Algernon Pharmaceuticals Inc. (AGN:CSE; AGNPF:OTCQB; AGW0:XFRA) has announced the acquisition of NoBrainer Imaging Centers Inc. (NIC), securing exclusive master franchise and licensing rights to establish Alzheimer’s Disease (AD) diagnostic and treatment clinics across Canada and key U.S. markets. According to the company, this move positions Algernon to address a significant gap in the availability of specialized brain-specific PET (Positron Emission Tomography) scanning for AD diagnosis and treatment. As Christopher J. Moreau, CEO of Algernon, stated, “The concept of building Alzheimer’s Disease-focused diagnostic and treatment clinics that offer a comprehensive package of medical services... is a unique and exciting approach to help fight this devastating disease.”

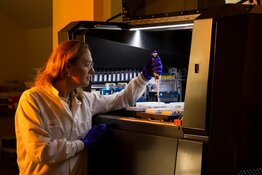

The company plans to launch its first clinic in Florida in the fourth quarter of 2025, followed by ten additional corporately owned sites and ten franchise locations in 2026. Each site will offer services including cognitive and genetic screening, blood tests detecting phosphorylated tau proteins (an established AD biomarker), and PET imaging using the ultra-compact Positrigo NeuroLF PET scanner, which was recently cleared by the U.S. Food and Drug Administration (FDA). These diagnostic tools are essential for confirming amyloid plaque presence before patients can receive new monoclonal antibody treatments such as Kisunla and Leqembi, approved by the U.S. FDA and covered by Medicare and Medicaid.

The Alzheimer’s treatment landscape has been reshaped by these approvals, creating what GE HealthCare CEO Peter Arduini recently called a “profound growth opportunity” for PET scan and molecular imaging providers. Scientific American estimated the global economic burden of AD at US$1 trillion in 2019, with projections reaching up to US$10 trillion by 2050. In the U.S., an estimated 7 million individuals live with AD, alongside approximately 750,000 in Canada. PET scans, which cost around US$5,000 per scan, represent a growing segment expected to exceed US$18 billion, according to company estimates.

Algernon will also pursue opportunities in the Canadian market, where initial services will focus on screening and wellness programs until Health Canada approves the PET system and AD treatments. Canadian patients identified at high risk may be referred to U.S. clinics for confirmatory PET scans and treatment. Beyond patient care, Algernon aims to provide PET imaging services for drug development trials, supporting over 160 AD drugs currently under investigation. The acquisition of NIC provides Algernon with access to CAD$250,000 in working capital, including a deposit on the first PET scanner.

The transaction involves issuing 4,500,000 common units, each consisting of one common share and one common warrant, plus 450,000 preferred units subject to shareholder approval. The company also secured an option to acquire 20% of NATC, the parent of NIC. Warrants allow for tiered exercise pricing, beginning at US$0.15 per share and potentially increasing to US$0.50 per share over a defined period. Shareholder and regulatory approvals, including from the Canadian Securities Exchange, are expected within five business days.

Biotechnology’s Expanding Role in Healthcare Innovation

According to Precedence Research on April 10, the global biotechnology market was valued at US$1,744.83 billion in 2025 and was projected to reach around US$5,036.46 billion by 2034, reflecting a compound annual growth rate (CAGR) of 12.5%. This growth has been driven by the rising prevalence of chronic disorders, increasing investments and collaborations, and technological advancements that enable the development of new diagnostic and therapeutic solutions. The report emphasized that biotechnology transforms healthcare by advancing areas such as cell and gene therapies, vaccines, and recombinant products. It also noted that the demand for biologics has been rising due to their targeted action and reduced systemic side effects, supported by favorable regulatory frameworks.

Research and Markets reported on April 15 that the global artificial intelligence (AI) in biotechnology market was projected to grow due to rising demand for personalized therapies, the use of AI in epidemiological models, and an increasing number of clinical trials applying AI tools. The research underscored that pharmaceutical companies held the largest share of the AI in biotechnology market, benefiting from AI’s role in tasks like target identification, lead optimization, and patient stratification in clinical trials. Europe, in particular, had become an important region due to heightened investments and patent activity in AI-related biotech innovations.

Investor’s Business Daily wrote on April 29 that despite volatility in April, biotech stocks showed resilience, rebounding 20% off a recent low. The publication noted that the 715-company medical-biomed/biotech industry group ranked No. 70 out of 197 tracked groups, reflecting a modestly strong position. Among broader market concerns, the article highlighted that biotech firms showing robust fundamental and technical metrics have helped maintain investor interest. The sector’s performance was supported by companies advancing treatments in areas such as rare diseases, cancer, and immune disorders, which have sustained growth despite external market pressures.

Algernon’s Strategic Drivers: Accelerating Growth and Innovation

Algernon’s investor presentation highlights its dual strategy of pioneering new Alzheimer’s clinics while advancing existing drug development programs. The company focuses on repurposing compounds that have never been approved in the U.S. or Europe, reducing investment risk and shortening development timelines. Its lead research efforts include NP-120 (Ifenprodil) for idiopathic pulmonary fibrosis (IPF) and chronic cough, where Phase 2a studies met co-primary endpoints, with significant improvements in forced vital capacity and reductions in 24-hour and awake cough counts.

Additionally, Algernon is progressing Repirinast, a small molecule for chronic kidney disease (CKD), which showed a 50% reduction in fibrosis in preclinical models. The company is preparing for a Phase 1 study following the manufacture of a cGMP drug supply. According to Algernon, the global CKD drug market is projected to reach US$15.8 billion by the end of 2024, while the IPF market is expected to grow to US$3.2 billion by 2025, and the chronic cough market to US$9.8 billion by 2027.

With a capital-efficient model, Algernon secures intellectual property through method-of-use, dosing, new formulation, and composition of matter patents. Its management team, led by CEO Christopher J. Moreau, and supported by a scientific advisory board and board of directors, positions the company to pursue multiple value-creating pathways. The company’s shares, traded on the CSE under the symbol AGN, are supported by a market capitalization of CA$3 million and an experienced leadership team driving its combined healthcare and pharmaceutical innovation strategy.

Ownership and Share Structure

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Algernon Pharmaceuticals Inc. (AGN:CSE; AGNPF:OTCQB; AGW0:XFRA)

According to the company, management and insiders own about 11% of the company, and about 21% is owned by institutions. The rest is with retail.

Top shareholders include Alpha North Asset Management with 20.52%, Chief Executive Officer Christopher Moreau with 5.05%, Chairman of the Board Harry Bloomfield with 1.97%, and Chief Financial Officer James Kinley with 1.4%, and Director Rajpaul Attariwala with 1.2%.

| Want to be the first to know about interesting Biotechnology / Pharmaceuticals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Algernon Pharmaceuticals Inc.,

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

- This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.

For additional disclosures, please click here.