The U.S. stock market is in a position to crash and has been for some time, but so far, it has held up, and a reason for this is that risk has moderated somewhat. An important signal that a crash may be imminent will be if we suddenly see the 10-year yield starting to trend higher again, which could be due to a “black swan” event.

The current story is that the Fed’s trend of rising rates is slowing, but that could change abruptly if inflation gathers pace again. There are plenty of black swans not least of which is the growing risk of Russia launching a nuke or nukes. Russia is under attack from cruise missiles launched from Ukraine deep into its territory, which is obviously the handiwork of the U.S. and faces an existential crisis that may result in it playing its big card.

While we can expect the PM sector to drop hard if the market crashes, it can also be expected to come back strongly way ahead of the broad market hitting bottom.

If this happens, markets could crater.

On the 6-month chart for the 10-year Treasury Yield, we can see that the debt market is still relatively tranquil, with the yield down at 3.48%, having peaked above 4.2% in mid-late October.

However, this chart also suggests that yields could start higher again rather than they did early in August, as the drop from October looks like a reaction back towards a rising 200-day moving average within a larger uptrend, with it now being considerably oversold on its MACD indicator.

If they do start rising again, and especially if they should rise sharply, it would probably rip the rug out from under the stock market which remains very vulnerable to such a development.

The chief purpose of this update is to consider what will happen to the PM sector in the event that the stock market does crash soon. Market crashes generally involve “pan selloffs” because the financial stresses created cause investors to “dump everything over the side” in many instances because they are forced to due to margin calls.

This is why during the initial crash phase we can expect the PM sector to drop too. To illustrate this point and see what is likely to happen to the PM sector, we are now going to go back and see what happened during the 2008 crash.

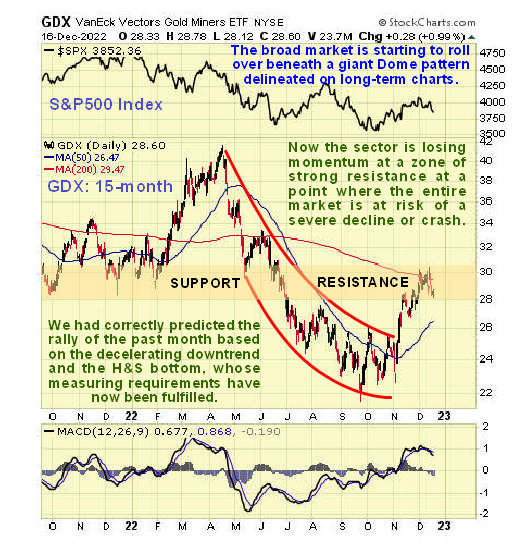

The chart below, which is for a 15-month timeframe, shows what happened to GDX during the 2008 market crash. One of the most important points to note is that the PM sector suffered a severe decline from July through September 2008 before the stock market had even begun to crash. and this decline may correspond to the heavy drop we saw in the sector from April through September this year.

That drop in 2008 was followed by a sharp relief rally in September before the stock market crashed and took the PM sector down with it, so it is interesting to observe that we have just seen a sharp relief rally in November back into an area of heavy resistance where the sector appears to be rolling over again.

Clearly, if we see a repeat of what happened in 2008 — and so far, the broad market has had an uncanny resemblance to what happened then — then the stock market will crash soon and take the PM sector with it down to a final low.

Now compare the chart above to the 15-month chart, for now, keeping in mind that there is no crash on this chart because it hasn’t started yet, but might be about to.

A very important point to note that is a big reason why we are looking at the chart for 2008 is that during the 2008 crash, the PM sector bottomed way ahead of the broad market and a powerful rally ensued that recouped almost all of the losses occasioned by the crash.

What this means is that while we can expect the PM sector to drop hard if the market crashes, it can also be expected to come back strongly way ahead of the broad market hitting bottom.

We will shortly consider the most effective ways to position for a severe sector selloff provoked by a market crash.

Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

CliveMaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

Disclosures:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. The author was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.