Defense Metals Corp.'s (DEFN:TSX.V; DFMTF:OTCQB; 35D:FSE) successful Phase 1 test of its hydrometallurgical pilot plant at SGS Lakefield in Ontario is a good sign for the viability of the company's Wicheeda rare earth element (REE) project, one analyst says.

The objective of the pilot plant is to demonstrate the processing of Wicheeda flotation concentrate to produce REEs using the acid bake hydrometallurgy process, Noble Capital Markets analyst Mark Reichman wrote on April 13.

"Given the pilot plant program's impact on the engineering design and economics of the feasibility study, we think early success, along with outstanding results from the 2021 and 2022 drilling programs, bode well for a compelling preliminary feasibility study (PFS)," Reichman wrote, who continued to rate the stock Outperform with a CA$0.90 target. "We believe the current stock price offers an attractive entry point for investors."

Noble Capital Markets analyst Mark Reichman wrote, "We believe the current stock price offers an attractive entry point for investors."

Defense Metals recently updated Wicheeda's 3D geological model with 10,000 meters of new drilling from 47 holes completed in 2021 and 2022, which the company called a "significant milestone."

It next plans to update its resource estimate and complete the PFS.

The company wants to produce as much as 10% of the world's light REEs to reduce reliance on China, which has about 85% of the world's processing capacity of the elements.

Why Rare Earth Elements?

REEs are in high demand in the new green economy for purifying water, MRIs, fertilizers, weapons, scientific research, wind turbines, computers, and permanent magnet motors for electric vehicles (EVs).

According to a report by Fortune Business Insights, the global REE market is expected to grow from US$2.6 billion in 2020 to US$5.5 billion in 2028.

"The rising demand for consumer durables such as tablets, laptops, and smartphones is one of the factors driving the consumption of rare earth elements," the report said. "The demand for these elements in developing economies is estimated to expand rapidly."

The Catalyst: Phase 2 Scheduled This Month

During five days of operation, the pilot plant ran continuously for 110 hours.

Defense Metals and SGS Lakefield "confirmed the viability of the process, optimized certain design parameters, and identified areas that will be improved ahead of the Phase II pilot plant run scheduled for late April," Reichman wrote.

Assays are still being received, and evaluation of the results is continuing, but Defense Metals said that extraction of praseodymium (Pr) and neodymium (Nd) from the acid bake calcine was more than 90%, the impurity removal circuits were efficient, and reagent regeneration and water circulation were effective. Only minor changes will be made to the circuit ahead of Phase II, and an alternative precipitant will be used.

Praseodymium is used in a variety of alloys, including a high-strength one it forms with magnesium that is used in aircraft engines. Neodymium is used as an alloy with iron and boron to make strong permanent magnets.

The demonstration "delivered exactly what was required of it," said John Goode, consulting metallurgist to the company. "We have confirmed the general workability of the process, optimized certain design parameters, and identified areas that will be improved ahead of the Phase II pilot plant. The SGS Lakefield team did an excellent job of construction and operation of the circuit."

The acid bake extraction process being tested could lower capital and operating costs, the company has said. High-temperature concentrated sulfuric acid is used to convert the REEs to water-soluble sulfates, which can then dissolve during a water leach. A precipitation process is then used to recover the REEs.

The process is expected to allow for a more than 95% recovery rate for the REEs, compared to less than 90% with the alternative caustic cracking process.

Analyst: Co. Well-Positioned for Global Markets

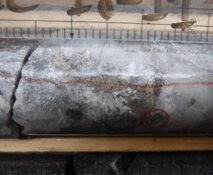

The holes from 2021 and 2022 returned some of Wicheeda's longest and highest-grade intercepts, the company said.

Hole WI21-58 returned 3.09% total rare earth oxide (TREO) over 251 meters, and WI22-68 returned 6.7% TREO over 18 meters.

Wicheeda is well-located with access to key infrastructure and "could become a globally significant producer" of REEs, analyst Michael Gray of Agentis Capital wrote.

High-grade REE dolomite-carbonatite was discovered in the north area of the deposit, returning 3.17% TREO over 196 meters, including 4.29% TREO over 55 meters to a depth of 201 meters extending 30 meters below the resource pit shell.

Wicheeda is well-located with access to key infrastructure and "could become a globally significant producer" of REEs, analyst Michael Gray of Agentis Capital wrote in a research note.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Defense Metals Corp. (DEFN:TSX.V; DFMTF:OTCQB; 35D:FSE)

"DEFN is a best-of-breed North American REE developer that is well-positioned to its leverage-growing global REE demand and government support to become part of a North American REE critical metals supply chain," wrote Gray, who set a 12-month valuation of CA$3.50 for the stock.

Ownership and Share Structure

About 5% of the company's stock is owned by insiders, including Director Andrew S. Burgess with 2.01% or 4.18 million shares, and CEO Taylor with 1.2% or 2.5 million shares, according to Reuters.

About 5% of the company is owned by institutional entities, including U.S. Global Investors Inc. with 0.96% or 2 million shares, Reuters said.

The rest, 90%, is retail.

Defense Metals has a market cap of CA$68.54 million with 207.7 million shares outstanding, about 165 million of them free floating. It trades in a 52-week range of CA$0.39 and CA$0.165.

Sign up for our FREE newsletter

Disclosures:

1) Steve Sobek wrote this article for Streetwise Reports LLC. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Defense Metals Corp. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: None. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees, or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Defense Metals Corp., a company mentioned in this article.