This weekend marks the 90th anniversary of the founding of the “Ontario Prospectors and Developers Association” where the first meeting ever (in 1933) was to overturn a proposed bill that would have hurt the mining industry.

Imagine that.

A gathering of hard-rock miners largely from the culturally-sophisticated towns of Timmins, Sudbury, and Kirkland Lake descend into the heart of Toronto to lobby the government. Needless to say, the proposed legislation died on the floor of the Queen’s Park legislature and twenty-four years later, the name was changed to the current one, the Prospectors and Developers Association, celebrated every March with the legendary convention in downtown Toronto, designed by the promoters to assist the starving hotel, restaurant, and entertainment businesses that by now are suffering from the economically-debilitating effects of Canadian winter. Mind you, “winter” in southern Ontario is considered “late Spring” by the residents of northern Ontario (and “late summer” by the residents of Winnipeg).

PDAC

I knew nothing of PDAC until 1981 and the only reason I attended was that I heard that a bunch of the mining people from Timmins, Ontario (which is basically everyone from that town) was going to be attending. This was just as the big discovery hole from the Hemlo discovery was announced sending joint venture partners Golden Sceptre Resources and Goliath Gold Mines — arguably two of the best names ever assigned to a junior explorer — through the proverbial ionosphere in what became for this author the most lethal narcotic ever introduced to a plebian bloodstream.

As a 28-year-old business double-major from the tenth best undergraduate university in the U.S. (Saint Louis University), I was first introduced to the securities markets by Professor Dean Yeager, whose passion for high-quality Scotch was second only to his passion for non-filter Camel cigarettes. Before attacking the day’s lessons, his lectures always included a level of vitriol (and coffee) considered most vile by many of my fellow classmates.

He would assail Arthur Burns and Bill Miller for being “wimps” and only calls back to friends still enrolled five years after my graduation did I learn that he turned down a roll in the Reagan Administration to assume the role of Dean of the Saint Louis University Business School. I called him “Doc” because he was proud of that degree and it was with great pride that I sent him a bottle of Scottish Single Malt on the anniversary of his appointment in 1990.

What usually ensued was a massive anticipatory volume being met with massive anticipatory selling such that as all the planes and trains left Toronto for destinations abroad, all that was left was shards of broken dreams and terminal margin calls.

The first time I ever had to speak at PDAC, I was at one of the sidebar events in the “workshop” section that was separate from the main event ballroom. That year, 2009, the world was in a conflagration of commodities “stories” where common folk were advised to put life savings to work in all issues related to the “Great China Build-out” narrative.

Every booth at PDAC emphasized a relationship with China by way of either their national geological/mining company (“CGM”) or their national investment company (“CIC”). I was walking around the floor of the convention center with a couple of veteran Bay Street mining players that were just shaking their heads at the blatant carnival atmosphere that was dominating the room.

The contrast between 1982 when every booth highlighted either several sections of drill core or maps showing proximity to a major discovery (or both) and 2006, where every booth had either a fishbowl of business cards eligible for a one-ounce-gold-coin draw or a free dinner with “prominent Vancouver entrepreneur” {name inserted} was unmistakable. The year after Bob Bishop sold his newsletter advisory service to David and Eric Coffin, I was walking the floor with him and made the comment that “I’m so glad you sold your newsletter last year because now I don’t have to compete with a hundred Vancouver promoters chasing you across the floor.”

The PDAC Effect

The problem with the PDAC “event” is that it became what I coined back in around 1986 a “seminal selling event” because the promoters used to get on the phones with the word that they “have a booth” and that they are “planning huge news” or are being touted “by a major newsletter speaker” and that you had “better load up” before the PDAC event. What usually ensued was a massive anticipatory volume being met with massive anticipatory selling such that as all the planes and trains left Toronto for destinations abroad, all that was left was shards of broken dreams and terminal margin calls. Western Uranium & Vanadium Corp. (WUC:CSE; WSTRF:OTCQX)

I used to have clients that would call me with the news that they has heard at the country club that Foo-foo Mines was presenting at PDAC and that they had “inside information” that the stock was going to pop immediately after PDAC once the news was out.

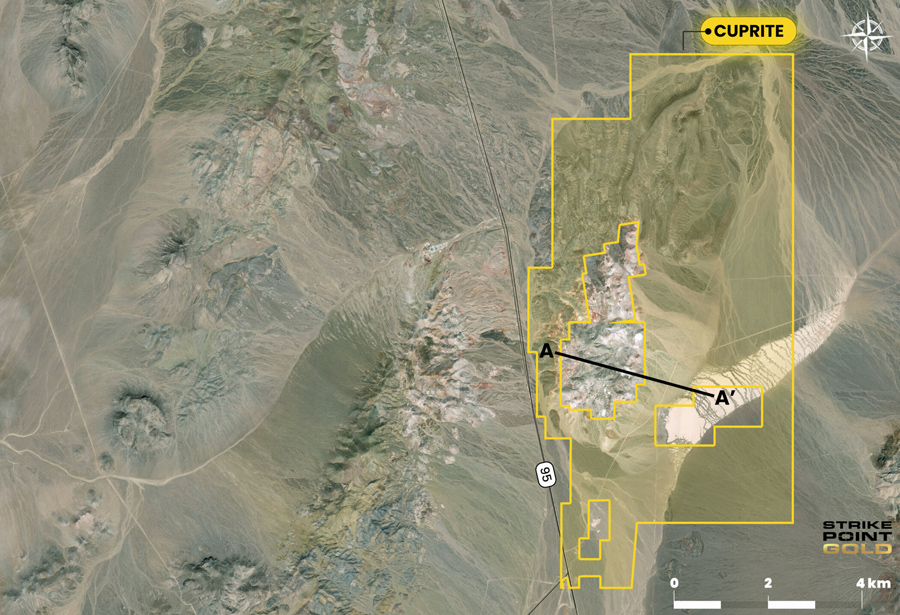

I would then lecture them on the dangers of PDAC and finally, when they all came into the groove, we used to SHORT especially active companies that never ever actually came with any real “news” because as far as the promoters were concerned, the buy-side volume created by the “PDAC Effect” WAS the news and news into which one should SELL all their stock. Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB)

So, here in 2023, we have yet another PDAC starting at 10:00 a.m. on Sunday morning and I will undoubtedly make an appearance but as of tonight, I have only one penciled-in meeting. It is with my longstanding uranium named Western Uranium & Vanadium Corp. (WUC:CSE; WSTRF:OTCQX), where I will have an afternoon luncheon with CEO George Glasier and CFO Robert Klein.

I rarely speak with either George or Rob these days because, with 56 million pounds of uranium sitting in their Sunday Mine Complex in Colorado with a market cap of a paltry US$30.5 million, it is only a matter of time before they get taken out lock, stock, and barrel for some number north of US$10/pound (US560 million).

I am sure I will hear from Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) who are also attending but the vast majority of companies I follow have the same attitude as do I — the PDAC is not the event that used to provide terrific opportunities to meet quality technical people and very useful investment industry representatives; it has devolved into a carnival act if clowns, jugglers, barkers, and weight-guessers whose primary goal is to part you from your wealth.

That said, I applaud the really good juniors that are attending that would serve to elevate the standard to a more palatable benchmark.

Last Week's Economic News

The past week was dominated by solid economic news and because of the tight labor markets and largely unfazed consumers, the U.S. economy is doing very little to assist Fed Chairman Jerome Powell in reining in inflation, and because of that the yield on the 10-year treasury note popped back above 4% albeit briefly before a late week respite took yields down, stocks, bonds, and the metals up, all amidst the backdrop of a declining U.S. dollar index.

The S&P 500 slid back below the 50 and 200 dma’s just kissing the uptrend line drawn off the December lows before getting launched into a 65=point rebound on Friday as the shorts ran for cover in what has become a rangebound market.

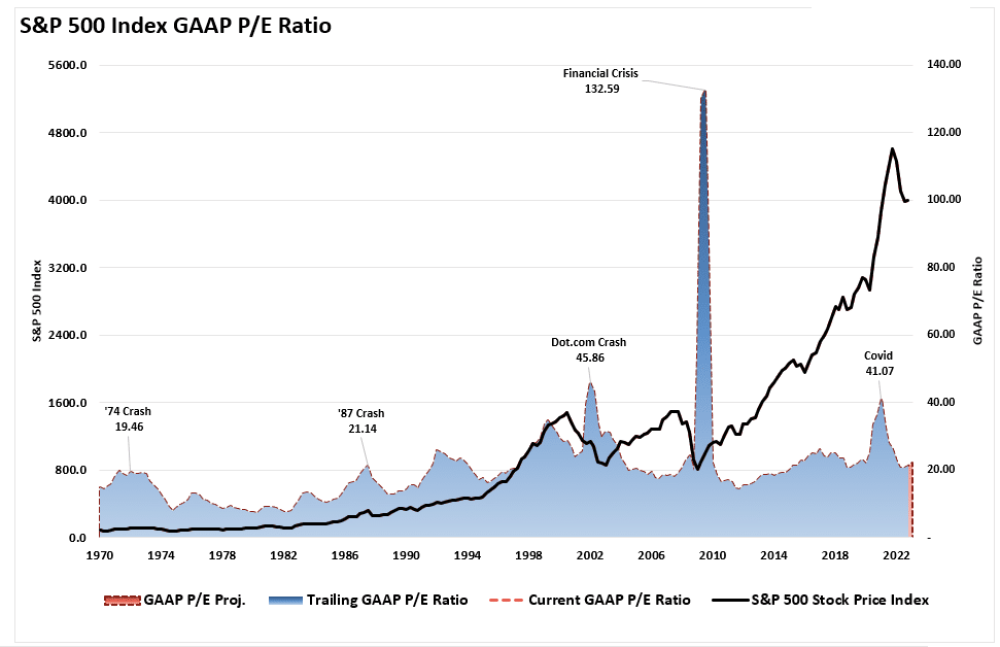

Rangebound markets (like the 1970s) are a trader’s dream as they are inevitably governed by clearly-defined support and resistance zones and while I would love to say that 2023 will become one, the problem I have is valuation. In 2020-2022, with the 10-year yield at 1.2%, one could make a case for elevated P/E multiples because the “TINA” (There Is No Alternative (to stocks) effect was very much in play.

With no inflation and moderated borrowing costs, traders felt emboldened to bid up prices and that is largely what propelled valuation from the March 2009 lows under Bernanke to the 2022 top under Powell, only it was the arrival of “non-transitory” inflation that flipped the Fed from stocks-friendly to stocks-hostile.

With inflation continuing to percolate along north of 5% after punching above 9% last year, Jay Powell is honing his tough-guy image while taking Paul Volcker Language Lessons at the Julliard School of Central Bank impressions.

The chart shown above is one reason why I reject the “rangebound market” thesis because when these rate increases which, by the way, are the most severe increases in economic history (“shocks” according to Stephanie Pomboy), finally start to affect the growth numbers, the Y-axis in that chart is going to look like a meteor coming into the atmosphere on a clear summer night.

In other words, elevated P/E multiples are fine as long as there is no problem with the “E” part but with interest rate hikes acting as a lagging indicator, the North American economies are in for more than a few earnings surprises.

This is why I refrained from taking a long position into the decline into that moving average convergence zone discussed last week. Covering shorts was the right move and in retrospect, one certainly could have scalped a few centablos on the long side but for me, stocks that dominate the SPX are simply too rich, especially with the Fed still talking about “higher for longer” with respect to monetary policy.

My greatest fear is that the economy suddenly grinds to a halt by the summer at which point the Fed panics but it turns out that it is too late to save the day and we descend into a prolonged 1973-1974 type of downtrend.

I will re-establish shorts on any move above 4,150 with a view that we are eventually going to see a retest of the lows seen in December. To repeat, it is the 3,764 level that now represents my internal “line in the sand” because if we violate that number, the bullish implications assigned by the January Barometer disappear and we definitely do not want to be a stock investor if that occurs.

Gold

Gold had a great week and if taken by itself, warrants me adding to my gold holdings. We got a decent reversal at the 50% Fibonacci Retracement level after coming off a very brief oversold condition on February 24th and with the way it went out on Friday afternoon, we could get a very bullish MACD crossover by mid-next-week.

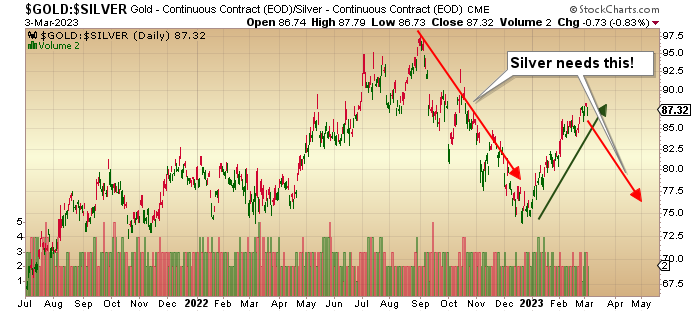

That is the good news; the bad news is that silver once again lags badly. The chart of the GSR (“Gold-to-Silver Ratio”) has silver underperforming gold since early December and when coupled with the 7% haircut in the HUI gold index, gold on its own will not withstand the assault from lagging silver and lethargic gold miners. Hopefully, there arises a slingshot effect where gold can extend the gains into the rest of the month and creates a slipstream of sorts for the laggards.

We are long overdue for a return of animal spirits to the junior gold and silver miners and while there has in the past been seasonal weakness in the post-PDAC period, we did not get the normal seasonal pop in gold and gold miners that we often see in the first few months of the calendar year.

It will be interesting to see how the junior resource issues fare after PDAC wraps up on Wednesday. In scanning the exhibitor list this morning, I see an inordinately large number of companies with the words “lithium” or “battery” in their names proving once again that these mining conventions make damn sure that they provide the public with ample servings of whatever the public is currently buying. I am absolutely certain that if processed cow manure was attracting investor dollars, then PDAC would be featuring a boatload of methane deals all pitching their stories up and down the aisles of the Metro Convention Centre. It is simply the way business is conducted in the complicated world of junior mining.

Want to be the first to know about interesting Uranium and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

Disclosures:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: All. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: My company, Bonaventure Explorations Ltd., has a consulting relationship with: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: None. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Western Uranium & Vanadium Corp. and Getchell Gold Corp., companies mentioned in this article.