Canadian mining exploration firm NevGold Corp. (NAU:TSX.V; NAUFF:OTC; 5E50:FSE) announced today that it submitted its Exploration Plan of Operations (EPO) to the Bureau of Land Management (BLM) on February 8, 2023, for its Limousine Butte project in Nevada.

Once the permit is approved by the BLM, NevGold will be able to broaden its drilling of mineralization and new untested areas at the Limousine Butte project. NevGold started drilling in the project in Q4/2021.

Aside from the Limousine Butte property, NevGold has three more projects which are the Nutmeg Mountain project in Idaho, Cedar Wash project in Nevada, and the Ptarmigan property in Southeast British Columbia.

Catalyst: EPO Approval to Expand Drilling

NevGold President and CEO Brandon Bonifacio said the proposed EPO project boundary is 16,488 acres and will allow for up to 200 acres of surface disturbance, which is larger than the current 15 acres disturbance under the company’s Exploration Notices at the project. The company also stated the EPO exercise included many de-risking activities, which are needed for project development.

An EPO approval will help NevGold increase its drilling because of the expanded disturbance area, which will speed up the process of arriving at a resource estimate.

"Gold’s future strength and rise is thus easy to foresee," Matthew Piepenburg of Matterhorn Asset Management said.

A sign of abundant mineralization in the district, Bonifacio said there is an increased level of drilling activity in both the southwestern and northeastern areas adjacent to their Limousine Butte project.

The southwest adjacent is owned by Freeport-McMoRan Inc. (FCX:NYSE) and the northeast adjacent is by Centerra Gold Inc. (CG:TSX; CADGF:OTCPK).

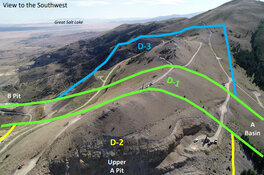

The Limousine Butte project is at the epicenter of this emerging Nevada district and NevGold controls over 20 km out of the total 30 km of strike length that has numerous mineralization and metal types such as gold, copper, silver, lead, and zinc (Au, Cu, Ag, Pb, and Zn)

NevGold is currently updating its geological model in the Limousine Butte project to incorporate 2022 drill results. Last year’s drill program yielded many drill targets that presented the potential expansion of mineralization at Resurrection Ridge and Cadillac Valley. On top of this, new exploration targets were also determined in untested parts of the project.

Drilling is planned for 2023 once geologic interpretation and targeting are complete.

Why Gold? Considerable Growth Seen This Year

According to Bonifacio, gold is an asset class that people can go to store and protect their wealth from currency devaluation or hyperinflation.

Matthew Piepenburg of Matterhorn Asset Management said that gold has been a "more loyal asset than stocks and bonds" in 2022, with prices staying flat and withstanding the turbulent economic situation. With recession fears this year, they forecast that investors can see better loyalty from gold, as the "USD strength will not hold."

"Gold’s future strength and rise is thus easy to foresee, as gold doesn’t rise, currencies just fall. It’s really that simple," Piepenburg said.

Despite the prices ending flat last year, gold prices are showing signs of strength this year, according to Jeff Clark of TheGoldAdvisor.com.

Rowan Dunne in his article published at Mugglehead Magazine said NevGold is the gold industry’s "new kid on the block" with a great potential to thrive.

Both Clark and The Future Trends Digest (FTD) see that gold prices can climb from US$1,875 per oz as of writing to hit US$2,000 per oz. this year. FTD further pushed that "gold will hit over US$2,000 by the summer."

Clark said in an interview that sentiment for gold is picking up, but noted that moves from the U.S. Federal Reserve will be critical, which he sees going from tightening interest rates to easing.

"I think that reversal — going from a tightening to an easing cycle — could easily be one instigator that lights a fire under gold," he said, adding that while the Fed has been aggressive with rate hikes, a turnaround may not be far away.

Why NevGold? ‘New Kid on the Block’ of the Gold Industry with Bright Prospects

Rowan Dunne in his article published at Mugglehead Magazine said NevGold is the gold industry’s "new kid on the block" with a great potential to thrive. He cited that positive shareholder relationships — resulting in financing support by institutions in the industry — make the stock a worthy investment.

Dunne also pointed out that even if NevGold is considered a junior mining company, its team has multiple decades of experience operating in the western U.S. belt, strong familiarity with contractors, and a competitive advantage in its ability to get drill rigs and quick turnaround times at assay labs.

This meant that the company keeps its costs low, with efficient operations and faster delivery of programs.

With the expected uptrend in gold this year, Bonifacio said the company’s focus is on its western U.S. projects Limousine Butte and Nutmeg Mountain.

"Our focus for 2023 is going to be drilling those projects and then updating the resource at both. And we think combined with both those projects, we’re going to be able to deliver what is north of a 3 million ounce near surface oxide gold resource by the second half of 2023," the NevGold president and CEO said.

Ownership and Share Structure

Streetwise Ownership Overview*

NevGold Corp. (NAU:TSX.V; NAUFF:OTC; 5E50:FSE)

Insiders and directors own 32% of the company. 26% is held by strategic investors, including GoldMining Inc. with 19.3% share and McEwen Mining with 7% holdings. The 42% balance is held by retail investors.

Market capitalization is at CA$25 million, with 71.418 million total outstanding shares.

The company has issued 16.947 million CA$0.60 warrants, with 10.303 million expiring on June 24, 2023, as well as 5.266 million options.

The company has CA$3.7 million in cash against a monthly burn rate of CA$50,000, which means it is funded to complete all of the work in the pipeline for 2023, including around 15,000 meters of drilling at its projects.

NevGold saw over CA$150,000 of participation by insiders in its most recent financing round completed in December 2022, along with a lead order from GoldMining Inc. worth CA$1.25 million.

The company’s drilling costs are currently at CA$300/meter for cores and CA$125/meter for reverse circulation.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Nika Cataldo wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. They members of their household own securities of the following companies mentioned in the article: None. They or members of their household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: NevGold Corp. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: None. Please click here for more information.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of NevGold Corp., a company mentioned in this article.