded mine plan. Notably, the Rowan deposit hosts near-surface indicated resources grading 12.8 grams per tonne, and permitting for a bulk sample is planned by 2027 or 2028. Further, West Red Lake continues to explore high-priority targets accessible via the newly developed Connection Drift, which opens up previously untapped extensions of the McVeigh, South Austin, and Austin zones.

Ownership and Share Structure

Strategic investor Sprott Resource Lending Corp. holds about 8%. Institutions hold about 30%, management, insiders, and advisors hold about 10%, and the remaining shares are held by retail investors.

The company's market cap is CA$200.28 million. The 52-week range for the stock is CA$0.52 to CA$1.04.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- West Red Lake Gold Mines Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of West Red Lake Gold Mines Ltd.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.