Key Points

- Gold

o About to complete the next wedge

o Upside resolution would be strong

o New highs in most currencies

- Nth Am Gold stocks continue to base

o Still within parabola

o XAU heading for 165

- ASX Gold Stocks consolidating ahead of breaking neckline

o H&S reversal pattern setup

o Much higher target levels generated

o NST looking for another sharp move

- US equities

o S&P 500 looking to break sharply higher

o Could be heading for new highs on short covering

o Housing sector index at 16-month highs

- Still housing shortage

- Banking sector bottoming on uptrend line?

US$ — Heading Higher

- Breaks 7-month downtrend

- Euro at a critical level

- Yen weaker again

BHP Looking Strong

- Copper bottoming

- China crude steel output strong again

Gold

Gold seemed surprisingly calm overnight while it consolidates above US$2000.

The US$30 sell-off on Thursday clouded the US$20 recovery on Friday, so the volatility in gold is very positive for this market.

Note gold is now making new highs each week in other currencies.

Technically, gold is ready for another sharp move higher.

The resistance around US$2000 is now supported.

Gold making new highs in Euros.

Gold Stocks

- Still within the parabola

- Gold stocks would be in wave 3

- Zone of maximum acceleration

- Next stop 165 on the XAU

The short term should see good support here.

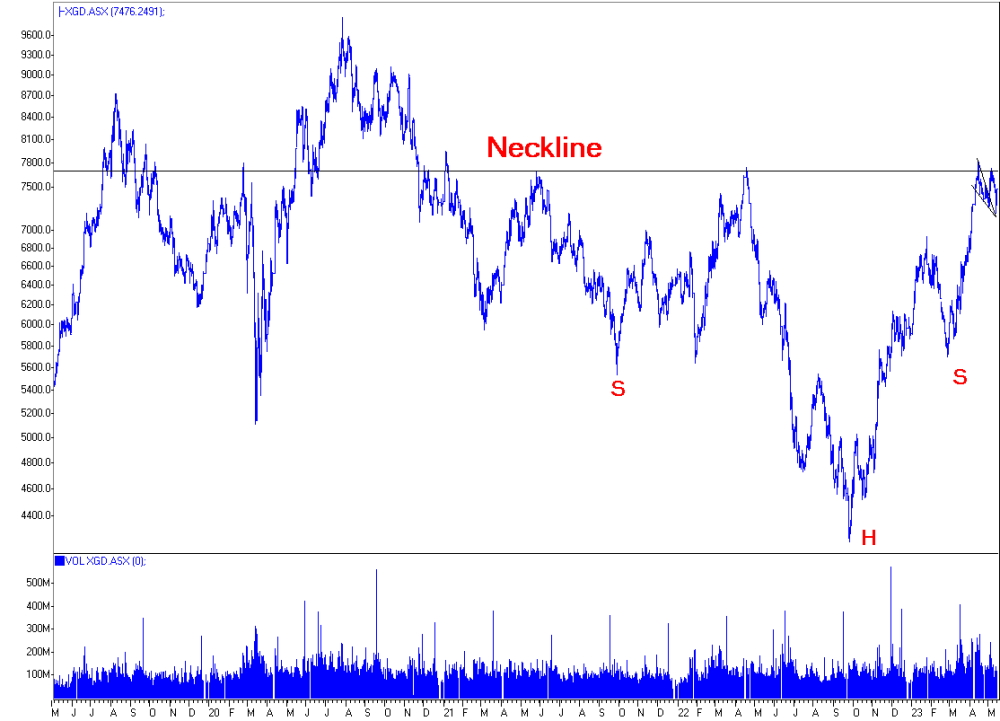

ASX Gold Index

Need to keep repeating the big picture here.

- 7700 is important long term resistance

- Clear 'Neckline' for Head and Shoulders reversal

- Target is around 12,000 as intermediate after passing 9888 previous all time high

- Over 20,000 longer term

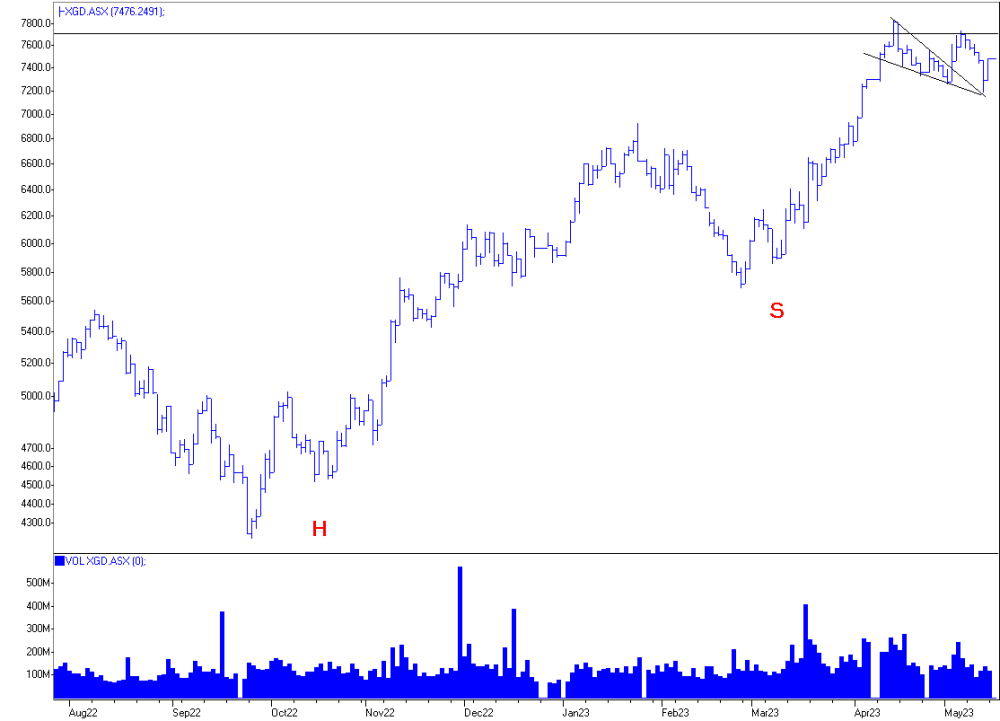

- Nice consolidation pattern here

The big picture supports a MASSIVE rise in the XGD.

- This short term wedge resolved higher

- Should be ready to rise to test 7700

- Big break out after that

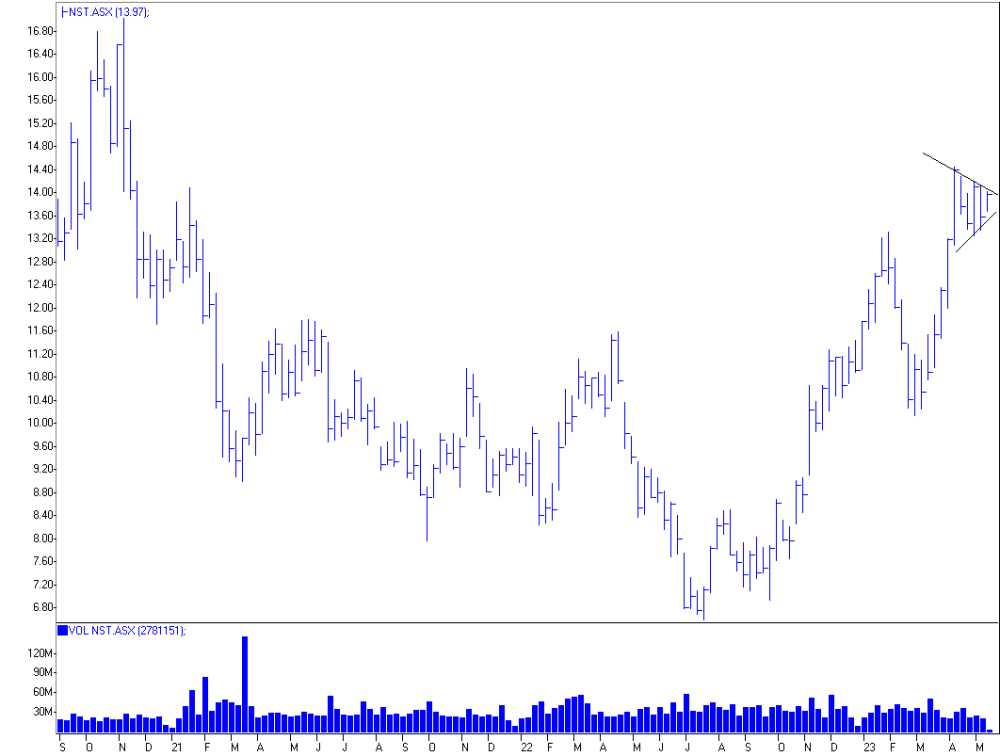

NST is Leading

- Disappearance of NCM will only boost NST higher

US$ Index

- Rally continuing

- Other currencies looking weak

Euro

- Critical level here

- Should bounce

- Breaking below 108 should lead to further weakness

- Euro has only rallied to break line, which is 50 year uptrend

- Still think Euro won't exist by the end of 2024

Japanese Yen

- Heading lower

US Equities

- Short term is setting up for a big breakout

- A breakthrough 4200 would signal a strong rise

- The next rise should be to at least 4300

- But if rapid would probably signal move to new highs

Housing Sector Index

- New 16 month high!

Big inventory catch up > 4 years.

Banking sector recovering.

Copper

- Bottoming

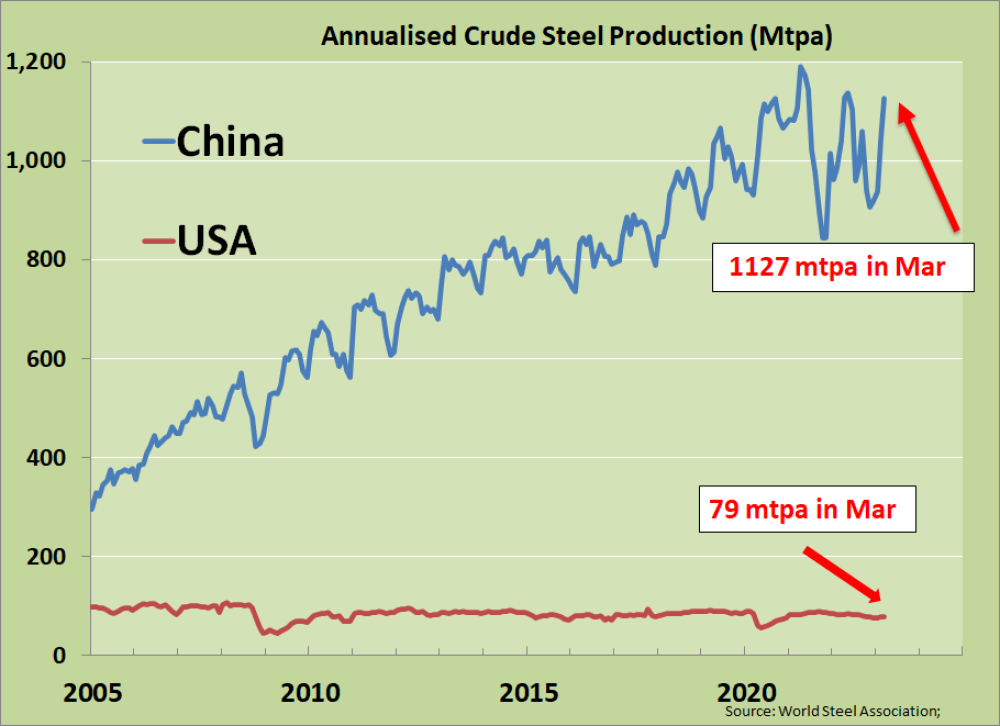

China Crude Steel Output

- Strong recovery

- Not far from all time highs

- Iron ore should soon pick up again

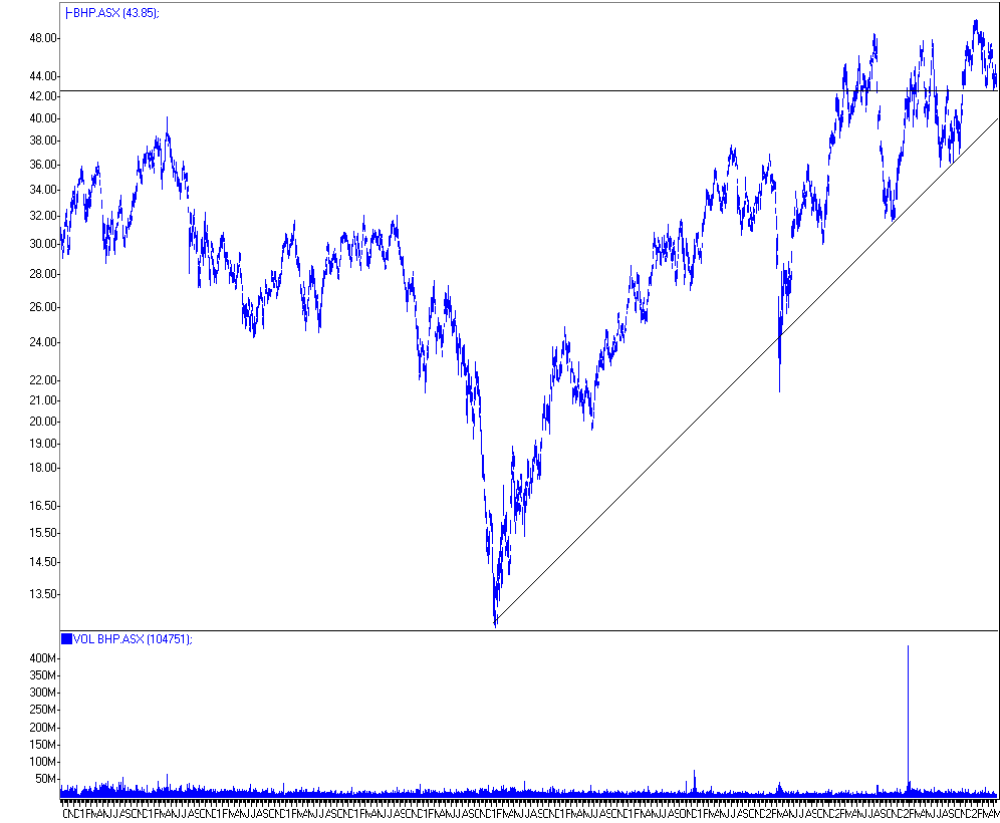

BHP

- Following copper and iron ore

- Looks likely to see significant new highs in 2023

- Some short term pull back possible

- BHP in AU$ looks robust with underlying uptrend support

Timing is everything.

Heed the markets, not the commentators.

Want to be the first to know about interesting Gold, Critical Metals and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

- From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.