On January 10, 2023, Volatus Aerospace Corp. (VOL:TSX; VLTTF:OTCQB) announced it had entered into an exclusive agreement to help manufacture, market, and distribute Airial Robotics’ next generation of Unmanned Aerial Vehicles (UAVs) under the Volatus Aerospace brand and its subsidiaries.

In light of this, Dean Attridge, Volatus Vice President of Solutions Engineering, said, "We are already seeing significant demand for Airial Robotics’ products. Our industry is at an inflection point and positioned for another period of explosive growth. Airial Robotics’ Gyrotrak passed our Vetted by Volatus evaluation for capability, safety, reliability, and suitability for night operations and flight beyond visual line of sight."

Volatus is a drone solutions company located in Canada, the United States, Latin America, and Europe. The company serves civil, public safety, and defense markets. It offers imaging and inspection, security and surveillance, equipment sales and support, training, research and development, design, and manufacturing.

Volatus Receives Funding From Research Manitoba

Volatus Aerospace Corp. has also received funding from Research Manitoba and the Government of Manitoba that will significantly enhance its Science Experiential Aerial Research (SEAR) Program.

The funding will allow the SEAR Program to expand to participating school divisions, partnering high school students with industry to research solutions for sustainability issues affecting the community, in line with the company’s commitment to carbon neutrality.

Volatus Aerospace CEO Glen Lynch said that it’s "an exciting project on so many levels."

Drone Sector Expected To Reach US$58 billion by 2026

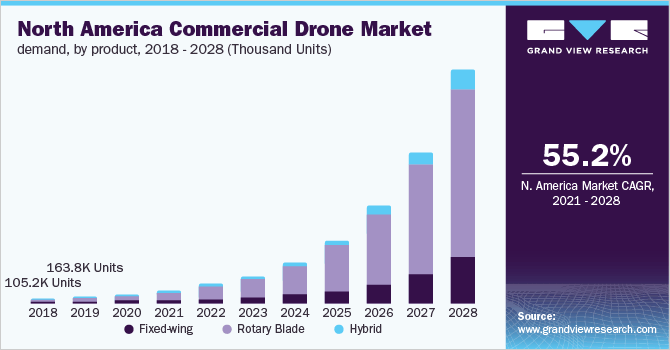

As an increase in military spending gains bipartisan support in the U.S. due to growing military threats from Russia and China, it’s likely that companies that deal in the manufacture of arms and weapons will see an increase in spending. According to Grand View Research, "the global commercial drone market size was estimated at US$13.4 billion in 2020 and was expected to reach US$20.8 billion in 2021."

Now, the drone sector is growing at a CAGR of 17% and is expected to reach US$58 billion by 2026.

Fortune Business Insights explained this growth, saying, "The global commercial drone market is projected to grow from US$8.15 billion in 2022 to $47.38 billion by 2029, at a CAGR of 28.58% in the forecast period."

Catalysts

Volatus shared a couple of upcoming catalysts with Streetwise Reports. Volatus Aerospace introduced new defense technology at the end of December 2022 and is looking ahead with aggressive expansion in the United States in Feburary.

Echelon Capital Markets analyst Rob Goff believes Volatus is "one to watch," referencing "heightened military product sales" as a clear reason for the company’s growth last year, noting that the company is "delivering intelligence, surveillance and reconnaissance (ISR) drones for organizations working in support of Ukraine."

The company previously acquired Syracuse-based Empire Drone Company LLC. in November last year. With a leading stock in the drone industry, Volatus is pointing its focus toward commercializing its technologies. It’s led by a team of experts with a combined experience of over 120 years.

Volatus has also announced that it has signed a contract to perform monthly, recurring inspections to detect fugitive methane leaks, in 14 water treatment facilities across the northwest of England, through its UK subsidiary, iRed Ltd.

This furthers the Company’s mission for sustainability and is a "very strategic win," according to CEO Glen Lynch. He expects this work to "generate new opportunities in that sector in the UK."

Echelon Capital Markets analyst Rob Goff believes Volatus is "one to watch," referencing "heightened military product sales" as a clear reason for the company’s growth last year, noting that the company is "delivering intelligence, surveillance and reconnaissance (ISR) drones for organizations working in support of Ukraine."

Ownership and Share Structure

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Volatus Aerospace Corp. (VOL:TSX; VLTTF:OTCQB)

Management owns 54.24% of shares. CEO Glen Lynch owns 26.62% of shares, while Chairman of the Board Ian McDougall owns 27%. It has 113.9 million outstanding shares.

There is small institutional participation from firms such as Charles Town and Long State. 90% is retail.

Volatus, based in Ontario, has a market cap of CA$30 million, and it trades in a 52-week range of CA$0.27 and CA$0.89.

Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Disclosures:

1) Lauren Rickard wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. They members of their household own securities of the following companies mentioned in the article: None. They or members of their household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: Volatus Aerospace Corp. Please click here for more information.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Volatus Aerospace Corp., a company mentioned in this article.