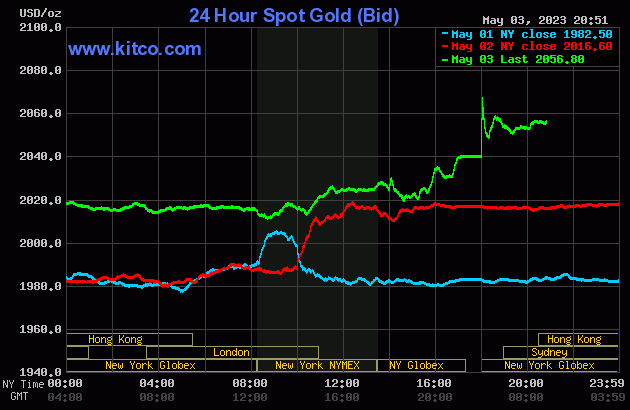

Gold Yesterday

Close examination of gold action in the past 24 hours. Short spike not apparent in Kitco intraday chart.

- A ~US$60 in 2-hour move in gold

- New all-time highs in US$

That US$100 intraday move is coming!

Gold Testing All Time Highs. New High in AU$ Gold. Gold ETFS Bond Rally Continues

- A ~US$45 in 4-hour move in gold

- Close to all-time highs in US$

Key Points

- Gold

- About to test all-time highs

- ~US$45 in just four hours

- Exceeds April highs

- Breaking out of the box

- New all-time highs in most currencies

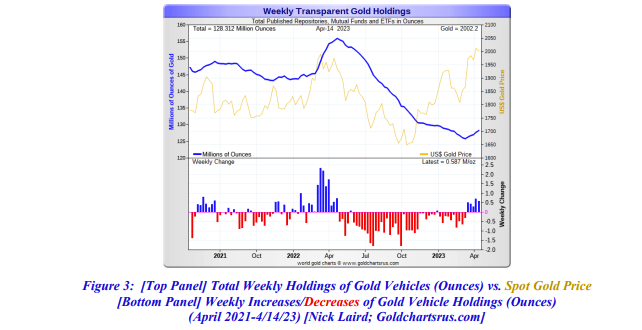

- ETFs are now accumulating gold after a 30moz reduction in 2022

- Nth Am Gold stocks continue higher

- Wedge already breached to the upside

- XAU heading for 165

- ASX Gold Stocks break through wedge and gap higher

- Big picture technicals setting up powerfully

- Short-term wedging pattern is very bullish.

- Small developers outstanding value

- U.S. Bonds

- Bond prices higher

- Yields falling sharply

- 10-year gapped down

- Heading much lower

Gold

So many drivers for gold to move higher.

- War mongering in Ukraine

- War mongering around Taiwan

- Global budget deficits

- Currency concerns

- Inflation

- Peak government arriving

Choose your favorite issue.

Supply and demand within ETFs are now working in gold's favor after a year of selling pressure. The technicals for gold are very strong. Higher gold prices after market close will make most of these charts outdated, but the direction is definitely up.

- Out-of-the-box move coming very soon

- After market close, action may have already broken this

- New highs imminent

- This is a massive base that will propel gold far into space.

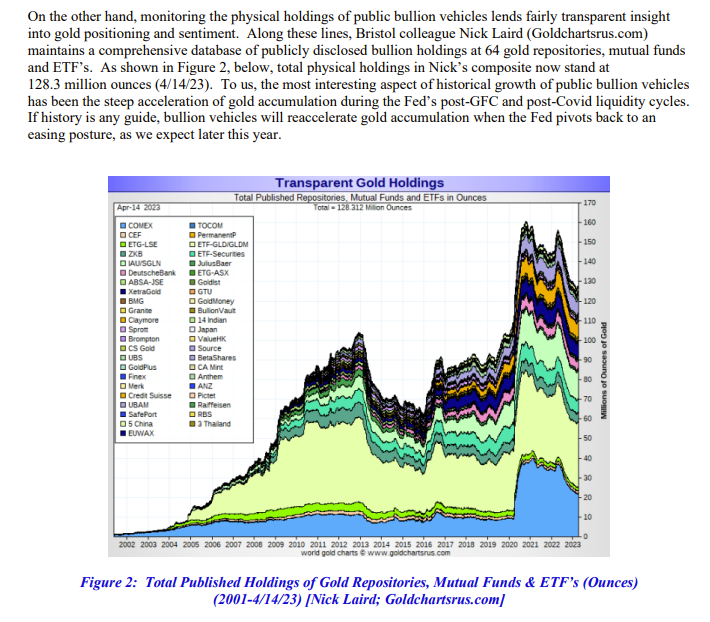

The following graphic from Goldchartsrus.com is the 30moz reduction in holdings by ETFs etc, since early 2022.

The major thesis here is that this rundown reverses very quickly and, in the 2020 run-up, added 100moz in less than a year. Will we be seeing this repeated and more in 2023 and beyond?

So far, gold has been rising, yet the holdings have continued to decline. It has only just started rebuilding.

Short Term Down Trend Is Broken

- Surging now after backtesting

- Wave 3

- Should now start to really move

- Exceeded April highs after trading hours

- Gold is through this resistance

- Is now ready to fly

Gold Stocks

- Up >3% as index breaks wedge

- In wave 3

- Zone of maximum acceleration

- Next stop 165 on the XAU

Long-term gives >100% upside in XAU

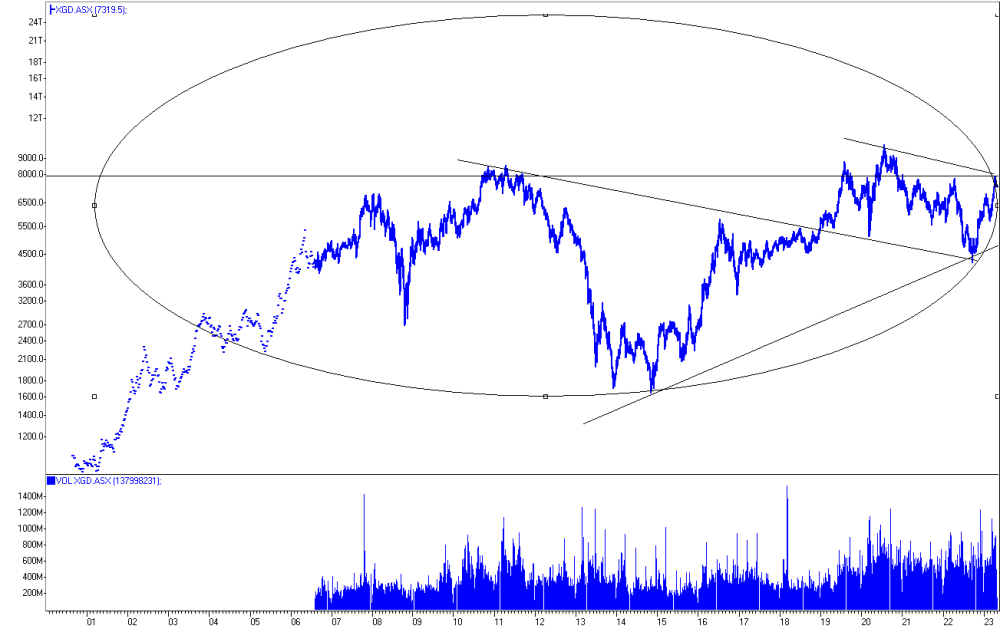

ASX Gold Index

Need to keep repeating the big picture here

- Coming to the end of this 20-year formation

- 12-year pattern being resolved

- 3-year pattern being resolved

- 3-week wedge resolved

- Prices now gap higher

This big picture supports a MASSIVE rise in the XGD.

This short-term wedge resolved higher and breakaway gap established.

U.S. Bonds

A big rally is still setting up.

Yields To Fall

- Yields gapped down here

- Signs of a strong move

- And here

- Resolution only days away

- Will be big if it does happen

Timing is everything.

Heed the markets, not the commentators.

Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

1) Barry Dawes: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: My company, has a consulting relationship with: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: None. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.