Oil has been largely rangebound since the last update posted early in November, with the trend being neutral / down. On the 18-month chart for Light Crude, we can see that technically it remains in the bear market that began following the twin peaks (Double Tops) that occurred last year, with the price being constrained by the falling 200-day moving average that reversed the late March — early April rally.

Whilst downside momentum has slowed somewhat, there are reasons for that, one of which is the feeble rally by the stock market since its low of last October, but this doesn't mean that we won't see a more serious decline later.

Fundamentally, oil faces serious headwinds going forward with an impending economic depression that can be expected to slash global demand significantly, made worse by the rogue and woke political establishment who are very anti-oil.

Whilst oil has been in a decelerating downtrend for the past 10 to 11 months, it is not clear on the 18-month chart just what is going on. So to gain more perspective, we will now move on to consideration of the longer-term 5-year chart.

On the 5-year chart, it is becoming increasingly obvious that a large Head-and-Shoulders top is forming above a band of quite strong support down to and at the US$60 level, and even if the pattern doesn't technically qualify as an H&S top, it is clear that failure of the support at US$60 will open the door to a much more serious decline.

The S&P500 index is shown at the top of this chart, and we can see that broadly speaking, oil and the stock market have been moving in tandem, at least as far as their major trends go.

This being so, if the stock market turns sharply lower, viewed as increasingly likely given the massive line out of Banks waiting to declare bankruptcy, then oil could soon crash this support and drop away steeply.

So what about oil stocks?

On the 18-month chart for the XOI oil stocks index, we can see that, after outperforming the broad stock market for most of last year, oil stocks have underperformed from last November, with momentum gradually turning negative.

This index has dropped steeply in recent days, and without a significant reversal to the upside, very soon, we will see a bearish cross of its main moving averages, the first time this has happened since late 2018!

On this chart, it looks like a large top has been forming for nearly a year now.

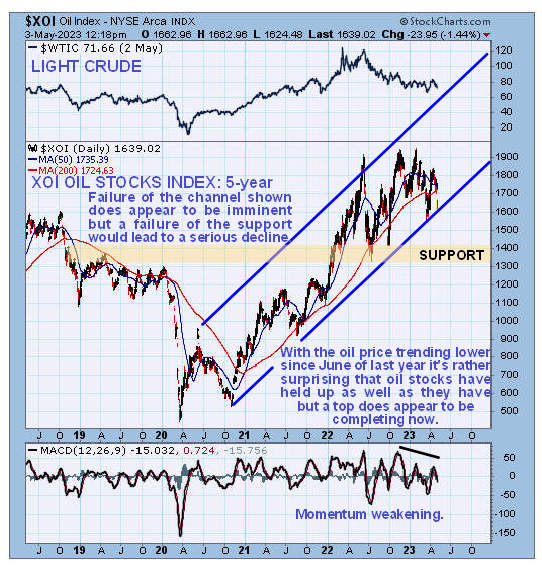

On the 5-year chart for the XOI oil index, we see that the sector has been in a powerful uptrend since the 2020 Double Bottom that has resulted in it more than tripling in value from its lows. This is a very big gain for a sector in less than three years, and of course, a big reason for it is the extremely low oil prices that prevailed for a while in the Spring of 2020 during the Covid panic when it briefly became worthless.

However, we can now see that, following the buildout of what looks like a top pattern for almost a year, the oil index is on the point of breaking down from this major uptrend, and it might have done so today after the Fed statement that caused markets to drop.

Over the near term, the index looks set to continue to drop, perhaps after a minor relief rally, initially to the support level shown, but the failure of this support would open up the prospect of a much more severe decline due to a collapse in demand resulting from reduced economic activity.

Originally published on clivemaund.com on May 3, 2023, at 4:35 pm EDT.

Want to be the first to know about interesting Oil & Gas - Services and Oil & Gas - Exploration & Production investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

1) Clive Maund: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: None. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

CliveMaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.