Silver47 Exploration Corp. announced the first results from its 2024 drill program at its wholly owned flagship Red Mountain Project in Alaska.

According to the company, results for the first six holes drilled on the property this year indicate "strong potential for increased high-grade infill drilling within the Dry Creek resource area."

"We are extremely excited to report these kinds of high-grade polymetallic intercepts in our first drill program on the project," said Vice President of Exploration Alex Walls. "This drill intercept supports our thesis that Red Mountain Project hosts significant precious metal enrichment in addition to the base metal endowment."

Silver47 said a total of 1,039 meters of drilling was completed in six holes at the Dry Creek, West Tundra Flats, and Kiwi prospects combined.

"Drilling cut several massive sulfide horizons within a 24.5-meter semi-massive mineralized section at the Dry Creek Zone with the highest gold grade interval intercepted to date on the project and remains open," the company said in a release.

The results released this week include:

- From a depth of 128.29 meters, Hole 106 cut 2.48 meters of 61.44% Zn Eq (zinc equivalent) or 2,938.5 g/t Ag Eq (grams per tonne silver), 14.95 g/t gold (Au), 249.50 g/t Ag, 21.97% Zn, 7.03% lead (Pb), and 0.42% copper (Cu).

- From a depth of 133.87 meters, Hole 106 cut 0.91 meters of 46.74% Zn Eq or 2,235 g/t Ag Eq, 8.08 g/t Au, 225.00 g/t Ag, 21.20% Zn, 6.68% Pb, and 0.42% Cu.

- From 126.40 meters to 150.91 meters, a 24.51-meter interval graded 10.17% Zn Eq or 486.3 g/t Ag Eq. 1.99 g/t Au, 55.50 g/t Ag, 4.08% Zn, 1.32% Pb, and 0.10% Cu.

Expanding Existing Resource

Based in British Columbia (B.C.), Silver47 is a mineral explorer with a diverse portfolio of silver-polymetallic projects in North America, including Red Mountain in Alaska, Adams Plateau in B.C., and Michelle in the Yukon. Its flagship asset, Red Mountain, is a volcanogenic massive sulfide (VMS) deposit rich in silver, gold, zinc, copper, and lead.

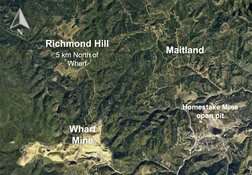

Red Mountain is located about 100 kilometers south of Fairbanks on state-managed lands in a top-tier, pro-mining jurisdiction. Alaska ranked as the 11th most attractive jurisdiction for mining investment out of 86 places worldwide last year, according to the Fraser Institute.

Red Mountain's current NI 43-101 compliant resource stands at 15,600,000 tons (15.6 Mt) of 7% zinc equivalent in the Inferred category. This is equal to 168,600,000 ounces (168.6 Moz) of 335.7 grams per ton of silver equivalent.

The company aims to expand the Red Mountain resource with its "Exploration Target" of 50-75 million tonnes at 300-400 g/t Ag Eq for and estimated to 500–900 Moz (million ounces) of Ag Eq and advance it toward a development decision, while generating new discoveries.

Chen Lin, asset manager behind What is Chen Buying? What is Chen Selling? wrote on Oct. 28. "The Red Mountain Project has a lot of exploration upside."

'A Great Silver Story'

Silver47 bought Red Mountain from White Rock Minerals after pivoting from the Michelle Project as permitting continues there. The company also went public, being listed on the TSX Venture exchange this month.

Red Mountain also benefits from existing infrastructure, with a haul road 30 kilometers away, and is free from federal jurisdiction and indigenous claims since it sits on state-managed lands, pointed out 321gold's Bob Moriarty.

"Silver47's valuation represents a fraction of comparable silver projects, offering investors exposure to silver at roughly one-tenth the cost of peer companies," Moriarty wrote for Streetwise Reports on November 14. "Being an investor in Silver47 for a few years now, I was pleased to hear it was going public. The market is keeping a keen eye out for a great silver story. With Silver47, you can buy silver for a major discount (around 10% less) than what others are paying for other companies that have less silver."

The Catalyst: Silver 'Ready to Take Off a Bit?'

Silver broke through US$35 per ounce last month, reflecting a year-to-date gain of about 47%, but has continued to "see a lot of noise," Christopher Lewis of FX Empire wrote, as it sank to US$29 last week. It was US$31.09 on Monday.

"The silver market rallied significantly during the early hours on Monday, as it looks like we are ready to take off a bit," Lewis wrote. "It's probably worth noting that the US$30 level came in as pretty significant support based not only on previous action, but psychology, I would imagine, and of course, the possibility that there were quite a few options trades placed there, and that always tends to have an effect on markets as well."

Lewis said, "The market had been in an uptrend for quite some time before this significant fall, so the question now is, will the momentum pick up to the upside? It’s very possible, but I also recognize that if we were to break down below the lows of Thursday of last week, then we almost certainly will test the 200-day EMA at the $29 level."

Silver is the most conductive element in nature. It's used to coat electrical contacts in computers, phones, cars, and appliances. It's also an important element in solar technology.

Mordor Intelligence noted that the white metal is expected to register a compound annual growth rate (CAGR) of more than 5% between 2024 and 2029.

Newsletter editor Brien Lundin encouraged investors not to get discouraged, as any price drop-off is temporary, he said.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Silver47 Exploration Corp. (AGA:TSX.V)

Based on silver's charts, Ron Struthers of Struthers Resource Stock Report also predicted a major run-up in the silver price.

"Back in April or early May, I highlighted the breakout from a cup and handle formation and [that] that would lead to a major upside move. This is now confirmed," he wrote on Oct. 23.

Ownership and Share Structure

The company said its three largest shareholders are Eric Sprott, Crescat Capital, and management.

According to Reuters, about 10% of Silver47 is held by strategic investor Silver Range Resources Ltd. and Chief Executive Officer Gary Thompson owns about 21%.

The silver explorer has a tight share structure with 50 million total shares, 65 million fully diluted. Its market cap is CA$34.03 million and it trades in a 52-week range of CA$0.65 and CA$0.79.

| Want to be the first to know about interesting Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |