Streetwise Articles

Raj Ray: Miners' Cost Cutting Set to Deliver in Late 2014

Source: Brian Sylvester of The Gold Report (9/3/14)

When gold prices plunged in late 2013, gold producers took notice and developed mine plans that offered greater flexibility in troubled times. But even the best plans take time. Well, it's almost time for the producers to deliver, says Raj Ray, associate metals and mining analyst with National Bank Financial. He is looking for producers with flexible mine plans that can generate cash flow against a backdrop of static gold prices; the market likes developers with advanced, low-capital intensity projects with permits in place. Ray delivers his top gold producer and developer picks in this interview with The Gold Report.

More >

How is Doug Casey Preparing for a Crisis Worse than 2008? He and His Fellow Millionaires Are Getting Back to Basics

Source: JT Long of The Mining Report (9/2/14)

Trillions of dollars of debt, a bond bubble on the verge of bursting and economic distortions that make it difficult for investors to know what is going on behind the curtain have created what author Doug Casey calls a crisis economy. But he is not one to be beaten down. He is planning to make the most of this coming financial disaster by buying equities with real value—silver, gold, uranium, even coal. And, in this interview with The Mining Report, he shares his formula for determining which of the 1,500 "so-called mining stocks" on the TSX actually have value.

More >

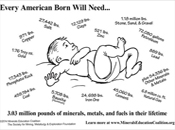

Today's U.S. 'Baby' Will Consume 3 Mlbs Metals and Minerals In Lifetime

Source: Lawrence Williams, Mineweb (9/1/14)

"The projected lifetime consumption of metals and minerals by today's U.S. baby extrapolated across the world presents an enormous challenge for the global resource sector."

More >

Six Innovative Australian Opportunities from Canaccord's Matthijs Smith

Source: Peter Byrne of The Life Sciences Report (8/28/14)

Canaccord Genuity's man on the beat in Australia delivers the insider scoop on how biotechs Down Under are faring in the markets. Matthijs Smith reveals a world of great firms, new products and competitive buys in this interview with the The Life Sciences Report. His enthusiasm for his work—spotting opportunities that help people cope with illness and injury—is contagious, and could bring renewed vigor to investors' portfolios.

More >

Laidlaw's Yale Jen: Biotech 101 for Buyers and Sellers

Source: George S. Mack of The Life Sciences Report (8/28/14)

Former biotech consultant Yale Jen picked up a few tricks advising companies on their pipelines before he came to Wall Street as a sellside analyst. These days Jen, managing director and senior biotechnology analyst at Laidlaw & Co., advises institutional investors to own stocks with stories that are not yet well understood by the market. In this interview with The Life Sciences Report, Jen offers investors a handful of names for consideration, each of which has an exceptional value proposition and exciting growth prospects.

More >

Keith Phillips: M&A Prey Offer Compelling Buying Opportunities

Source: Brian Sylvester of The Gold Report (8/27/14)

Keith Phillips, a managing director and head of Cowen & Company's Mining Investment Banking Group, says strong companies with solid balance sheets are on the hunt for precious metals development projects or small producers trading at steep discounts. In this interview with The Gold Report, Phillips explains that these juniors represent unprecedented value for acquirers with longer-term goals, and he tracks some potential M&A prey.

More >

Oasis: Gold in the Sand

Source: Visual Capitalist (8/27/14)

"For every ten barrels of oil in world reserves, Middle Eastern countries in OPEC have eight."

More >

Ethan Park Expects to Harvest a Bumper Crop from Potash and Phosphate Juniors

Source: Peter Byrne of The Energy Report (8/26/14)

Ethan Park of Extract Capital could teach a college graduate-level course on the differences between phosphate and potash. Park's basic advice to The Energy Report: Don't miss out on making money with these essential commodities just because they smell like, well, fertilizer.

More >

Canaccord's Luke Smith: Five Aussie Companies with Cash Flows, Low Costs and MOUs

Source: Kevin Michael Grace of The Mining Report (8/26/14)

Now more than ever, only select mining companies are attracting investors. Luke Smith, head of mining research for Canaccord Genuity in Melbourne, argues that low costs, increasing cash flows and improved net cash positions are crucial for gold companies. Solid contracts with end-users and strong institutional support are crucial for commodities. In this interview with The Mining Report, Smith highlights two undervalued Australian gold companies and three Australian companies in graphite and lithium that have already seen explosive share growth and appear poised for even greater gains.

More >

K-Waves: How to Predict the Next 'Gold Rush'

Source: Henry Bonner, Daily Reckoning (8/26/14)

"It's going to be a painful period in the economy, but I believe gold will shine as we have seen before, during the long wave economic winters."

More >

Keep the Faith, Says Michael Fowler: Juniors and Midtiers Poised for M&A-Fueled Breakout Once Gold Recovers

Source: Brian Sylvester of The Gold Report (8/25/14)

Michael Fowler, senior mining analyst with Toronto-based Loewen, Ondaatje & McCutcheon, predicts when gold breaks out, mining M&A will take off. He expects the major producers to lead the next rush of M&A. The majors want development-stage companies with high-grade, near-term production assets, and Fowler suggests some targets in this interview with The Gold Report.

More >

Michael Fowler, senior mining analyst with Toronto-based Loewen, Ondaatje & McCutcheon, predicts when gold breaks out, mining M&A will take off. He expects the major producers to lead the next rush of M&A. The majors want development-stage companies with high-grade, near-term production assets, and Fowler suggests some targets in this interview with The Gold Report.

More >

The Clear Map to this "Hidden" Investment Treasure

Source: Ernie Tremblay, Money Morning (8/25/14)

"As scientists reach the discovery limits of 'one-size-fits-all' drugs and the ailments that respond to them, such as infections and circulatory diseases, they find themselves up against tougher, wilier, more intractable challenges. . ."

More >

Silver Is Everywhere—And Poised for Big Gains

Source: Michael Robinson, Money Morning (8/22/14)

"Silver is so vital in consumer electronics, solar power and even healthcare now that it has become one of those 'Miracle Materials' that are literally changing our lives. "

More >

Musings on the Second Great Recovery Experiment and the Promise of Natural Gas: Ron Muhlenkamp

Source: Tom Armistead of The Energy Report (8/21/14)

Like the economy as a whole, the Muhlenkamp Fund is still struggling to extricate itself from the morass of the Great Recession. Ron Muhlenkamp, founder of Muhlenkamp & Co. Inc., sees a forerunner to this downturn in the 1980–82 recession. In this interview, he tells The Energy Report how good policy ended the earlier slowdown and set the stage for two decades of prosperity. He also explains why bad policy is hampering recovery now, and what this means for investors.

More >

Junior Mining Companies that Will Make Beautiful M&A Music: AgaNola's Florian Siegfried

Source: Brian Sylvester of The Gold Report (8/20/14)

Florian Siegfried, head of precious metals and mining investments with Switzerland-based AgaNola Ltd., knows where the music is playing in the mining M&A space. In this interview with The Gold Report, Siegfried notes that well-financed juniors with low production and capital costs, or intermediate cash-flowing producers, will be hitting the M&A high notes, and suggests a sextet of companies capable of making beautiful music.

More >

Jim Collins: Five Names to Love from the LD Micro Conference

Source: Streetwise Reports' Special Situations Staff (8/20/14)

The conference circuit can be a brutal one, with scores of companies vying for investor attention, but some vendor halls hold more opportunities than others. In this interview with Streetwise Reports' Special Situations, Jim Collins, author of The Portfolio Guru, shares his finds from the productive LD Micro Conference, an event he describes as a "micro-cap love-in." He details a quintet of investing opportunities, from areas as varied as deep-sea exploration support services, Wi-Fi energy delivery and drinks for kids.

More >

CEOs in Mining

Source: Visual Capitalist (8/20/14)

The CEOs of the top 25 gold, silver, copper, coal and base metals mining companies in the world are profiled in this infographic.

More >

Medtech Shifts from High Gear into Overdrive: Canaccord’s William Plovanic

Source: Dan Levy of The Life Sciences Report (8/19/14)

Rapid growth in the medical device industry and changes in the regulatory environment have propelled valuations in the medtech sector to the high end of the range. But new technologies create new investment opportunities. In this interview with The Life Sciences Report, William Plovanic of Canaccord Genuity highlights investment opportunities in medtech companies with innovative products targeting high-impact areas such as obesity, diabetes and wound care.

More >

Fund Adviser Björn Paffrath's Mantra: In the End, Performance Matters

Source: Brian Sylvester of The Mining Report (8/19/14)

Björn Paffrath, Switzerland-based fund adviser and newsletter writer, says there is certainly an elevated risk of a correction in the broad market but the upside in the mining sector is worth looking at as the market turns. Paffrath expects more M&A activity in the fall and says he's always looking for opportunities that really impact the performance of the funds. In this interview with The Mining Report, Paffrath shares some silver, base metals and tungsten positions.

More >

Minerals Versus Marijuana

Source: Douglas French, The Daily Reckoning (8/19/14)

"Rule, Casey, Cook, and James say now is the time to invest in natural resource plays, not run for high-tech or a product to get high with."

More >

Björn Paffrath: Mining Sector Bottom Is In and Opportunities Abound

Source: Brian Sylvester of The Gold Report (8/18/14)

Björn Paffrath, Switzerland-based fund adviser and newsletter writer, is so convinced that we've seen the bottom in the mining sector that he's launching a new gold and silver fund in Europe. He says capital is trickling back into long-forgotten mining equities as the smart money seeks to rotate out of frothier sectors and into real assets. In this interview with The Gold Report, Paffrath also forecasts a broad market correction as he tells us about some promising equity positions.

More >

Wedbush Securities' Liana Moussatos on the Art and Science of Picking Biotechs with Upside

Source: George S. Mack of The Life Sciences Report (8/18/14)

Liana Moussatos of Wedbush Securities doesn't wait for the catalyst to strike. She, like other successful investors, picks her targets and takes profits earlier, while less sophisticated investors wait for the press releases. In this interview with The Life Sciences Report, Moussatos describes a group of biotech stocks rich with upcoming catalysts, and invites investors to sample what she expects will be exceptional profits.

More >

Liana Moussatos of Wedbush Securities doesn't wait for the catalyst to strike. She, like other successful investors, picks her targets and takes profits earlier, while less sophisticated investors wait for the press releases. In this interview with The Life Sciences Report, Moussatos describes a group of biotech stocks rich with upcoming catalysts, and invites investors to sample what she expects will be exceptional profits.

More >

Why Investing in Solar Energy Is Attracting the Big Boys

Source: Kent Moors, Money Morning (8/18/14)

"What began as backup to more conventional grid-networked sources of power has quickly blossomed into a separate profit center."

More >

Bring On the Orphans: Aegis Capital's Raghuram Selvaraju Lays Out a Winning Biotech Strategy

Source: George S. Mack of The Life Sciences Report (8/14/14)

For former drug researcher Raghuram "Ram" Selvaraju, picking biotech stocks is both science and art. It's about understanding the competitive landscape and the mechanisms of drug action, and then making sure all the pieces fit together for a plausible investment case. In this interview with The Life Sciences Report, the managing director and head of healthcare equity research at Aegis Capital lays out his growth hypothesis for companies—several targeting orphan diseases—that he believes will nurture portfolios.

More >

America's First Oil Sands Producer and Other Natural Resources Surprises: Peter Epstein

Source: Tom Armistead of The Energy Report (8/14/14)

The natural resources space has been difficult in recent years. Potash prices collapsed, uranium spot prices hit a nine-year low, the gas market was in glut. Only oil has stayed strong. But Peter Epstein of MockingJay Inc. has found some gems in the resource rubble, and foresees better times ahead. In this interview, Epstein tells The Energy Report who stands to capture the graphite market, how to catch the next wave in potash, and offers his thoughts on when investors might catch a break in the uranium market.

More >