The stock of Innovative Holdings Alliance (IHAI:OTCMKS) has huge upside potential from its current low level, and when you have a basic grasp of the fundamentals of the company and then look at its stock charts you will quickly understand why. We are going to do both here.

The greatest challenges to the widespread adoption of electric vehicles are associated with battery life, range, and battery thermal stress, meaning overheating in high-load situations. Innovative Holdings Alliance's Premergy, which it acquired 100% ownership of last January, addresses all three of these problems in a comprehensive, integrated manner with its fully patented proprietary technologies that make huge improvements possible in all of these areas.

As the company says, "Premergy currently holds 30 patents in the areas of Multi-Chemistry Battery Systems, Rapid charging systems, and Solar charging solutions. Our multi-chemistry technology provides a 20 percent increase in range and a dramatic reduction in thermal stress on the battery packs. While our Rapid charging solutions allow us to charge any battery chemistry two to three times faster without force-feeding the battery. Our patented technology reduces heat during charging, allowing for better battery life and charging safety. Finally, our solar solutions provide the ability to harness low morning and late evening light to enhance the charging of the solar battery packs.

All three of these technologies can work collectively for an overall solution, including dual battery chemistry, Rapid charging, and taking advantage of incorporating solar for charging.

Premergy's technology is applicable for the Auto, Aerospace and Marine industries. While the Auto industry is currently in flux. The Aerospace and Marine industries are quickly embracing new EV technologies. That is why Premergy is currently focusing its attention on the Drone segment of Aerospace.

The global commercial drone market size was estimated at US$30.02 billion in 2024 and is expected to grow at a CAGR of 10.6% from 2025 to 2030. The market growth is attributed to the increasing enterprise application of drones across various industry verticals. Several drone manufacturers are continually testing, inventing, and upgrading solutions for diverse markets used for various applications, including filming and emergency response. Besides, the integration of modern technologies in commercial drones to deliver enhanced solutions is opening new growth opportunities for the commercial drone market.

The global drone battery market size was US$6.84 billion in 2023, calculated at US$8.07 billion in 2024, and is expected to be worth around US$42.32 billion by 2034. The market is slated to expand at 18.02% CAGR from 2024 to 2034."

From the above, it is clear that Premergy is aiming for all markets where its technology is applicable, especially those with the greatest growth prospects. The following slide from the company's latest investor deck overviews what its innovative technology offers.

This company snapshot overviews its well-developed portfolio of patents, its unique technology solution that will help the industry move forward, and how this has been proven up to the point that it is ready for commercialization.

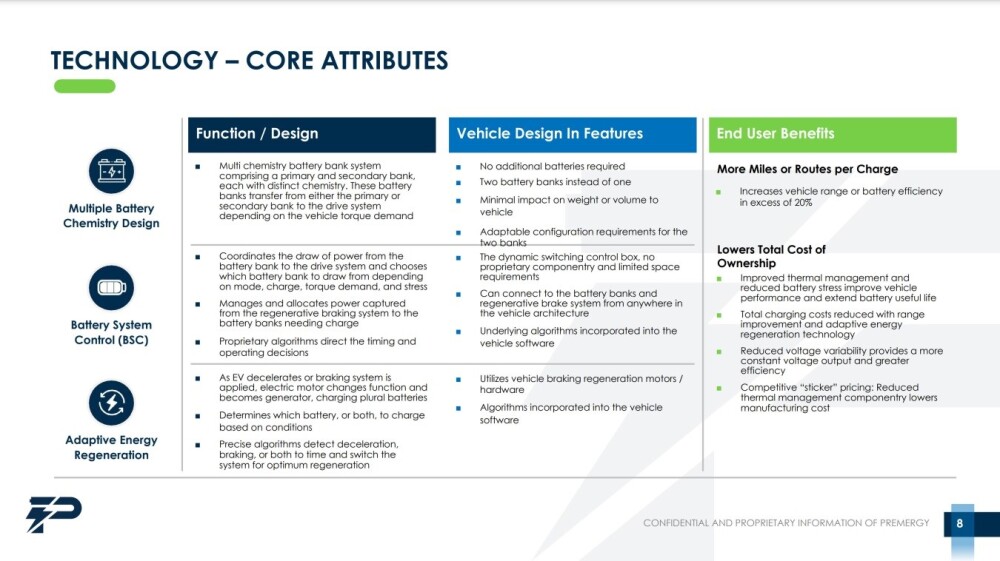

Core attributes of the technology are set out on the below slide.

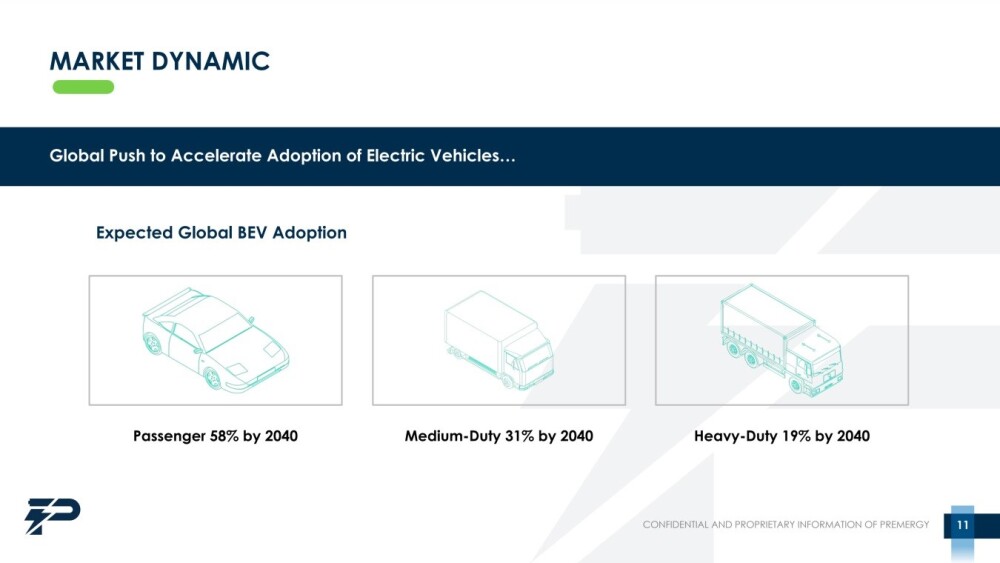

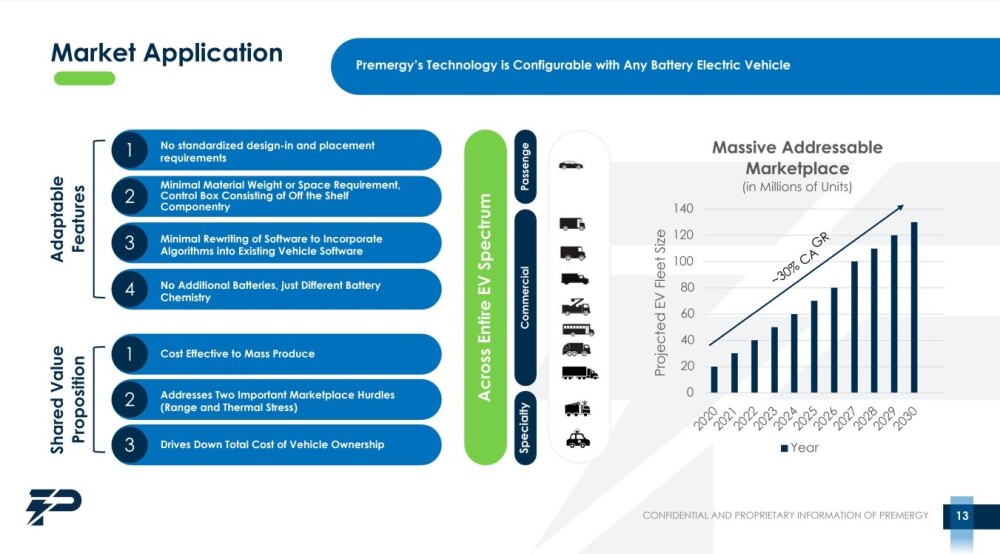

Premergy's technology increases efficiency or range by more than 20% and is applicable across the entire EV spectrum, including passenger cars and trucks, buses, military and government vehicles, trucks, vans and tractor trailers etc.

An estimated 35% of all vehicles will be electric by 2040, which is a US$3.5 trillion market.

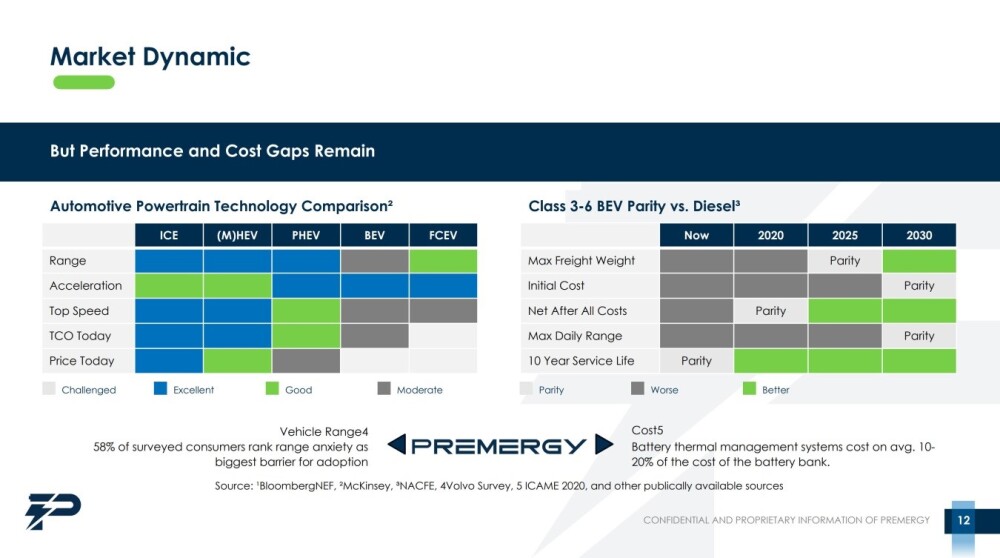

The performance and cost gaps between ICU's (internal combustion engine driven vehicles) and EV's that require to be closed that have until now constrained the EV market are set out on this slide which shows how they are expected to narrow going forward.

A key point set out on this slide is that Premergy's technology is configurable with any battery electric vehicle.

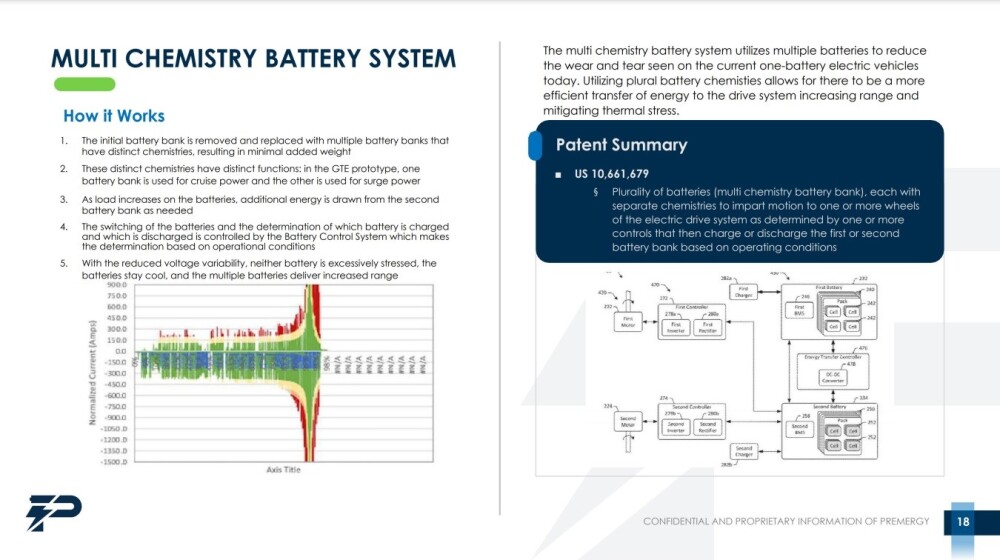

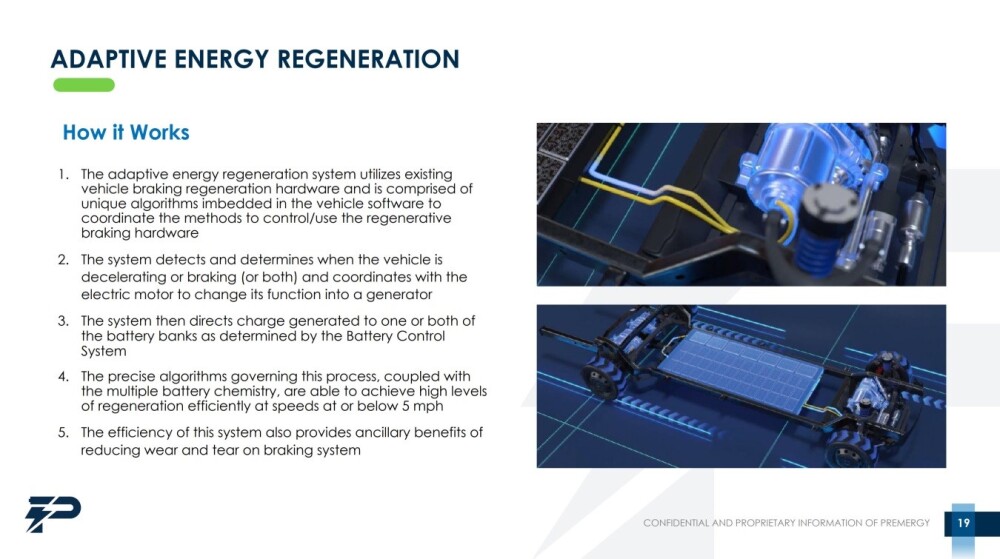

The way the technology works is that there is a secondary battery bank that kicks in and reduces the load on the primary battery bank during times of high load that would otherwise cause potential battery damage and reduced life and eliminates the problem of overheating for both battery banks thus prolonging range and battery life.

The thermal stress reduction also means fewer cooling parts and lower manufacturing costs. The key to how this technology works is the company's patented multi-chemistry battery system.

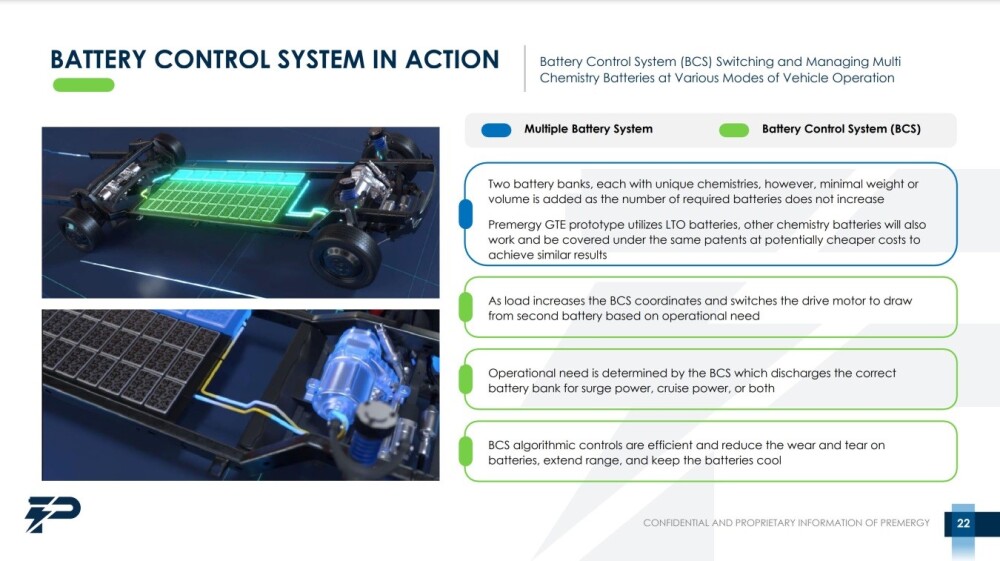

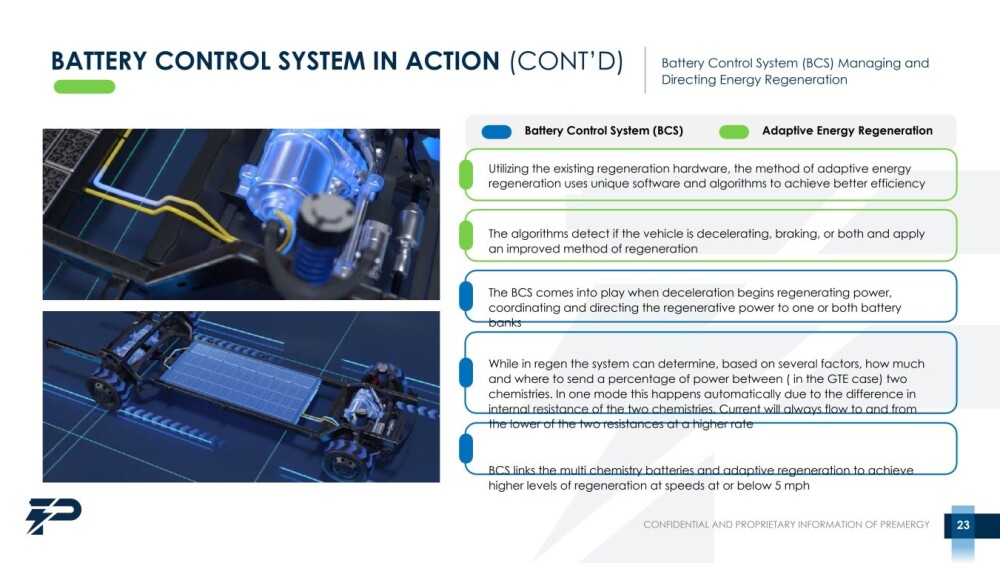

A sophisticated battery control system switches and manages the multi-chemistry batteries at various modes of vehicle operation.

This extends to control of energy regeneration when the vehicle is decelerating or braking.

This slide shows how the energy regeneration system works.

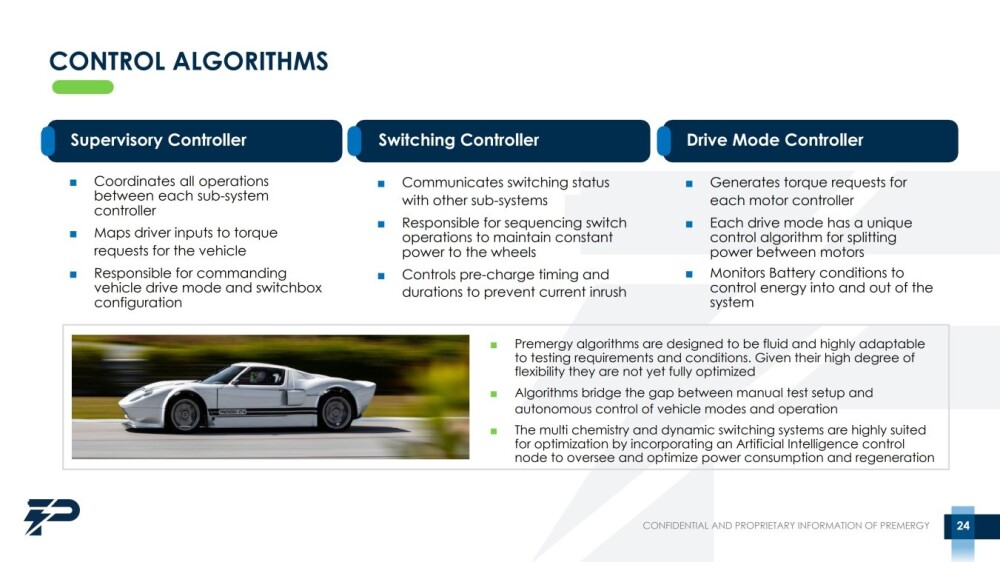

This slide details the control algorithms.

During deceleration and braking, the electric motor changes function and becomes a generator, recharging both battery banks according to their requirements, maximizing energy recovery down to speeds of 5 mph or less. Switching control software optimizes performance at all times.

Third-party testing of Premergy's multi-chemistry battery architecture has verified range improvements of more than 20%. In summary, Premergy's Smart-switching technology allows for multiple modes of operation, extended range, reduced thermal stress, extended battery life, and maximized power regeneration with little or no increase in weight or volume, thus closing the cost–range gap between electric vehicles and internal combustion driven vehicles.

Refer to the investor deck to find details of the technology development history, the intellectual property portfolio (extensive list of patents established), the global push to accelerate the adoption of electric vehicles, and the development achieved using the company's GTE vehicle prototype and the opportunity spectrum for those adopting the technology which is not included here for reasons of space.

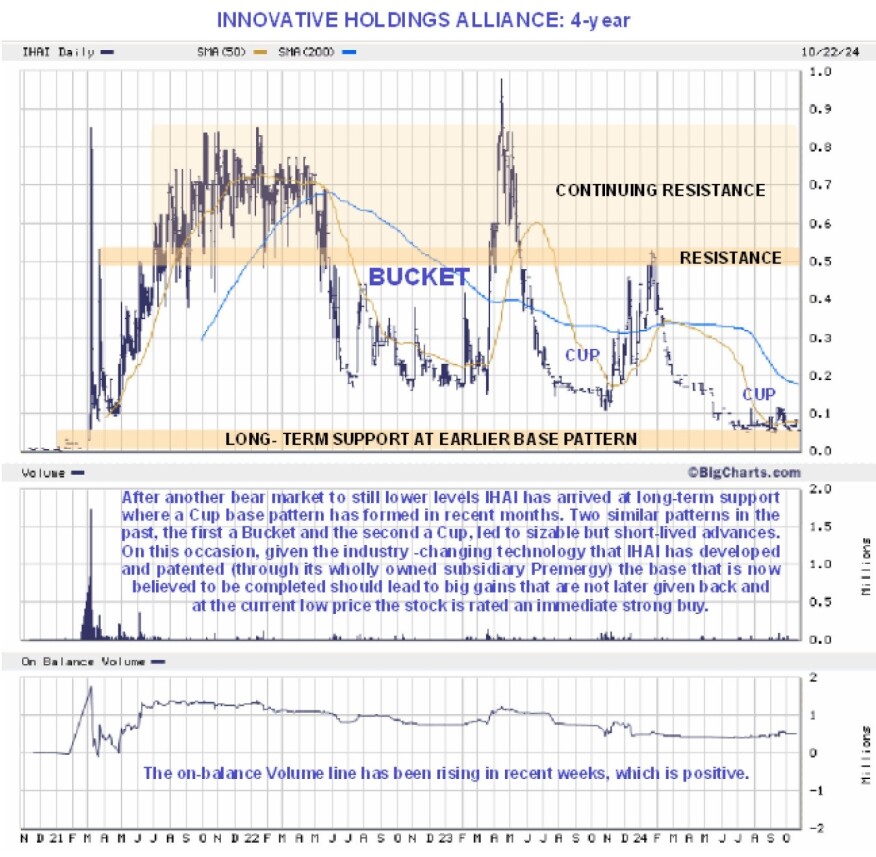

Turning now to the stock charts for Innovative Holdings Alliance the first point to make is that, even if you don't know much about charts you should be able to see that it looks like a buy here, if you do understand charts you will or should quickly see that there is a compelling technical case for buying the stock here.

Starting with the longer-term 4-year chart, we see that the stock has made some huge percentage swings over the past several years. The strong uptrend in 2021 was followed by a large choppy top pattern that led to a steep drop, this drop forming the left side of a Bucket base. A dramatic and steep rally that formed the right side of the Bucket base took the stock to new highs but then it reversed and gave back all of the gains and more, dropping to beneath the low of the Bucket.

Then, a smaller Cup base formed that led again to big percentage gains over the course of several months, but again, it reversed to the downside with the price going on this year to drop below the low of this Cup with the decline bringing it all the way down to long-term support above the base pattern that preceded the strong uptrend in 2021. Yet another Cup base has formed in recent months at a low level at this support that we will now proceed to look at on the 1-year chart.

The 1-year chart shows the Cup base that has formed since June of this year in much more detail. The most important point to observe on this chart is the increasingly bullish volume pattern, especially since early September, with bouts of aggressive buying driving the On-balance Volume line higher in an uptrend.

This is bullish volume behavior, and with the Cup looking like it is close to complete and moving averages flattening out, the probability of a sustainable advance gaining traction soon is fast increasing. It should be pointed out that, due to the extraordinarily positive fundamentals of the company, this time, gains made, unlike over the past several years, are unlikely to be given back.

Innovative Holdings Alliance is therefore rated a Strong Buy in this area.

Innovative Holdings Alliance's website.

Innovative Holdings Alliance (IHAI:OTCMKS) closed for trading at US$0.0851 on October 21, 2024.

| Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Innovative Holdings Alliance.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, XXXXX.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.