Gold is only at-bat, and not even at first base yet.

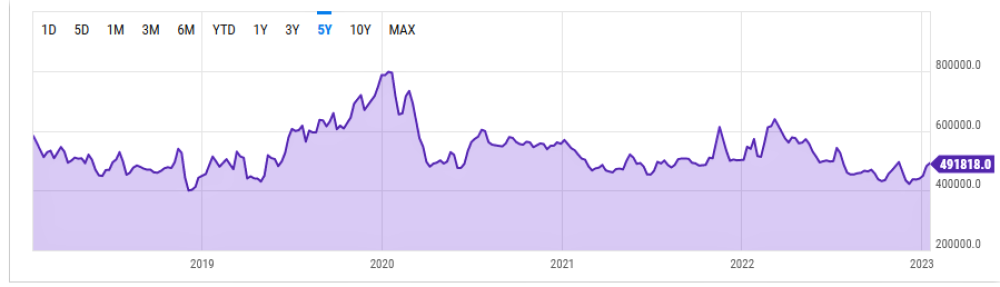

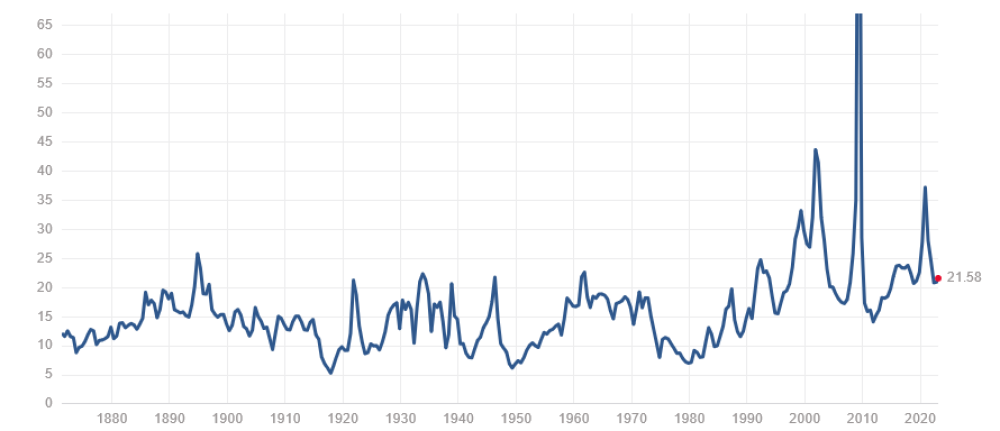

These charts gold and open interest below are 5-year charts. I find the gold price is manipulated so much it is better to watch the Comex charts and trading as much or more so than fundamentals.

I watch open interest because if there is a lot of buying and speculation, you will see a rise in open interest like the 2020 bull run. Open interest is still very low which means the market is over sold, even considering the price increase.

The current rally has mostly been driven by short covering. Remember back in November, I highlighted that managed money was 41,000 contracts short, now they are over 60,000 contracts long.

There has been some additional buying, but mostly it has been short covering, or else open interest would have increased much more. The Central Bank buying was a factor in convincing shorts to cover and spurred some buying. If speculation comes back into the market, and I think it will, gold can go a lot higher.

So far, the S&P 500 is holding on to a positive January, but recession pressures are rising, and earnings falling. The market has broken the down trend channel to the upside and tested 4,100 resistance. I think the market will break higher and its best chance will be in the next few months if inflation continues to ease and the Fed slows rate increases.

That said, this will be a bear rally and a bear trap.

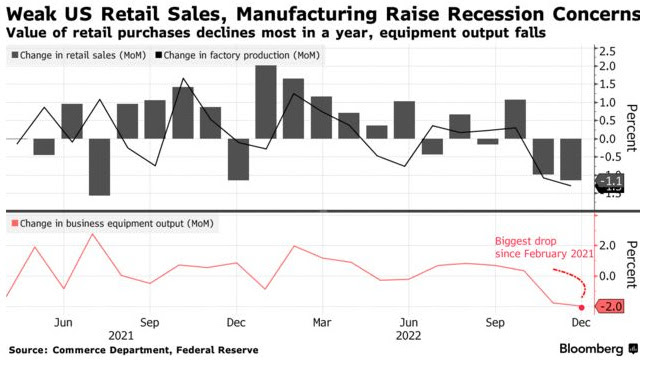

U.S. retail sales posted their biggest drop in 12 months in December.

Purchases at stores, restaurants, and online declined a seasonally adjusted 1.1%. And remember, these numbers are inflated with high inflation.

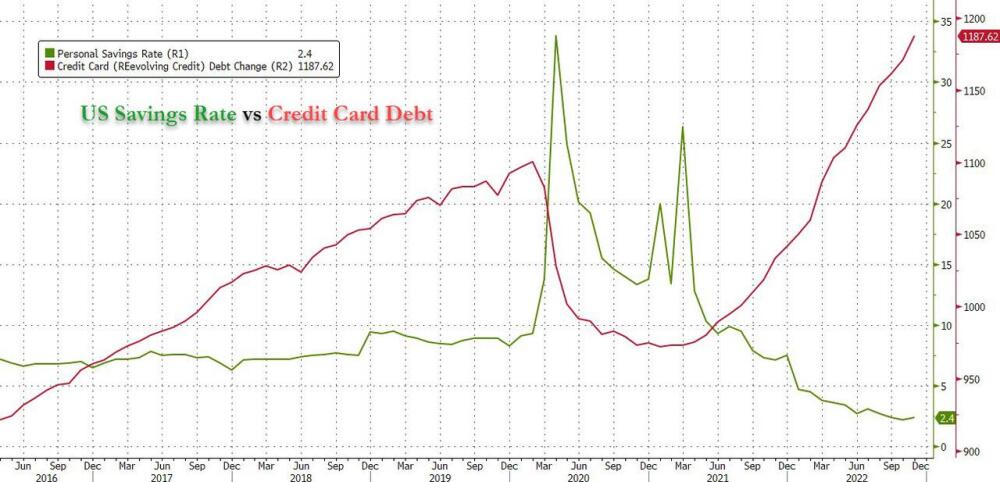

I believe the U.S. consumer is pretty much toast.

Not only has the consumer used up savings but has piled on record debt. To add insult to injury, they have to pay higher interest rate charges. The U.S. average interest rate on credit card debt went up from 14.5% to 19% in 2022.

And the future for the consumer looks horrific. Over the course of 2022, America’s real disposable income fell to its lowest level since the 1932 Great Depression, Heritage economist EJ Antoni said.

The Federal Reserve Bank of St. Louis shows real disposable personal income dropped to -6.4%, data released by the Federal Reserve Bank of St. Louis shows. The steep decline cost Americans over a trillion dollars in 2022, Antoni reported.

The Everything Bubble

The most important aspect of successful investing is predicting extreme bottoms and tops in the markets. Especially the bubbles because they can be so damaging to your portfolio when they pop. You don't have to get it right on, just close enough to avoid the major damage.

I have spent a lot of effort studying cycles. I profited from the Japan stock market bubble with Nikii Put Warrants before I had a newsletter. Since then, I predicted the 2000 tech bubble, and the 2007 real estate bubble. I predicted the Canadian marijuana bubble. Predicted the top in bitcoin within a few weeks. And the recent bear market with my 2022 Outlook.

I am not negative all the time, making it so that I will eventually be right. We made a killing in marijuana stocks before they went down the tubes. I had huge winners before the 2000 tech bubble, like Research in Motion (Blackberry) and NetOne, which developed the debit card. However, I did not buy into Crypto at all.

What is so scary about this recent bubble is so many things inflated together, like bubbles, all around the same time. Many have coined it the 'Everything Bubble.' Bonds were in a 40-year bull market, and stocks went to extremes, as I pointed out in my 2022 Outlook. Crypto currencies joined the bubble and real estate too.

And the stock market is still over priced in historic terms. The p/e ratio at the end of December, about 20.5, is well above the lows after the 2000 tech crash and the 2008 crash.

I would assume that you have heard over and over again that the Fed will soon pivot, and that will be great for stocks. Nothing could be further from the truth. In previous bear markets, the actual bottom occurred long after the Fed pivot. I am calling a pivot when the Fed cuts interest rates for the first time after raising them. I could give numerous samples, but let us look at the past two bear markets.

-

The Financial crisis of 2007/08 — The Fed pivot was in August 2007, and the bear market bottomed in February 2009, 18 months later.

-

The Dotcom bubble of the late 1990s/2000 — The Fed pivot was December 2000, and the bear market bottomed in September 2002, 21 months later.

The problem is that the Fed always acts too late. Remember just recently when they said inflation was transitory, and they were far too late raising rates.

I was critical of the Fed about this a year ago. The market consensus is that inflation will continue to fall, but I believe it has become entrenched. The Fed will pivot long after the economy is in recession and stock markets declining again.

Chairman Powell has made it very clear that he intends to error on the side of excess tightening, fearing inflation will bounce back if he does not. This certainly increases the odds that the Fed will pivot too late to fend off a steeper bear market.

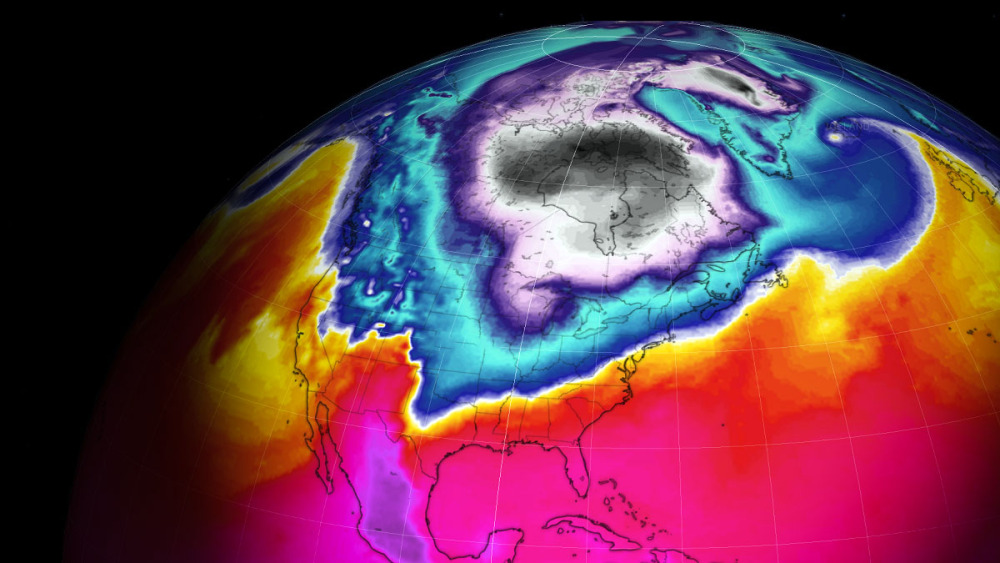

Winter Finally Arrives?

As you know, I have been bullish on energy and put the odds very high of an energy shortage this winter. Weather patterns suggested we could get a colder-than-normal winter. However, the weather is about as predictable as stock markets. North America and Europe were very fortunate because we had a far milder winter in December and January compared to averages.

That said, February can often be the coldest month of the winter and looks to be so this year. From the record warmth earlier this January, more seasonably cold weather for a large part of southern Canada and the U.S. Is arriving. The coldest air of 2023 has just plunged into the U.S. this past weekend with a stretched polar vortex.

From a good web site on Polar Vortex. Following the stretched PV, a larger PV disruption is likely that could bring a return of the cold to North America, Asia, and/or Europe following an interlude of milder weather. But much uncertainty surrounds this event, so my best advice is “the trend is your friend.”

Natural Gas prices have plunged with the above-average warm winter in North America and Europe, but all I am saying is that we are not out of winter yet. Perhaps the warm trend has come back; perhaps February will be very cold.

The chart above is on January 20th, and natural gas storage has been declining around the average rate of the past five years. However, this was in an above-average warm winter, and if February comes in colder than normal we could still see natural gas inventories plunge to very low levels that would spike prices.

I believe the natural gas price has bottomed. Note the high volume in the last several days at prices well below US$3.00. It looks like capitulation. Prices are down to a support level when oil and gas prices were very weak with the onslaught of the Covid-19 pandemic.

Birchcliff

Birchcliff Energy Ltd. (BIR:TSX) is my favorite natural gas stock. They just raised their dividend to CA$0.20 per quarter, so CA$0.80 for the year. This gives a yield of 9.4%.

There is some fear in the market with these low gas prices that Birchcliff could reduce the dividend. I believe natural gas prices are way over sold and will be back over US$3.00 soon.

The dividend is perfectly safe at US$3.00 gas, and although prices are below this now, the average price for the quarter will likely be above US$3.00.

Looks like a good entry price on the chart.

I am also suggesting the Birchcliff April $8.00 Call on the Canadian dollar side at CA$1.00

I believe government energy policies are going to result in energy shortages, specifically oil, and gas, but I am not against green energy, and many companies in this segment will benefit, like

Greenbriar Capital

Greenbriar Capital Corp.'s (GRB:TSX.V; GEBRF:OTC) Montalva solar project in Puerto Rico has been inching ahead slowly among government red tape, but Greenbriar and PREPA (Puerto Rico Energy) are in a mutually positive consensus to move the CA$195 Million 160 MWdc/80 MWac Solar Project forward within the venue of the Energy Bureau.

Greenbriar received a US$195 Million funding mandate from Voya Financial (Voya is a US$750 Billion investor and asset manager) to fund the project at the project level without shareholder dilution. The U.S. Federal Government pays for 40% of the project, which amount then becomes the company's core project equity investment during and after construction.

In Alberta, Canada, Greenbriar is proceeding with its 400 MW solar initiative with West Lake Energy, starting with a series of inside-the-fence projects at various West Lake operations and pumping facilities. Currently, West Lake is in discussions with the company for a strategic investment into Greenbriar Capital.

Sage Ranch in California is very near sales and construction. Greenbriar is soon expecting the approval of the precise development plan and then pull building permits to start construction. This is a 995-unit government-subsidized entry-level ESG sustainable homes project. Voya has provided a project-level line of credit for US$40 Million with no shareholder dilution.

Positive news is expected on all three fronts this year, and any of these should move the stock as it has been stuck in a wait-and-see syndrome or show-me mode for about two years. The stock has come down close to long-term support on the stock, so there is little downside from here and much more upside.

The gold stocks are now in a new bull market, with the HUI gold bugs index up as much as +47% since it's November 2022, 180 low. With strong gains in gold producers, I am starting to add junior explorers with strong high-grade gold discovers. I am following and have bought Amex Exploration, New Found Gold Corp., and Victoria Gold/Zonte Metals.

Amex Exploration

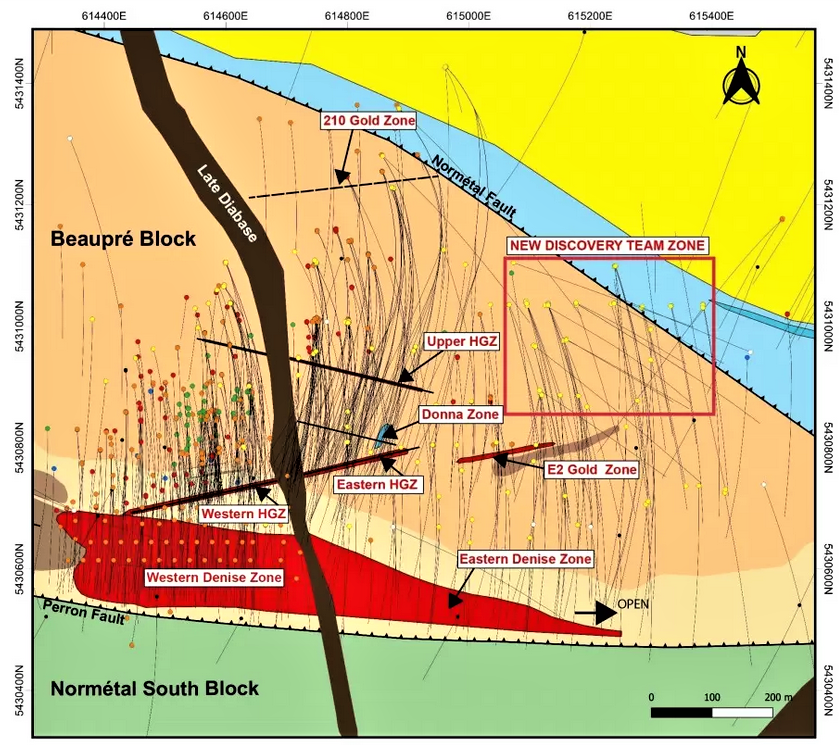

On January 23rd, Amex Exploration Inc. (AMX:TSX.V; AMXEF:OTCQX; MX0:FRA) announced results on continued expansion and definition drilling of the High-Grade Zone ("HGZ") on the Perron project in Quebec.

The results included intercepts from both the eastern and western portions of the system and are focused on defining less understood areas as well as testing the strike and depth extensions of the zone.

Highlights (in core length) include:

-

PE-22-535: 75.81 g/t Au over 4.85 m at a vertical depth of ~750 m

Including: 193.79 g/t Au over 1.00 m

And including: 235.87 g/t Au over 0.50 m

And including: 77.12 g/t Au over 0.50 m -

PE-22-524W5: 7.40 g/t Au over 14.80 m at a vertical depth of ~1200 m

Including: 152.22 g/t Au over 0.50 m -

PE-22-524W6: 24.34 g/t Au over 3.85 m at a vertical depth of ~1210 m

Including: 76.38 g/t Au over 1.20 m -

PE-22-524W7: 45.66 g/t Au over 1.80 m at a vertical depth of ~1190 m

As you can see in the above graphic, 100s of drill holes have been completed and intersecting high-grade gold. Amex conducted a total of 104,639 meters of drilling during 2022, which was one of the largest drilling programs conducted in Canada "For the coming drilling season, we will be focusing on the eastern portion of the Beaupre Block, where we see excellent expansion opportunities," said Kelly Malcolm, VP Exploration at Amex Exploration in their 2022 exploration review.

On the chart, we can see a wedge pattern with higher lows. A break above the wedge, over CA$2.00, would be positive, and a close above CA$2.25 would confirm a new uptrend.

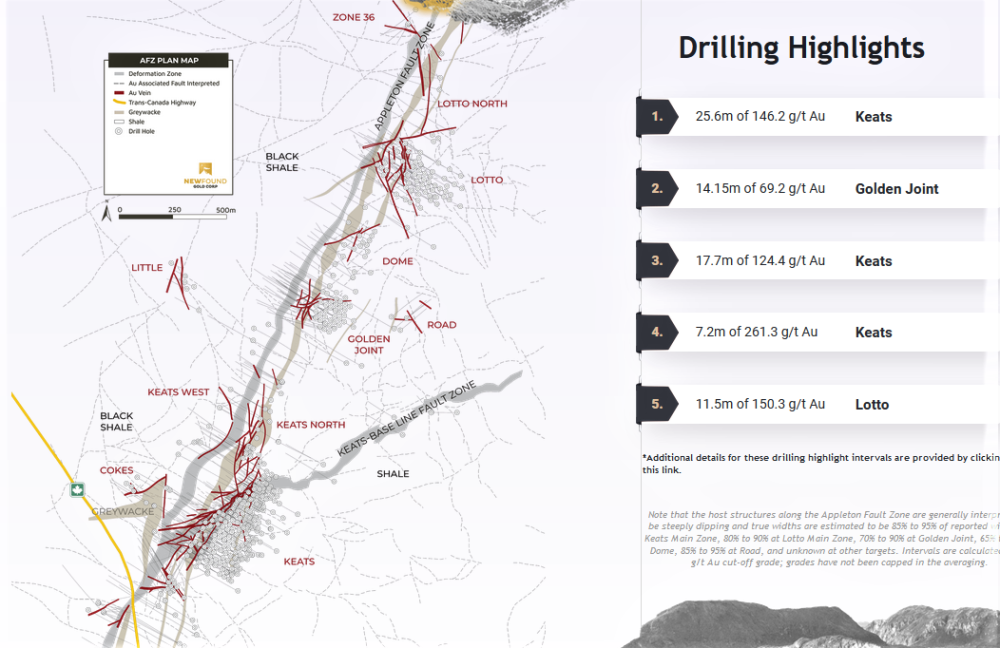

New Found Gold

New Found Gold Corp. (NFG:TSX.V; NFGC:NYSE.American) has opened its new 25,000-square-foot core shack and office facility in Gander, Nfld., designed and constructed to support logging and processing of drill core from the continuing 500,000-metre drill campaign at its Queensway project.

On January 24, they released drill results from 37 drill holes that were completed as part of a program designed to follow up on newly discovered high-grade gold at Keats West, located west of the highly prospective Appleton fault zone (AFZ), and from expansion drilling at Keats North.

At Keats West, ongoing drilling up-dip of NFGC-22-960 that intercepted 42.6 g/t Au over 32m continues to intersect expansive zones of gold mineralization, including 6.68 g/t Au over 24.00m in NFGC-22-784, 13.9 g/t Au over 5.00m and 2.01 g/t Au over 7.00m in NFGC-22-808, and 2.12 g/t Au over 16.25m in NFGC-22-868.

Across the AFZ to the east is Keats North, where an extensive array of brittle faults host to high-grade gold have been discovered and traced over an area 150m wide x 630m in strike. The focus is on the top 200m of vertical depth. Highlight results from this drilling include 28.8 g/t Au over 3.45m in NFGC-22-855 and 2.13 g/t Au over 14.10m in NFGC-22-813.

A new high-grade vein has been discovered between Keats North and Golden Joint, reporting a grade of 50.3 g/t Au over 2.45m in NFGC-22-766. The graphic next page is a good snap shot of discovered zones and some of the high-grade highlights.

The NFG chart also shows a wedge pattern with a trend of higher lows. A break above this would be positive, but there is significant resistance around CA$6.60 to over come.

Victoria Gold

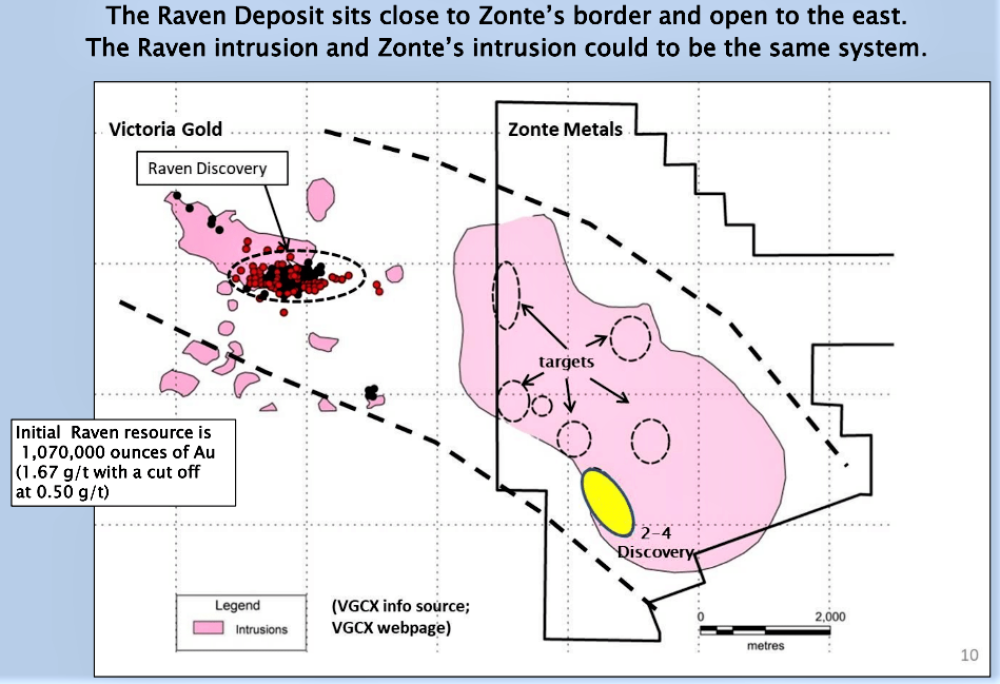

Another very significant discovery in Canada is Victoria Gold Corp.'s (VGCX:TSX; VITFF:OTCMKTS) Raven Project. Victoria Gold is already producing at their nearby Gold Eagle Mine. For the full-year 2022, Eagle gold production was 150,182 gold ounces.

From their home page, as of December 31, 2021, the Reserve is 2.7 million ounces of gold (133 m tonnes grading 0.65 g/t) at Gold Eagle. On October 31, 2022, they released their first resource estimate at Raven, which is about 15 kilometers east of the Gold Eagle mine, and it is a near-surface 1,070,329 ounces at 1.7 g/t gold. This Raven resource is almost three times the grade of their nearby producing Eagle Mine.

On January 19th, they released more drill results that included 3.59 g/t over 83.5 meters. Of the 90 drill holes drilled at Raven in 2022, 30 drill holes (8,810m) were located within the Raven Resource footprint, and 14 drill holes (4,410m) were collared within 100m of the Raven Resource.

The Raven Distal Exploration Program consisted of 46 drill holes (12,024m) drill holes, the majority of which are collared greater than 100m from the Raven Resource bounds. Raven mineralization remains open, in particular to the east, which will be the focus of the next phase of exploration.

Zonte Metals Inc. (ZON:TSX.V)

Zonte Metals Inc. (ZON:TSX.V)

The one million-plus resource is in pink, and you can see that there are a lot of drill holes that hit good numbers outside this resource. There is no doubt that this is going to be a lot larger and will end up being a multi-million-ounce discovery. This gives Victoria Gold a lot of upside potential.

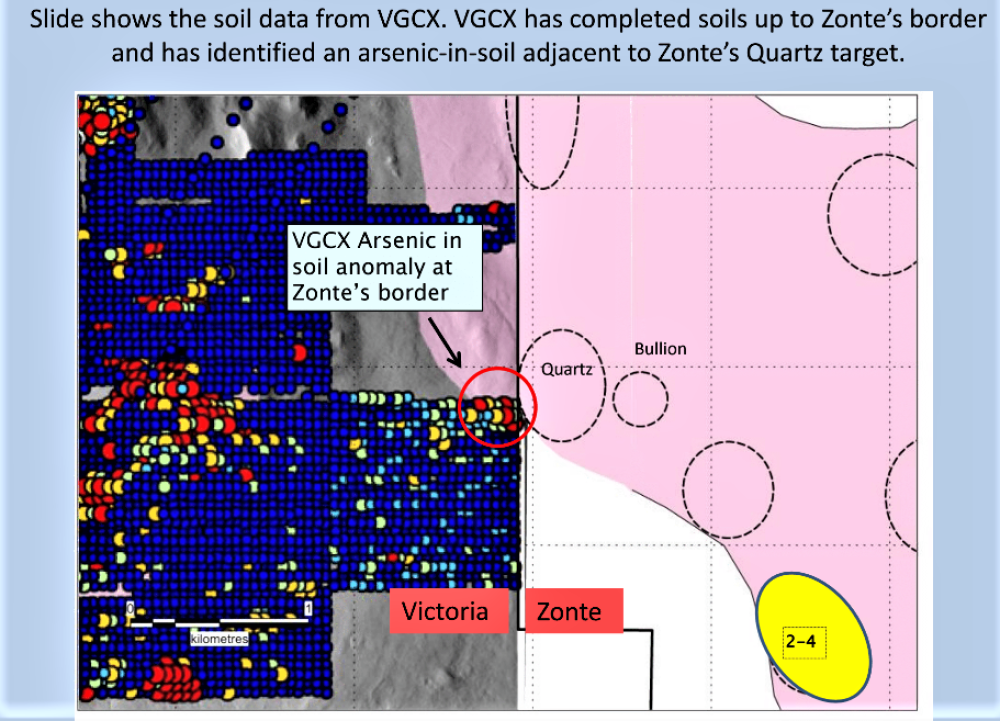

What is more, Victoria Gold says it is mostly open to the east, and that brings me to Zonte Metals Inc. (ZON:TSX.V) because they have the property on Victoria Gold's boundary where Victoria Gold has found high-grade gold right at surface on the border.

The Raven deposit is 2.3 kilometers from Zonte's border and is open in the direction of Zonte's border. Victoria Gold's soil anomaly goes right to Zonte's border and is next to the Quartz and Bullion targets that Zonte has identified.

In 2017, Zonte made a drill discovery at the 2-4 zone where hole MJ-04 intersected two zones, 20.44 meters of 0.72 g/t and 20.28 meters of 0.69 g/t at the bottom of the drill hole, so it bottomed still in mineralization. These grades are similar to Victoria's Gold Eagle mine.

For a bigger picture of the two systems, note that Zonte's intrusion (in pink) is much larger than Victoria Gold's Raven intrusive and also their Gold Eagle intrusive (not shown). I have no doubt Zonte will have a large discovery on their intrusive. Zonte's strategy of letting Victoria Gold spend $$ to narrow down targets on Zonte's ground, next to Victoria Gold was either brilliant or lucky.

Victoria Gold has rallied up to support on the chart. I would look to buy on a pull back.

Zonte appears to have bottomed out around CA$0.10 going back to support over six years ago. Little downside form here.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Struthers Stock Report Disclaimers:

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate.

The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information.

Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.

Disclosures:

Charts provided by the author.

1) Ron Struthers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: All. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: Greenbriar Capital. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees, or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in the securities mentioned. Directors, officers, employees, or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Greenbriar Capital Corp., a company mentioned in this article.