When I was a young lad, my late older brother Donnie used to show me this trick where he would take a long elastic band and attach an egg to one end and an ice cream holder to the other and then pull the end with the fastened egg to the absolute maximum of tension.

He would ask me to choose whether the ice cream stick or the egg would break first, failing to inform me that no matter which outcome, the result was either messy or painful. If the stick broke, this insanely-stretched band would whip back and hit you in the hand or face, while the opposite resulted in egg all over you and the floor around you.

It was one of those tests where no matter the answer, the outcome was dire.

Fed Rate Hikes

I do not know what made me think of that, but as I was reading a piece from the most recent JP Morgan market strategy letter, I was amazed at the amount of detail that was contained in their assessment of what it is going to take to force the Fed into either pausing or terminating the rate hikes and the process they described was not a lot different than Donnie's little elastic bank trick.

No matter what the outcome, the Fed's quest for a 2% inflation rate is approaching a gigantic fork in the road, and no matter which way one turns, it is either messy or painful.

No matter what the outcome, the Fed's quest for a 2% inflation rate is approaching a gigantic fork in the road, and no matter which way one turns, it is either messy or painful.

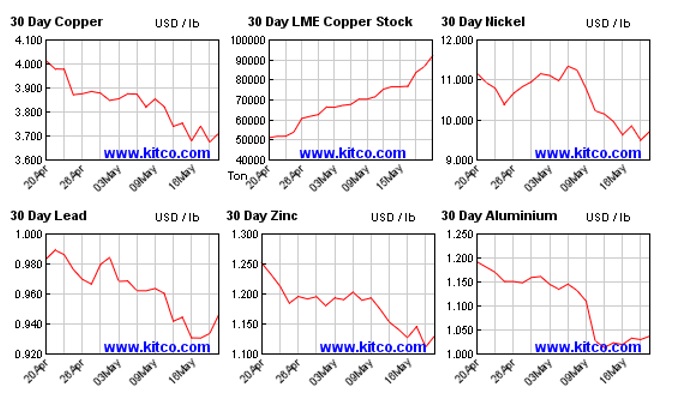

The Fed rate hikes are creating an environment of fear where purchasing managers around the world are now reducing their internal forecasts for raw materials of all shapes and sizes. As this happens, the inputs that typically have an effect on the Producer Price Index (PPI) head lower and act as a precursor for cost-push inflation. The graphic shown below says it all:

Note how all of the base metals traded on the LME are under pressure but how copper inventories are screaming northward at a breakneck pace. This tells me that the global economy is decelerating at a very dangerous pace which will bring inflation rates down to a more subdued rate of change, but that the collateral damage brought about by this drop-off in demand will cause business closures that will inevitably affect the supply chains.

I am no economist, but if I can see this deflationary flight path, then I fail to see how others in positions far more powerful than a newsletter writer from a remote Ontario town are unaware or unsympathetic to the cataclysmic outcome that is lurking out their just beyond the tree line.

The Fed is constantly reminding us of the bag of "tools" they possess that can cure deflation with the stroke of a printing press, but I would argue that the global economy, especially the Western economy, is like a large aircraft carrier that needs thirty-five nautical miles to execute a turn. By the time the boat has turned, the enemy has several dozen torpedoes barrelling down on the vessel's hull.

Powell had a 50-lb. anvil on the top of his right foot that was on the accelerator pedal of credit-creating largesse while politicians around the world gave nary a thought to the longer-term ramifications behind such profligate spending. Unintended outcomes, indeed.

The other fork in the road is the one that is putting the Fear of God in the hearts and minds of the central bankers, and that is the turn that takes the world to a massive inflationary spiral far more damaging than anything we have seen since the pandemic-created supply chain shutdowns. When you combine helicopter-dropped "stimmy cheques" into the bank accounts of millions of citizens who refuse to work, nothing gets produced, but everything gets bought, thus exhibiting a textbook case for the Econ101 theory of what happens when rising demand hits a reduced supply of all good and services in a shuttered economy.

It is called "sticky" inflation because while factories were re-opened and workers re-hired, there was little that could be done to offset the torrent of freshly-printed, wet-inked cash that continues to slosh obscenely around the world. This is why the leading indicators are crashing, but prices are not yet following. Neither the Fed saving its precious member banks' bottom lines nor the Administration saving future votes could harness the inflationary impact of the actions of 2020-2022.

Powell had a 50-lb. anvil on the top of his right foot that was on the accelerator pedal of credit-creating largesse while politicians around the world gave nary a thought to the longer-term ramifications behind such profligate spending. Unintended outcomes, indeed.

Hence, the world is now rapidly approaching this fork, but the steering wheel is in the hands of bureaucrats and philosophers and central bank academics that never had to auction off a favorite family heirloom to "make payroll" during difficult times.

This is what the financial markets are trying to decide right now as whipsaws are everywhere, and traditional technical analysis is quickly joining fundamental analysis in "The Graveyard of the Irrelevant and Obsolete."

Nobody looks at balance sheets or financial statements anymore; support and resistance zones are now the domain of pattern-recognition software programs and artificial intelligence robotics. In my opinion, all of these influences combine to create one of the most difficult trading environments of the past fifty years.

From 2009 until 2022, the suppression of interest rates was the sole domain of the N.Y. Fed, and over that thirteen-year period, they demonstrated the Law Of Unintended Consequences with alarming acuity in that the historically-low yields forced rookie portfolio apprentices fresh out of the Harvard Business School to systematically remove conservative assets from portfolio weightings because the yields were far too low.

It forced pension fund managers in need of a minimum 8% annual yield to run kicking and screaming after higher-risk, totally-unsuitable asset mixes in order to remain employed. With this came the inevitable use of leverage such that by the time late 2021 came along and Fed Chairman Powell began to warn of an impending tightening cycle, the poor kiddies flipping junk bonds around had no clue what he was talking about. The failure of First Republic Bank in March was just that.

The debt levels are real, and they are growing, and whichever tine in that fork that one chooses, it leads to a messy and painful outcome.

I speak to dozens upon dozens of younger investors — no, traders — (there are no investors left anymore) that have made and lost more money since 2009 than I have earned in a lifetime. The losses from the cannabis bubble in the late 2010s and from the crypto bubble in 2022 have left the Reddit crowd in a zone of scorched earth.

Recent polling of retail clients by one of the big marketing outfits has revealed a high level of illiquidity brought on by losses on assets that were bought on credit lines and second mortgages. This is eerily similar to the 1930s after all of the profligate spending of the Roaring Twenties trained the children of that era how to use leverage to enhance stock market returns.

We all know how that ended…

Both fiscal policies by clueless elected representatives and monetary policy by clueless academic forecasters are creating a scenario where two freight trains are coming down the tracks at full speed on the same rails and headed directly at each other. Whatever the outcome, debt-ridden countries that depend on "full faith and credit" to avoid insolvency behave as though the tricks of past financial crises can be used to delay the ultimate day of reckoning, where everything grinds to an abrupt halt, and civil unrest becomes commonplace.

Equities cannot survive periods of prolonged inflation, nor can they survive periods of crippling deflation either. As we are seeing today, inflation is starting to erode margins, but with corporate debt so stifling, deflation will destroy the ability for debt to be serviced. Bonds are no different. They get vaporized in an inflationary period and even more so in a deflationary meltdown where economic conditions implode. That leaves only the asset upon which no person, government, or entity has any claim, and that is gold.

The fork in the road described in this missive is not in the distant future as in a science fiction novel or movie; it is happening as we speak. There is no giant asteroid about to hit the earth or a global climate change about to send a tsunami to sink New York City. The debt levels are real, and they are growing, and whichever tine in that fork that one chooses, it leads to a messy and painful outcome.

Bizarro

In the old Dell "Superman" comics (that I used to collect and read religiously), there was an arch-enemy called "Bizarro" that was from a world where everything was the opposite of our world. Black was white, bad was good, and Superman was the moral mirror image of Bizarro and vice-versa.

Well, that is the trading world in which I exist because breakouts should be sold, and breakdowns should be bought.

A debt ceiling resolution authorizes the expansion of the U.S. national debt, which already stands at US$32 trillion so this implies a reduction in the purchasing power of the currency due to increased supply in circulation.

That is the "real" world, but what we saw this week was the one created in 1958 by writer Otto Binder and artist George Papp where increased debt is dollar friendly when by any analysis, it is clearly bearish.

The bizarro world in which I live has me in a corner sucking my thumb as I ask myself the question: "How on earth can the resolution of the debt ceiling debate be dollar bullish? Well, I guess it is because the rumor of debt ceiling "progress" sent the U.S. dollar screaming higher this week, and only as the Pavlovian algobots know too well, a 2% pop in the Dollar Index most certainly justifies a US$100 drop in gold prices (SARC).

Of course, I type this in jest, but I honestly cannot fail but to sit back in abject astonishment as gold moves from a mere US$20 from all-time highs a week ago to a technical breakdown of the US$1,975 level on Thursday before rallying today.

I told subscribers that I was going to "BUY THE BREAKDOWN" on the assumption that it would turn out to be a false breakdown. I then rifled through my box of good luck charms for a rabbit's foot, a monkey's claw, two four-leaf clovers, and a crucifix just for good measure.

Stocks

Yesterday, the SPX closed at a level above the upper range of the prior high and, coupled with a bullish MACD crossover, gave all indications of a breakaway move to the upside to close out the week.

RSI is not yet overbought; MACD is positive, and a really good-looking chart since before the regional banking crisis instilled fear into the hearts and souls of men; I could have sworn that there would be a vicious short squeeze in SPX today, but as in my earlier comments about trading in the "Bizarro" universe, stocks reversed a morning pop and settled higher for the week but lower on the day.

I remain a cautious bull on stocks, but as I have been repeating over and over ad nauseum, the perversity I find in these markets tests one's resolve and sanity.

Gold

Not a great deal more to say here other than June Gold traded down to US$1,956 before rebounding to close out the week above the US$1,975 breakdown point, and GLD closed above its breakdown point at US$183.00, closing out the week at US$183.64.

Could this be a false breakdown?

Anything is possible, but as I wrote to subscribers yesterday, I do nothing unless I get a two-day close below my stop points — to avoid the whipsaws, which are, thanks to Bizarro, many these days.

I long for a return to normal markets and an exit from the Bizarro world of intervention, interference, and suppression, but that is like longing for a return of the Toronto Maple Leafs, where their motto under former owner Conn Smyth was "If you can't lick 'em in the alley, you'll never lick 'em on the ice."

One can only dream…

Sign up for our FREE newsletter

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

- From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.