Company: Volt Lithium Corp.

Symbol: VLT.V/ VLTLF:US OTC Qb

Recent Price: CA$0.47 / US$.35

52-Week Range: CA$0.06 / US$0.007 to CA$0.55 / US$0.4097

Market Cap: ~CA$46m /~US$35m

Head Office: Vancouver, B.C.

CEO/President: Alex Wilie

With the junior markets for resource issues mired in a seasonally-typical lethargy of sorts, it is always encouraging to own shares in a company where the overall market or economic conditions have little or no impact on the share price performance. Such has been the case with GGM Advisory top-pick Volt Lithium Corp. (VLT:TSV;VLTLF:US).

Ahead 526% YTD (as of May 24), Volt has achieved all of the significant milestones laid out for investors back in August when Volt CEO/President Alex Wilie described the opportunity as apparent in the proposed merger between his company and Allied Copper Corp. (CPR:TSX.V; CPRRF:OTCQB).

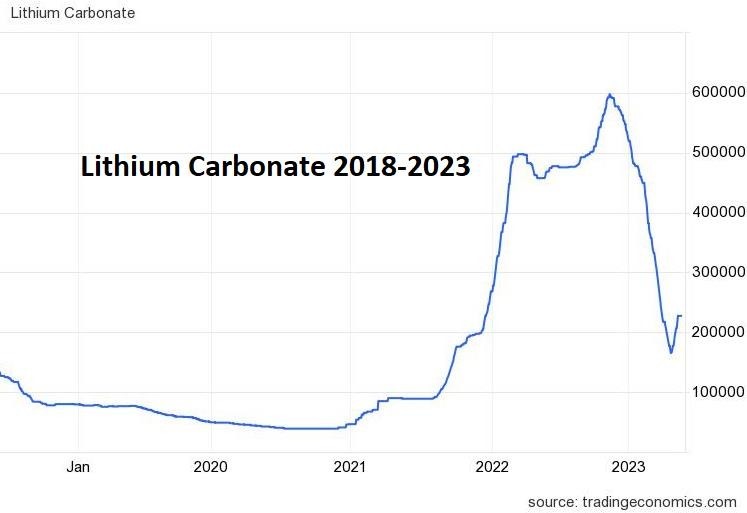

Every brand and type of lithium deal has gone berserk in the massive price advance from under US$5,000/t to over US$60,000/t since late 2020. Companies with pegmatite deposits in northern Quebec that are ten years from production without anything resembling a resource estimate are capitalized at over CA$1 billion, while Volt is already en route to a Preliminary Economic Assessment for its Rainbow Lake brine project but being capped at under CA$50 million.

The staggering price movement in lithium carbonate price to the end of 2022 has now corrected appropriately to levels where sanity has started to prevail, but what is not up for debate is the insatiable demand for the mineral with no better evidence of that than two deals announced in the past week that involved one oil company (Exxon) and one auto manufacturer (Ford Motor).

The staggering price movement in lithium carbonate price to the end of 2022 has now corrected appropriately to levels where sanity has started to prevail, but what is not up for debate is the insatiable demand for the mineral with no better evidence of that than two deals announced in the past week that involved one oil company (Exxon) and one auto manufacturer (Ford Motor).

These companies are moving mountains to secure lithium supplies well into the future by actually buying deposits which is a sign of the

desperation that prevails. The lithium-ion battery is critical to the EV industry, so the big automakers are reacting with major capital expenditures, and many are injections into companies that are extremely "early-stage," underscoring the panic that is in the air.

The company made a significant press release on Wednesday, May 24, in which there were a number of important takeaways:

- The combination of the DLE technology and the "high grade" Rainbow Lake property is a "one-two punch " that could move Volt into the number one seed position in the North American Lithium play.

- The value-added component Volt brings to an existing Oil and Gas play, even in the simplest form of water treatment cost-sharing, will make it a must-have situation, particularly from an "ESG" standpoint.

- To achieve filtration at the 5-micron Level is a game changer. The ability to extract Magnesium concentrates and additional rare earths is significant.

- Although there are concerns with the need for a US$50 million Capex on a plant to get to commercial production, it is a fractional amount of the cost to bring a hard rock project online. (Based upon pro forma)

- Most of the propositions stated above make project permitting magnitudes more streamlined, setting the stage for commercial development by Q2/2024.

With today's announcement that their pilot plant test facility has produced extremely robust results from a 50,000-liter test run was a critical achievement and an important milestone, all of which have been exceeded ahead of schedule and under budget, giving way to expected commercial development as early as Q2/2-24.

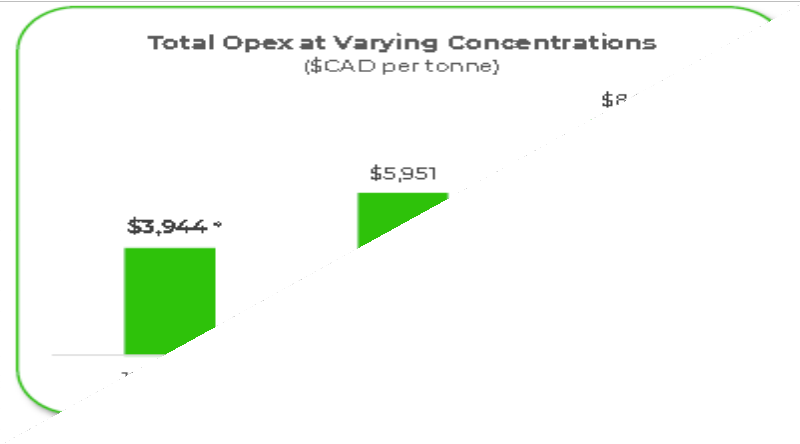

In the interim, it is expected that they will commence production of 1,000 tonnes of lithium in June 2024, which would generate annual revenue to the order of CA$35,000,000. In the news release, it was stated that OPEX for the 1,000 tonnes would be CA$3,477,000 placing the pre-tax earnings number at CA$31,523,000 or around CA$0.23 per share on a fully-diluted basis.

Comparable lithium producers sport P/E multiples in the 30-times range, so a fair value for EPS to the end of June 2025 would suggest a value in and around CA$6.90 per share.

The company intends to deliver a positive PEA by the end of summer 2023, followed by Pre- Feasibility and Feasibility studies thereafter. In the mining business, I was always impressed if a company could generate enough cash in the first three years to retire all capital expenditures ("CAPEX")

incurred during the build-out phase but in Volt's case, cash flow from lithium sales would offset the estimated CA$50 million in costs within eighteen months, which would bode quite well for rerating in year three.

Also, the expectation is for them to gradually grow the operation to a 20,000-tonne operation generating CA$700 million per annum in revenue against CA$69,540,000 in OPEX, netting out CA$630,046,000 in pre-tax profit.

The per-share number will depend solely on the price at which they raise the CA$50,000,000. At CA$0.50, that would be 100% dilution, while at CA$2.00/share, a mere 25% dilution.

In a news release dated May 18, the company stated that the Rainbow Lake aquifers carry enough brines to support a 20,000-tonne operation for a period of 215 years, which is astounding.

Today's news release places the recovery rates from the pilot plant testing amongst the highest on record for DLE operations. As can be seen from the adjacent map, they have access to the brines through their deal with Cabot Energy, a subsidiary of Ivanhoe Electric which in turn is a company controlled by Ivanhoe Capital, the family holding company of none other than billionaire Robert Friedland.

Friedland is obviously aware of Volt's activities and of the tremendous milestones achieved since last summer. He is also highly active on social media as a champion of "responsible mining" and a huge bull on copper.

The company has demonstrated an excellent command of marketing its story as 30-day, 100-day, and 365-day daily volumes range from 107,000 to 132,000, providing the much-needed institutional liquidity that is a large concern for professional investors.

Catalysts for advancement in upcoming weeks include the following:

- Preliminary Economic Analysis ("PEA")

- The involvement of strategic investors

- CAPEX financing (CA$50m plus)

- Acquisitions / land expansion

- Government grants (the company has already applied for CA$100 million grant in March 2023)

- Initial production

Conclusion

In a world economy driven by the need to move to electrification and away from fossil fuels, the three pillars are source (new electricity sources), transmission (more copper needed in moving the energy), and storage (more batteries with sufficient capacity requiring lithium, graphite, and manganese).

Granitic pegmatites provide the greatest abundance of lithium-containing minerals, with spodumene and petalite being the most commercially viable sources, and while these are present in varying concentrations in North America, they take a great deal of time and CAPEX to develop.

VLT has proven that brines are a long-term, dependable source of lithium supply, with the recent pilot plant results confirming the economic viability of their DLE technology in processing lower-grade brines.

Volt is in itself an enormous growth story in an enormous growth industry, so with major multinationals such as Ford and Exxon moving to secure dependable lithium sources through acquisition, I see Volt as a major target as the leading lithium brines processor in North America and as such, a viable candidate for acquisition by other energy or auto companies. I am holding

the position in anticipation of an M&A-based valuation in the CA$7-8 range to the end of 2024 with possible upside revisions based upon lithium prices and Volt's operational progress.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese, Base Metals and Battery Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Volt Lithium Corp./Allie Copper Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of:-Volt Lithium Corp./Allie Copper Corp.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.