This is considered to be an excellent time to buy Algernon Pharmaceuticals Inc. (AGN:CSE; AGNPF:OTCQB; AGW0:XFRA) which is remarkably inexpensive here following a severe bear market and long basing process as the technical indications are that it is ready to break out into a new bull market as we will proceed to see when we look at its latest stock charts.

Algernon Pharma is a Canadian clinical-stage drug development and repurposing company that is advancing multiple drugs to address conditions for which there has until now been no satisfactory treatment. The company's key active research programs are for chronic cough, idiopathic pulmonary fibrosis, and chronic kidney disease.

Drug repurposing offers cost and efficiency benefits relative to traditional drug development because of the reduction in investment and risk — repurposed compounds have a much lower risk of failing in human safety trials — and have shorter research periods and a longer active patent life.

*The two key repurposed drugs that Algernon Pharma is advancing are:

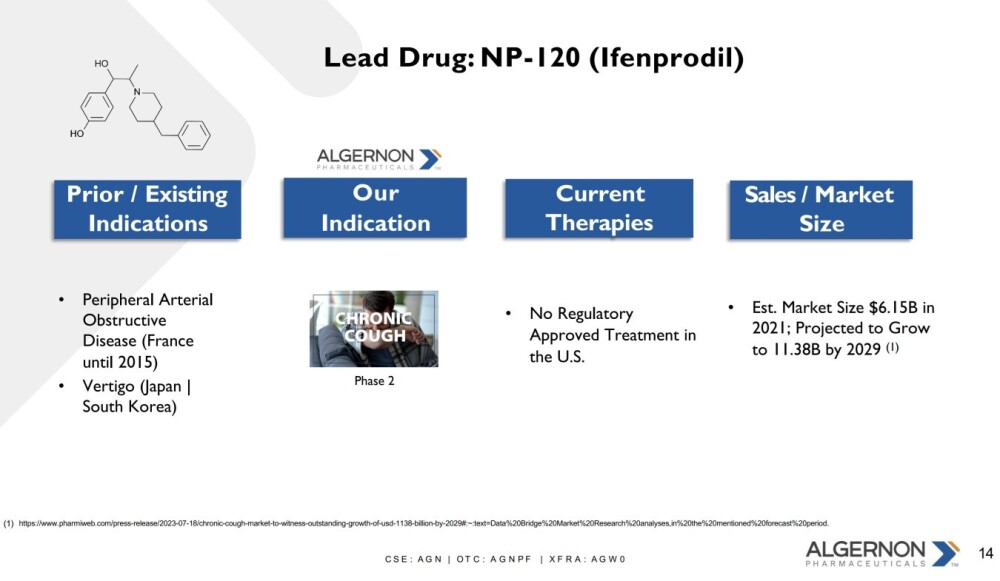

- NP-120 (Ifenprodil) — for Refractory Chronic Cough

- NP- 251 (Repirinast) — for Chronic Kidney Disease

*Drug repurposing is the process of discovering new therapeutic uses for already approved drugs, and since they have already been approved, costs and development times are clearly greatly reduced.

There is a huge potential market for the drug under development for treating Chronic Cough, NP-120 (Ifenprodil).

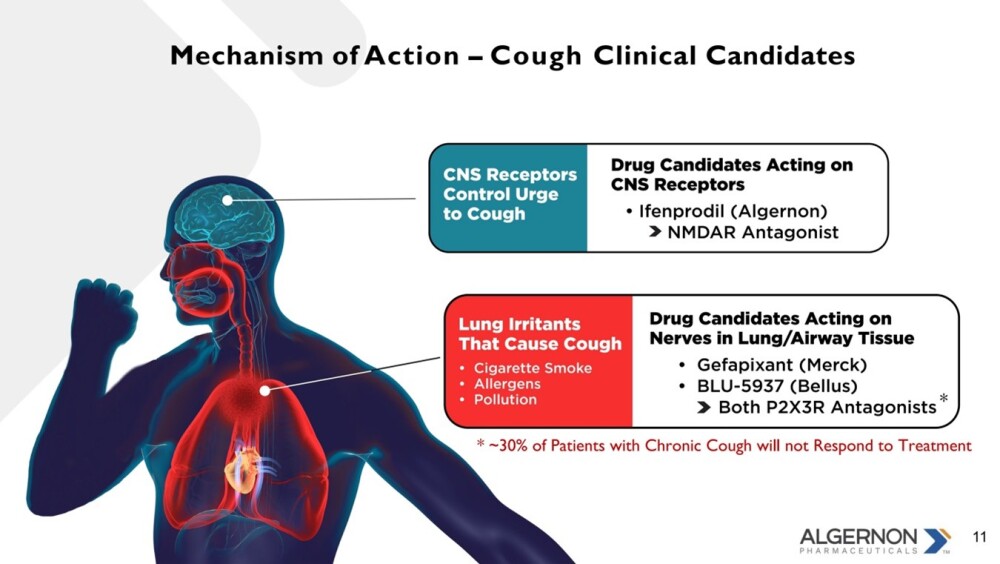

Ifenprodil acts on the CNS receptors in the brain to control the urge to cough.

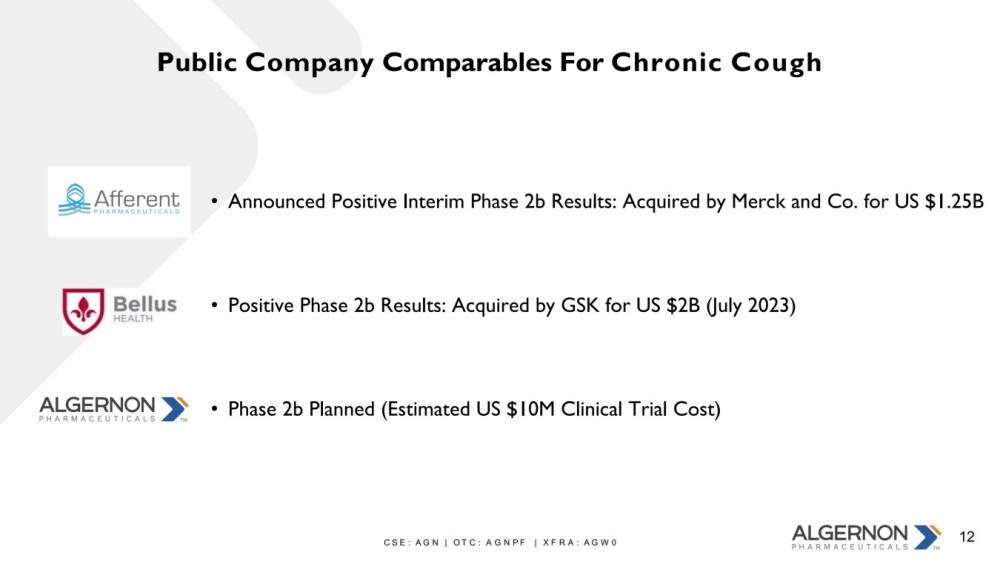

The experience of Afferent Pharma and Bellus Health makes clear that there is a powerful incentive to develop effective treatments in this area.

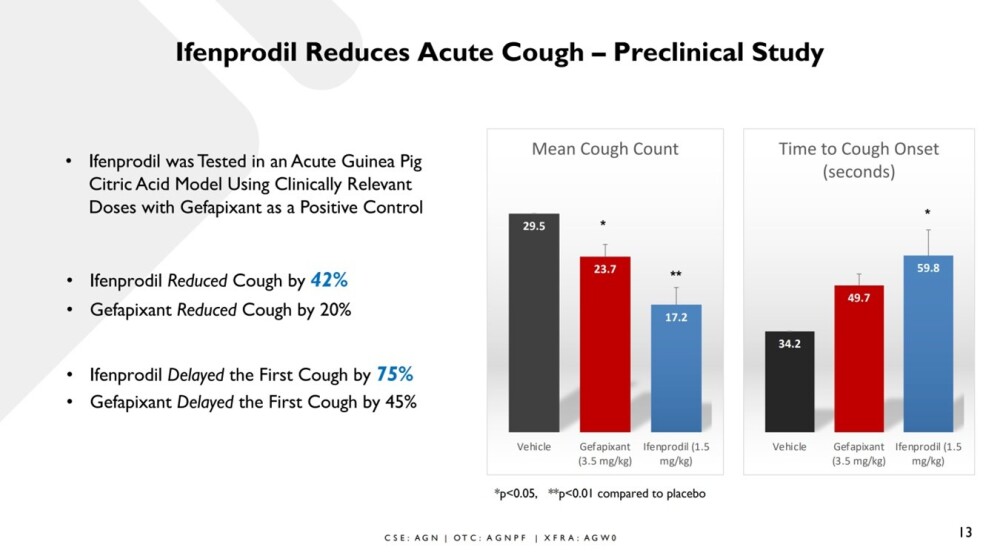

Ifenprodil has been shown to substantially reduce chronic cough.

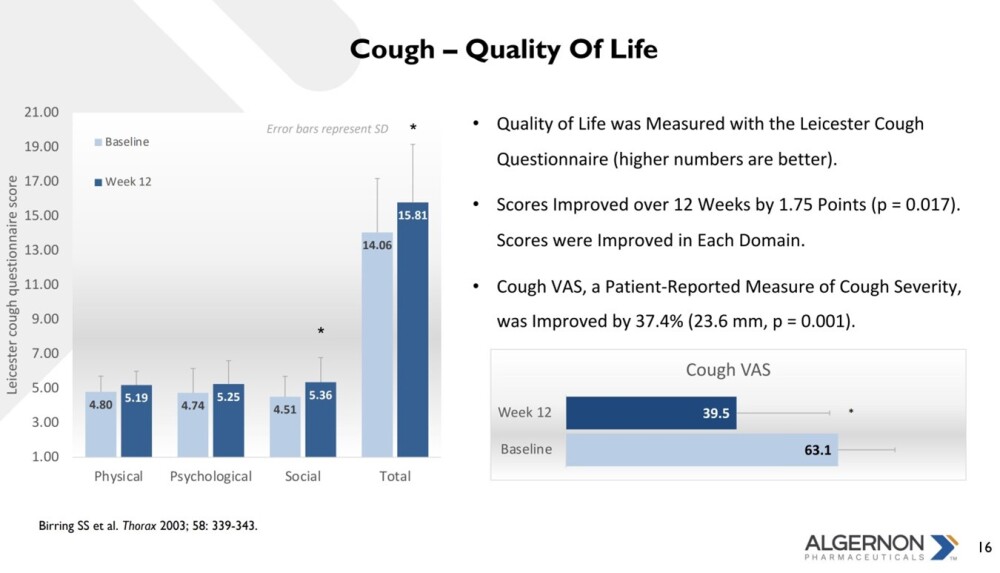

Quality of life improvements resulting from this treatment for chronic cough.

There is a huge potential market also for the other main drug under development, which is for the treatment of Chronic Kidney Disease, NP-251 (Repirinast).

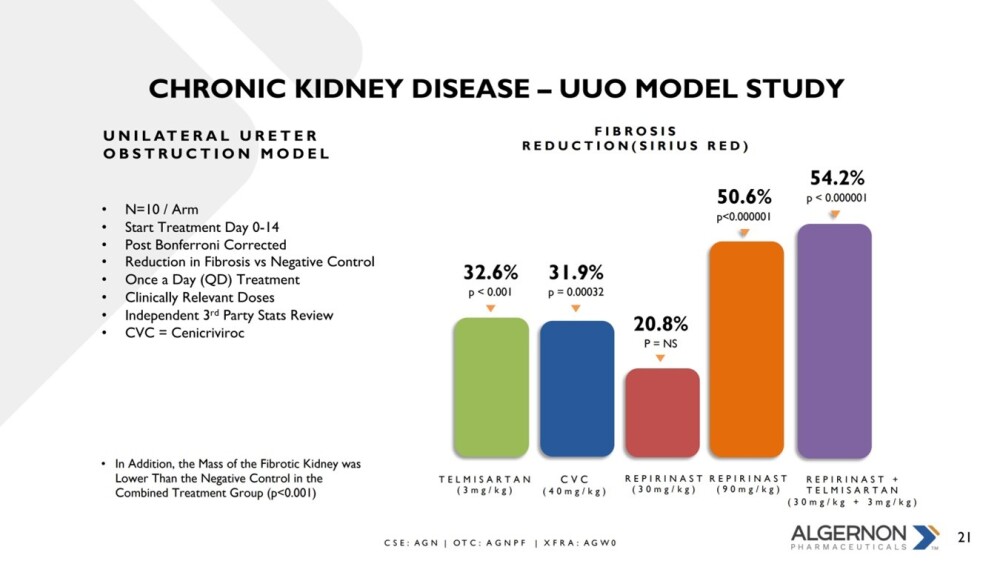

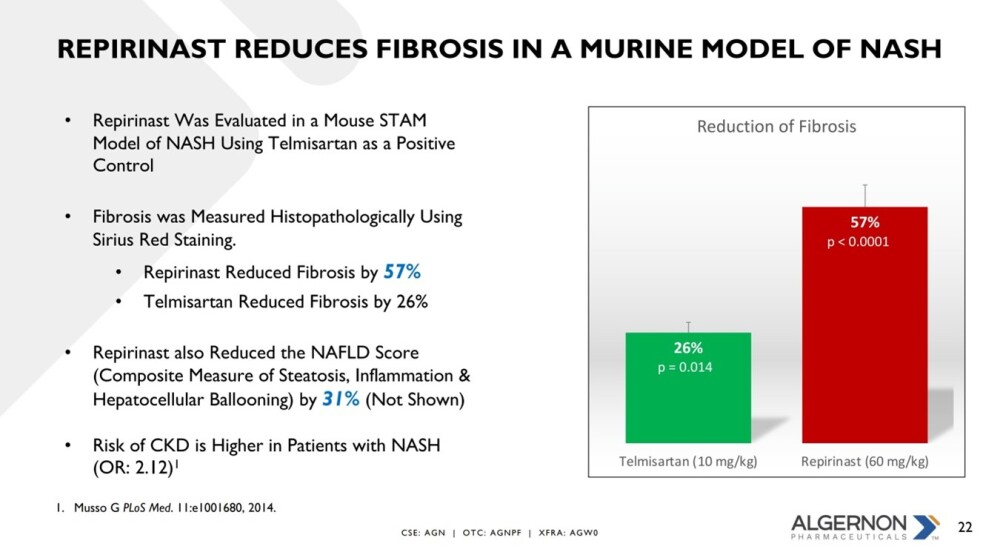

Repirinast demonstrates a great reduction in fibrosis.

And especially relative to Telmisartan. . .

More information is available in the company's investor deck.

Turning now to the charts and starting with the 4-year arithmetic chart, we see that Algernon Pharma appears to have been basing from late 2023, following a really severe bear market that resulted in it losing most of its value. Although it is hard to discern what has been going on within this presumed base pattern on an arithmetic chart, we can at least observe two important and positive points.

One is that there has been a marked overall increase in volume since the pattern started forming, which means that there has been a substantial rotation of stock from weaker to stronger hands. This is so because most of the sellers are obviously selling for a loss, whilst most of the buyers are looking for better times ahead and will not be inclined to sell until they have turned a profit.

This has the effect of reducing the available supply and is therefore bullish. The other point is that most of the volume within the pattern has been upside volume, which is made clear by the persistent strong uptrend in the Accumulation line that has been in force for about nine months. This is a marked positive divergence that normally results in a breakout into a major new bull market. Beyond these observations, there is not much more to observe since the base pattern is flat and featureless on an arithmetic chart. We can get around this problem by switching to the use of a log chart, which has the effect of opening out the base pattern.

On the 4-year log chart (same time period as the arithmetic chart above) we can see exactly what form the base pattern from late 2023 has taken. It has the characteristics of both a Double Bottom and a gently converging Symmetrical Triangle and may be described as a hybrid between the two, but whatever label it is given it looks bullish, especially as the Accumulation line has been trending higher during its latter stages.

Since this Triangle is now closing up, a breakout is to be expected sooner rather than later.

Zooming in further via a 16-month log chart, we see that the second low of the Double Bottom shown on the 4-year chart is itself comprised of a Head-and-Shoulders bottom, which has been building out since last September.

This pattern is approaching completion with the price believed to be very close to rising away from the Right Shoulder low, and if this is indeed the case, then we are at an excellent entry point. The strongly bullish volume pattern and uptrending Accumulation line support this contention. Whilst moving averages are still in bearish alignment, they are tightly bunched with the price, and so an advance from here will quickly swing them into bullish alignment.

The conclusion is that Algernon Pharma is at a very favorable entry point here, and so anyone holding should stay long, and it is rated an Immediate Strong Buy. The immediate target for an advance is the resistance in the CA$0.12 area, with the next target being resistance at CA$0.17 and beyond that the CA$0.25 level, with much higher targets possible., and so anyone holding should stay long,

Algernon Pharma's website.

Algernon Pharmaceuticals Inc. (AGN:CSE; AGNPF:OTCQB; AGW0:XFRA) closed for trading at CA$, US$, on May 6, 2025.

| Want to be the first to know about interesting Technology, Special Situations, Life Sciences Tools & Diagnostics and Biotechnology / Pharmaceuticals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$2,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Algernon Pharmaceuticals Inc.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.