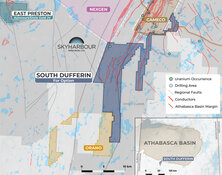

North Shore Uranium Ltd. (NSU:TSX) announced more details of its target generation efforts at its Falcon uranium project at the eastern margin of Saskatchewan's Athabasca Basin.

Out of three exploration zones, the new release discussed 15 targets in Zone 2. The company has identified 36 uranium targets across all three zones.

“We have a great pipeline of targets to choose from for our next drill program at Falcon," said President and Chief Executive Officer Brooke Clements. "Our Zone 2 has attracted the interest of uranium explorers in the past and we believe there is potential to make a significant uranium discovery using new data and interpretation.”

Earlier this month, North Shore announced it had received a Crown Land Work permit for the full 55,700-hectare Falcon project. Issued by the Saskatchewan Ministry of Environment, it authorizes the company to conduct mineral exploration activities, including prospecting and ground geophysics, trail and drill site clearing, line cutting, the drilling of up to 75 exploration drill holes, and the storage of drill core. The permit expires in July 2027.

The 15 targets identified in Zone 2 were selected using multiple datasets interpreted by Condor North Consulting LLC, Earthfield Technologies Inc., Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE), TerraLogic Exploration Inc., and North Shore.

Unlike Zone 1, where there had been no significant drilling prior to 2024, there have been several drill programs focused on parts of two prominent EM conductor systems in Zone 2, the company said, including seven holes in 1979, 28 holes in 2008, and one hole by North Shore early this year.

"One focus of the evaluation of Zone 2 is to determine the priority of investigating areas with previous drilling based on results from the drill programs and new interpretation, versus new target areas that have seen no drilling," the company noted in a release.

Options Being Considered

The hole drilled earlier this year by North Shore at target P12 was abandoned at 107.6 meters, short of the targeted conductor depth of 125 meters, due to unstable ground conditions, the company said. A fault zone with elevated boron values up to 74 ppm was identified from 10 to 12.5 meters, the company said.

Future work options in the area being considered by the company include completing the drilling of the P12 target, using new data to determine if more drilling is justified where holes were drilled in 2008, and selecting other targets yet to be evaluated.

One target, FA020, outcrop grab samples showed up to 0.492% U3O8 and 1,300 ppm lead (Pb) within a 10- to 20-meter wide sheared pelitic unit with granitic inliers, the company noted. Holes were drilled in 2008 at the eastern end of the EM conductor.

Another possible target, F011, "is located along the strong northeast-trending conductor system that has been the focus of previous exploration programs," the company said. "There is an interpreted fault intersecting the conductor system coinciding with a slight disruption in the conductor at the fault intersection."

North Shore said it will continue prioritizing targets at Falcon to maximize the chances of success in its next drilling program. As currently planned, it would have two components: follow-up drilling in areas with previous drilling such as the 3-kilometer trend within Zone 1 where the company discovered near-surface uranium mineralization and portions of Zone 2, and the testing of new targets.

North Shore said it would provide updates on target prioritization efforts "on an ongoing basis."

Still Room for More Success in Basin?

Uranium expert and strategic advisor to the OAM Uranium Opportunity fund, Alex Molyneux, was also a founding investor in North Shore. He has said that there is still room for more success in the eastern Athabascan Basin.

"North Shore has picked up prospective tenements on the eastern margin of the basin that are outside of the areas that are dominated by Cameco Corp. (CCO:TSX; CCJ:NYSE) and Orano and other major groups, and it can make a discovery," said Molyneux, who is also the former CEO of Paladin Energy. "And all they have to do is discover something that's a bit better than what Cameco and Orano have in their inventory, and then, boom, it's going to attract a lot of attention, potentially with the majors."

The private company that ultimately became North Shore acquired its initial tenements from several prospectors and added neighboring tenements that are now part of the company's Falcon Project under option from Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE) to complement its prospective land package.

One analyst has noted the company's strategy is on target. "As the company continues to execute on its exploration strategy at Falcon and West Bear, we believe that the stock has the potential to rerate," Red Cloud Securities Analyst David Talbot wrote in a research report earlier this year.

The Catalyst: Fueling the Energy Transition

As the fuel for nuclear power, uranium is one of the most important elements for the energy transition, but it's had a bumpy year. It rose to US$106 per pound in February but hasn't returned to those heights since then. The price was US$82.85 on Monday.

But higher demand and prices could still be coming, signaled by a dwindling supply of secondary sources, including uranium in stockpiles and decommissioned nuclear weapons.

According to Nucnet, analysts at Bank of America Securities now say the price could rise to US$135 per pound by 2026.

High-tech and artificial intelligence (AI) companies are looking for more carbon-free power sources going forward. Microsoft just announced a 20-year deal with Constellation Energy to buy all of the power from the potentially reopened Three Mile Island plant, site of the worst nuclear disaster in U.S. history, to use for AI. The reactor in question closed five years ago and could be revived in 2028, depending on Nuclear Regulatory Commission approval.

And recently at New York Climate Week, a group of 14 global financial institutions expressed support for tripling nuclear energy capacity by 2050.

Ownership and Share Structure

Insiders and founding investors own approximately 45% of the issued and outstanding shares. Clements himself owns 3.6% or 1.33M shares, Director Doris Meyer has 2.11% or 0.78M shares, and Director James Arthur holds 1.58% or 0.58M shares. According to North Shore, 14.92M shares (40.5%) held by six founding investors are subject to a voluntary pooling agreement that restricts disposition of these shares before October 19, 2026.

Most of the rest is with retail, as the institutional holdings are minor.

North Shore has 36.84M outstanding shares.

The company currently has a market cap of CA$2.21 million. It has traded in the past 52 weeks between CA$0.06 and CA$0.30 per share.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- North Shore Uranium Ltd. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of North Shore Uranium Ltd.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.