Unusual Machines Inc. (UMAC:NYSEAMERICAN) has put in a stellar performance since we looked at it on two occasions earlier this year, once in June when it was priced at about CA$1.40 and again in August when it was at about CA$2.00. At its recent high, it had made an 18-fold gain from where we first looked at it. We had correctly deduced that the "onshoring" of drone and drone component production would be highly beneficial to centrally positioned companies such as Unusual Machines, especially as its Flight Controller that gained approval in August has been a tremendous success with a huge influx of orders and in addition, it was announced late in November that Donald Trump Jr. would be joining the company as an advisor.

Before proceeding to review its recent outstanding performance on its stock charts and why it is starting to look attractive again here after its normal reaction back this month, we will first swiftly overview the fundamentals of the company using its latest October investor deck and with reference to some important news releases.

This first slide from the investor deck lists the INVESTMENT HIGHLIGHTS. Note, in particular, the US-based development and assembly, which is of fast-growing importance in an increasingly unstable world.

This slide overviews the company's business.

Unusual Machines is already an established company in the consumer drone field and has an e-commerce platform, "Rotor Riot," which generates $5 million in revenue per year with 20 to 30% year-on-year growth that looks set to continue. The company serves all segments of the drone market, which includes Drone Racing, where fast and agile drones take part in competitive events; Freestyle Flying, where drones are for hobby use and are used in aerial acrobatics, and Cinematic Filming, in which drones are used to make high-quality videos which are especially useful in the tourism trade.

Last February the company acquired the strong brands Fat Shark and Rotor Riot by means of a purchase agreement with their creator, Red Cat Holdings Inc. (RCAT:NASDAQ). Additionally, it is worth noting that the CCCP (Chinese Communist Party) Drone Act will ramp up the company's sales of Fat Shark products and video transmitter products and FPV (First Person View) goggles by shutting out the main Chinese competitors from the market. This slide emphasizes the contribution of Rotor Riot to the company.

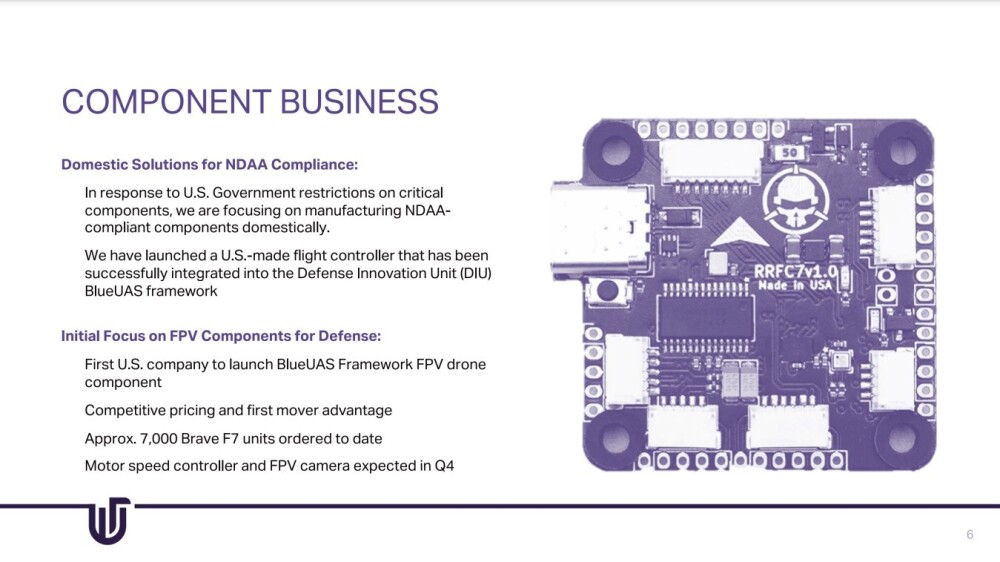

Government restrictions on the importation of critical components put the company in a strong position with its domestic production of approved components such as the already highly successful Brave F7 units (flight controllers).

Needless to say, the spread of global conflict is driving a big increase in demand for the company's products.

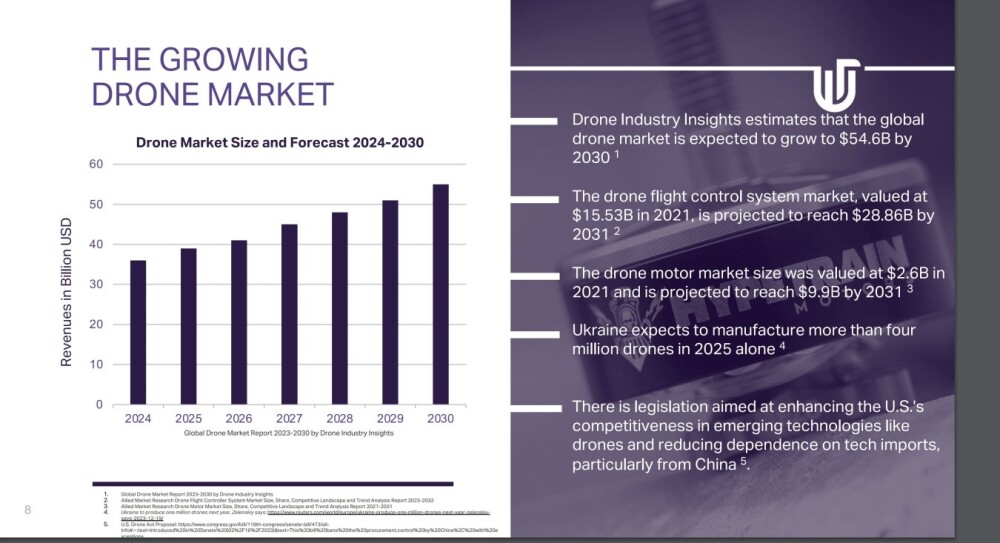

Steady and substantial growth is projected for the drone market through 2030 and beyond.

RIGHT PLACE, RIGHT TIME — this slide showing recent and proposed legislation makes clear that it's boom time for U.S. drone and drone component manufacturers who have done the necessary groundwork as Unusual Machines clearly has.

This slide shows the main players in the U.S. drone marketplace.

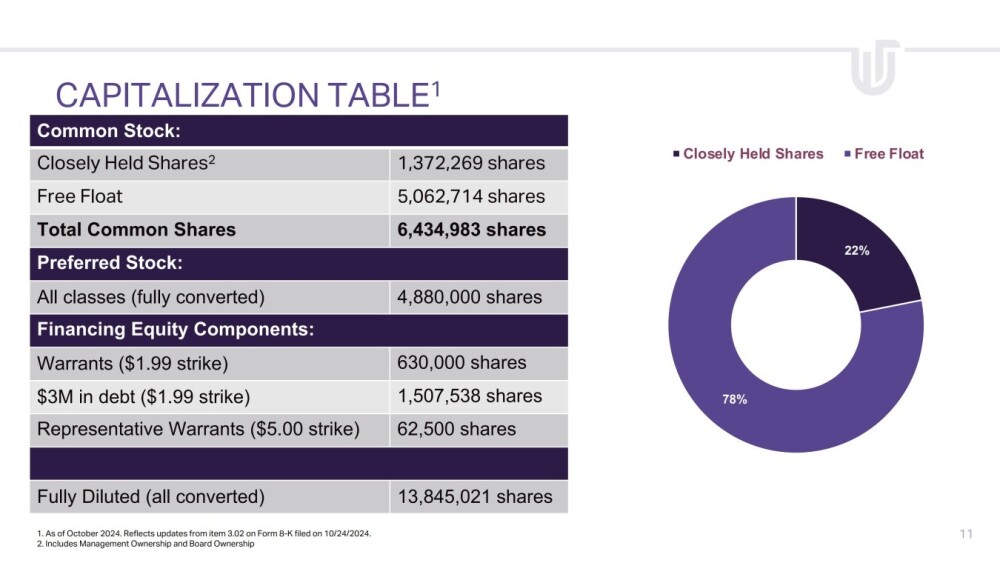

Lastly, this slide showing the capitalization table helps us understand why the stock recently made such a big move — there were only a little over 5 million shares in the float!

Amongst various news releases in recent months, perhaps the most important were the one making clear the roaring success of the Rotor Riot Brave F7 Flight Controllers and the one towards the end of November announcing that Donald Trump Jr. has joined Unusual Machines as an advisor — to put it mildly, he is well-connected.

Now we will consider the company's latest stock charts.

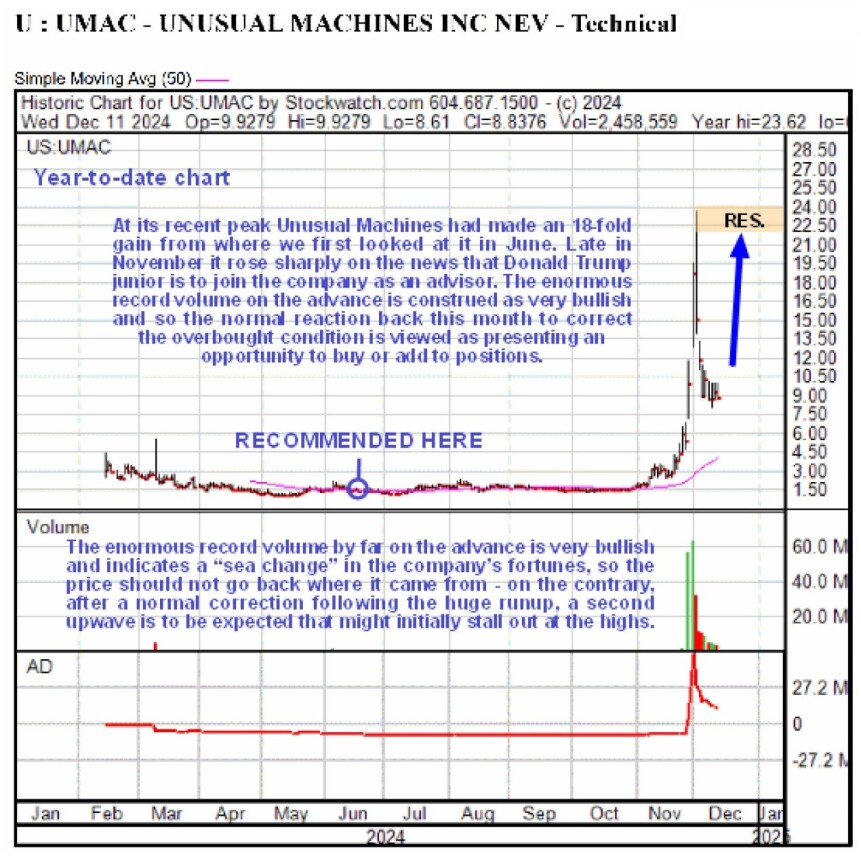

Unusual Machines, which was recommended on two occasions during the year as it trundled sideways, marking out a large base pattern, broke out in November into a spectacular rally that, at its peak, resulted in an 18-fold gain from where it was recommended last June as we can see on its latest year-to-date chart below.

The question now, of course, is whether this was just a one-off "flash in the pan" rally or whether this dramatic move marks the start of a major bull market. For both fundamental and technical reasons, it is thought to be the latter, which is the reason for this update, as the normal reaction back this month is believed to have brought it back into buying territory. Fundamentally, the company is in the right place at the right time as it is a drone company, and to put it mildly, this is a growth industry with demand exploding, and it just so happens that Donald Trump Jr. has joined the company on its advisory board, the news of which caused the stock to rocket higher late in November.

Technically, as we will now proceed to see on the charts, the stock does not look done — on the contrary, the sharp breakout move in November looks like the first upleg of a major bull market.

The year-to-date arithmetic chart shows the entirety of the low flat base pattern that formed during the year and how the price started to break out of it early in November and then formed a fine bull Flag in the middle of November before racing ahead towards the end of the month. By the end of the month, after the spike triggered by the news of Trump joining, it had become massively overbought, so the reaction that followed this month was a perfectly normal correction. The breakout and runup that followed was on massive record volume by far, which is viewed as having major long-term bullish implications. Now, we will look at the runup and subsequent reaction in more detail on a shorter-term chart.

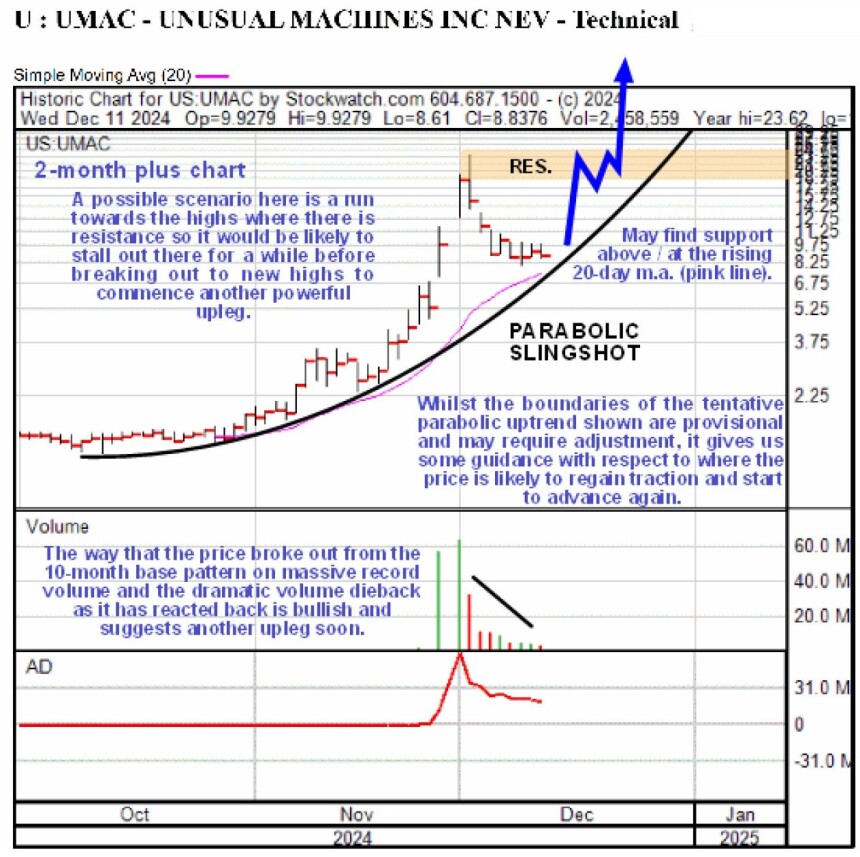

On a 2-month plus log chart, we can see that although the runup certainly looks steep on the longer-term chart, there is a fair chance that it will adhere to the parabolic uptrend channel shown, in which case we can expect another sharp upleg, probably to new highs. Whilst we would ordinarily not be surprised to see it break down below this parabola on account of the magnitude of the runup, the enormity of the change in the company's fortunes and the extraordinarily bullish volume pattern in the stock make another strong upleg more likely.

As we have already observed, the volume on the breakout from the base pattern and the runup that followed was colossal, and if we couple this with the marked volume dieback to a relatively low level as the price has reacted back this month, the picture continues to look strongly bullish. It is thus interesting to observe that the price has now reacted back almost as far as the significant support at the parabolic uptrend (which is provisional, and its boundaries may require adjusting) and the rising 20-day moving average, which is currently at the same price level as the parabola. So this is clearly a very good juncture for it to start higher gain, which the volume dieback this month suggests is very likely. However, we should note that, due to its still being substantially overbought despite the correction, it may initially run towards the highs but not get above them at first, instead perhaps consolidating beneath them in a trading range such as a Rising Triangle before going on to break out to new highs later, but in any event, this looks like a good point for it to start higher again.

In conclusion, it looks like Unusual Machines is set to start higher again soon, and while it may initially find it a challenge to break out to new highs, it should proceed to do so in due course as its still young bull market becomes established. Would-be buyers should note, however, that there is some chance that the current correction turns out to be a 3-wave drop with the initial steep decline that we have already seen followed by a narrow trading range that is now forming, which breaks into a much more modest drop before it reverses to the upside again. This is considered unlikely because of the strongly positive volume pattern, but we should be aware of the possibility. The way to handle this for those interested in buying is to do some buying here and more if we see upside volume kick in and much more if we see another (lesser) downleg.

Unusual Machines' website.

Unusual Machines Inc. (UMAC:NYSEAMERICAN) closed for trading at US$8.80 on December 11, 2024.

| Want to be the first to know about interesting Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Unusual Machines Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Unusual Machines Inc. and Red Cat Holdings Inc.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.