Pasofino Gold Ltd. (VEIN:TSX.V) is developing its 100% owned Dugbe Gold Project in Liberia. After a long and severe bear market followed by a period of base building, its stock looks ready to commence a major new bull market.

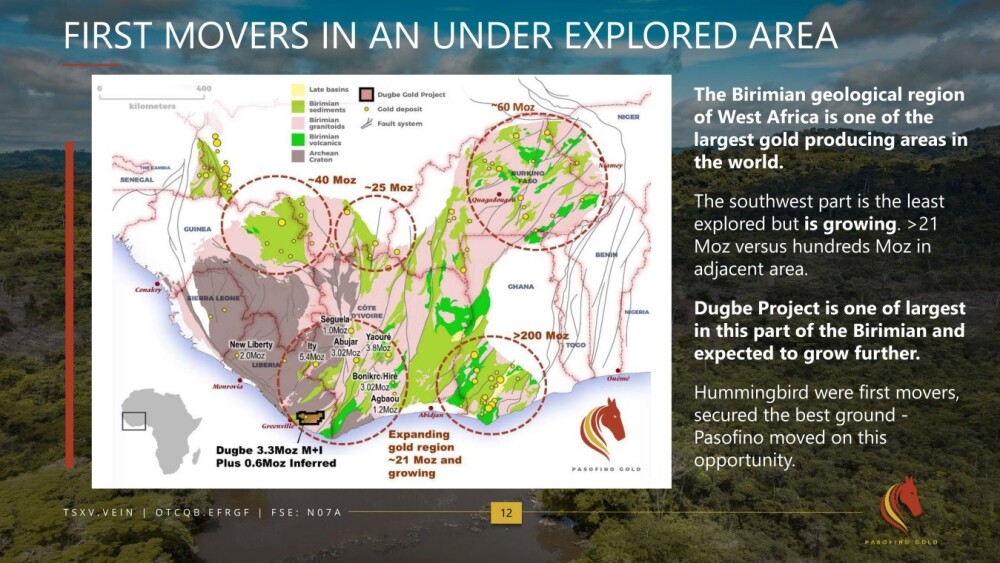

The following map shows the location and extent of the Dugbe Gold Project in Liberia and how it relates to other major gold deposits in the prolific Birimian Gold Belt which extends to the north and east of Liberia into the Ivory Coast, Ghana, Burkina Faso and even into Senegal.

The proximity of these major deposits within the belt obviously bodes well for further discoveries at Dugbe.

An important and highly pertinent reason for showing this map at the outset of this article is that it helps to make clear the strategic importance of the company's Dugbe Project, given the fact that powerful Chinese companies and investors are active in various parts of Africa acquiring assets and influence and the prolific Birimian Gold Belt is surely an area that will attract their interest.

It is thus interesting to learn that back in August, Pasofino announced that it had been engaged with multiple parties, with two of them providing offer letters to acquire the company. Further to this, in mid-September, the company announced that it had entered into an exclusivity deal for acquisition.

A few weeks later, a non-brokered private placement was announced as the company needed to maintain liquidity through this process. This private placement was successfully completed and brought in CA$3.3 million. However, a couple of crucial points for would-be investors here to note are that the exclusivity period granted to the interested counterparty expired some weeks back.

Nevertheless, the engagement with this counter-party continues as it remains interested, but in addition, it is considered to be highly likely that, given the attractiveness of the company's project, as set out below, there will be other suitors around wanting to buy the company who will possibly make an offer that is more attractive still to the company and its shareholders.

Now, we will proceed to overview the fundamentals of the company using selected pages from its October investor deck.

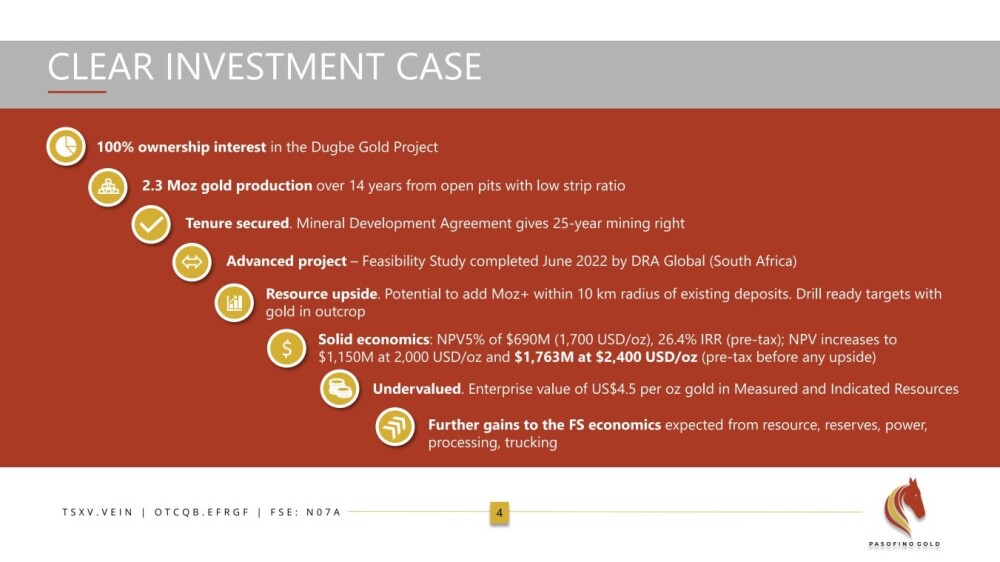

This first slide makes the case on one page for investing in the company. Of particular note is the Feasibility Study completed in mid-2022.

These are the key highlights of the project:

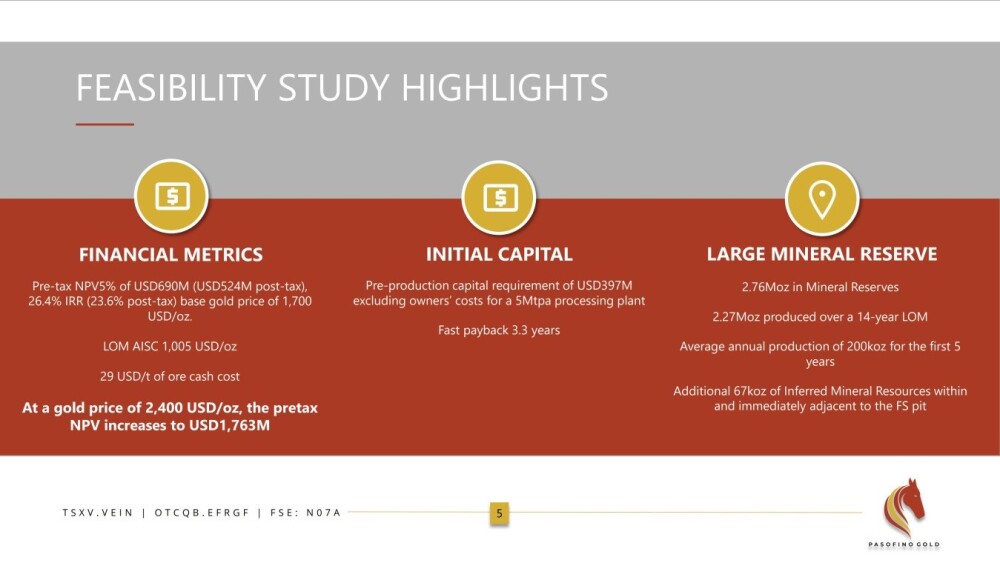

These are the highlights of the Feasibility Study:

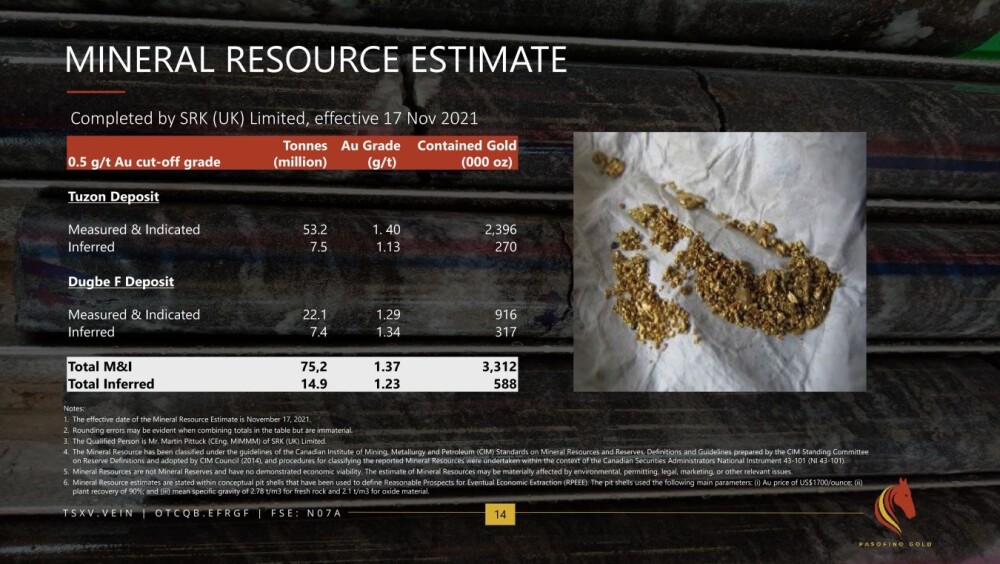

Here is the MRE (Mineral Resource Estimate) effective November 2021:

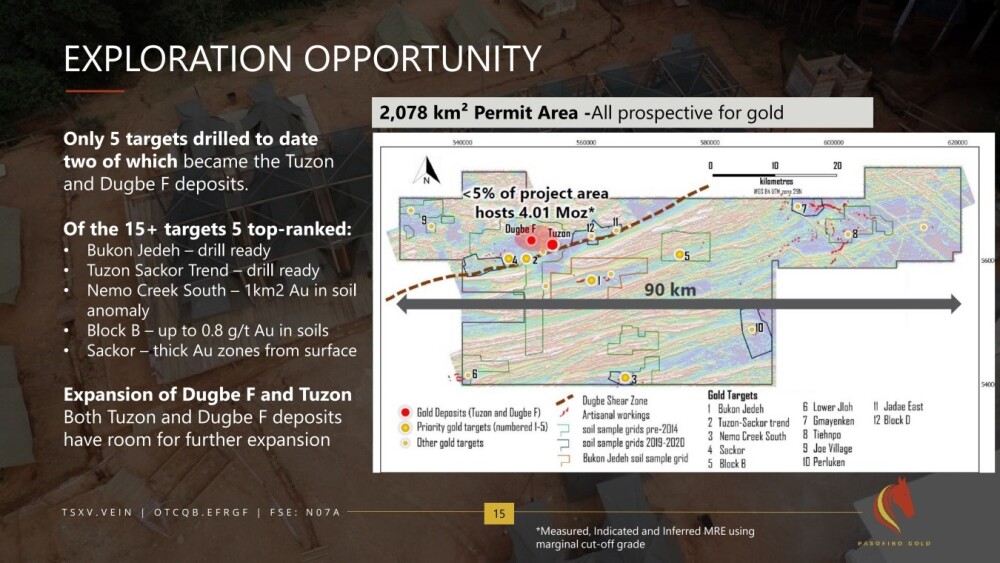

The following interesting slide shows the extent of the Dugbe Project and how two of the 15 drill targets became important deposits, Dugbe F and Tuzon, which are close to each other. Five of the 15 targets have been drilled to date, and exploration is ongoing.

From the Feasibility Study, the following Mining Strategy has been developed:

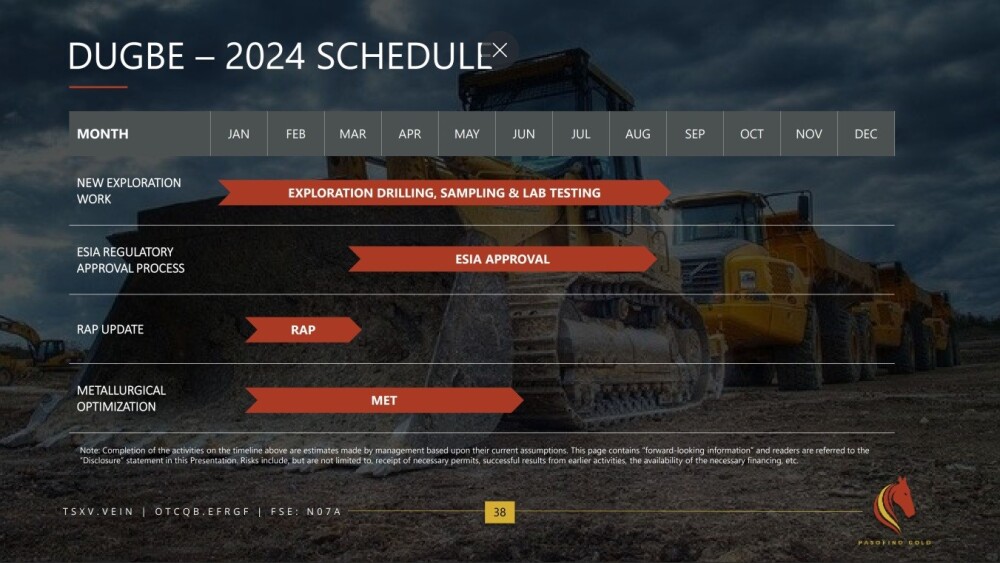

This slide shows what has been accomplished in 2024:

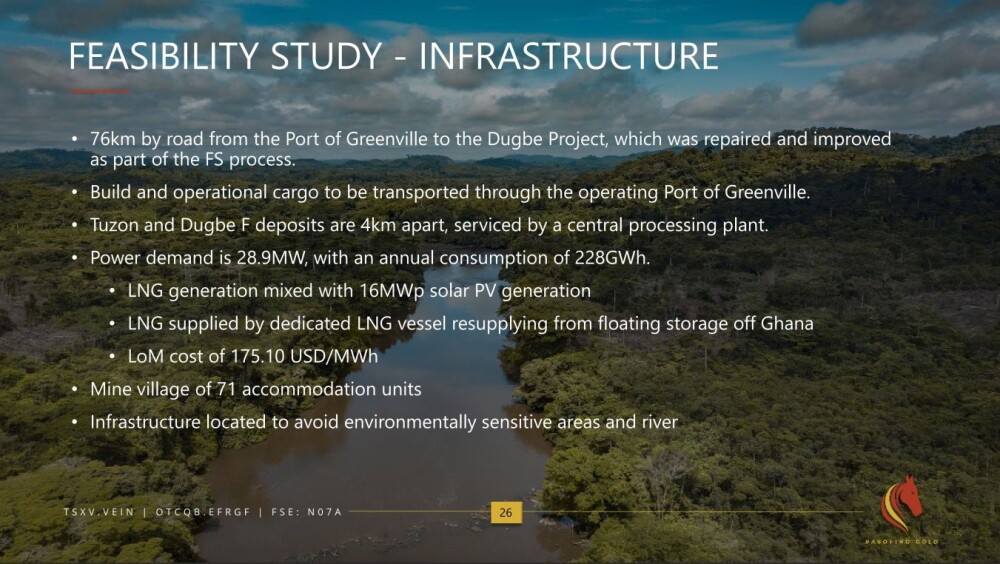

This one sets out the situation with respect to infrastructure:

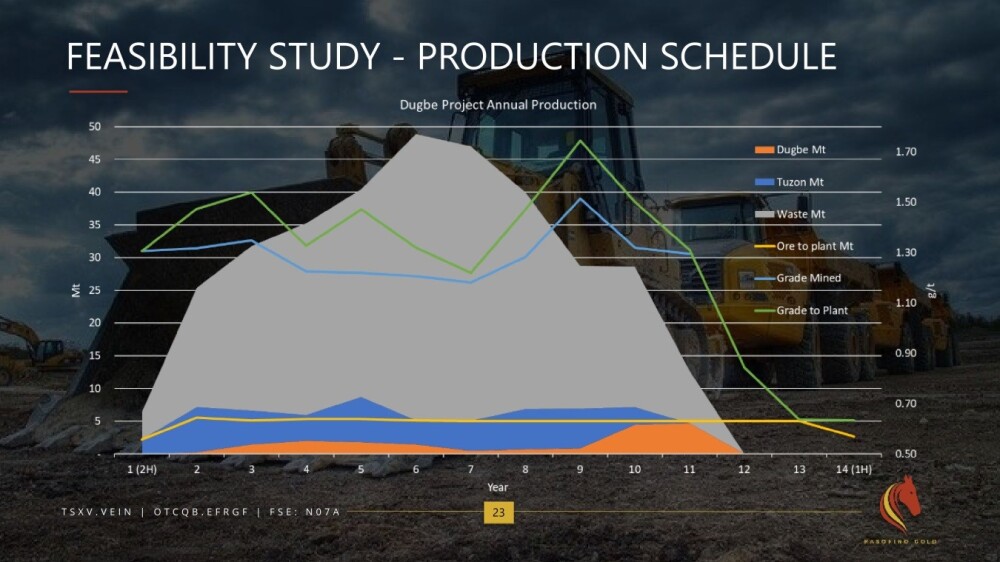

This graphic shows the projected production schedule of the property over its life:

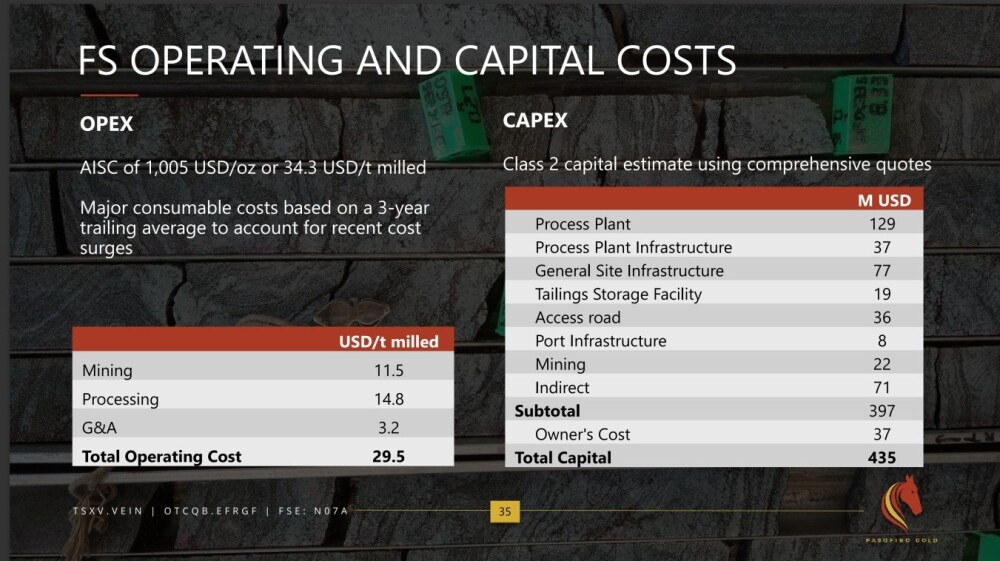

Projected operating and capital costs are below.

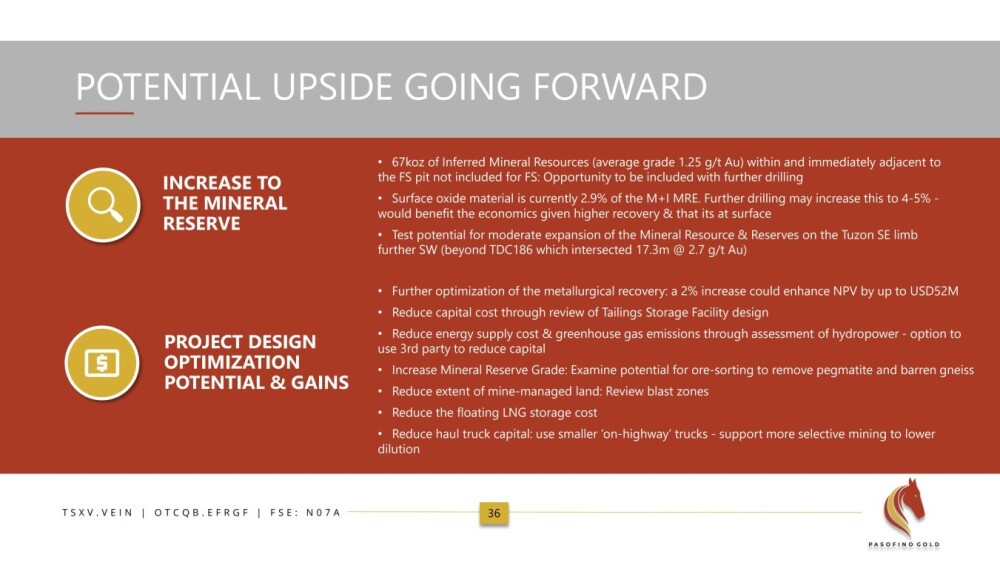

There is scope for the upside of the project with the prospect of further discoveries being made:

The number of shares outstanding is 112.23 million, 119.02 fully diluted.

Note that further information and details of exploration, geology, and other matters may be found in the investor deck, which is not included here for reasons of brevity.

Now, we will proceed to review the company's latest stock charts.

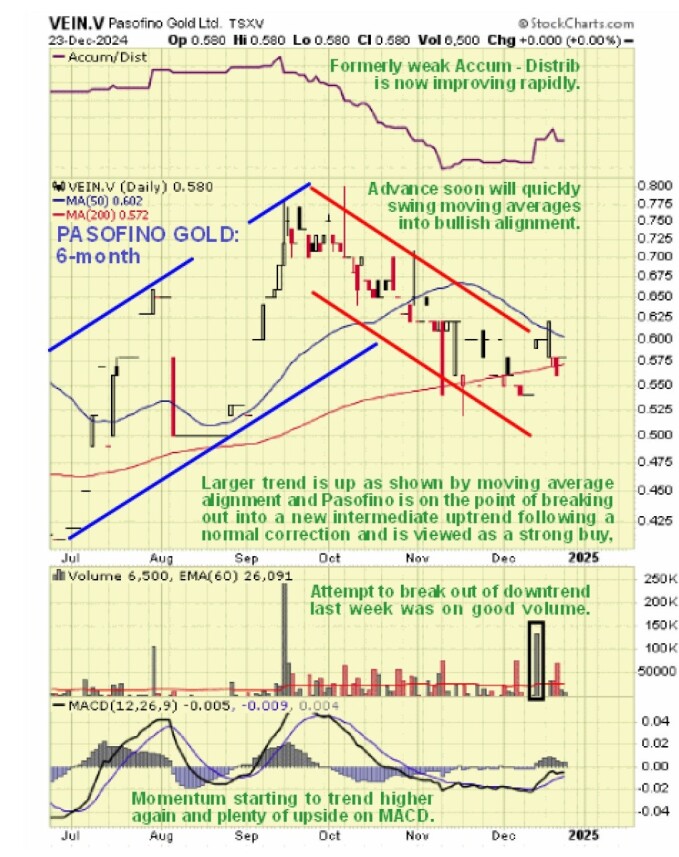

After a long, multi-year bear market, an uptrend has become established in Pasofino Gold this year, and it looks set to gain traction and accelerate going forward.

Whilst the very long-term 19-year chart shown below is technically useless, it does at least show us that Pasofino Gold traded at much higher prices in the early 2010s, adjusted for periodic consolidations (reverse splits), and even on this chart, we can see that there has been a big volume buildup this year which is viewed as a volume breakout that will lead before much longer to a price breakout, although on this arithmetic chart it is impossible to discern the price variation at current very low levels.

Zooming in, the 11-year log chart serves to "open out" the price action at low levels, enabling us to see the tentative uptrend that has become established this year and how it is nudging the price towards a breakout from the giant Falling Wedge that has developed from the 2016 high and which is now closing up, making a breakout more and more likely.

As mentioned above, this year's uptrend has been accompanied by a volume breakout that is expected to lead to a price breakout before long, and it is already close to breaking out. The reason that the volume buildup this year is interpreted as bullish is because it signifies that a considerable quantity of stock has rotated from weaker to stronger hands since the sellers are mostly selling for a loss while the buyers will be less inclined to sell until they have turned a profit and this effectively reduces the supply of stock around these levels.

On the 6-month chart, we can see that, after trending higher into mid-September, the price has corrected back within an orderly intermediate downtrend to arrive in a zone of support in the vicinity of its rising 200-day moving average, which is, of course, a good point for it to turn higher again and already last week it tried to with an attempted breakout from the downtrend on a marked increase in volume that drove up the Accumulation line, and this price / volume action is bullish, suggesting that a new uptrend will soon become established, which fits with the improving outlook for the sector.

In conclusion, Pasofino Gold looks very undervalued here and is set to start higher again soon. With a high and growing probability of a buyout soon on favorable terms for shareholders, it is rated an Immediate Strong Buy.

Pasofino Gold's website.

Pasofino Gold Ltd. (VEIN:TSX.V) closed for trading at CA$0.58 on December 24, 2024.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Pasofino Gold Ltd.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.