Streetwise Articles

Investing in Silver: Double Down on the White Metal's Gains

Source: Don Miller, Money Morning (9/5/12)

"Thanks to wildly bullish technical and fundamental indicators, silver could soon retest its 2011 high, or even blow through it."

More >

Medtech Deals Buoyed by Cost Pressures, Device Tax

Source: Reuters, Debra Sherman and Soyoung Kim (9/5/12)

"Medical device mergers look poised to take off in 2013 as the industry compensates for shrinking reimbursements, a new U.S. tax and executive shake-ups at its biggest companies."

More >

Has QE3 Already Begun?

Source: Toby Connor, GoldScents (9/4/12)

"With the recent breakout of the frustrating consolidation zone that always follows a B-Wave bottom I think gold is now ready to begin the initial phase of the next C-Wave advance."

More >

Gold, Silver, Mining Stocks: Breakout Time, Not Bubble Time

Source: Jeb Handwerger, Gold Stock Trades (9/4/12)

"Precious metals and miners appear to be making constructive and powerful breakouts."

More >

Near-Term Targets for Gold, Silver and Mining Shares

Source: Jordan Roy-Byrne, The Daily Gold (9/4/12)

"It's amazing. Two months ago you couldn't give away mining shares or silver. Suddenly, everyone is bullish again."

More >

Don't Push the Panic Button on Rare Earths: Lisa Reisman

Source: Brian Sylvester of The Critical Metals Report (9/4/12)

Lisa Reisman describes herself as a "classic libertarian," but the managing editor of MetalMiner.com nonetheless believes government has a role to play in protecting and developing domestic supplies of critical metals. In this exclusive Critical Metals Report interview, Reisman argues for private/public partnerships and explains why today's low prices don't faze her—or surprise her.

More >

Could More Lithium Mining Stocks Benefit from Merger Mania?

Source: Zig Lambo of The Energy Report (9/4/12)

Rockwood Holdings' deal with Talison Lithium means more consolidation in an already tight market. With demand on the rise and supply lagging behind, lithium juniors and their partners are jockeying for market share. Analyst Jonathan Lee dissects the deal's implications in this exclusive interview with The Energy Report and champions both low-cost producers and Argentinean plays in this growing industry.

More >

Colombia Oil Stocks: Time to Invest Once Again?

Source: Keith Schaefer, Oil and Gas Investments Bulletin (9/4/12)

"Now, these stocks have not only fallen to earth, they've crashed through the floor into the basement—despite good oil prices. What happened? And more importantly, is this an opportunity for investors?"

More >

The Real Answers in China Are Never That Simple

Source: Keith Fitz-Gerlad, Money Morning (9/4/12)

"Rather than tackling the incessantly 'they'll never succeed because they're not democratic' or 'ghost cities' arguments, let's dig into the subtleties that escape most Westerners."

More >

U.S. Shale Glut Means Gas Shortage for Mexican Industry

Source: Reuters, Carlos Manuel Rodriguez (9/4/12)

"Mexican gas prices are tied to rates in its northern neighbor, where soaring supplies from shale fields drove gas to a 10-year low and reduced Mexico's wholesale price 32% in the past year. Manufacturers can't get enough of the energy."

More >

Invest in Silver Before Prices Climb Higher

Source: Deborah Baratz, Money Morning (9/4/12)

"For silver investors, news of stimulus measures would be just the bounce they need."

More >

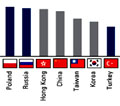

The Case for Emerging Europe

Source: Frank Holmes, U.S. Global Investors (9/4/12)

"Many investors have interpreted the underperformance of the iShares S&P Europe 350 ETF as a contrarian sign to hunt for bargains in developed Europe. However, even greater opportunity may lie to the east—in Poland, Russia and Turkey."

More >

The 'Experts' Are Wrong About Oil Prices

Source: Kent Moors, Oil & Energy Investor (9/4/12)

"Their argument is deceptively simple—with all of shale oil coming on the market, there will be an oil glut in the U.S. Gluts naturally depress prices. And those pounded-down prices will force companies to fold. Unfortunately, the argument is both simplistic and wrong."

More >

Colorado Wrestles with Fracking Rules

Source: Penelope Kern, Energy Prospects West (9/4/12)

"The memo of understanding between Erie, EnCana and Anadarko could serve as a model for future agreements between cities and energy companies."

More >

What to Do When, Not If, Inflation Gets Out of Hand

Source: Jeff Clark, Casey Research (9/4/12)

"Are you prepared to handle high inflation for a sustained period of time?"

More >

Why the GOP Is Really Talking About the Gold Standard

Source: Ben Gersten, Money Morning (9/4/12)

"The move to 'audit the Fed' and a return to the gold standard are two ideas Ron Paul supporters care most about."

More >

Project Aims to Harness the Power of Waves off Oregon

Source: New York Times, Kirk Johnson (9/3/12)

"The first commercially licensed grid-connected wave-energy device in the nation, designed by a New Jersey company, Ocean Power Technologies, is in its final weeks of testing before a planned launch in October."

More >

Who Is Buying Your Stocks?

Source: Brian Bolan, Zacks Investment Research (9/3/12)

"Who buys your stock can be more important than how much of it they bought."

More >

Four Important Biotech Stocks Targeting Unmet Needs

Source: George S. Mack, The Life Sciences Report (9/1/12)

Biotech rallies need catalysts to be sustained. Market moving events include drug approvals, such as a couple of obesity products from Vivus Inc. and Arena Pharmaceuticals Inc., as well as a product to help control serum lipids from Amarin Corp. Plc (AMRN:NASDAQ). But the major diagnostic feature of a market that might be putting it all together is merger and acquisition (M&A) activity. The theory is that if fully integrated, major drug developers want products and platforms. You can bet they've done their due diligence and that market conditions are nearly perfect. Even retail investors begin to pay attention.

More >

Don Coxe Recommends Investors Read Lenin to Understand the Markets

Source: Peter Byrne of The Gold Report (8/31/12)

China and India have always been crazy for gold and the yellow metal remains the choice store of value in those two countries, says Don Coxe, a strategic advisor to the BMO Financial Group. In an exclusive interview with The Gold Report, Coxe explains how demographic shifts are affecting the price of gold and delves into the logic of investing in gold as a long-term strategy. Coxe also draws an important lesson in economics from his reading of Lenin.

More >

Gold Headed for Third Straight Monthly Gain

Source: Ben Traynor, BullionVault (8/31/12)

"Gold prices looked set for a third straight monthly gain by Friday lunchtime in London, trading around 2.3% higher than the final July fix price."

More >

Under-Explored South Sudan Open for Business: Minister

Source: Mining Weekly, Esmarie Swanepoel (8/31/12)

"While little prospecting has been carried out so far, South Sudan is thought to have significant mineral potential."

More >

Gold Market Buoyed By Bernanke's Jackson Hole Remarks

Source: Kitco, Allen Sykora (8/31/12)

"Gold prices ran up to fresh five-month highs Friday as traders seemingly concluded that Fed Chairman Ben Bernanke’s highly anticipated Jackson Hole speech meant there is a good chance for further easing from the central bank."

More >

Global Copper Inventories to Decline Substantially This Year: Pat Mohr

Source: Dorothy Kosich, Mineweb (8/31/12)

"Substantial production losses and outages at existing copper mines will cause global copper inventories this year to fall to 47 days of consumption from 52 last year, Scotiabank Economist Patricia Mohr has forecast."

More >

China's Rare Earth May Become a Bit Less Rare

Source: The Street, Ralph Jennings (8/31/12)

"The kinder export quota will make little impact over the next two to eight years as offshore competitors—potentially solid investments—have already started to develop better processing technology."

More >