Arizona Silver Exploration Inc. (AZS:TSX; AZASF:OTC) has identified a large drill target in its Philadelphia gold and silver project in Arizona after seeing positive results from their controlled source audio-magnetotellurics (CSAMT) geophysical survey.

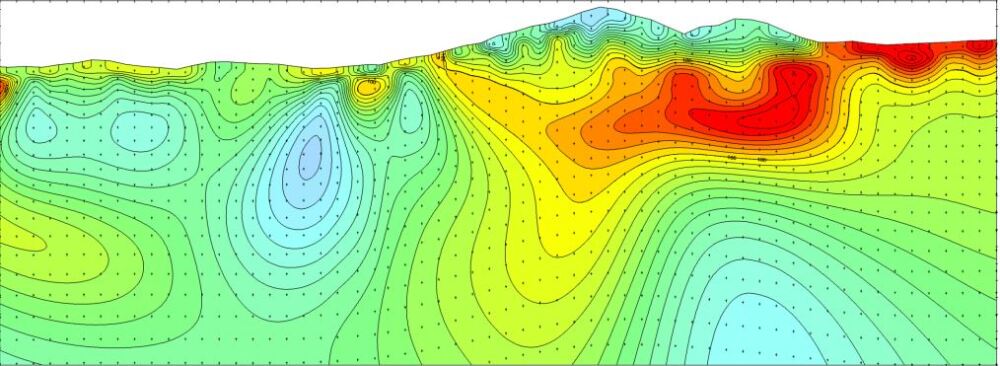

The company announced on February 7, 2023, that its CSAMT survey identified a large low resistivity layer at 100-200 meters deep, below the hydrothermally altered flow dome complex of the project. The layer is potentially a sizeable mineralized body that extends for over 500 meters east of existing drill holes.

In January, Arizona Silver announced its positive assay results, reporting that all three core holes drilled in 2022 have intersected wide intervals of potentially bulk tonnage gold grades.

Both the CSAMT survey and drilling results point to extensive and sizeable high-grade gold and silver targets in the west (drilled holes, at the side of the flow dome) and east (survey area, below the flow dome) of the Philadelphia project.

"Building ounces in a low sulfidation epithermal system takes a lot of drilling if the target is simply the veins themselves. Grades in the veins can be spectacular but a gold inventory that includes low-grade disseminated-style mineralization is potentially a big win."

"We have intersected considerable widths of low-grade material on the flanks of the flow dome. This survey indicates an extensive target lies below the flow dome hill," Arizona Silver Vice President of Exploration Greg Hahn said.

Arizona Silver is a young exploration company focused on gold and silver properties in Arizona and Nevada. It has four gold and silver projects to date, including the Philadelphia property; Silverton Gold Project in Nye County, Nevada; Ramsey Silver Project in western Arizona; and the Sycamore Canyon gold and silver project in southern Arizona.

Figure from Arizona Silver Exploration Inc. shows the conceptual bulk tonnage target below the large flow dome, hosting gold and silver deposits. It also shows an array of drill holes that can test the target — including existing drill holes in the west side, and future drill holes toward the east side.

The Catalyst: New Gold Resources Under a Historical Mining Site

The Philadelphia project is located in Mohave County, which is home to the Oatman Mining District. The district produced over 2.5 million oz of gold from high-grade veins from underground mining activities done decades ago.

Chris Temple of The National Investor pointed out in September last year that Arizona Silver could be sitting on 3 to 4 million ounces of higher-grade gold resources than what has mostly been encountered thus far, just at the Philadelphia property alone.

Arizona Silver said the west end of the targeted low resistivity layer from the CSAMT survey (called the Red Hills target) can be readily tested and drilled from pads once the Bureau of Land Management (BLM) approved their Plan of Operations.

Chris Temple of The National Investor pointed out in September last year that Arizona Silver could be sitting on 3 to 4 million ounces of higher-grade gold resources than what has mostly been encountered thus far, just at the Philadelphia property alone.

The company also found a "feeder zone” on the west side, beyond that of the low resistivity layer. Drill hole PC22-91, the easternmost hole out of the three core holes, made it down more than 200 meters and intersected a prominent hydrothermal breccia immediately before the hole was lost when the rods became stuck.

The company views that this breccia could be the outer portion of a feeder zone, which assay results are at 2 g/t of gold.

"The objective going forward is to drill the low resistivity layer and the interpreted ‘feeder zone’ from the BLM pads currently being permitted once permits are received,” Arizona Silver said.

Also with the result of the survey, there can be potential targets determined once the company starts drilling in the central and eastern sides of the low resistivity layer.

Why Gold?

With the inflation and dampened economic sentiment overall, Bob Hoye of ChartsandMarkets.com views that the gold sector is "likely in the early stages of a fabulous bull market, propelled by the real price rising which translates to rising earnings — making the sector an investment and improving valuations of gold exploration projects.”

He further pointed out that the gold sector could outperform S&P, even bringing more aggressive fund managers to take up gold.

Given that it is often seen as a hedge against inflation, Hoye said that gold is a "better proxy for profitability than the Consumer Price Index.” He said some investors are doubting the central bank’s ability to manage the economy and its recklessness, therefore a factor in further dollar depreciation as seen through the years.

"If you knew for a fact that gold will hit US$2,670 per oz by year-end due to NIA's exclusive gold moon indicator . . . The biggest risk in the world is not having exposure to gold," it added.

He further stressed that gold will remain to be a good long-term investment strategy to counter accelerating inflation and bear markets.

The National Inflation Association said on February 16 that gold prices need to dip and consolidate first before eventually going up to beyond US$2,000/oz level by year-end.

"Gold which rallied from its September 28th extreme bottom of US$1,615 per oz up to a February 2nd high of US$1,960/oz got way ahead of itself and its dip to today's short-term bottom of US$1,827.65 per oz was 100% necessary, healthy, and expected,” the NIA said.

"If you knew for a fact that gold will hit US$2,670 per oz by year-end due to NIA's exclusive gold moon indicator . . . The biggest risk in the world is not having exposure to gold," it added.

Why Arizona Silver: Tight Share Structure and New Gold Discoveries in Arizona

Greg Hahn, Arizona Silver’s vice president for exploration, said Philadelphia is one of the few gold systems remaining in the Western U.S. that has never been evaluated using modern exploration concepts. With the use of a modern model called "Boiling Zones”, the company has seen immediate discoveries that have not been touched by previous miners of the site.

"Discovering the bulk tonnage target answered my question as to why we see such a remarkable alteration feature at surface. All this project needs is drilling to demonstrate its real potential,” Hahn added.

Employing modern drilling techniques, Arizona Silver has encountered new gold discoveries in the region. The company is anticipating having large gold and silver resources defined in 2023 and 2024.

Market-wise, the NIA said that "the smartest thing to do is to buy undervalued gold stocks because the gold industry is the most beaten down, out of favor, and extremely undervalued with nowhere to go but up big.”

Maund said, "This is therefore considered to be an excellent point to buy Arizona Silver Exploration or add to positions."

This statement is also reflective of Temple’s outlook for Arizona Silver, saying: "Arizona Silver Exploration is hardly the only promising company priced at peanuts. But its geological model and story are more compelling than most.”

He added that because of the tight share structure and trust from institutional investors, it is apparent that the stock "has obviously been in strong hands”.

Arizona Silver President & CEO Mike Stark backed this up, stressing that their tight share structure is not blown up, management has a big stake in the company, and that these investors are not seeing to sell their shares.

"The company has an extremely low burn rate, (and the) money goes into the ground advancing the property for higher shareholder value. Philadelphia is becoming larger by every single drill hole,” Stark added.

"We firmly believe that we have the next emerging gold and silver discovery in Arizona. It is a strong statement, but our drill results speak for themselves. We are approaching this methodically, designing programs strategically. We know how to spend shareholders’ money in a beneficial way from the earliest stages," Stark said.

On Valentine's day, technical analyst Clive Maund also shared his love for Arizona Silver.

He shared the above chart, and said, "This is therefore considered to be an excellent point to buy Arizona Silver Exploration or add to positions."

Ownership and Share Structure

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Arizona Silver Exploration Inc. (AZS:TSX; AZASF:OTC)

According to the company, management, advisors, and other insiders hold over 28% of Arizona Silver.

According to Reuters, Advisor Brandy Stiles has 14.11% at 9.77 million shares. VP of Exploration Greg Hahn has 4.68%, with 3.24 million. President and CEO Mike Stark has 3.79%, with 2.62 million. CFO Dong H. Shim has 1.16%, with 0.80 million, and Director Eugene (“Gene”) Spiering has 0.09%, with 0.06 million.

9% is held by institutions and strategic investors. SSI Wealth Management AG has 8.11% with 5.62 million shares, and Moloney Securities Asset Management LLC. has 0.01%, with 0.01 million.

41% is with family and friends of the company.

The rest of the 22% is held by retail investors.

The company did not disclose its total cash, but it has a monthly burn rate of CA$24,000. Drilling costs total CA$50/foot for cores and roughly CA$35/foot for reverse circulation all-in costs.

Arizona Silver’s market capitalization is at CA$21.48 million, with 69.2 million shares outstanding, and it trades in the 52-week range between CA$0.17 and CA$0.60.

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Nika Cataldo wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Arizona Silver. Please click here for more information.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Arizona Silver, a company mentioned in this article.