It has been a while since I updated my Millennium Index, and probably most don't care because they see dividend stocks as boring. However, the Millennium Index is unique and far from boring.

As of December 4, it is up a whopping 44.5% on the year, plus a 5.3% dividend yield, for a total return of 49.8%. This is three times better than the S&P 500 and more than twice as good as the TSX index. There are 16 stocks in the index, and all but four have decent gains. The best gains this year are 77% with Cameco Corp. (CCO:TSX; CCJ:NYSE) and 260% and 144% with two gold stocks, AngloGold Ashanti Ltd. (AU:NYSE; ANG:JSE; AGG:ASX; AGD:LSE) and Newmont Corp. (NEM:NYSE; NGT:TSX; NEM:ASX), respectively. I added the gold stocks in 2022 because I was concerned with general market volatility, and they would be a good hedge. That has worked nicely.

Even without big gains with the gold stocks, the index would still have a return of about +27.2%.

I want to show some charts with significant market perspectives.

The S&P500 PE ratio has gone higher since my last update on this. This is a new record for a pre-crash level. Remember that when a bubble bursts, the stocks fall quicker than the earnings at first and set a higher PE. The last peak around 2000 was the dot-com bust. Once this AI bubble pops, we will probably set a record high with the PE of over 60.

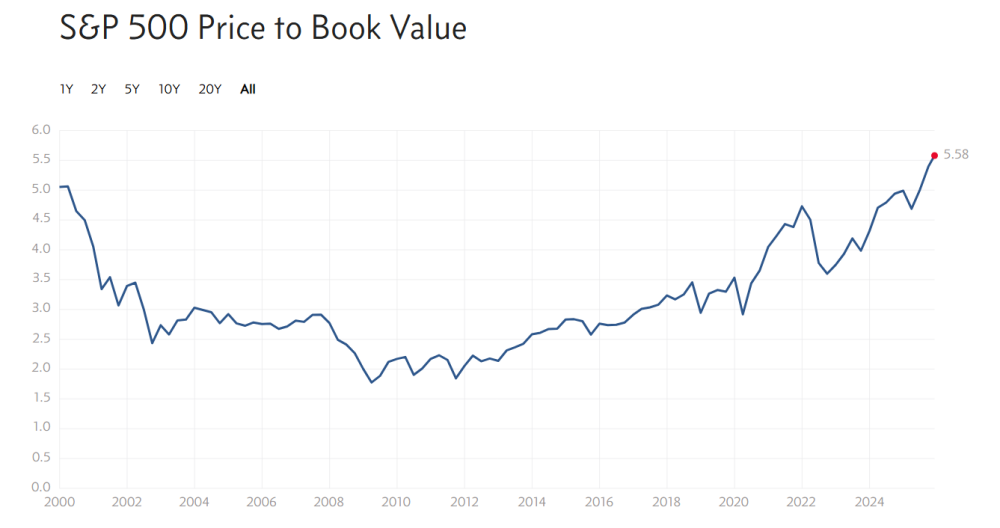

Another chart that shows the extreme overvaluation of the market is the S&P 500 book value.

It now surpasses the dot-com bubble.

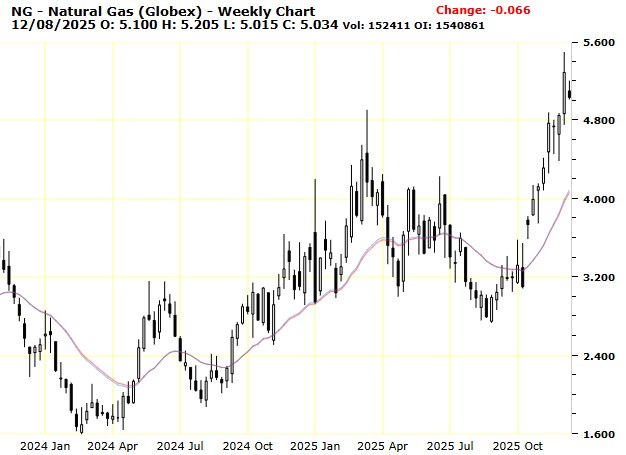

There was a major event in the energy market last week. On Friday, natural gas prices broke out and popped to new highs, not seen since the gas crisis at the start of the Ukraine war.

The factor was a cold snap that started last week, and what is unique here is that it happened very early in the winter season. Often, we don't see this until late December or January.

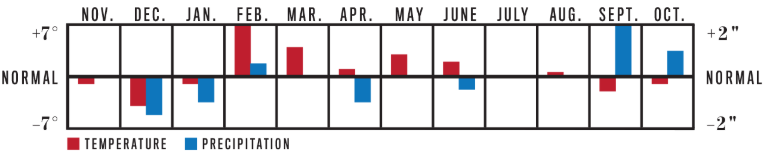

La Nina is affecting the weather this year, and the Almanac is predicting a mild winter for the U.S. Northeast (major oil and gas heating district), but starting off colder than normal.

It looks like they have it right so far. At this point, natural gas storage is within the 5-year range. Typically, gas is stored in the summer months because of lower demand to be used for heating in the winter months. However, I believe this typical trend is going to be turned upside down because of the rising demand for gas to produce electricity for AI and the data centers in the summer months.

I have commented a few times that the AI bubble is going to burst, probably because there is not enough energy or hardware (chips) derived from critical minerals.

Memory chip prices have surged dramatically due to a global shortage, with some types of DRAM and NAND prices increasing by over 100% in recent months. This shortage is primarily driven by high demand from AI infrastructure, and experts predict that the crisis may persist until at least 2028.

Energy shortages are not making headlines yet, and many analysts are warning of them. I believe it will become front and center this coming summer. Low natural gas prices will be a thing of the past.

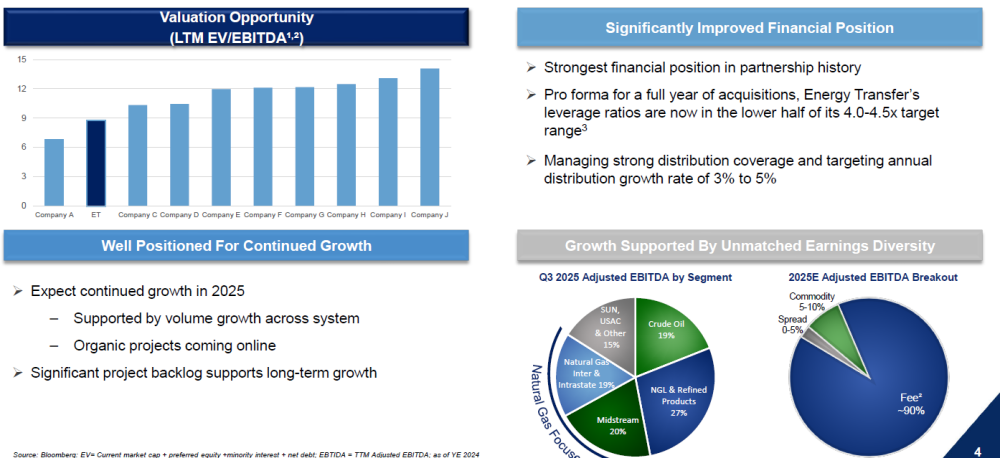

That said, right now, energy has the lowest valuation in the S&P 500, trading about half the S&P average. However, I want to tell you about the best energy stock among energy stocks that is trading about one-third the S&P p/e average, one-fifth the S&P average book value, and is paying a solid 8% yield while insiders are buying millions of shares.

You may have heard the saying, 'the market is always right,' but that is not true. Sometimes the market is wrong or has a misconception.

Let's get into the details of a stock where the market is very wrong!

There is no other reason to explain why ET Transfer is so cheap, other than that the market has it wrong.

ET Transfer LP Unit

Recent Price - US$16.80

It cannot be a fear of lower oil and gas prices, because Energy Transfer LP Unit (ET:NYSE) derives 90% of its EBITDA from fees.

There is no negative signal from insider selling, and in fact, insiders own about 10% of the stock; multiples of their peers and insiders are buying. Kelcy Warren, Executive Chairman, bought 1,000,000 shares on November 19 at an average price of US$16.95, bringing his direct ownership to 104,577,803 shares. In fact, Mr Warren has bought 3 million shares since August.

As a recap for those who don't already own shares or know the company, their operations focus on moving and storing natural gas, natural gas liquids (NGLs), crude oil, and refined products through an integrated network of pipelines, terminals, storage facilities, and processing plants. Energy Transfer provides core midstream services such as gathering, compression, fractionation, processing, and bulk transportation to support production and downstream supply.

The stock is trading at just 1.38 times book value and has a very attractive 8% yield. ET's trailing and forward P/E were 13.46 and 10.87, respectively, according to Yahoo Finance.

The only negative I could find was an earnings miss in the last quarter. Energy Transfer posted Q3 2025 earnings on November 5, 2025, reporting an EPS of US$0.28, which missed the consensus estimate of US$0.34 by US$0.06. Quarterly revenue fell 3.9% year-over-year to US$19.95 billion, below the consensus estimate of US$21.84 billion.

Energy Transfer's growth outlook is strong, and its valuation is low. Year over year, NGL exports are up 13% and NGL transportation volumes are up 11%. NGL refined products terminal volume up 10%. They have numerous pipeline, storage, terminal, processing, and export projects in the pipeline or already under construction. Energy Transfer's market share of worldwide NGL exports remains at ~20%. Earnings are expected to grow 4.11% next year, from US$1.46 to US$1.52 per share.

Others see good value too. Energy Transfer scored higher than 92% of companies evaluated by MarketBeat, and ranked 33rd out of 259 stocks in the energy sector.

The only way the U.S. can power data centers for the next two to five years is with natural gas, as it will be about five years before nuclear power starts to come on stream. Beyond its baseline stability, ET stands out like a star to provide gas and power for AI and data center expansion. They have multiple agreements with Oracle, including previously announced agreements, to supply ~900 MMcf/d of natural gas to three U.S. data centers, and long-term agreements with CloudBurst to provide a firm natural gas supply to a data center in Central Texas. The company has already secured partnerships with a Colorado-based data center and Fermi's gigawatt energy campus in Texas, with further agreements in progress.

I would say that ET's fair value is between US$21–US$23, implying roughly 25% undervaluation versus peers.

The chart is very bullish as well. It has come down quite a way from the January highs and is now at 1-year lows, other than a brief time during the April market panic. The chart shows a triple bottom, and that bottom is also put in with a hammer candlestick.

Right now, I see Energy Transfer as the best buy on my Millennium Index and one of the best buys in the energy sector.

For those who don't care about the dividend. The call options are very cheap. The March 2026 US$16 call is trading for about US$1.20. It is US$0.80 in the money, so the premium is only US$0.40

| Want to be the first to know about interesting Oil & Gas - Exploration & Production, Technology and Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Cameco Corp.

- Ron Struthers: I, or members of my immediate household or family, own securities of: Energy Transfer LP Unit. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.